Even during its current rough patch, investors in Brazil are confident in the fundamentals of the market.

Latin America has, in the past few years, become an increasingly important destination for corporate venture investors. A young, entrepreneurial population, a common – or at least very similar – language throughout the region and much cultural overlap make it attractive for business and the startup scene has been thriving for years. Brazil, the largest economy in the region, has been a particular driving force, although recently, a high interest rate environment and a global slowdown in investments has taken its toll.

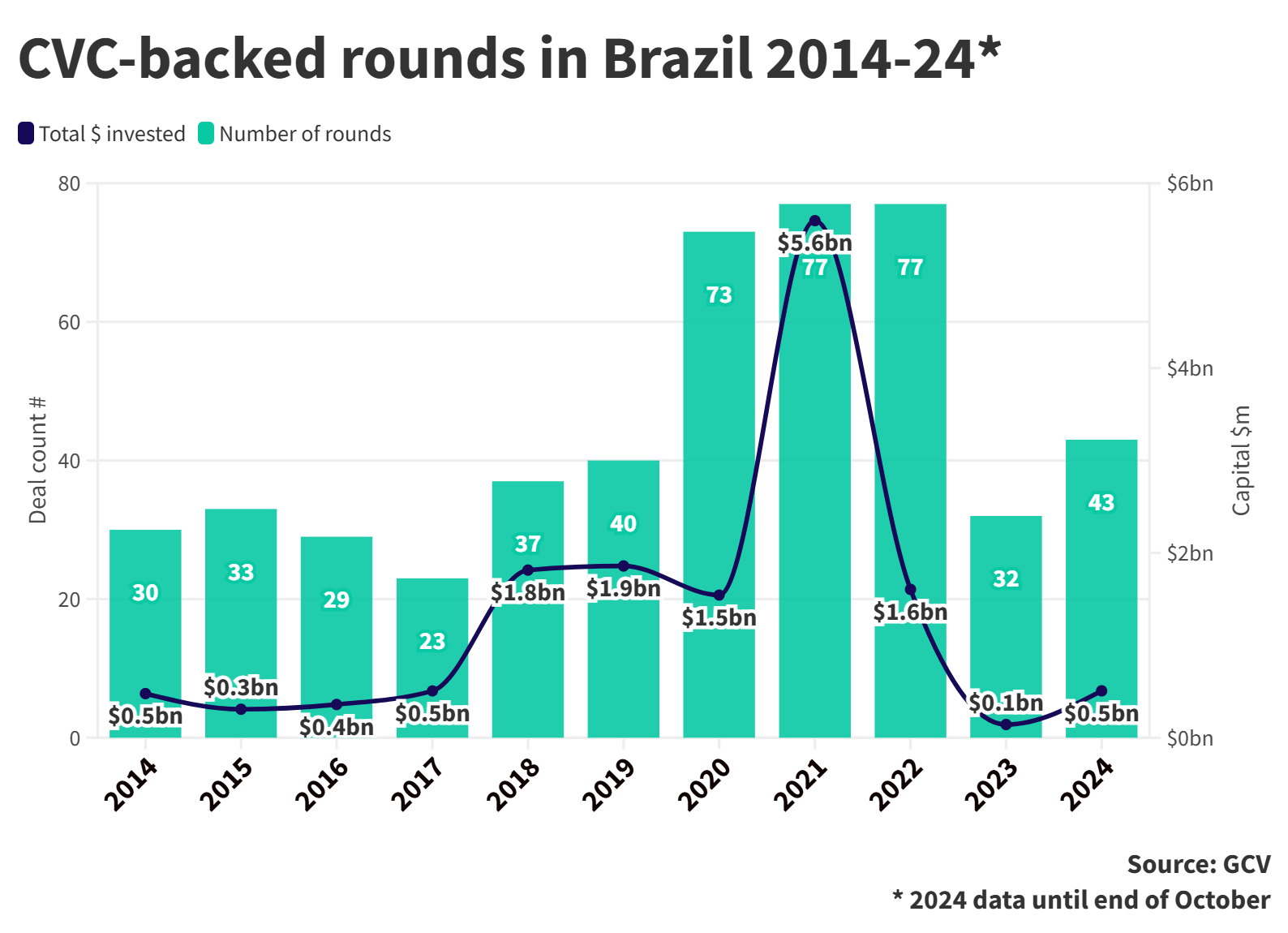

Dealflow is down, returns are harder to come by and while new CVCs have popped up, some – like steel maker Gerdau’s venturing unit – have stopped investing or shut down altogether. But investors remain confident in the fundamentals of the market, the strength of the country’s long-term position, and that the rough patch is temporary. The number of corporate-backed startup funding round in Brazil, though down from 2021 highs, is higher this year than in 2023.

