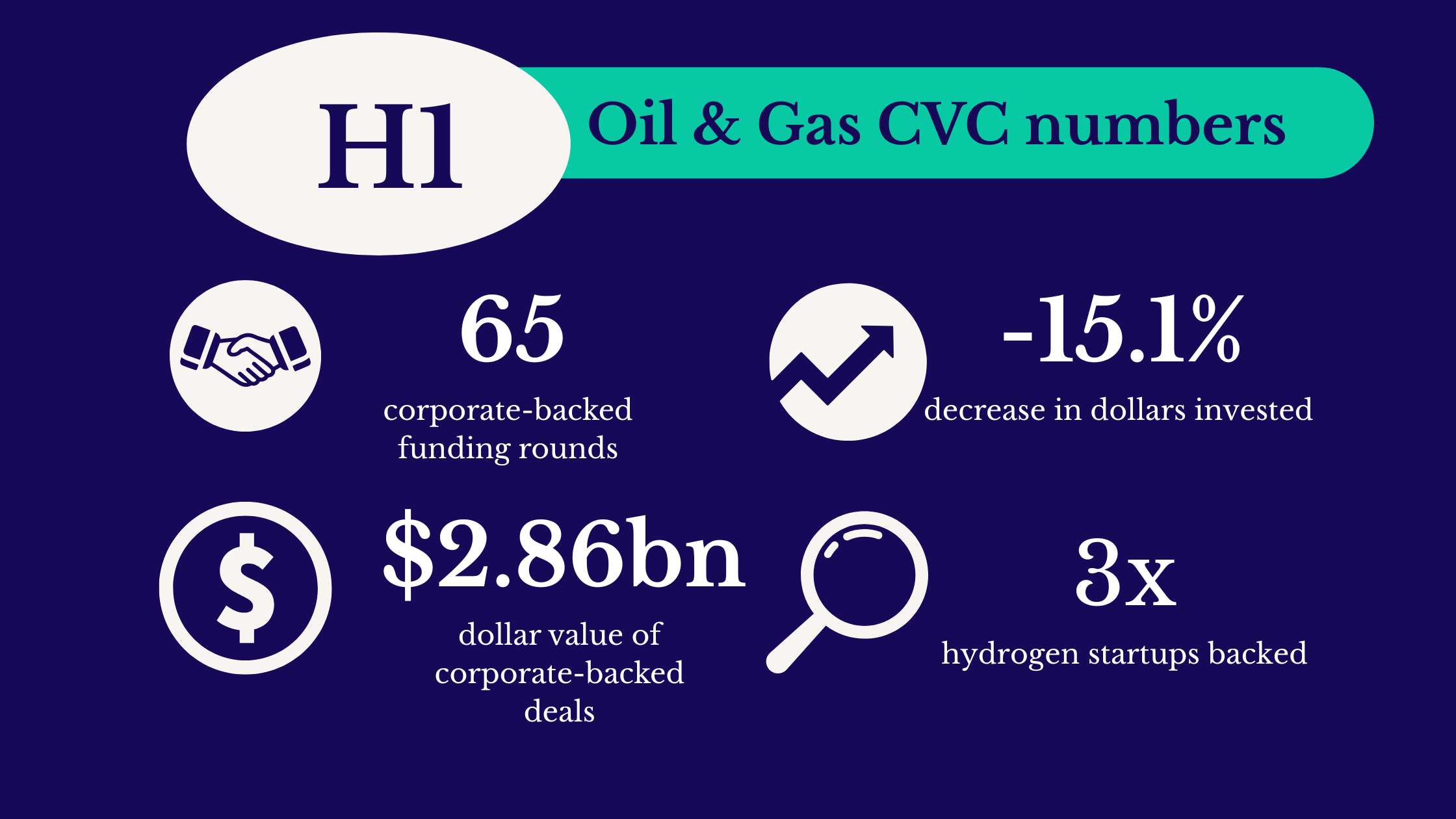

The decline of cleantech and hydrogen investments is overstated in H1, according to GCV data, while transport investments go cold.

