Swiggy helped boost Rapido's valuation to $800m in a round that featured Shell Ventures and TVS Motor. This is a deal of a rather surprising size and valuation in a space that has not been as hot over the past years, as far as corporate-backed deals are concerned.

India-based on-demand ride hailing service provider Rapido raised $180m in a series D round led by food delivery service Swiggy at a valuation of $800m. The round also featured oil and gas producer Shell, which participated through its corporate venturing unit Shell Ventures, along with motorcycle manufacturer TVS Motor Company. Shell was a returning investor. The company has increased its funding to $310m with this round. Previous backers of Rapido include automotive manufacturer Yamaha and consulting firm Positive Moves.

Launched in 2015, Rapido runs a a mobile platform offering bike-based taxi services across India and it claims it has more than 1.5 million drivers and 25 million registered users, a number it aims to double during the next year. Swiggy’s chief executive, Sriharsha Majety, said: “Swiggy and Rapido share a vision to build a logistics platform that empowers riders through more opportunities and higher earnings.”

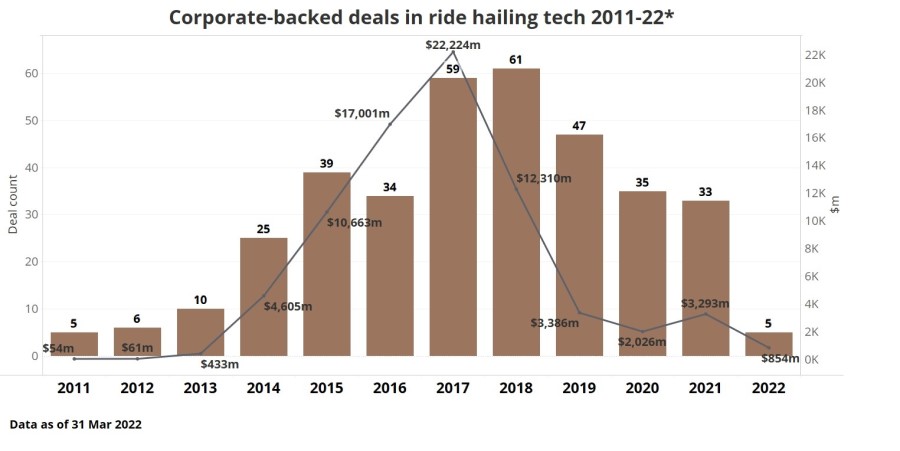

Rapido is part of the ride-hailing space which has not remained outside the radar of corporate venture investors over the years, as our data, summarised on the chart below, suggest. The ride hailing space saw a peak in corporate-backed deals and total estimated dollars in 2016-2018, when there was much deal making in the space. Both the number of deals and the total estimated capital have been going down since then, as major players in this space like Uber and Lyft have gone public or been acquired. The size of this Rapido deal is thus somewhat surprising in this context, particularly in a time of rising inflation and interest rates across both developed and developing markets.