Alastair Hick, chief commercialisation officer at Australian university Monash, will be tasked with raising a new fund when he takes over as CEO of the university spinout investor.

Australian universities need to accelerate the rate at which they produce spinouts from academic research if they are to remain globally competitive, says Alastair Hick, the new CEO of Australian spinout investor Uniseed.

Hick is taking over as CEO of Australia’s longest-running venture fund in January from Peter Devine, who has led the VC for the past 20 years. Uniseed manages a A$50m ($32.5m) fund with several academic institutions as investors including the universities of Melbourne, Queensland, Sydney & New South Wales and Monash.

It also manages a A$100m co-investment vehicle with Australian retirement savings fund UniSuper.

Australia’s venture capital sector has transformed over the past several years, with a big increase of funds investing in deep tech. But the country’s VC market is still small by international standards. “We don’t necessarily have as big pools of capital in the venture space. If we are not moving faster than the competition, then we’ve got a problem,” says Hick.

Hick, who has spent the past 18 years at Monash University in various technology transfer and commercialisation roles for the Australian university, wants to streamline VC investments by simplifying commercial and legal terms for fundraising deals. “We are seeing syndicates get together with investors into some of these early-stage opportunities. But then you’ve got multiple investment committees and decision-making processes that never align with each other.

“You’ve got multiple views on what the commercial and legal terms should be, multiple lawyers. And then you’ve got the university side of the fence with an equally different range of views,” says Hick.

Australia’s venture community is discussing whether to introduce a set of standard recommendations for spinout deal terms, similar to the University Spinout Investment Terms (USIT) Guide published last year by TenU, a group of 10 top-tier universities. The guide is designed to create a framework for best practices in negotiating spinout deal terms such as how much equity universities should take in spinouts and timelines for finalising financing agreements.

Antipodean neighbour New Zealand recently introduced a policy that will cap at 5% to 10% the amount of equity that universities can take in academic research spun out into companies. The new regulation is an effort by the government to boost the commercialisation of spinouts from the country’s universities and research organisations, by setting clear rules on ownership and giving researchers more control over the commercialisation of their inventions.

If you invest in university spinouts, we would love your input in GUV’s University Venture Funds survey.

Gain valuable insights into the performance of university-affiliated funds globally. Compare your fund’s structure and performance with your peers. Take the survey here.

Hick also recommends creating a system for bringing in entrepreneurs earlier to head spinouts, with the aim of accelerating the commercialisation of academic research. Ideas include creating entrepreneur-in-residence programmes that would match business leaders with researchers. These programmes have been adopted by university spinout investors Oxford Science Enterprises and Cambridge Innovation Capital in the UK as well as spinout funds in Japan.

Uniseed has had several high profile exits over the past few years, including the sale of Spinifex, a pharmaceutical spinout from the University of Queensland, which was sold to Novartis; the sale of Fibrotech, a drug developer spun out of the University of Melbourne, to Shire Pharmaceuticals; and the sale of Forcite, a smart helmet invented by two University of New South Wales graduates, to GoPro in 2024.

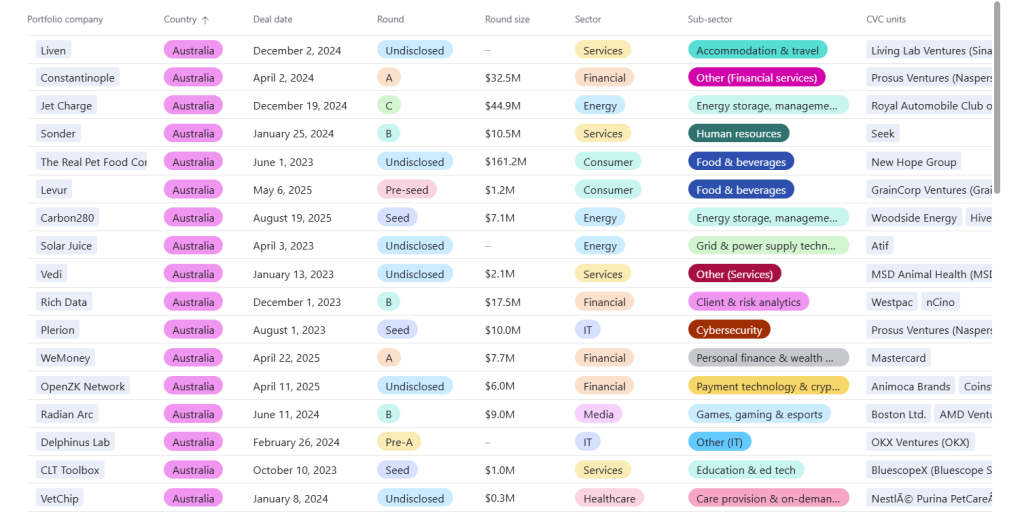

Track Australian startups receiving corporate investment in GCV’s CVC Funding Round Database

In 2026, Uniseed will launch its next fund. Hick hopes to raise a minimum of A$50m, with the possibility of new university partners joining. “There are more universities that are active in spinning out companies and looking for investment for those companies,” he says.

The VC has five large Australian universities participating as well as a consortium of four smaller academic institutions that joined later. Government lab Commonwealth Scientific and Industrial Research Organisation (CSIRO) is also an investor.