Big AI mega funding rounds are pushing up the dollar value of funding rounds, but the underlying number of rounds is up 25% signalling growing investor confidence.

Corporate investors have backed some 2,474 startup funding rounds since the start of 2025, with the value of funding rounds doubling to more than $129bn as large AI transactions swelled the total.

The first half of the year saw a handful of mega funding rounds, such as the $40bn Softbank-led funding round for OpenAI and Meta’s $14.3bn investment in Scale AI, which pushed up the number for total spending.

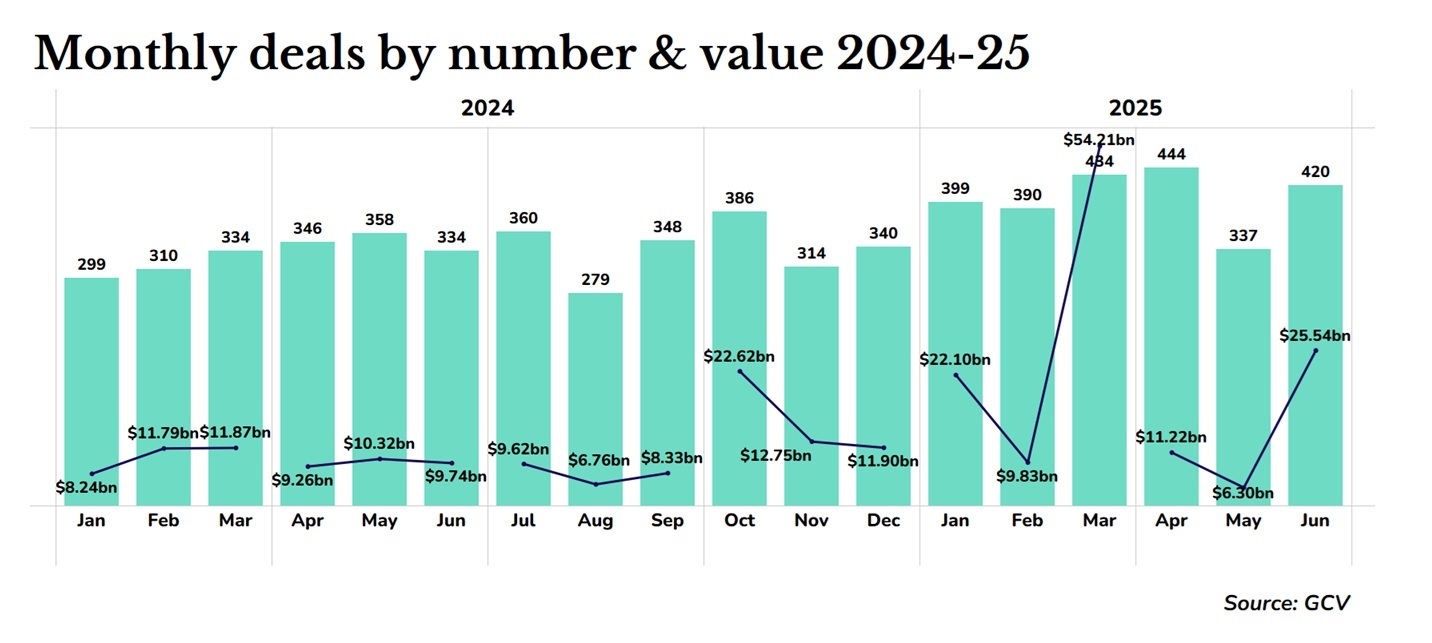

But even outside these outlier deals, corporate investment in startups has picked up, with 25% more funding rounds than in the first half of last year. This is despite a sharp drop in May as uncertainty over US trade policy put many transactions on hold.

