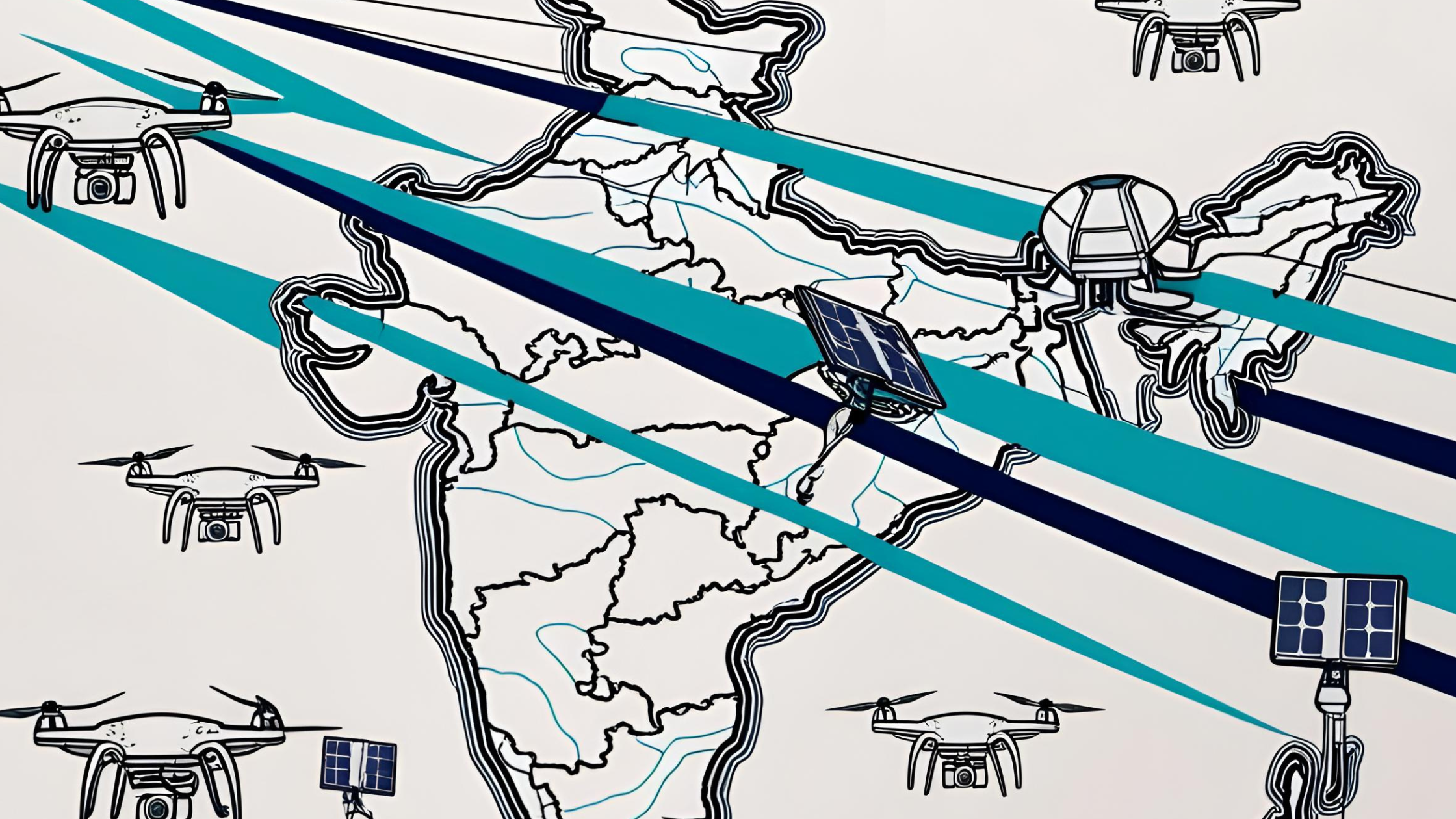

Indian defence tech startups are seeing greater investor interest, thanks to various government initiatives. Here's what it means for the sector - and 11 Indian defence tech startups to watch.

India has for years been the world’s largest importer of arms, shunted into second place only recently by Ukraine. But now the country is pushing for greater self-reliance in military technology, spurring the creation of more than 1,000 defence startups creating everything from drones to surveillance systems to body armour.

Investors are becoming increasingly interested in this emerging defence cluster, says Ankit Mehta, CEO of unmanned aircraft systems maker ideaForge.

