Several corporate venture investors participated in a round which took the crypto IoT network developer's valuation to $1.2bn. The round and the company are part of the larger crypto tech space, which has been attracting much interest and capital in most recent times.

US-based decentralised wireless communications technology provider Helium rebranded to Nova Labs and raised $200m in series D round, which was backed by internet conglomerate Alphabet, tyre producer Goodyear, Liberty Global and telecoms firm Deutsche Telekom. Tiger Global Management and Andreessen Horowitz co-led the round, which also featured NGP Capital, the venture capital firm funded by communications equipment maker Nokia, among other investors. Alphabet, Goodyear and Deutsche Telekom participated through GV, Goodyear Ventures and Telekom Innovation Protocol respectively. The round reportedly valued the company at $1.2bn post-money.

Founded in 2013, Nova Labs has developed a blockchain-backed decentralised peer-to-peer wireless internet-of-things network monetised through cryptocurrency, allowing users to set up network devices to expand coverage while mining crypto.

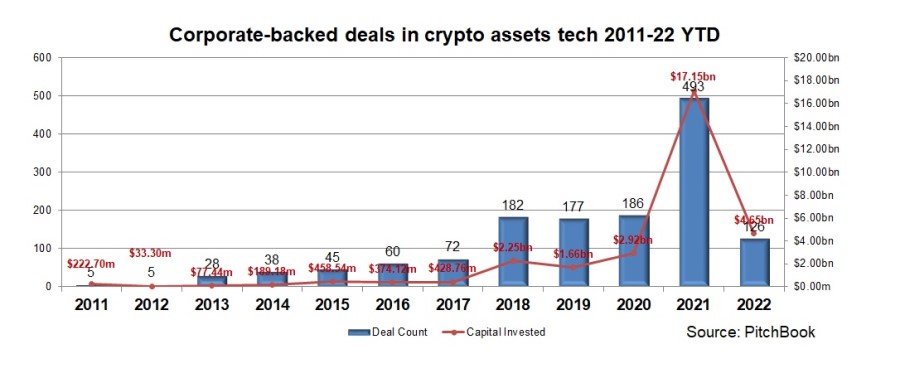

The company forms part of the broader crypto assets tech space, which has attracted the attention of corporate venture investors, as shown on the chart below, summarising data from PitchBook. Speculation in such assets throve during the past decade of quantitative easing, with the number of corporate-backed deals in such businesses reaching new stable highs between 2018 and 2020. However, with the flood of liquidity from central banks during the pandemic, the upward trend became even more pronounced and the number of corporate-backed rounds soared to 493 by the end of 2021, along with estimated total dollar in them to $17.15bn. These figures were up from 186 deals and $2.92bn estimated for 2020. With the proliferation of non-fungible tokens in gaming and elsewhere as well as trading platforms, it seems like crypto assets are here to stay but it is unclear whether this boom will continue with rising inflation and tighter monetary policy ahead.