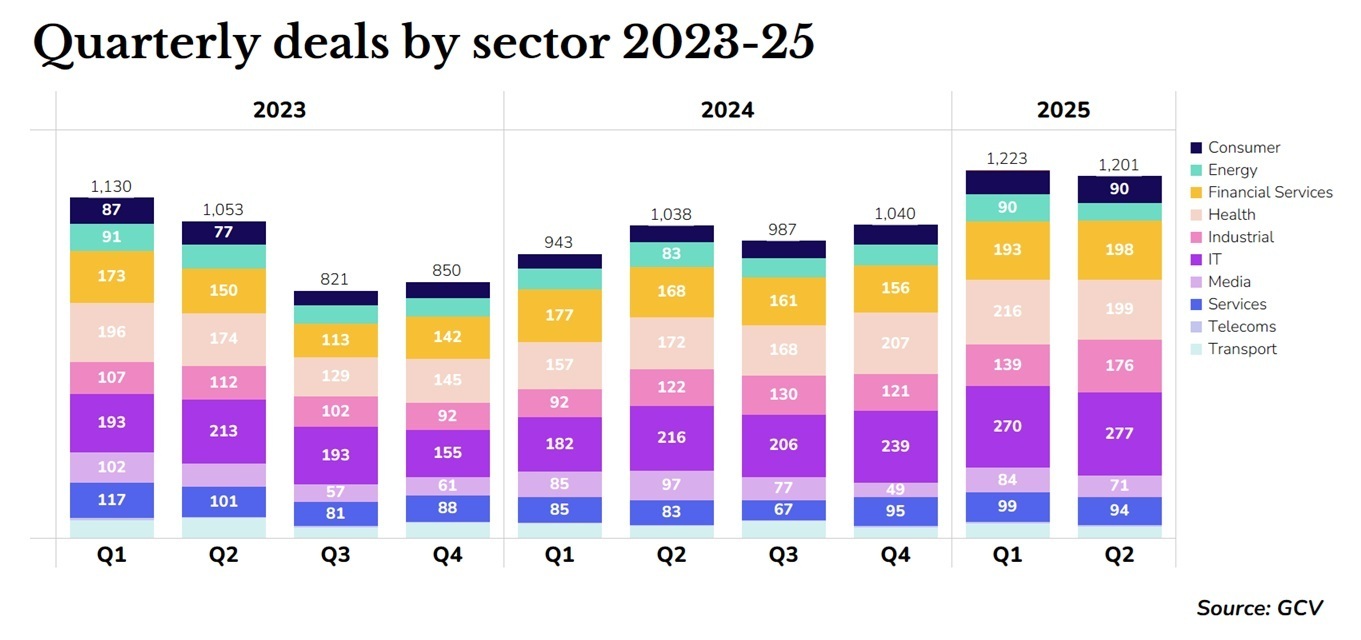

Deal volumes came back in June, however, and overall the second quarter finished stronger than the same period a year ago, with 1,201 startup rounds with a value of $43bn dollars, up from 1,038 deals and $29.3bn in the year-ago period.

Corporate deal flow rises in Asia

While the US remains by far the leading geography for corporate VC deal flow – its numbers virtually identical to Q2 2024 – Asian markets have seen big increases in activity. Japanese startups saw a 33% increase in funding rounds, India went up by 23%, and China also saw increased activity. Singapore was an outlier, dropping by 35%.

The uptick in Asian deal flow comes as a flurry of new venture units and funds has sprung up across the region. In Japan alone in the past year, corporates like KDDI launched a new $34 fund targeting AI and deep tech, internet company LY kicked off a $191m startup fund, insurance company MS&AD launched a $100m fifth fund, medical device company Terumo kicked off a $75m fund, and ketchup manufacturer Kagome and game developer CryptoGames launched funds of their own, to name a few.

In India, tech company Info Edge just recently launched a $117m third fund, while in Korea hotels-to-confectionary conglomerate Lotte launched a healthcare fund as it also seeks to expand its US presence, Vietnam’s Vingroup opened a $150m CVC fund and Thailand’s Krungsri Bank launched a $38m private equity trust.