“The pandemic, iDEX [Innovations for Defence Excellence programme], the government’s intention of buying locally – all of it has led to higher interest in this sector. We are now getting sizeable investments from non-government entities as well,” he says.

India’s shift to more self-reliance in the military equipment has been a decade in the making, with the government making several policy initiatives in recent years to promote indigenous design, development and manufacturing and bring down its defence imports.

India has more than 1.47m active troops and one of the largest defence budgets in the world – $78.7bn for 2025-26, a 9.5% increase from the previous year. The country also ranked as the world’s second-largest importer of major arms between 2020-2024, holding 8.3% of the market share. Ukraine’s share is 8.8%.

The push towards self-reliance has led to the country’s defence startup ecosystem witnessing significant growth in recent years, with over 1,000 defence startups driving deep tech innovation. While it is likely that India’s state-owned Defence Public Sector Undertakings (DPSUs) will remain the mainstay of defence procurement for the future, defence startups can act as drivers of innovation and play an increasing role in equipping the armed forces with newer forms of technology.

The defence sector has also posed challenges for companies. “Customer cycles tend to be unpredictable, as is predictable for a business that is reliant on the government. Also, there is a disconnect between the procurement process and the financial side that doesn’t necessarily match the need or intent on the ground,” Mehta says.

“But this started changing around 2017,” Mehta adds, making it easier for startups to make headway in the industry.

Changing nature of warfare

Rising geopolitical tensions, cross-border skirmishes and the ongoing war between Russia and Ukraine has caused the nature of warfare to change tremendously. “Not only are the theatres of conflict becoming longer than usual, but also the world is moving from large platforms like big tanks and aircrafts towards smaller, more autonomous systems, such as drones,” says Prateek Raj, senior associate at Lightspeed India Partners, part of the VC firm Lightspeed Venture Partners. Lightspeed is a global multistage VC firm that primarily invests in the enterprise, consumer, health and fintech sectors and has backed defence tech startups including Anduril, Pixxel Space Technologies and Airbound.

“The world is moving from large platforms like big tanks and aircrafts towards smaller, more autonomous systems, such as drones.”

Prateek Raj, Lightspeed India Partners

The logic, according to Raj, is that it is possible to produce a larger number of small, autonomous systems at a fraction of the cost of a battle tank, which can then be used to potentially overwhelm the other side.

Within these small autonomous systems, there exists a category that incorporates large language model-like reasoning capabilities. “A very basic manifestation of this is giving a ‘smart’ unmanned aerial vehicle (UAV) the command to go survey an area and to take x action on finding anything suspicious. The UAV will go into the area and take action based on the intelligence stack built into its system,” explains Raj. “It effectively comes down to building autonomous systems that are capable and cost-effective – broad areas that hold very interesting investment opportunities.”

The iDEX initiative

While defence startups such as ideaForge has been around since 2007, the ecosystem received a huge boost in 2018 with the launch of the Innovations for Defence Excellence (iDEX) initiative. The programme floats open challenges based on problem statements issued by India’s armed forces and invites defence tech startups to come up with solutions. The winner is awarded a grant of up to $1.2m.

The startups that have emerged as a result of iDEX provide innovative solutions ranging from advanced imaging capabilities and electro-optical surveillance systems to body armour and combat-friendly medical devices.

It’s all about drones

One of the areas where Indian defence startups have made significant technological advances is in unmanned systems. IdeaForge, which launched in 2007 and is now stock market listed, supplies the Indian army with UAVs for border surveillance and high-altitude transport, and has now been joined by younger companies such as Flying Wedge and NewSpace.

IdeaForge has itself become an investor in the sector, taking a stake, for example, in GalaxEye, an Indian spacetech startup developing multi-sensor satellite imaging technology that could help drones operate better in low-visibility scenarios.

Meanwhile, Torus Robotics is working on unmanned ground systems to help the army transport heavy loads. In the maritime sector, EyeROV is developing underwater drones for underwater surveillance, while Sagar Defence Engineering is developing unmanned surface and underwater vehicles for naval defence applications.

“Building for India implies building for some of the toughest conditions in the world.”

Ankit Mehta, ideaForge

Mehta believes startup founders realise the importance of unmanned systems operating in a country with diverse geographical conditions like India. “Building for India implies building for some of the toughest conditions in the world, with platforms that need to operate from -30 degrees at a 6,000-metre altitude and the deserts of Rajasthan to the marine environment along our extensive coastline. So we learned how to leverage those extremes really well,” says Mehta.