International interest

A particularly encouraging sign is how much attention the market is receiving from international investors. This interest was evident at this year’s Corporate Venture in Brazil event in São Paulo at the end of October, which attracted more than 700 people over three days.

The interest from the outside is strong, even if the investment itself is not immediate – there can be a lag in that capital coming in as investors are learning more about the market before jumping in.

Some of the interest was on show in the panel discussions throughout the conference. Jessica Persson, head of venture capital and M&A at Scania Invest, highlighted how much of the Swedish commercial vehicle manufacturer’s global trucking operation is based in Brazil, along with some 20% of its buses – making it an important market for the company.

Persson said, however, that she would want to see more investors in the region who know how to commercialise deep tech, and who are stable and steadfast enough to stick it out through the tough times.

For Dong-Su Kim, CEO of LG Technology Ventures, Brazil’s strength in minerals and natural resources is of particular interest, given LG’s need to strengthen the supply chain for batteries, for example. For Kim, the bottleneck right now is not knowing enough about the market, but he said he would be willing to invest alongside a local VC who knows the terrain.

Saison Capital, Credit Saison’s CVC which is focused primarily on financial returns, is excited about the heavy fintech focus in Brazil, but also wary of the exit risks in emerging markets, said vice president Ziheng Li.

For German chemical company Evonik’s CVC, Evonik Venture Capital, there is great potential in Brazil’s life science, agtech and biotech sectors, while its abundance of natural ingredients represents an opportunity to capitalise on trends that seek to replace chemical ingredients with natural ones, according to the unit’s investment manager Jonas Ide, who added that there is a lot of space to create new materials.

Andrew Ng, managing general partner of AI Fund, pointed to Brazil’s commitment to education, as well as its strength in fintech, transport and energy as reasons to be bullish, adding that the country’s investment in tech startups so far is a great base to build upon.

Tougher times

Nevertheless, the Brazilian venture capital market is facing a number of headwinds. The first concern is the interest rates in Brazil. Compared to other growing CVC markets in the region, they may pale in comparison to their neighbours in Argentina, but at nearly 11% they are double that of Chile, and higher than Colombia. Unlike any of those three, however, only Brazil’s rates have been hiked of late, the most recent increase being in September.

Apart from having an adverse effect on startups in the lending business – financing platforms for agriculture, for example, have traditionally been a bright spot for investors looking to Brazil in recent years – it has also made some asset managers wonder if venture is the best place to put their money right now. In some cases, it’s been hard to convince certain co-investors, who would have expected returns in the same range as the interest rates, that the risks involved in VC investing are worth it when the rates mean they could invest in other more stable assets like treasuries.

This has not meant that startups aren’t expecting high valuations, though, and what they’ve found is a lack of liquidity. The dry powder may be there, but fund managers have a firmer grip on the purse strings, meaning only the very best and most impressive young companies are able to raise money, and the investors looking to back them are consequently finding it harder to get into those rounds.

This has all translated into a noticeably slower deal flow than in recent years, and in smaller rounds. Fund managers aren’t quite seeing the returns come in yet.

For CVCs, the need to constantly communicate their raison d’etre has become all the more important. In the short-term absence of returns, many are framing their benefits to the corporates – sometimes impatient ones – in strategic terms, and managing expectations has become a constant exercise.

One avenue more are looking to take is venture building, which carries less risk than venture investing. Even then, investors are finding its better to frame those initiatives in terms of direct benefits to the parent business, rather than amorphous concepts of open innovation – corporates want to be innovative, but sometimes the fear of failure is too large and there comes a point beyond which no one wants to be the one approving budget for a wayward venture.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.