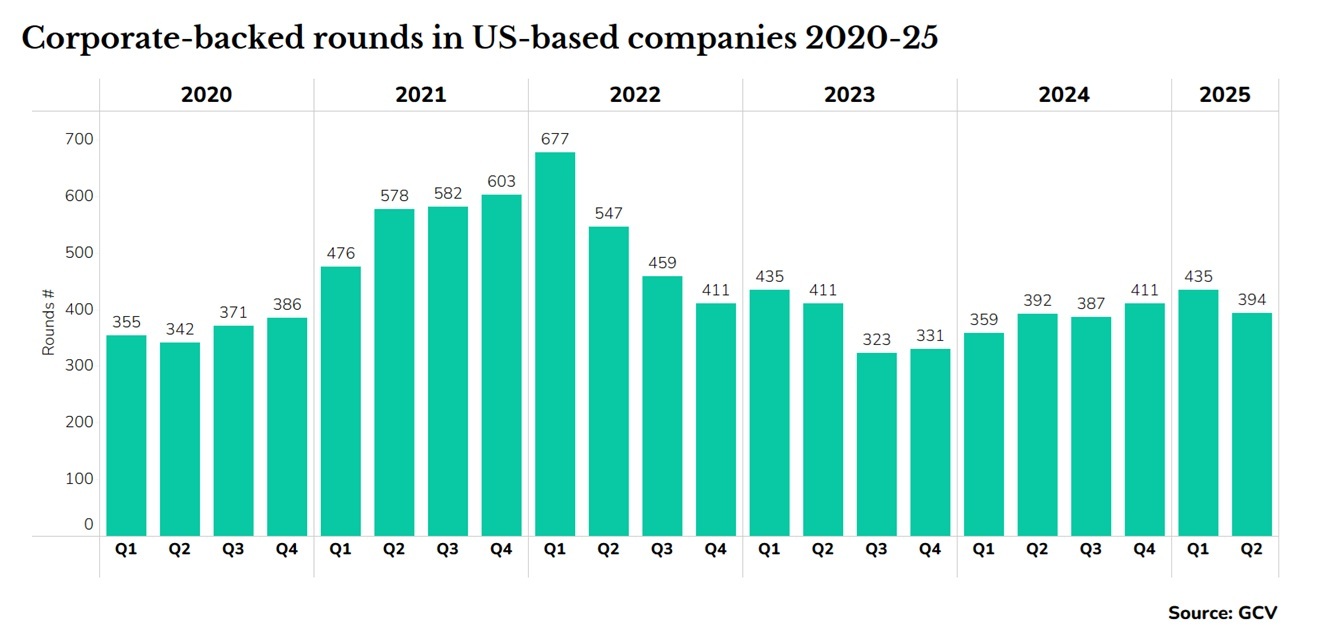

Within the US, the largest VC market in the world, corporate-backed rounds have been slowly rising since the middle of 2023 but fell back a little in the recent quarter.