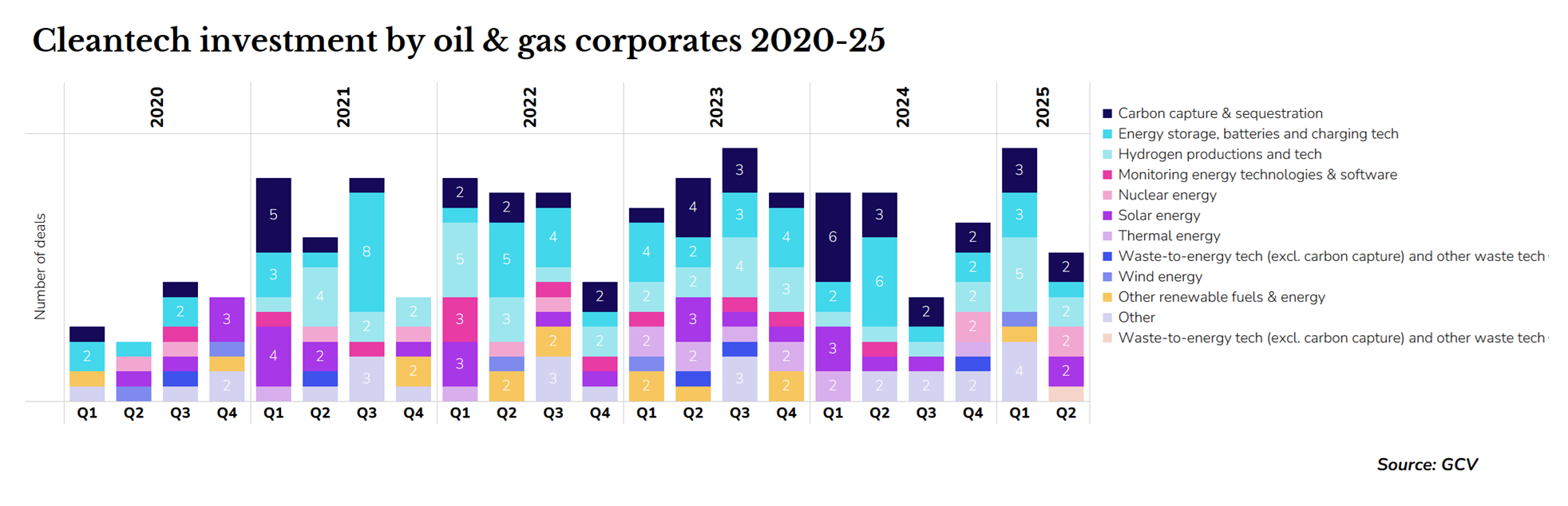

Oil and gas companies increased the number of investments in hydrogen startups in the second quarter of 2025, more than tripling the number of deals compared to the same period last year.

This is despite a general cooling of interest in hydrogen by energy investors. Whereas five years ago it was hailed as a quasi-silver bullet, green hydrogen, especially, has become something that investors are weighing carefully against other uses of green electrons, often relegated to narrower use cases. However, oil and gas companies have continued to invest in a variety of hydrogen-related startups.

Hydrogen investments in the second quarter included Perenco’s Taranis Carbon Ventures backing a $20m round for Elemental Advanced Materials and Orlen taking part in a $36m series C for electrolyser membrane developer Hystar. Also earlier this year, Shell Ventures and Thaioil’s TOP Ventures backed an $18m round for green hydrogen electrolyser maker Supercritical. BP participated in rounds for electrolyser company Advanced Ionics and hydrogen exploration company Snowfox Discovery, which is looking to extract naturally occurring “white” hydrogen from underground deposits. OMV Petrom also invested in Hycamite TCD Technologies, which has developed a methane-splitting technology to produce low-carbon hydrogen.

Many see hydrogen as a critical area to stay relevant in as industrial sectors come under significant pressure to decarbonise and to use hydrogen instead of liquid natural gas where appropriate or affordable. Oil and gas majors are wary of being left outside of an industry that could ultimately cut their customer base.

