The IPO window is finally opening in the US, as activity expands from medtech and pharma to fintech and enterprise startups.

Enterprise collaboration software provider Figma floated yesterday in a $1.2bn initial public offering which shows how the US IPO market is ramping up as flotations expand from medtech and pharmaceutical companies to startups in fintech and enterprise software.

Figma’s shares shot up on their first day of trading, passing $115 before close, giving the company a market capitalisation of roughly $67bn, more than five times the valuation of a $700m secondary round it closed in mid-2024. That came a day after Ambiq Micro, a corporate-backed AI chipmaker, saw its shares double in price on their first day of trading following a $96m upsized offering.

It’s official: IPOs are back.

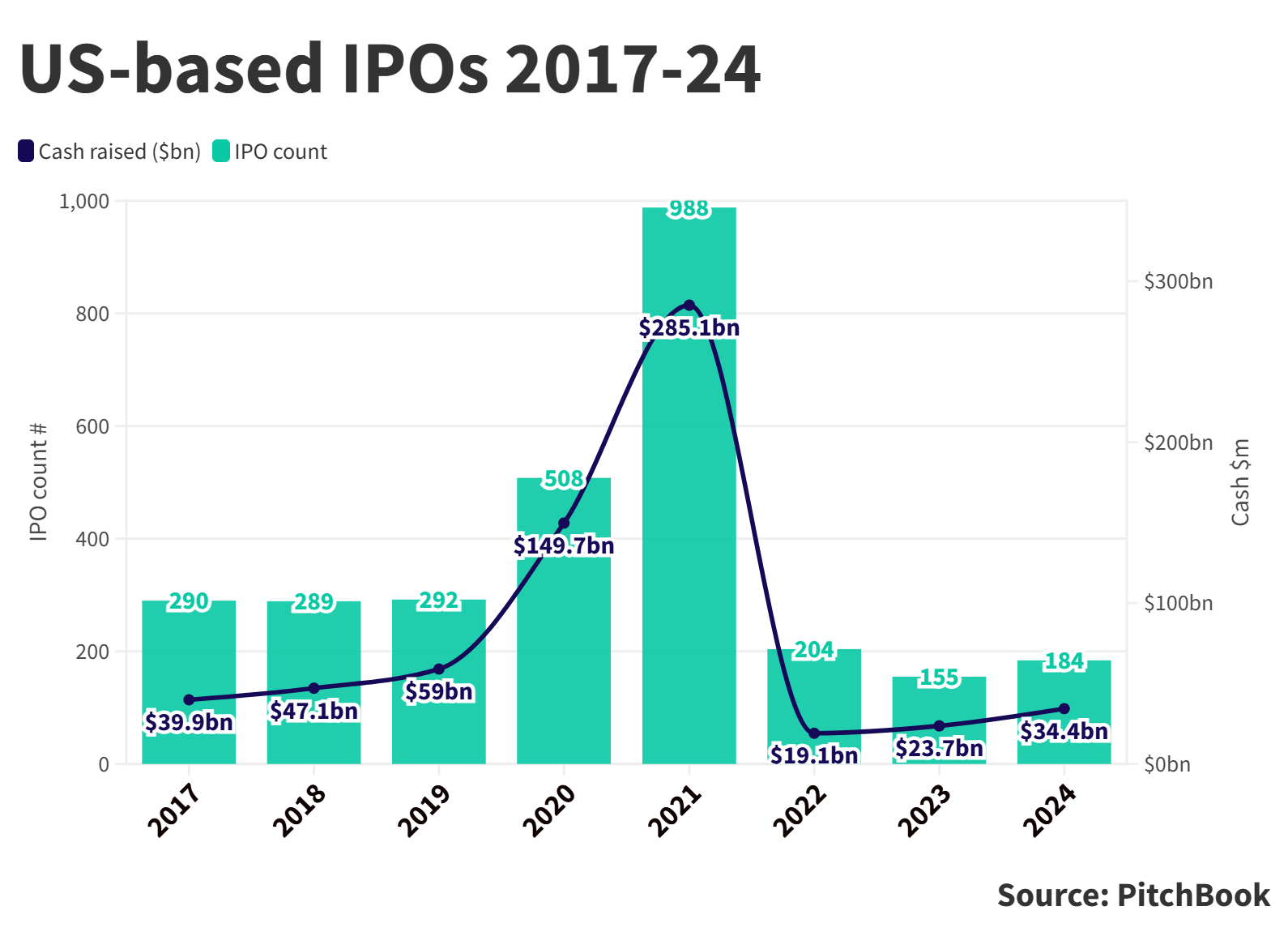

The environment is a welcome change for the startups and investors. The IPO market hit its greatest heights ever in the boom years of 2020 and 2021, only to face a serious hangover as public share prices dropped during the 2022 stock market decline.