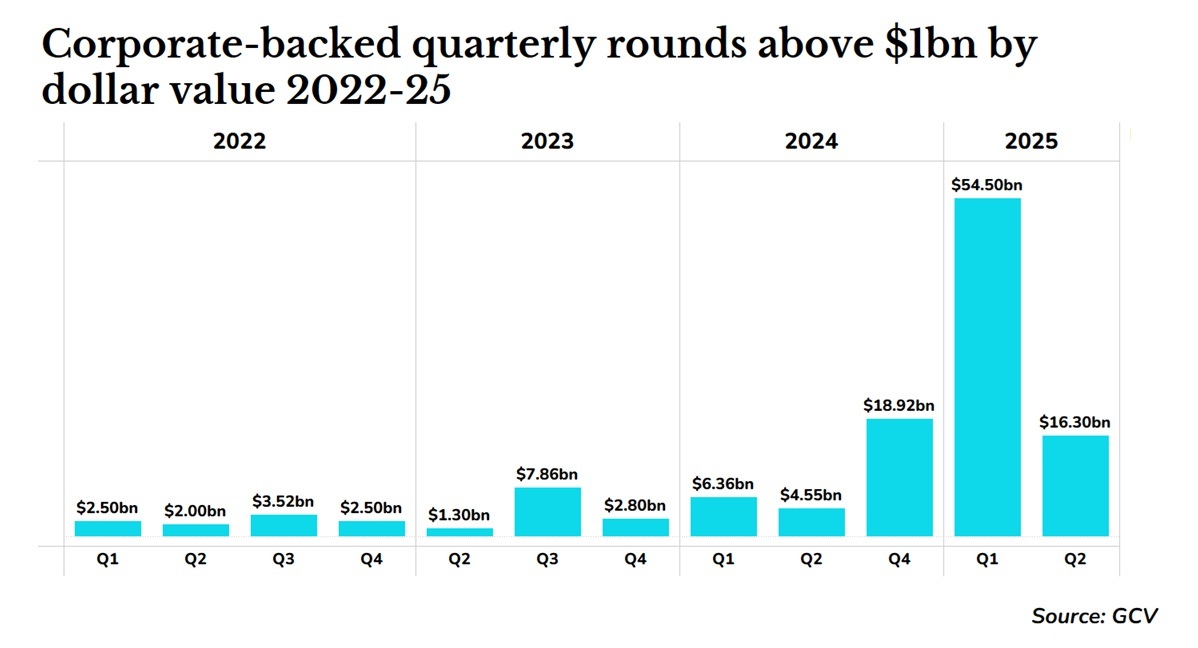

Sharp uptick in mega rounds

A notable feature of the first half of 2025 was the explosion in dollars invested in rounds surpassing $1bn, signalling not just the return of comfort with mega-deals, but a much more bullish environment when the circumstances around a startup look right. There was a year-on-year increase for Q2 megadeal dollar volume, following an over eight-fold increase for Q1 compared to 2024. Even at the beginning of 2022, before the hammer dropped, we were not seeing numbers anywhere near that.

Much like in Q1, though, which featured monster rounds like the $3.5bn Cisco and Salesforce-backed round for Anthropic and the $40bn injection for ChatGPT-maker OpenAI, in what was the largest tech round in history backed by the likes of SoftBank and Microsoft, Q2’s megadeals also heavily featured big-name AI startups. Meta made a north-of-$14bn investment in AI training engine developer Scale AI as it tried to close the gap between it and its major competitors, something that many remain sceptical it could ever pull off, months after backing a billion-dollar round for data intelligence software provider Databricks. Meanwhile, Alphabet and Nvidia backed a $2bn round for AI model maker Safe Superintelligence in April.