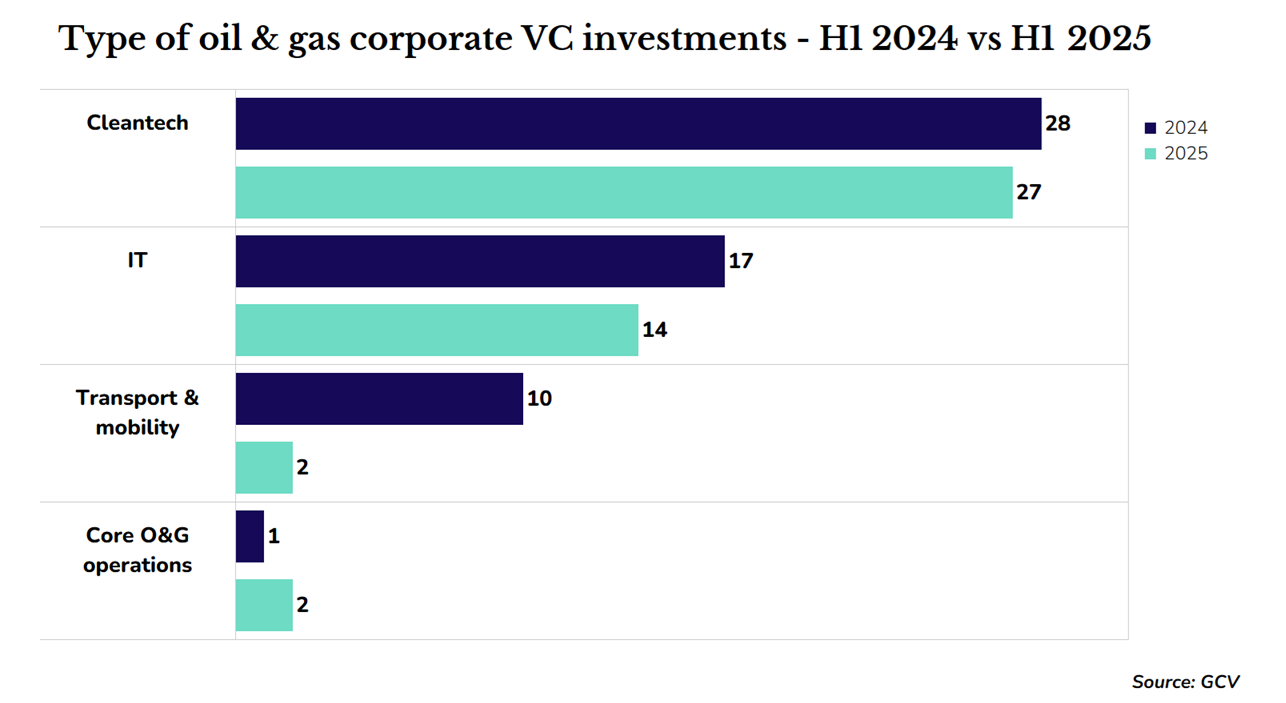

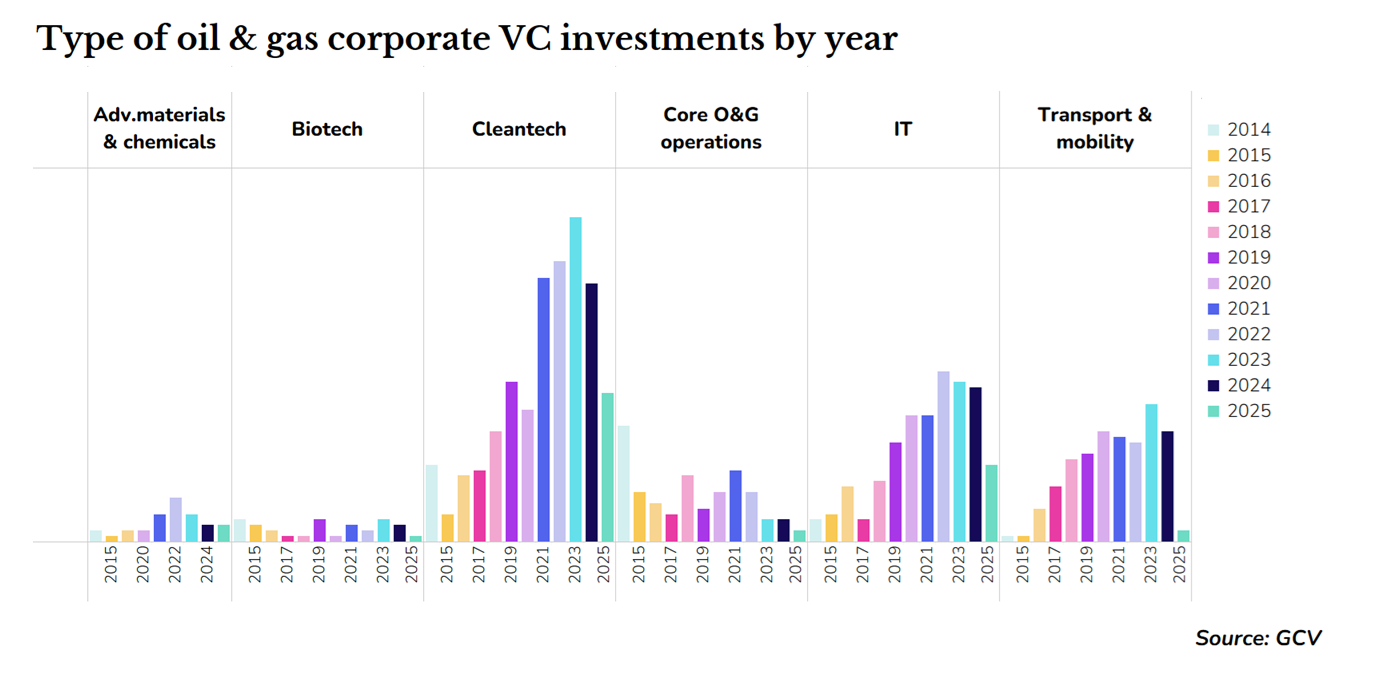

The first half of 2025 has felt like a less optimistic time for cleantech investment relative to the same period last year – indeed, energy majors like BP have been vocal about their de-emphasis of cleantech and pivot back to their hydrocarbon core, while a major regulatory deemphasis on cleantech is ongoing in core markets like the US. However, the results in terms of deal flow have been negligible, with only one fewer cleantech related funding round being struck by oil and gas corporates.

Carbon capture technology startups have kept the relatively steady tempo of fundraising they’ve maintained over the past three years of between one and three rounds per quarter – Q1 2024 being an outlier with 6 deals – but it’s still clearly an important piece of O&G decarbonisation strategies.