The chart below doesn’t tell the whole story, with many of the IPO numbers in 2022 and 2023 in particular boosted by the occasional multibillion-dollar offering (Arm Holdings and Johnson and Johnson spinoff Kenvue were responsible for nearly half the 2023 proceeds) and a flurry of small-market IPOs: not a prime environment for tech unicorns.

The result was that startups were spooked, and apart from a short burst last year, have simply stayed away from public listings for the past three years. While there have been success stories – notably, Reddit, which has seen its share price triple since its March 2024 IPO – the startups that did go public in that stretch of time have seen their share prices stagnate or even drop.

“There’s no other way to describe it other than tough. IPOs have been tough to come by,” says Craig Schedler, vice-president of venture and corporate development for financial services firm Northwestern Mutual, which celebrated its first IPO exit when portfolio company Chime floated in June.

“If you look at the valuation and the revenue you need to achieve in order to go public, it’s just a much higher standard today than it was probably five, six years ago,” Schedler adds. “That’s partially a function of the availability of private capital allowing companies to stay private longer.

“But I think in large part that the public markets have been more discerning, and so if you’re not profitable, ideally like a Chime, you better be able to show a strong path to profitability. If you’re lacking one of those two elements, the public markets aren’t going to be very receptive.”

The move from a healthcare-heavy market to fintech and enterprise startups

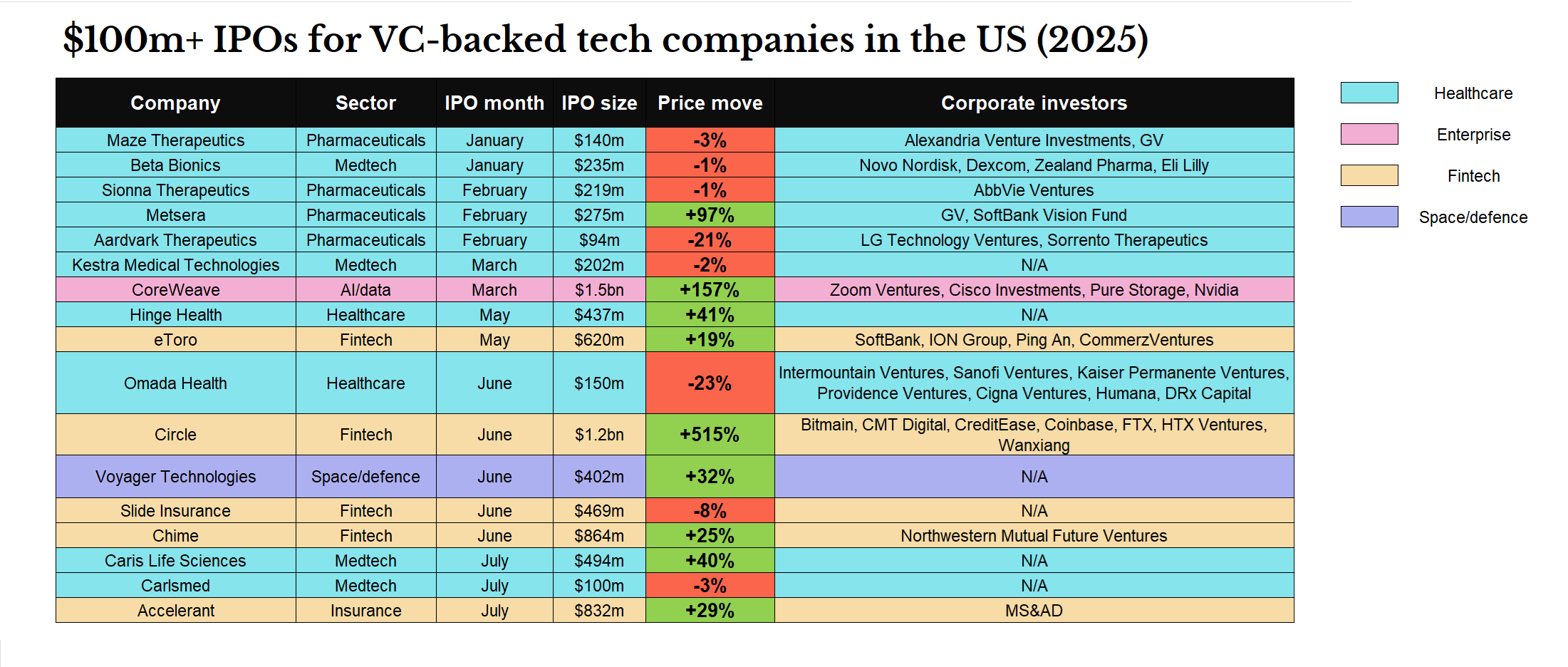

Activity in the IPO market has steadily increased this year, despite fears that a tumultuous economy could scare startups away from the public scrutiny of the stock market. A closer look at the companies that have gone public in the US this year tells a clearer story about which startups are thriving in the market.

Seven of the first nine VC-backed tech IPOs over $100m this year were by pharmaceutical and medical technology companies. As the pace of IPOs has increased, seven of the 10 since then (including Figma) have been for fintech and enterprise startups.

