The capital boost puts Vivo Ventures in the league of larger CVCs in Brazil.

Vivo, the Brazilian arm of multinational telecommunications company Telefónica Group, has increased its corporate venture fund by R$150m ($27m). The capital boost brings the fund’s total to R$470m, making it one of the largest corporate venture funds in Brazil.

Founded in 2022, Vivo Ventures invests in growth-stage startups from series A onwards in financial services, health, education, the connected home sector, energy and entertainment.

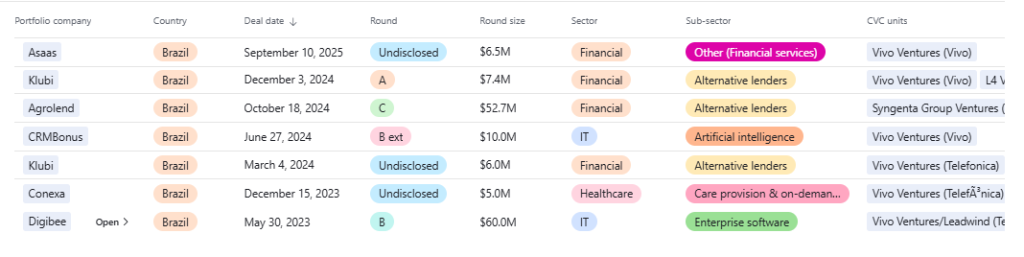

Vivo Ventures has seven startups in its portfolio, including fintech startup Klubi and CR Bonus, a customer loyalty platform for retailers.

The fund is managed by the Brazilian arm of Wayra, Telefónica’s CVC arm.

Vivo Ventures is not the only Brazilian CVC to get a funding boost. The Bank of Brazil recently doubled its CVC’s total capital to R$500m.

Track the deals that Vivo Ventures has invested in by accessing GCV’s CVC Funding Round Database.