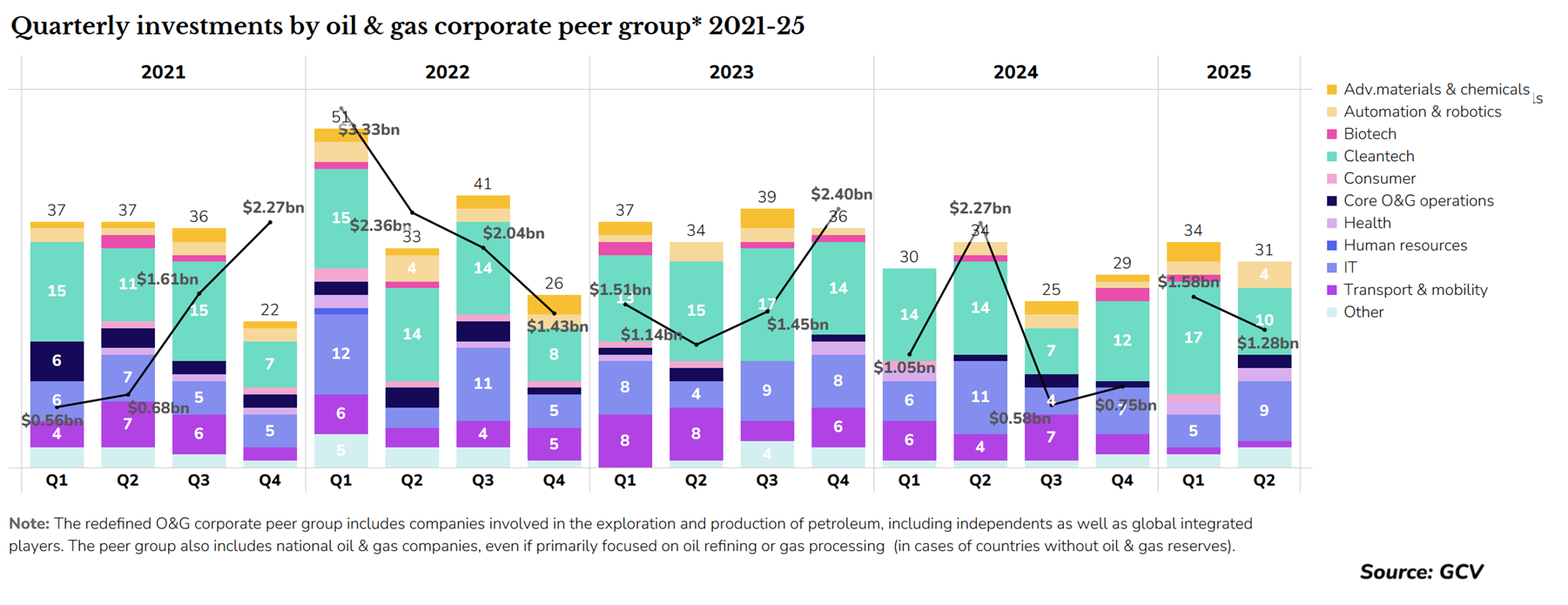

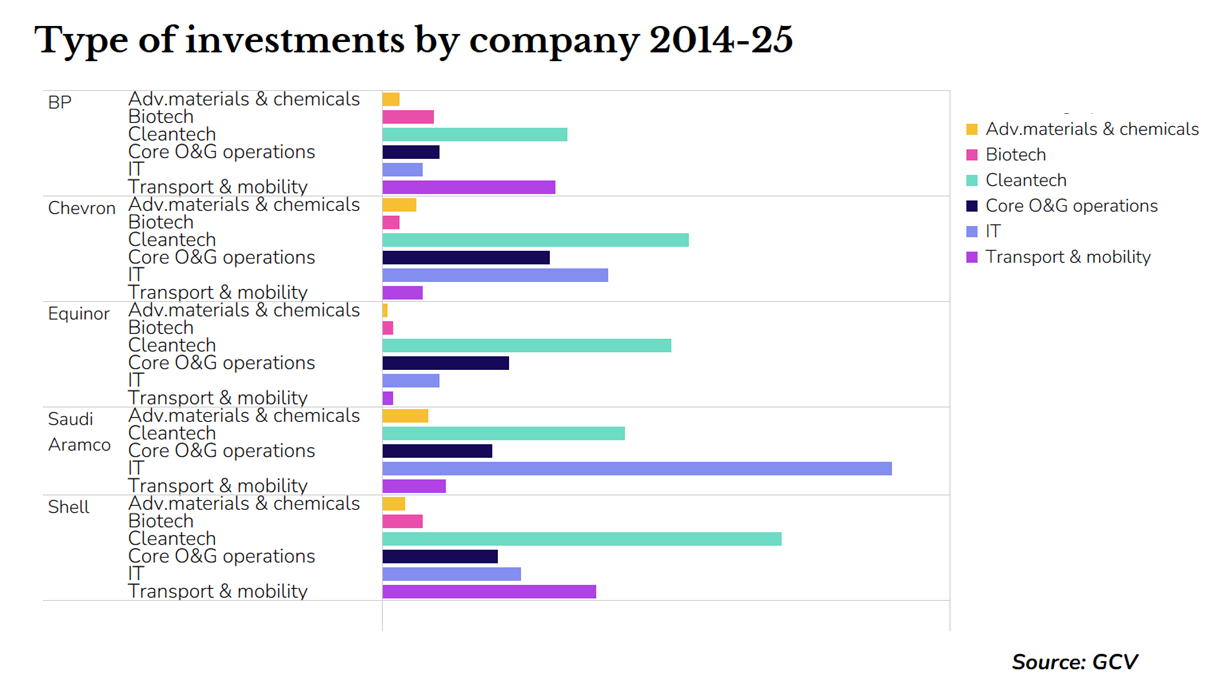

IT investments remain the second biggest draw for capital, despite a small drop from last year. Digitisation has been a major priority for the industry in recent years with certain companies, like Aramco, spending heavily over the past decade as legacy systems get upgraded.

