Kingdom Holding co-led Nana’s $133m series C round while Panasonic exited Geo Semiconductor in a $180m acquisition and corporate-backed Hesai raised $190m in its IPO.

Fund

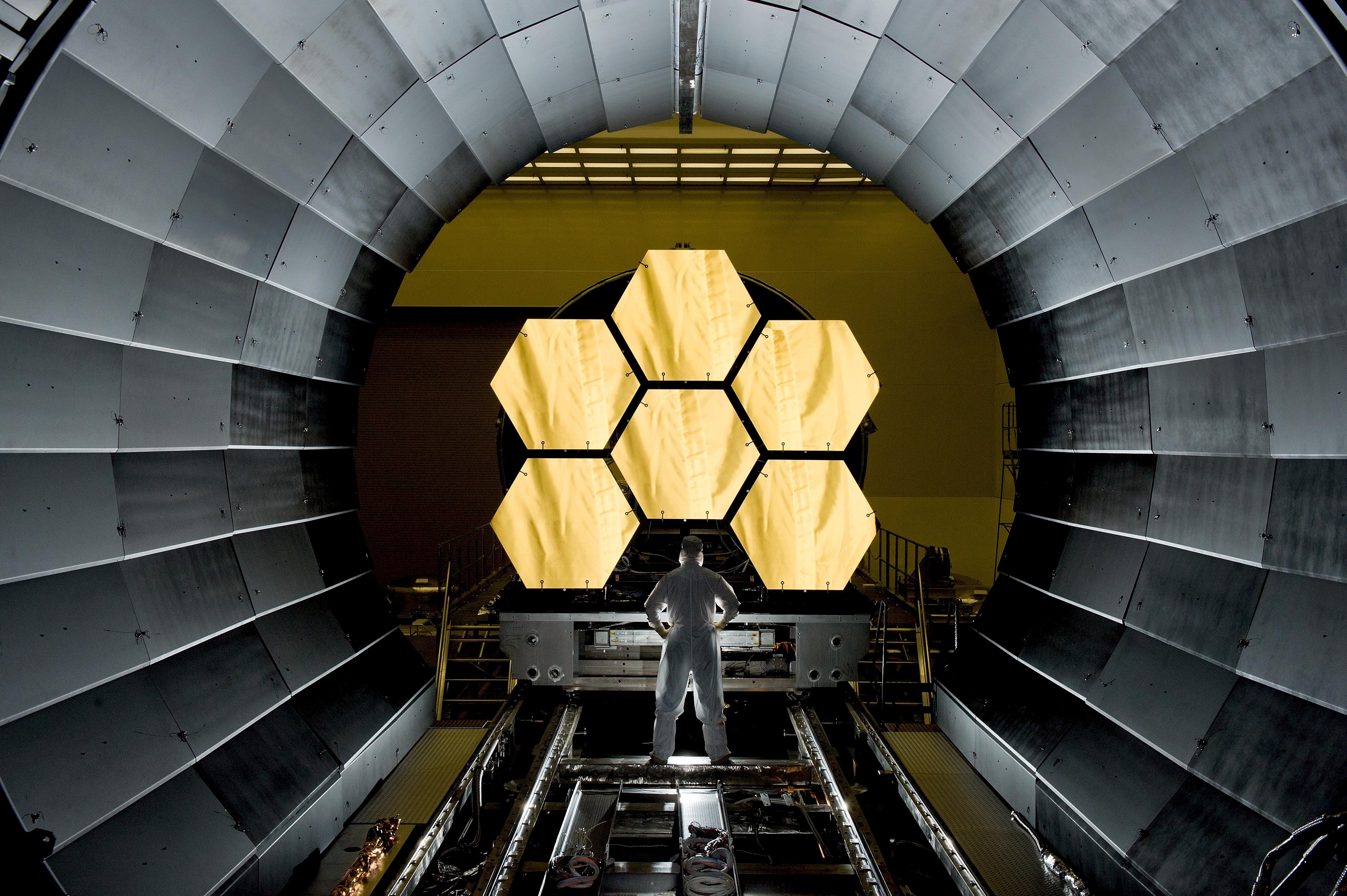

Israel-based venture capital firm Earth & Beyond Ventures formed a $125m deep and space technology-focused fund having secured commitments from limited partners including corporate backers Corning, Kyocera, Samtec and Spacecom.

