The US university plans to launch new investment funds and deepen ties with venture capital in order to grow more spinout companies.

University of California, Davis is launching a series of sector-specific spinout funds in order to help finance the spinouts being created in its labs — and it is bringing in venture capital firms and corporate investors to help boost its firepower.

UC Davis is one of many US universities creating their own investment funds as traditional government funding declines under the new US administration.

The university started in April with the launch of the Investing in the Future of Medicine Fund, a $25m fund to support life sciences and healthcare startups spinning out of the university. San Francisco-based venture capital firm HM Ventures is a partner in the fund and sits on its investment committee.

“We’ve never had a mechanism for investment into our own companies. This Investing in Future Medicine Fund will allow us to do that for the first time,” says George Baxter, chief innovation and economic development officer at UC Davis.

Now UC Davis is in talks with other venture capital firms and industrial partners about investing in the healthcare fund, and is planning to set up other sector-specific funds. It has signed a deal with US venture capital firm The March Group, based in Davis, California, to set up a new food and health accelerator based at the university. It is aiming to launch an associated $10m food and heath spinout investment fund to invest in spinouts in the field.

Launching funds to invest in its own spinouts is a new approach for the California-based university, which despite its proximity to the venture capital ecosystem of the Bay Area, has historically has relied on generating revenues from licensing technologies rather than taking equity stakes in spinout companies. However, uncertainty over federal research and grant funding under President Trump’s administration — some $6bn in funding was put on hold at nine universities so far this year — has made US universities eager to find new sources of income.

“The federal funding is getting uncertain and difficult. So can we diversity the funding to collaborate with startup companies and big corporates and work with venture capital funds,” says Baxter.

“We are looking at all of these alternate sources of funding so that we can support our faculty and keep the great work we are doing here supported,” he says.

In addition to tapping VCs and corporate investors, UC Davis is also looking to raise funding from an alumni angel network focused on early-stage food and health investments, an area of expertise for the university. “The idea is it’ll run like a classic angel network, where we will bring together groups of people, they’ll hear three or four pitches from potential investment opportunities, and then we’ll put together a package of investment,” says Baxter.

The university is ramping up its commercialisation efforts with the recent opening of a 1.2 million square foot innovation park, called Aggie Square, which provides research facilities and lab space and where faculty, students, entrepreneurs and members of industry can collaborate on commercislisation of research.

The new innovation park is home to a new bio-pharma accelerator for South Korean life sciences startups seeking to enter and grow in the US healthcare market.

The pullback of government funding for science and research opens up opportunities for venture capital to fill in the void, says Baxter. “It is an opportunity for VC firms to look more at universities,” he says. “I think what you might see is a shift towards VC firms looking earlier stage and at things that might have been funded through federal routes.”

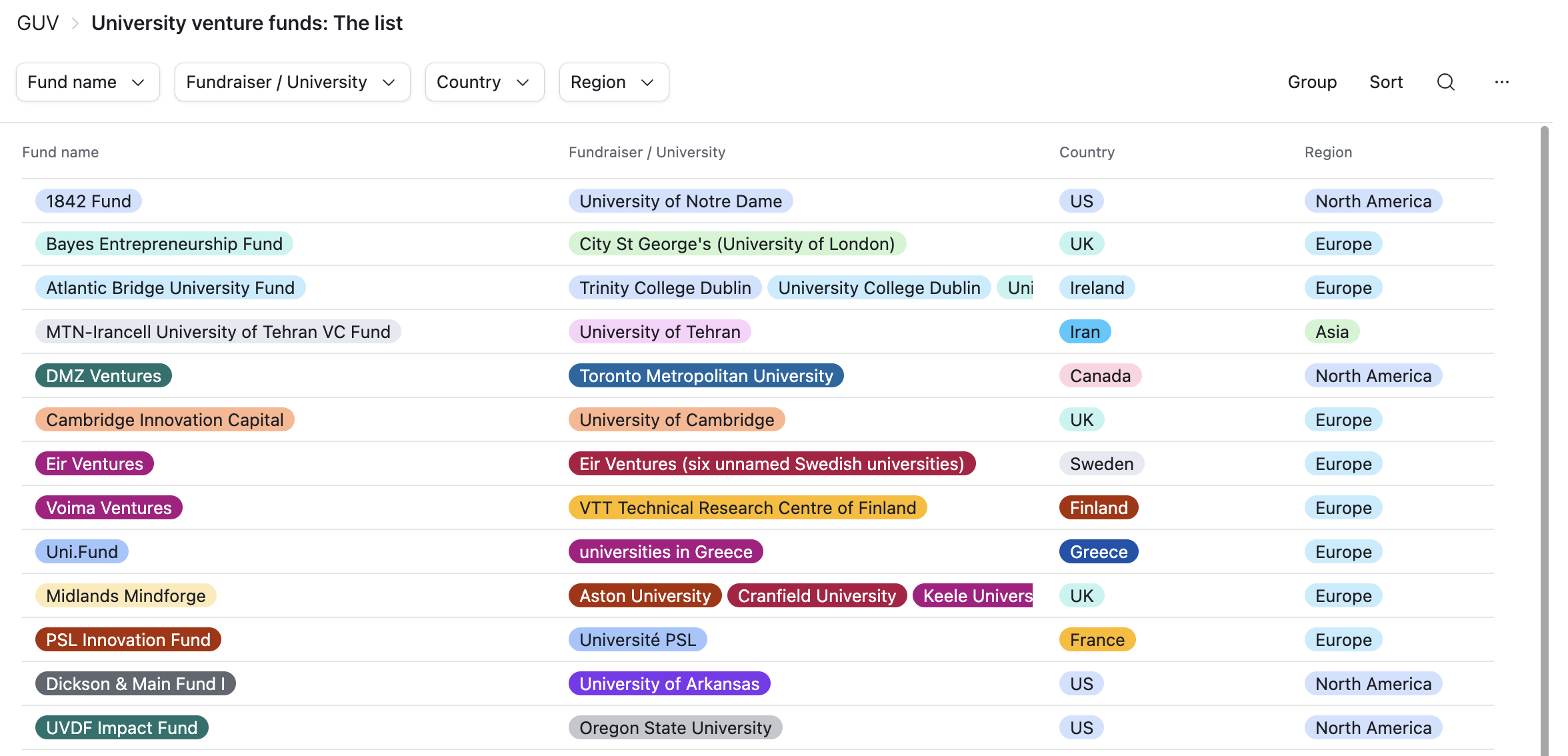

Global University Venturing tracks more than 200 venture funds affiliated with universities in this list.