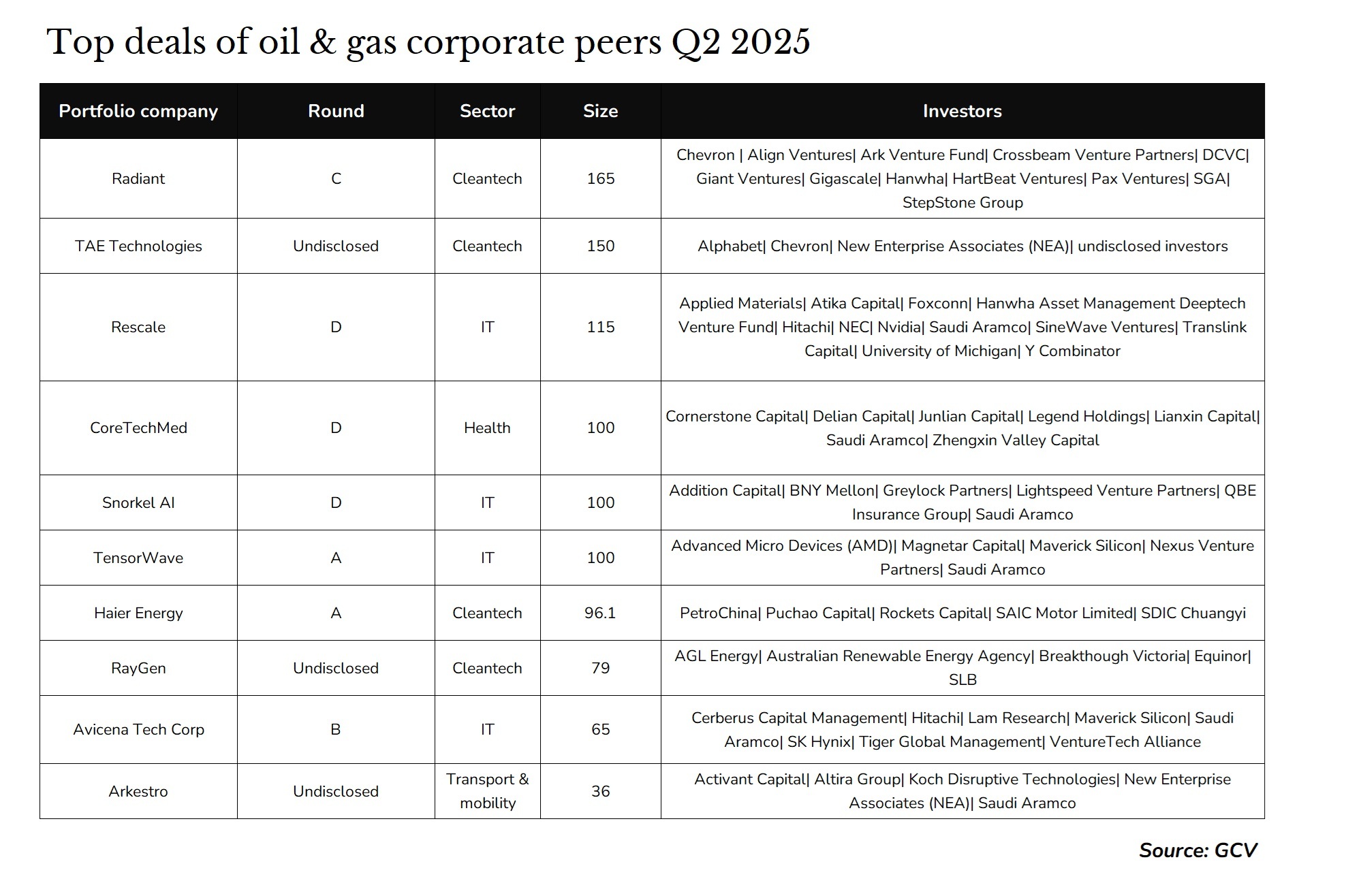

Aramco also made its mark on Q2, displaying no shyness whatsoever about deploying its dry powder, taking part in six of the 10 biggest funding rounds backed by oil and gas companies in Q2. Chevron Technology Ventures, for its part, participated in the two biggest rounds, both of which were for novel nuclear generation technology.

Decrease in overall investment dollars