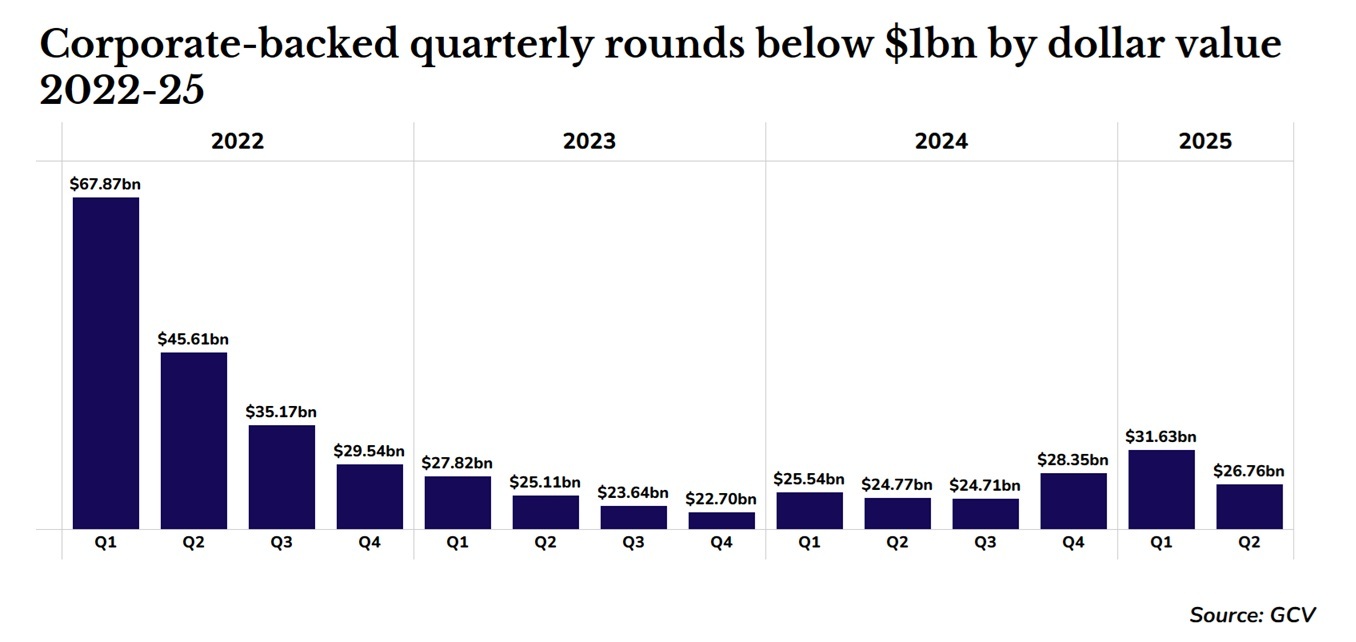

These deals garnered the most headlines but there has also been a steady rise in cumulative dollars invested in corporate-backed rounds below $1bn – the year-on-year trend lines are on their way back up from the dip beginning in 2022. The Q2 numbers, however, dipped.