Obesity drug developer Metsera has been the only health-focused company to float in the first half of this year and see a big leap post-IPO – its share price has more or less doubled since its February offering. The majority of those initial seven floated in upsized offerings, and all but one at the top of or above their price range.

Once it became clear that the market was amenable, other companies grabbed the opportunity. And while the health-focused startups have done well, they’ve been outstripped by the software-focused companies that have followed.

Six of them – AI hyperscaler CoreWeave, online share marketplace eToro, stablecoin provider Circle, neobank Chime, insurance risk marketplace Accelerant and now, Figma – raised over $500m in their IPOs, compared to none from the healthcare side.

And several have thrived once they’ve hit the markets. Circle’s shares are trading at six times their IPO price and CoreWeave’s quadrupled in price inside three months, while Chime and Accelerant have also seen big rises post-IPO.

That enthusiasm is built on healthy balance sheets. Take Chime, which has cut its net loss from $470m to $25m in the past two years while hiking revenue to more than $1.6bn. CoreWeave’s revenues have leapt from just $15m to $1.9bn over the same period, while Circle turned a $769m loss in 2022 into a $156m profit last year.

“The companies that have generally found success have been more of the recurring revenue model. I think generally, the market is looking for predictable growth stories, and those are the companies that are going to be rewarded,” Schedler says.

“There are just a lot of tailwinds to [the stablecoin] sector in general, and obviously, Circle has built a nice business,” he adds. “You put that kind of tailwind behind good individual performance and you end up kind of where they are in the public markets. Similarly, from Chime’s perspective, they’ve built a really nice, sustainable business and shown strong growth.”

Figma is an example of this trend, floating above a price range that had already been significantly increased. And while it did post a hefty net loss last year, it also increased revenue by 50%.