Overall, Q2 2025 saw a roughly $1bn drop in investment compared to the same quarter in 2024 — although Q2 last year had been something of an outlier in what has otherwise a relatively subdued year in terms of spending.

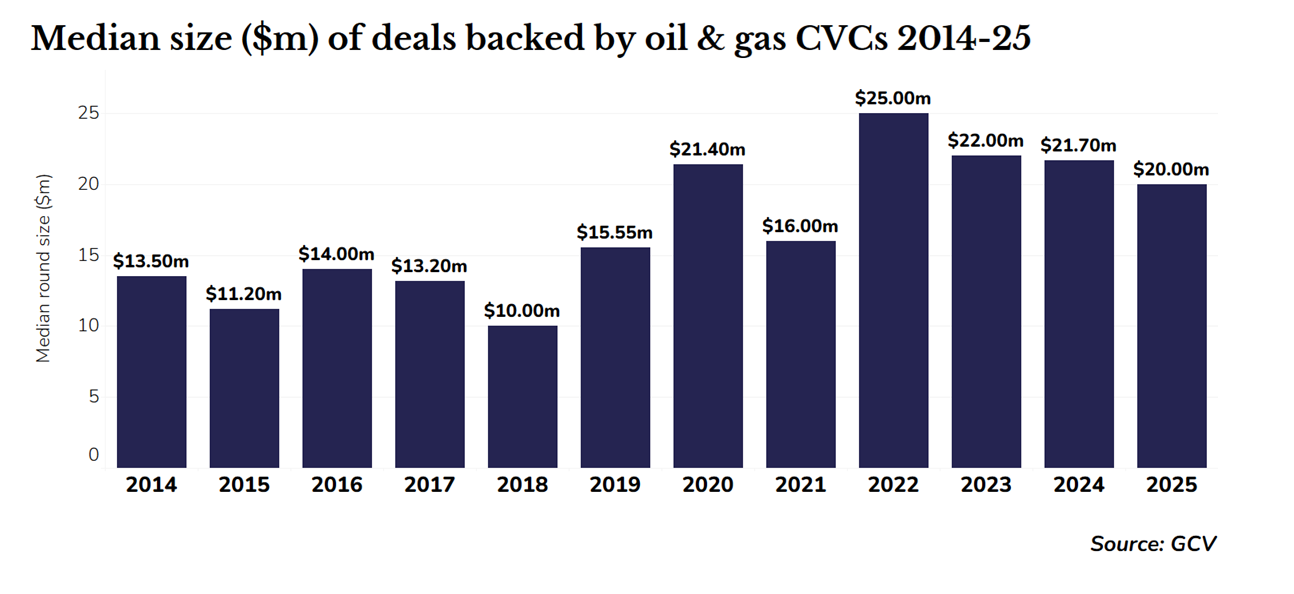

The median size for rounds backed by the peer group so far this year is down a little from previous years. Deal sizes have been decreasing by around $1m each year since 2023. However, large outlier deals of more than $100m have made a comeback, reaching their highest share since the end of 2022.