IT, industrial and consumer startups win most backing

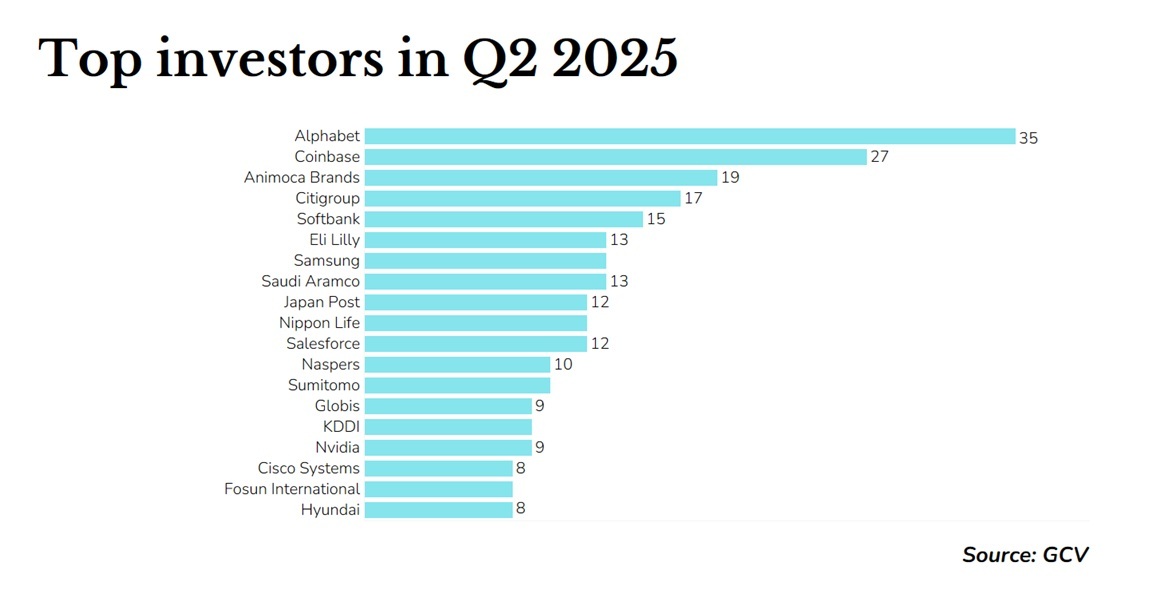

Alphabet has been the biggest single investor in Q2 with 35 investments, buoyed by AI-focused rounds. Coinbase and Animoca Brands followed in second and third place, signalling a strengthening environment for crypto and digital asset-related funding rounds. Crypto rounds are more generally on the up again, after a circa two-year winter, benefiting from tailwinds partially provided by the Trump administration’s hyper-bullish stance on cryptocurrency.

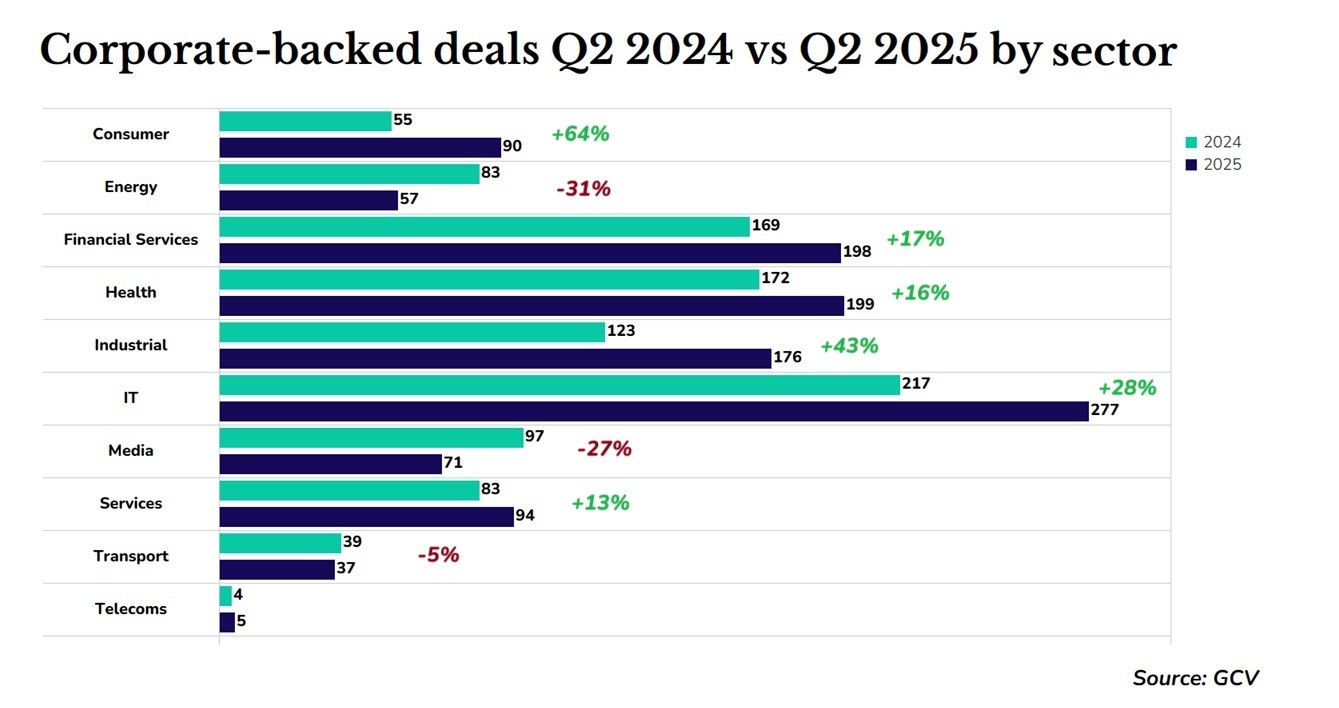

Not surprisingly, then, IT was one of the fastest-growing sectors in terms of corporate-backed deals – AI is a driving force here that doesn’t seem to be slowing down any time soon, while cyber threats continue to hold demand high for cybersecurity startups.

