The global VC secondaries market is at its highest point since 2021, with the US in particular seeing higher transaction sizes and smaller discounts.

Sales of startup shares on the secondary market is approaching a peak last seen in 2021, as investors look to crystallise value in a still-depressed exits market, according to data from a PitchBook analyst’s note. However, corporate venture investors still make up a relatively small proportion of the sellers.

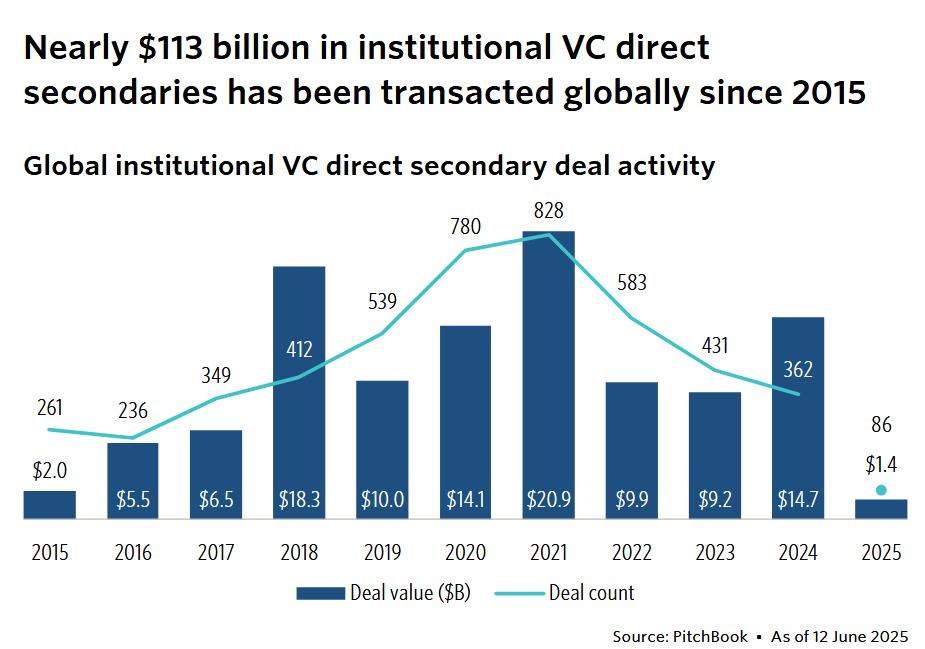

The report, Sizing the Institutional VC Direct Secondaries Market, recorded $14.7bn of activity in direct VC secondary sales in 2024 (numbers for 2025 appear low because data collection methods may lead to a lag).

The figures do not include sales that occur between brokers and thus cannot be traded, but they show deal volume last year was at its the highest point since 2021.

Those sales also made up a much larger share of global VC exit value in 2024, approximately 4.2% of global VC activity – up from 1.4% three years earlier. A good deal of that growth is because the IPO market has been so sparse, meaning investors have had to look elsewhere for an exit.

“A lot of it has been driven by depressed exits,” explains Navina Rajan, the PitchBook senior analyst who authored the note.

Investors tend to sell stakes in companies when they have held them for a number of years — the median is six — and many of these are later-stage companies, that have raised money in series D, E, F and further transactions, but have seen their growth slow.

Some sales are also driven by founders. “Although it’s not a big part of our data, I think founder liquidity is a very important angle to this. With a lot of the funds we speak to, a lot of their strategy is [due to] the function of the exit markets and generating liquidity, but it’s also just giving founders that liquidity to buy a house or take some sort of cash off the table,” says Rajan.

Secondary investors willing to pay a premium for big tech successes

In some cases, the secondary market has also been boosted by investors wanting to get onto the cap tables of big technology companies, like SpaceX, Databricks and Canva, which haven’t yet listed on the stock market. Investors are often willing to pay high prices for stakes in these businesses, lifting the overall value of the secondaries market.

The median transaction size for VC secondaries deals in the US exploded to over $64m in 2024, from under $10m the year before, and the country was responsible for 58% of the deal value for direct VC secondaries sales last year.