M&A

Automotive chipmaker Indie Semiconductor agreed to buy Geo Semiconductor, a US-based fabless semiconductor technology provider backed by electronics producer Panasonic, for about $180m, subject to the terms and conditions. Geo had raised a total of $18m in debt and equity financing before adding an undisclosed sum in 2017.

Caption Health, a US-based developer of smart ultrasound diagnostics technology, agreed to an acquisition of undisclosed size by medical technology producer GE HealthCare, enabling medical device maker Edwards Lifesciences and healthcare provider Minneapolis Heart Institute to exit. Caption’s overall funding stood at about $60m as of a $53m series B round in 2020.

Public markets

Hesai Technology, a China-based developer of autonomous vehicle sensor technology, raised $190m in an initial public offering on the Nasdaq Stock Market. It had received at least $533m in venture funding from backers including corporates Meituan, Xiaomi, ON Semiconductor, Robert Bosch and Baidu as of a late 2021 series D round.

Funding

Saudi Arabia-based online grocery shopping and delivery platform Nana has secured $133m in a series C round co-led by conglomerate Kingdom Holding and backed by food and beverage distributor Red Diamond Foodservice and diversified holding group Dallah Al-Baraka Group. The round was led by Uni Ventures and included Sultan Holding, Al-Jasser Holding, AlJammaz Holding and unnamed others.

| Company | Company description | Sector | Country | Round | Round size($m) | Deal date | Investors |

|---|---|---|---|---|---|---|---|

| Cirba Solutions | Battery recycling management service | Energy and Natural Resources | US | N/A | 50 | 09/02/2023 | Marubeni |

| Arrcus | Networking software producer | Telecoms | US | D | 50 | 09/02/2023 | Saudi Aramco (Prosperity7 Ventures) (lead), Liberty Global; Clear Ventures, General Catalyst, Lightspeed Venture Partners, Silicon Valley Bank |

| Minu | Employee wellness management portal | Services | Mexico | N/A | 30 | 02/02/2023 | Grupo Coppel (Coppel Capital); Besant Capital, Enea Capital, QED Investors, Salkantay |

| Marker Learning | Learning disability services provider | Services | US | A | 15 | 09/02/2023 | Virgin Group; Andreessen Horowitz (lead), Primary Ventures, Difference Partners, Operator Partners, Night Ventures, Danny Green (GreenLight Venture Partners), Jewell Loyd |

| Rezolve.ai | AI-powered employee support management platform | Services | US | A | 11 | 10/02/2023 | Susquehanna International Group (SIG Venture Capital) (lead); Exfinity Venture Partners, 9Unicorns, Tri-Valley Ventures |

| SwipeRx | Online pharmaceutical purchasing network | Healthcare | Singapore | B | 10 | 09/02/2023 | Sanofi (Sanofi Global Health) (co-lead), Johnson & Johnson, Susquehanna International Group; Cercano Management (co-lead), Patamar Capital |

| Nodus Oncology | DNA damage response-focused cancer therapy developer | Healthcare | UK | N/A | 2.9 | 07/02/2023 | Cumulus Oncology; Khanu Management (Khan Technology Transfer Fund I) |

| Shaperon | Healthcare industry-focused messaging platform | IT | Japan | A1 | 2.7 | 10/02/2023 | Cygames (Cygames Capital); All Star SaaS Fund |

| VRRB Labs | Web3 DevOps tool developer | IT | US | Pre-Seed | 1.4 | 08/02/2023 | Jump Trading (Jump Crypto); Taureon, Big Brain Holdings |

| Fanbase | Sports ticketing and engagement software provider | Media | UK | N/A | 1.2 | 10/02/2023 | SaltPay (lead) |

| CFEX | Cloud-based decarbonisation platform | Energy and Natural Resources | US | Seed | N/A | 07/02/2023 | Accurant International (lead) |

| Global Sea Mineral Resources | Deepsea mineral exploratory arm of Deme Group | Energy and Natural Resources | Switzerland | N/A | N/A | 09/02/2023 | Transocean |

| Frontier Field | Medical institution-focused mobile app provider | IT | Japan | N/A | N/A | 10/02/2023 | Suzuken |