Several companies originating in academic labs were acquired this year in billion dollar plus transactions.

This year was a big one for exits of university spinouts. Several companies originating from academic research were acquired in deals valuing them at more than a billion dollars, offering handsome payouts for investors that took early bets.

The University of Oxford had two of its spinouts acquired for more than one billion dollars. The UK university is one of the most prolific producers of spinouts and has built up a pipeline of companies that is likely to accelerate the rate of exits in the coming years.

Quantum computing is also a sector emerging as a source of exit value for investors. Two of the spinouts exits in our list are quantum technology startups, signalling how this area of deep tech has strong roots in academic research.

Most of the exits in our list were acquired rather than listed on stock exchanges, indicating how the market for initial public offerings is still muted.

Mergers and acquisitions for European deep tech and life sciences spinouts is expected to reach a record $12.3bn in 2025, according to Dealroom.co.

Here are eight notable exits this year that provided returns to VCs and corporate investors.

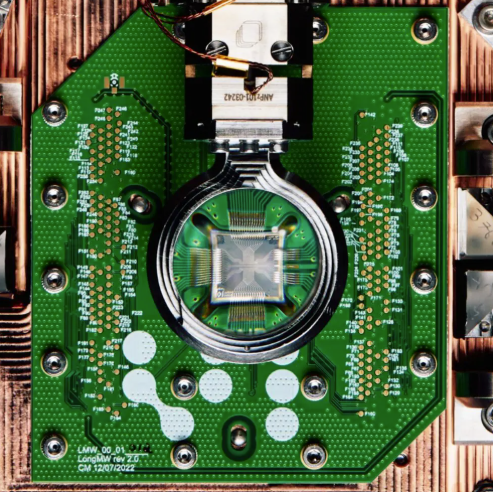

Oxford Ionics, spinout from University of Oxford, UK

Quantum computing company Oxford Ionics, a spinout from the University of Oxford, was acquired by US quantum computing and networking company IonQ in June 2025 for $1.075bn.

Oxford Ionics develops ion trap technology using standard semiconductor chips. IonQ said the acquisition will help speed its manufacture of more powerful and accurate quantum computers and support its expansion into UK, Europe and other global markets.

Founders Chris Balance and Tom Harty stayed on after the acquisition and the combined company plans to expand its workforce in Oxford, UK.

Oxford Science Enterprises, an investor in University of Oxford spinouts, is the largest shareholder in Oxford Ionics. The investment firm provided pre-seed funding and venture building support to the spinout in 2019. Other shareholders include the University of Oxford, Braavos, Lansdowne Partners and Prosus Ventures, the corporate venturing arm of Dutch ecommerce brands owner Prosus.

OrganOx, spinout from University of Oxford, UK

The acquisition of OrganOx by Japanese medical technology company Terumo Corporation was another large exit for the University of Oxford in 2025. OrganOx was sold for $1.5bn in August, the largest acquisition of any UK university spinout so far.

The company’s perfusion technology, which has been used in more than 6,000 liver transplants, enables organs to be preserved for longer outside the body and gives surgeons more time to assess the organ before transplant.

Investment firm BGF is the largest shareholder in the spinout. Other investors include Lauxera Capital Partners, Sofina, Avidity Partners, the University of Oxford and Oxford Technology and Innovations Fund, a seed investor in Oxford-based startups.

Cytora, spinout from University of Cambridge, UK

Applied Systems, a US provider of cloud-based software for the insurance industry, bought Cytora, a University of Cambridge spinout, for an undisclosed amount in September.

Cytora, an AI-powered digitisation software for commercial insurance, allows brokers and carriers to streamline the administration of policies including claims servicing and renewals.

UK spinout investor Parkwalk Advisors is the largest shareholder in Cytora. EQT Ventures, Cambridge Innovation Capital and and Australian insurer QBE Group also invested in the company.