“The pandemic was also a game changer. It made people turn towards leveraging robotics since it would take you away from humans as much as possible. There were all kinds of robotics being driven aggressively globally post the start of the pandemic and drones were no exception. And we saw combat drones being leveraged effectively with the Galwan attack, the Armenia-Azerbaijan conflict and the Russia-Ukraine war as well. All of them have leveraged drones as a real and critical part of those events.”

11 Indian defence tech startups to watch

With the Indian government making it easier for homegrown startups to access funding and collaboration opportunities, the defence tech sector has seen a definite boost. Of the many innovative startups that exist, here’s a list of 11 that are building cutting-edge technology to meet local demands.

Optimized Electrotech

- HQ: Ahmedabad, India

- Founded: 2017

- Funding to date: $8.2m in grant funding

- Investors: Government of India, Gujarat Venture Finance

- Description: Develops long distance, multispectral surveillance equipment for defence, aerospace and critical asset protection.

NewSpace

- HQ: Bengaluru, India

- Founded: 2017

- Funding to date: $73.5m in debt financing

- Investors: SBI, DS Group

- Description: Develops aerospace technology for piloted systems, autonomy, sensor fusion and stratospheric operations.

Torus Robotics

- HQ: Chennai, India

- Founded: 2019

- Funding to date: $470,000 in seed funding

- Investors: T.N. Infrastructure Fund Management Corporation, Microsoft

- Description: Develops unmanned ground vehicles, robotics, and innovative powertrain technology.

EyeROV

- HQ: Kochi

- Founded: 2016

- Funding to date: $1.9m in seed funding

- Investors: Department of Science and Technology, Qualcomm

- Description: Develops underwater drones to perform visual inspection/survey of submerged structures.

Flying Wedge

- HQ: Bengaluru, India

- Founded: 2022

- Funding to date: Undisclosed

- Investors: Undisclosed

- Description: Develops and services drones for defence and agriculture sectors.

Big Bang Boom Solutions

- HQ: Chennai, India

- Founded: 2018

- Funding to date: $31.2m in venture financing

- Investors: SBI, SIDBI

- Description: Develops deep tech defense solutions.

CronAI

- HQ: New Delhi, India

- Founded: 2015

- Funding to date: $4m in series A financing

- Investors: VenturEast, Kitaki Ventures

- Description: Develops 3D data perception platforms to help machines perceive and learn unknown environments on the edge enabling innovators.

AjnaLens

- HQ: Mumbai, India

- Founded: 2014

- Funding to date: $6.3m in seed financing

- Investors: IDBI Bank (Maharashtra Defence and Aerospace Venture Fund), Udyat Group

- Description: Develops mixed reality AI-enabled products intended to cater to training, education and defence sectors.

Sagar Defence Engineering

- HQ: Mumbai, India

- Founded: 2015

- Funding to date: Undisclosed seed financing

- Investors: Indian School of Business

- Description: Develops unmanned surface and underwater vehicles for commercial and naval defence applications.

Agnit Semiconductors

- HQ: Bengaluru, India

- Founded: 2019

- Funding to date: $3.5m in seed financing

- Investors: Zephyr Peacock, 3One4 Capital

- Description: Develops next-generation wireless systems for defence applications using gallium nitride technology.

Jeh Aerospace

- HQ: Hyderabad, India

- Founded: 2022

- Funding to date: $2.5m in seed financing

- Investors: General Catalyst

- Description: Develops manufacturing, engineering and supply chain management solutions for the global aerospace and defence industry.

Investing in defence

Initiatives such as iDEX have created a wave of new defence startups, but whether these will significantly alter the patterns of Indian defence investment still remains to be seen.

“I would say the jury is still out. Have some interesting companies come out if it? Yes. But the rest? It’s too early to tell,” says Raj.

Mehta says that while he’s seen an increase in institutional venture backing for the sector, most of this has gone to startups startups working with dual-use technologies. Investors are also still sifting through the vast number of nascent companies to find the ones with lasting value.

“The real challenge though lies in finding the right companies to invest in. As an investor, you need to know how to separate the wheat from the chaff. How do you separate people who are merely system integrating versus people who are building core technology? I think those are areas where deep diligence is needed,” he says. But this new era is on the right track, he adds. “There is much more openness today than there was earlier.”