The corporate card provider was valued at $2.1bn in a round backed by Stanford University that increased its funding to $380m altogether.

Jeeves, the US-based provider of a corporate card tailored for startups, has pocketed $180m in a series C round backed by Stanford University.

The round was led by internet group Tencent and filled out by financial services firm Silicon Valley Bank, GIC, Andreessen Horowitz, Haven Ventures, Clocktower Ventures, Urban Innovation Fund, Gaingels, Spike Ventures, CRV, private investor Carlo Enrico and unnamed family offices. It brought Jeeves’ total funding to $380m.

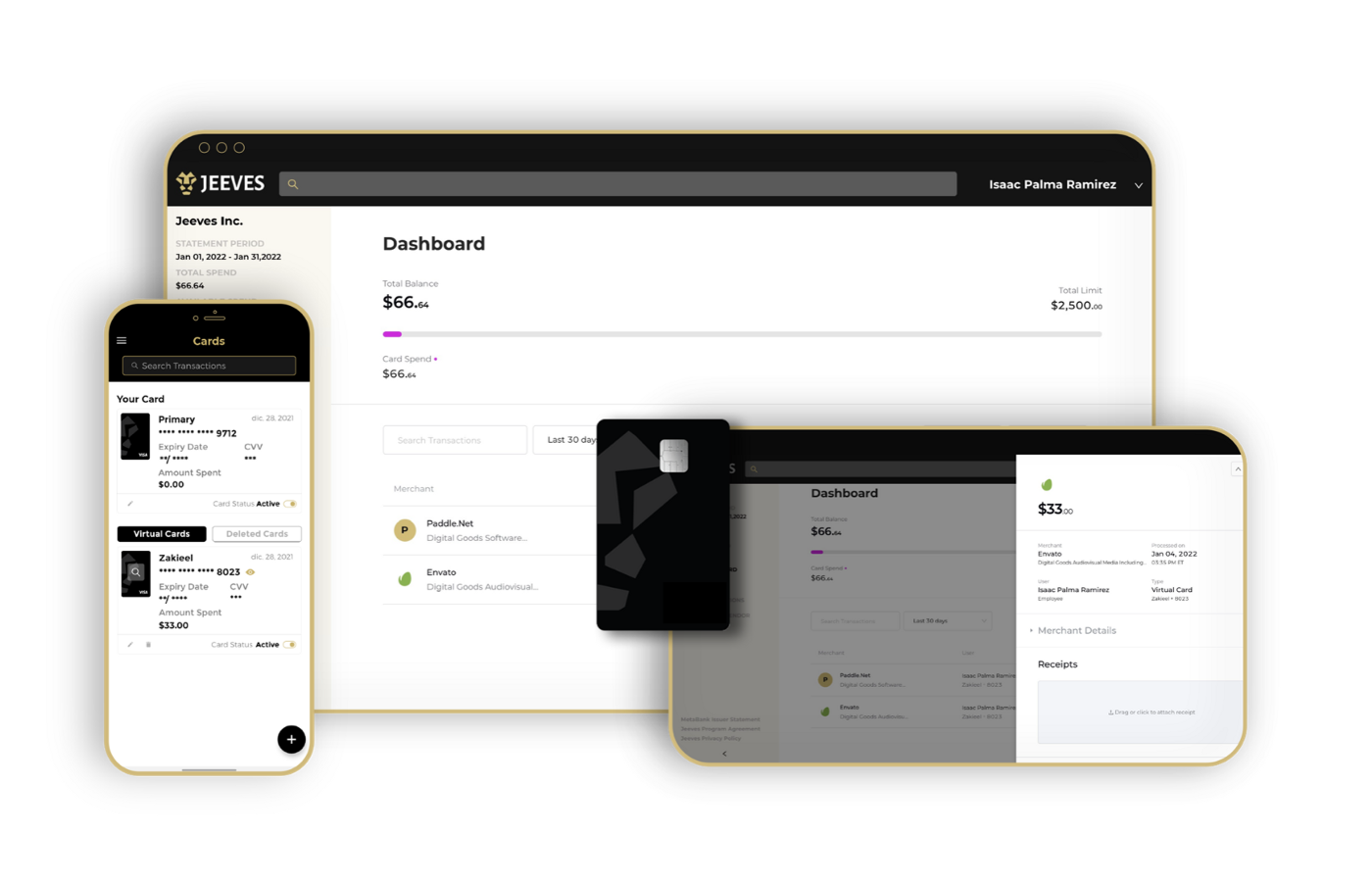

Founded in 2019, Jeeves provides corporate cards and an all-in-one expense management system to startups, e-commerce companies and small and medium-sized enterprises. It claims to currently serve companies in 24 counties across three continents.

The round valued the company at $2.1bn and the proceeds will be used to grow its footprint across Canada, Europe and Latin America, as well as onboarding more talent and further developing its platform.

Jeeves said it has grown revenue by 900% since its $57m series B round in September 2021. It was led by CRV and also featured Tencent, Silicon Valley Bank, Soros Fund Management, Stanford University, Alkeon Capital Management and more than a dozen angel investors, valuing the company at $500m.

Andreessen Horowitz led Jeeves’ $26m series A round, announced when it emerged from stealth in June 2021. Y Combinator’s YC Continuity Fund also took part, as did Jaguar Ventures, Uncorrelated Ventures, Urban Innovation Fund, Clocktower Ventures, 9 Yards Capital, BlockFi Ventures and assorted angel investors.

The series A funding was raised alongside $100m in debt financing from undisclosed investors and was preceded by $5m in seed financing.

Dileep Thazhmon, Jeeves’ founder and chief executive, said: “While we are in one of the toughest environments for startup funding this year, we are excited in the trust investors have, not only in Jeeves but in growing businesses who will be able to use our financial products globally.”

– A version of this article first appeared on our sister site, Global Corporate Venturing. Image courtesy of Jeeves.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.