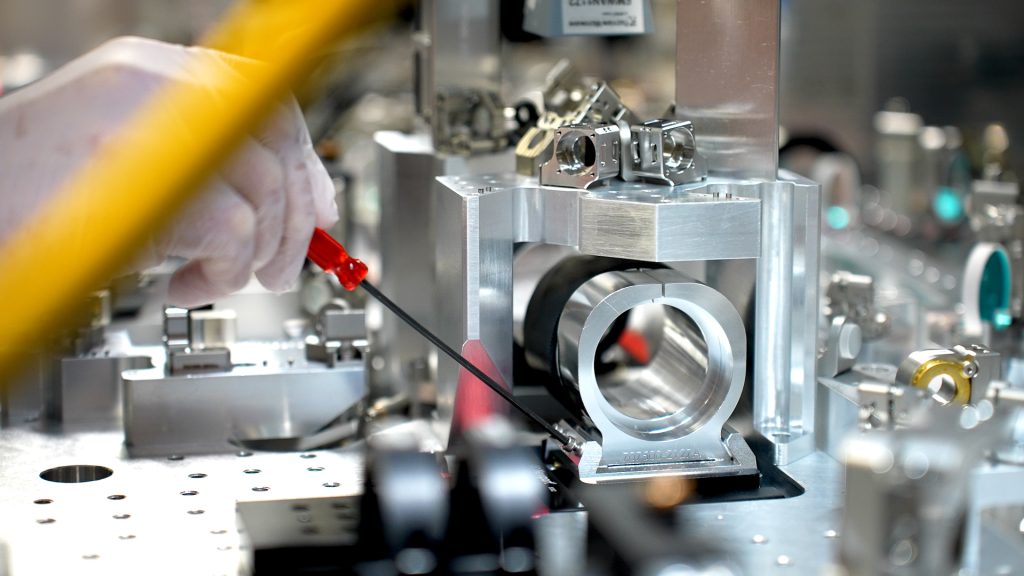

Infleqtion, spinout from University of Colorado Boulder, US

Infleqtion was another quantum computing spinout that was bought out this year. This company was spun out of the University of Colorado Boulder in the US.

The spinout is set to go public after Churchill Capital Corp X, a publicly traded special purpose acquisition company, merged with the company in a transaction that values Infleqtion at a pre-money equity value of $1.8bn.

Infleqtion has developed a neutral atom-based quantum technology. It designs and builds quantum computers, precision sensors and quantum software.

Investors in the company include Maverick Capital, Counterpoint Global, Glynn Capital. BOKA Capital and LCP Quantum.

Apromore, spinout from the University of Melbourne, Australia, and University of Tartu, Estonia

In November US cloud-based software company Salesforce acquired Apromore, a provider of process intelligence software based on research from the University of Melbourne in Australia and University of Tartu in Estonia.

Apromore’s software aims to allow businesses to use data science algorithms and AI to gain a better understanding of their business processes. Salesforce said in a release that the acquisition will be integrated into its platform to accelerate its agentic automation strategy.

Apromore was cofounded by University of Melbourne professor Mercello La Rosa and University of Tartu professor Marlon Dumas. Apromore’s technology is based on more than 10 years of research from the Australian and Estonian universities, as well as several other universities.

The spinout’s shareholders include Tin Alley Ventures, a joint venture between Tanarra Capital and the University of Melbourne, and GBTEC, a German business software vendor.

Nexthink, spinout from École Polytechnique Fédérale de Lausanne (EPFL), Switzerland

Nexthink, a digital employee experience management software, spun out of Swiss university EPFL, received a majority investment from US private equity investor Vista Equity Partners. The deal, announced in October, values the company at $3bn.

Nexthink was cofounded by EPFL alumni Pedro Bados and Patrick Hertzog. Launched in 2004 and with headquarters in Switzerland and the US, the company’s software aims to help companies automate processes and resolve IT issues seamlessly.

Shareholders exiting from the buyout include Permira, Highland Europe, Index Ventures and Auriga Partners.

CureVac, spinout from University of Tübingen, Germany

Germany-based RNA therapy company CureVac, a spinout from the University of Tübingen in Germany, was acquired by biopharmaceutical company BioNTech in October. The deal values the startup at $1.25bn.

Founded in 2000, CureVac has developed an RNA technology platform with the aim of designing and developing vaccines. The messenger RNA technology formed the basis of mRNA vaccines against covid-19.

BioNTech, headquartered in Mainz, Germany, said its acquisition of the spinout will help it to develop mRNA-based immunotherapies for cancer.

Investors in CureVac include pharmaceutical firm GlaxoSmithKline. Eli Lilly, Dievini Hopp BioTech, Bill & Melinda Gates Foundation, Baillie Gifford, Sigma Group, LBBW Asset Management Investmentgesellshaft, Landeskreditbank Baden-Württemberg, Chartwave, Coppel Family, Northview, DH Capital, OH Beteiligungen and Leonardo Venture also invested in the company.

Araris Biotech, spinout from ETH Zurich, Switzerland

Another Swiss biotech spinout, Araris Biotech, was sold in March to Taiho Pharmaceutical, a Japanese drugmaker. The company, a spinout from ETH Zurich and Swiss research centre Paul Scherrer Institute, was sold for $400m, with the potential for additional milestone payments of up to $740 million.

Founded in 2019, Araris Biotech has developed antibody-drug conjugate linker technology that allows potent anti-cancer drugs to attack disease tissue while sparing healthy parts of the human body.

The spinout’s investors include 4BIO Capital, b2venture, Pureos Bioventures, Redalpine, Schroders Capital, VI Partners, Wille AG, Institute for Follicular Lymphoma Innovation and Samsung Ventures