Other big mover sectors include industrial and consumer verticals, which increased by 28% and 64% respectively. The industrial sector has seen a massive amount of investment in things like robotics, drones and advanced manufacturing in recent months, building on a sharp increase we saw in Q1. Media saw a year-on-year decrease of 27%, reflecting a slump in gaming investments and following a wider trend of media companies suffering in the current economy, which has resulted in some layoffs at major companies like TechCrunch.

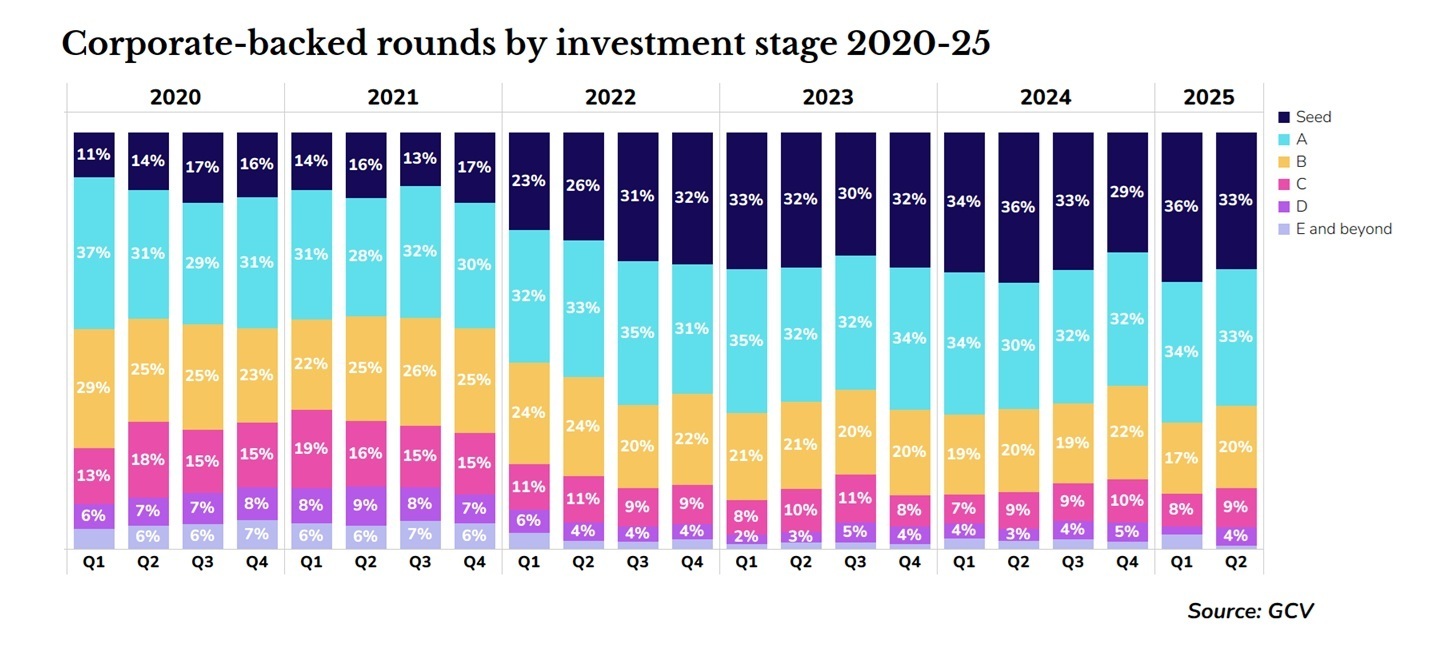

Corporate investors continue to split most of their deal flow between seed and series-A stage, a trend that started in 2022.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.