Lord Grimstone, minister for Investment at the UK’s DIT, spoke at the GCV Symposium

In a private lunch held at the Global Corporate Venturing (GCV) Symposium this month, Lord Gerry Grimstone, Minister for Investment at the UK’s Department for International Trade (DIT) and the Department for Business, Energy and Industrial Strategy, asked the assembled guests, including the global chief investment officer for BlackRock Alternative Investors, the general manager of Sumitomo Europe and head of corporate development in Europe for Amazon their asks.

The responses were varied and often around a more consistent, long-term planning process for inward investment, especially with the new National Security Investment Act (NSIA) coming into force in January. The act requires minority investments in sensitive sectors to be reviewed before clearance, similar to the US’s CFIUS and FIRRMA regulations.

Lord Grimstone had promised clarity and speed in his earlier keynote discussion at the 10th GCV Symposium but also the prospect of the “more investment opportunities than I have seen in my lifetime” due to the reinvention of the economy around sustainability and decarbonisation.

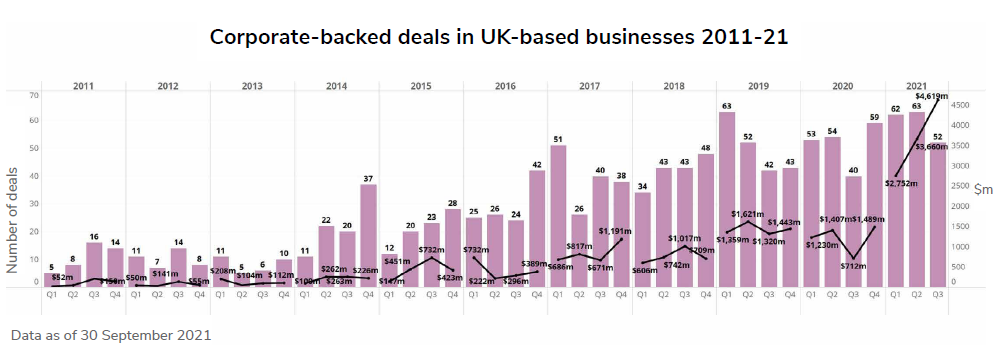

The UK has already been an increasingly attractive place for corporate venture capital. GCV Analytics tracked 177 deals worth more than $11bn in the first nine months of the year (see chart above). DIT’s venture capital unit helps bring in the overseas CVCs to complement domestic investors (see picture on following page).

Lord Grimstone and the government want more of both as well as increased support to entrepreneurs after a swathe of initiatives announced in last month’s Budget.

The Economist at the end of October wrote: “A panoply of programmes will funnel taxpayer money to the private sector. The government-backed British Business Bank will receive £1.6bn ($2.2bn) to allocate to its regional funds, which provide debt and equity capital for fledgling businesses. The Global Britain Investment Fund – which invests in life sciences, offshore wind and car manufacturing – gets a £1.4bn boost. A further £150m goes to a fund that aims to rebalance geographical inequalities in access to early-stage equity capital.

“All of this is dwarfed by a pledge to raise government spending on research and development (R&D) to £20bn a year by the end of the parliamentary term, in 2024. After adjusting for inflation, that represents an increase of around a quarter from current levels [and includes £800m per year for the new Advanced Research Invention Agency (ARIA)]….

“As well as handing out cash, the chancellor set about reassuring startup founders and their investors that long-held gripes would be dealt with. One of these is a cap on the fees workplace pension schemes [valued at $3.6trn] can pay to investment managers. Designed to protect retirement savings from outsized investment charges, it also limits pension schemes’ ability to invest in things like infrastructure and early-stage companies, due to the performance fees charged by venture capital funds. Treasury officials will now consult on loosening the cap.

“Another is access to foreign talent, which is set to be liberalised next spring. A new visa programme will allow those with a job offer from a fast-growing British firm to migrate with few strings attached. A second will make graduates of top universities eligible for visas, even if they do not have a job offer.”

UK universities can do with the good news. A delegation of CVCs hosted by venture capital firm Cambridge Innovation Capital (CIC) visited the city to meet some of its portfolio companies as well as affiliated accelerators Deep Tech Labs and Start Codon and Cambridge Enterprise, the university’s tech transfer office.

CIC is expected to blow past its £200m target for its second fund currently being raised, according to limited partners, having scored half a dozen $100m-plus rounds for portfolio companies in its first fund in recent months.

CIC backs intellectual property-intensive businesses, such as flexible chip maker Pragmatic or healthcare-focused Bicycle Therapeutics and Microbiotica. The depth of opportunities is perhaps unremarkable for the Cambridge given its unique track record for scientific excellence with 121 Nobel prizes awarded.

As Andy Neely, pro-vice chancellor at the university, said: “Just one [Cambridge] lab has more Nobel Prize winners than all of France.”

He was also keen to protect the university’s reputation for independence saying the university tracked closely the number of foreign students from different countries, such as China, and how much they contributed to overall research budgets.

However, with the NSIA coming into force there was a general recognition by attendees at the delegation’s dinner held at Queens’ College that startups’ chances of success could be compromised at their earliest stages if researchers or hackers from malicious states could take the ideas out into their own innovation ecosystems for development. Attention around cybersecurity procurement and researcher background checks were likely to face greater attention going forward, attendees said, as a due diligence item before future funding could then be applied.

Subject to these DD checks, therefore, the more recent focus has been to turn these “highest levels of international excellence” in research into scalable opportunities through “partnership and commercialisation” with 65 multinational corporations, such as AstraZeneca, Arm, Amazon, Microsoft, Apple, Roche’s Genentech and GlaxoSmithKline, in the city.

George Freeman, UK Minister for Innovation, told the delegation the country had a “mission to be a high value, high skills, high returns ecosystem” helped by an “innovation arc” between Oxford and Cambridge as well as into London – together the three make up the so-called Golden Triangle.

Adding into the south-west’s growing innovation ecosystem under the SETsquared partnership of six universities in England and Wales and the Northern Gritstone and related initiatives in the Midlands and North plus Scotland’s high status universities and attendees at the symposium were confident the UK was finally linking invention to rebuild the economy around the industrial and intellectual opportunities of the future.