Amer Sheikh, who was previously at HSBC Ventures, will co-lead Novo Holdings' quantum investments.

Amer Sheikh has joined the seed investments division of Novo Holdings, the investment arm of Denmark’s Novo Group, which includes pharmaceutical company Novo Nordisk.

He will be a partner co-leading the unit’s quantum technologies investment strategy. His focus, according to the LinkedIn post announcing the new role, will be on building and growing Novo’s quantum investment strategy, spanning software and applications in addition to the infrastructure that underpins these including quantum computing and sensing, and advanced computing.

Novo Holdings has recently ramped up investments in quantum. It is the anchor investor in newly formed VC 55 North, which exclusively invests in the technology. Direct investments include QuNorth, a joint venture established to buy and operate a commercial quantum computer based in the Nordics, and Phasecraft, a UK spinout from the University of Bristol and University College London, which develops quantum algorithms.

Sheikh was an investment director at HSBC Ventures, the corporate VC arm of financial services firm HSBC, where he was responsible for the unit’s investments in quantum technologies, advanced computing, AI and cybersecurity.

Novo Holdings is one of the most active investors in life sciences startups globally, participating from seed to private equity stage. The unit also manages a broad portfolio of equities, bonds, real estate, infrastructure and private equity assets.

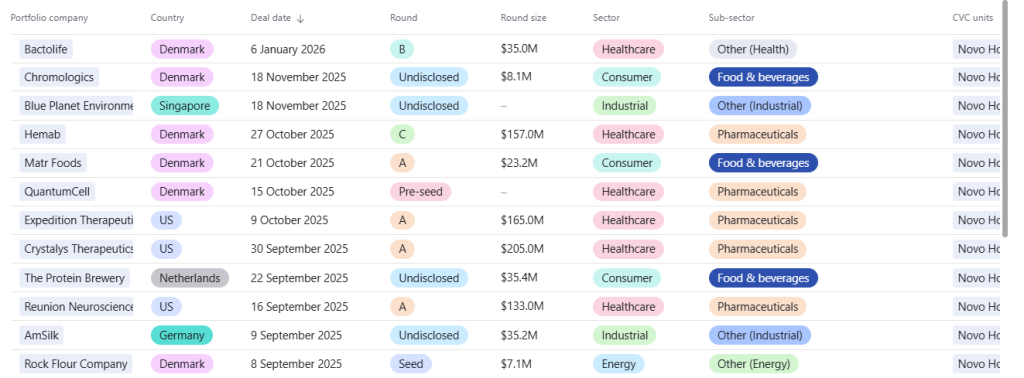

See all the recent deals by Novo Holdings in the CVC Funding Round Database