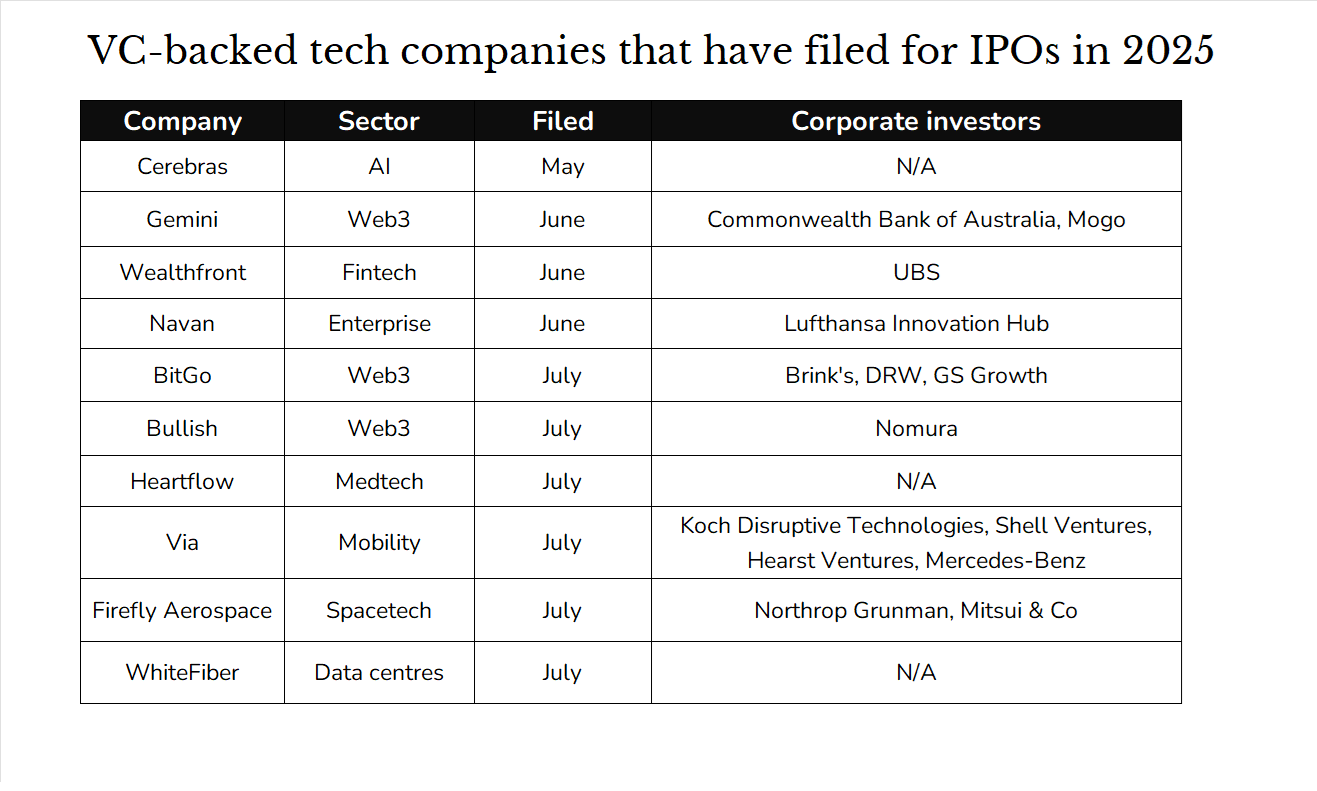

What’s next on the horizon?

About a dozen other tech companies have filed for IPOs in the US and, while it’s a more diverse selection that goes from rocket maker Firefly Aerospace to transit software producer Via, fintech is the standout area, Web3 in particular. That trend looks likely to continue as the year progresses.

“Fintech went through a very difficult stretch,” says Schedler. “2022 and 2023 in particular were very rough periods for fintech as a sector. But I think you’ve had a lot of growth and maturation amongst the leading fintech companies, and so I think you’ll see more and more of them, with the success of Chime and others that have gone public.”

The other factor, Schedler adds, is that while the fintech companies that floated in the 2021 rush may have experienced big falls in their share price in their first year or two of trading, many have seen big recoveries since. Online lender SoFi’s shares were sitting below $5 in mid-2022 and are now priced at over four times that. Mobile bank operator Dave’s shares sunk to the same sub-$5 level a year later and are now trading above $230.

Looking further ahead, there are a clutch of highly valued corporate-backed fintech startups that could be joining the IPO queue, including payment technology producer Stripe and buy now, pay later service Klarna. Add that to enterprise software companies like Databricks, Canva and Airtable, and a swathe of high-growth AI startups, there could be a busy two to three years ahead in the IPO markets.

“Nobody wants to be first, and once you get one and now two that have done well post-IPO, it breaks the logjam, so to speak, and you see a lot more companies looking at it and considering it as an option now, where maybe they wouldn’t have six to nine months ago,” says Schedler.

“I think that overall, there’s been sort of a reset. Fintech was very, very hot, and everybody was in it in 2021. Then, it kind of cooled off, and now you’re seeing like the reemergence of the strong companies. So, when you start to look at the exit market, I can probably think of at least a dozen or more that would look to go public sometime in the next two years.”