The Unicorn Growth Fund will target leading technology companies across Asia, with India as the focal point of its investment strategy.

South Korean gaming studio Krafton plans to launch an India-focused investment fund worth around $669m (INR 6,000cr), in partnership with South Korean internet company Naver and South Korean financial services company Mirae Asset, in January 2026.

The new fund – called the Krafton-Naver-Mirae Asset Unicorn Growth Fund – will invest in technology companies in Asia, with India as the focal point.

Krafton will contribute an initial investment of $137m (INR 1,230cr). The fund is expected to begin operations with a total size of more than $334m (INR 3,000cr).

The fund reinforces Krafton’s long-term strategy of considering India as a critical market and builds on years of investment and ecosystem development in the country.

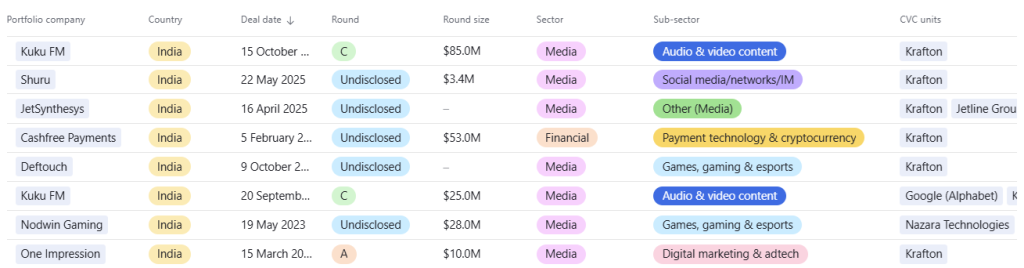

Krafton is believed to have cumulatively invested over $200m in India’s digital entertainment market, with a particular focus on the gaming sector. Through the new fund, the company plans to expand its investment focus beyond gaming, channeling capital into a wider set of tech sectors.

“Our participation in this fund aims to discover sustainable businesses in India that create social and economic value in addition to gaming. By exploring investment opportunities in various sectors such as consumer goods, sports, media and healthcare, we plan to position ourselves as a brand trusted by its people,” says Sean Hyunil Sohn, Krafton India CEO.

It marks the first collaboration between Krafton, Naver and Mirae Asset in India. The fund will be managed by Mirae Asset Venture India.

See all of Krafton’s investments in Indian startups in our CVC Funding Round Database.