“Within the US, with some of the really big names, the big tender offers are driving up the pricing there and that is really distorting the pricing in the market,” says Rajan (left).

“We saw quite a few step-ups in some of these larger names, where it just made sense for investors to crystallise that value, especially given the fact that distributions and exits have been weak,” she says.

“I think it’s a mix of the bigger names doing well and – especially in Europe and the US – we’ve seen more actual funds directed toward these strategies, so we’ve had an increase in capital availability on the supply side as well.”

But the growth is also due to discounts becoming less harsh. While the discounts in valuations for these secondaries deals still often top 40% or 50%, they have improved from 2023, when a wide range of highly valued startups struggled to raise more money after the coronavirus-era boom, and investors were forced to take large haircuts to get rid of shares.

“Overall, I think it’s moving in the right direction,” Rajan says, adding that sellers are also seeking good investors to take on their shares. “The ones that are doing this well…are looking for good quality assets, rather than focusing on a 70% discount for something you know has little value intrinsically. I think more of the focus is on the actual asset itself.”

Corporate VCs not yet very active

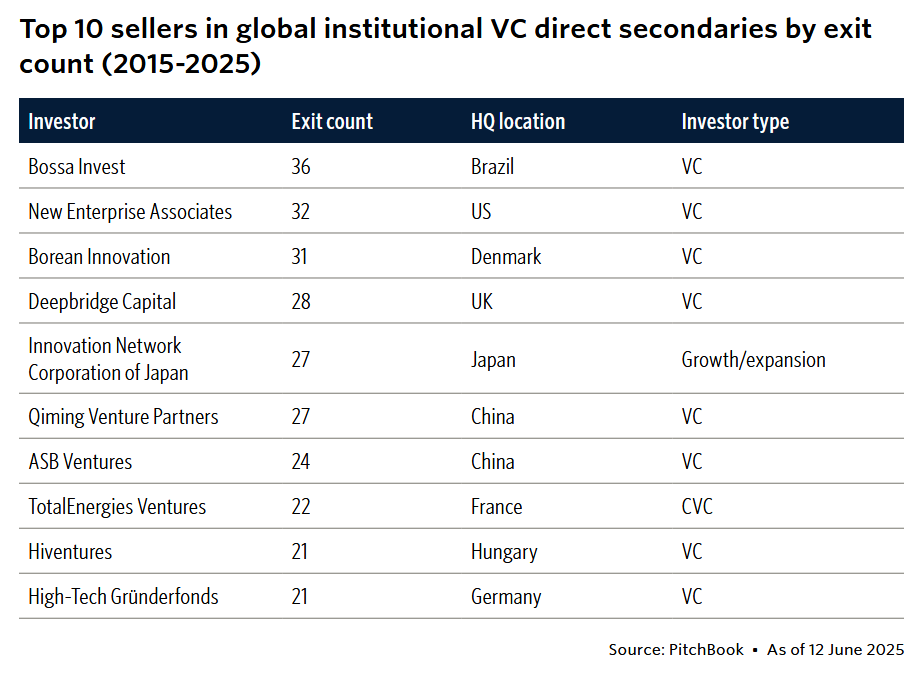

However, corporates are yet to form a sizeable part of the seller’s market, according to Pitchbook’s data. Of the 10 most active secondaries sellers over the past decade, most are early-stage venture firms like NEA or China’s Qiming Venture Partners.

The only corporate VC in the list is TotalEnergies Ventures, the investment arm of petroleum producer TotalEnergies that wound down in 2022. Most of the larger-scale transactions take place between institutional investors like specialised secondaries funds, sovereign wealth funds or family offices, according to the report.

“We’re not really seeing corporate VCs transact so much, just because most of the stage we see in CVC activity is in the earlier-stage part of the venture ecosystem,” says Navan. “And a lot of the activity is in biotech, pharma and wider software-as-a-service; a lot of the tech is perhaps not in the sorts of verticals where we see some of these big direct secondary transactions take place.”