Several corporates backed the blockchain technology developer in its latest round, boosting its valuation to $1bn. Valuations of blockchain tech companies have soared along with the interest in speculative assets classes inherently linked to the blockchain in recent times.

Canada-based blockchain technology developer LayerZero Labs raised $135m in a round co-led by cryptocurrency exchange FTX’s corporate venturing unit, FTX Ventures, Sequoia Capital and Andreessen Horowitz, at a valuation of $1bn. The round also featured cryptocurrency exchange Coinbase, payment processor PayPal, blockchain technology developer Uniswap Labs, Tiger Global Management and unnamed others. Coinbase and PayPal participated through their respective subsidiaries Coinbase Ventures and PayPal Ventures.

Launched in 2021, LayerZero Labs has created an interoperability protocol dubbed LayerZero which allows decentralised apps to operate across multiple blockchains. Areas in which those apps operate include gaming, media and finance, enabling users to transfer assets such as non-fungible tokens to other blockchains, in contrast to the fragmented networks that exist in the absence of protocols, to bridge them. The company recently launched a cross-chain liquidity transfer protocol dubbed Stargate, enabling digital assets to be moved across chains. It plans to use the funding to boost the development of its cross-chain apps.

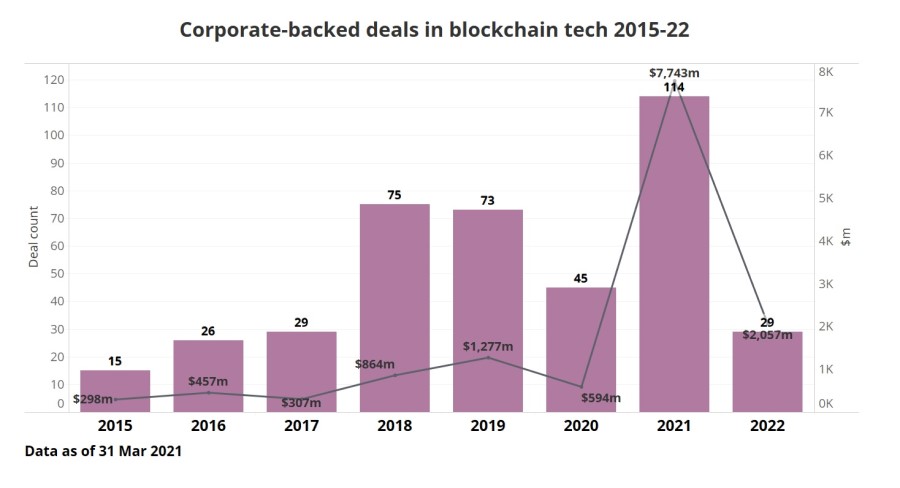

LayerZero is part of the broader blockchain tech space, which has been on the radar of corporate venture investors over the latter half of last decade, as the chart below based on GCV´s data suggests. The number of corporate-backed deals in blockchain technologies had reached a peak before the pandemic, dipped in 2020 but only to reach a new all-time high in 2021. The same applies to the total estimated capital and the growing valuations it implies. With stimulus and liquidity after the covid-19 pandemic broke out, there was a boom in valuations across all asset classes and cryptocurrencies and non-fungible tokens, speculative in nature and inextricably linked to the blockchain technology, soared as well. While the applications of the blockchain technology go far beyond cryptocurrency speculation and gaming, we are yet to see if this interest will be sustained in an environment of rising inflation and rising interest rates.