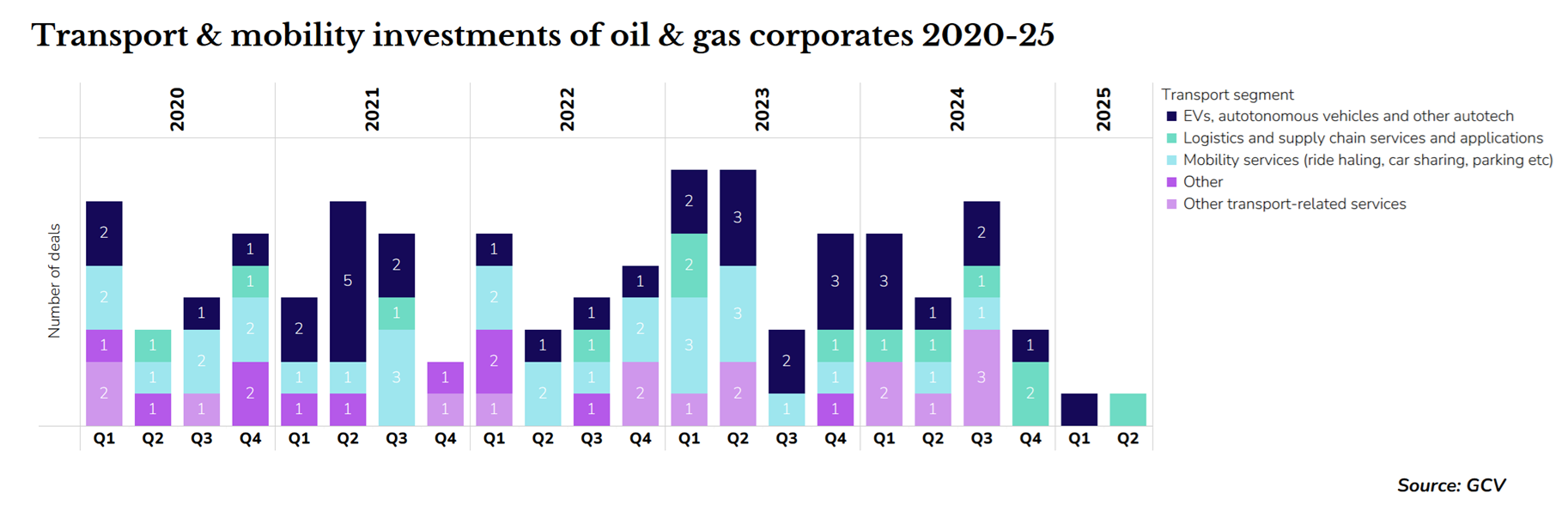

No love for transport?

One area where investment gas dropped sharply this year is in transport and mobility, where there was just one deal in Q1 and one in Q2. Previously companies like BP and Shell have invested heavily in the mobility sector as they sought to build up EV charging businesses to supplement existing petrol station operations. However, new investments appear to be on hold.

In sub-segments like clean tech and IT, 2025 is on track to at least match the previous year’s deal flow, but the transport sector shows a sharp change from previous years.

Cashing in and out

Oil and gas companies are getting ready to put more capital into the market, having established a number of new funding initiatives in the past quarter.

Brazil’s Petrobras put out a call for proposals, seeking to find managers to run a new $89m VC fund to back startups in areas like renewable energy, electromobility, energy storage, sustainable fuels, carbon capture and the decarbonisation of operations. It hopes to find a partner by October and start investing in the first half of 2026.

Petrobras was not the only Brazilian company bolstering its war chest, with Prio allocating $21m to a new fund targeting a slightly different set of technologies, with less emphasis on cleantech and more on operations, including predictive maintenance, energy efficiency, AI, logistics, advanced recovery, and equipment monitoring.

Across the Pacific, China’s Sinopec is doubling down on the hydrogen economy with a new $690m VC vehicle looking at startups focused on the equipment, materials, and proprietary technologies for hydrogen, following the Chinese government effectively saying full steam ahead late last year when it reclassified hydrogen from a hazardous chemical to a clean energy source.

We’ve also seen a small number of exits by oil and gas companies in the past quarter, with underwater hyperspectral imaging startup Ecotone, which had Equinor on its cap table, being acquired by Eelume, as well as cybersecurity company CPX buying cyber-AI startup SpiderSilk, providing an exit for Saudi Aramco’s Wa’ed Ventures.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.