Around 11% of Tencent's startup investments have been in the healthcare sector over the past five years as the internet company diversifies.

Image of Jeffrey Li, managing partner, Tencent Investment. Image courtesy of WeChat.

Chinese internet company Tencent decreased the pace of its startup investments dramatically last year, investing in just 37 startup funding rounds, down from 95 in 2022 and nearly 300 in 2021, making it the lowest figure in 10 years, according to financial data aggregator ITjuzi.

But there was one area where the company has continued to back startups: healthcare, particularly in its home turf of China.

Tencent Investment, the firm’s corporate venture capital arm, invested in another homegrown healthcare-related startup, stem cell therapy developer Bioon, last week.

“Drug discovery and biotechnology development are among the most attractive sectors in the past five to six years,” Jeffrey Li (pictured), managing partner of Tencent Investment, tells Global Corporate Venturing in an exclusive interview.

China has an ageing population, and that is one of the reasons why Tencent Investment has been supporting bioscience technology startups, Li adds.

“After Covid, there have been lots of changes in the market as liquidity becomes a big challenge to the local startups, but that’s also good timing for us to make further investments.”

The hottest healthcare innovation area was oncology until a few years ago, but as China’s population ages, neurodegenerative diseases have become more prevalent. No new drugs have been developed in the past decade to treat such diseases.

Research and development of new drugs is a long, risky and costly endeavour. It requires a large amount of capital and human resources to commercialise a new medication.

As a result, Tencent began taking advantage of its cloud computing, artificial intelligence and digital technologies to save time and cost in drug development. It is part of the firm‘s plan to diversify its business, which has been traditionally associated with gaming, music, ecommerce and payment services.

Tencent conducts AI and machine learning research through an R&D subsidiary, AI Lab. Some focus areas include AI-enhanced gaming, digital human avatars, AI content generation and AI-based social media. In 2020, the unit launched iDrug, whose generative algorithms can help identify molecule candidates.

In April 2022, iDrug released a large-scale AI research framework, DrugOOD, covering areas such as drug development data management and benchmark testing. With the generative AI boom the following year, Tencent launched a large medical model that provides a smart Q&A tool, family doctor assistant and digital medical imaging platform.

Earlier this year, Tencent backed the $98m series E funding round for Sinovent, a Chinese small molecule drug provider. The deal comes after it took part in the $80m series A funding round for liver-focused RNAi therapy company Sanegene Bio and Neurodawn Pharmaceutical, which is working on treatments for central nervous system diseases, in late 2023.

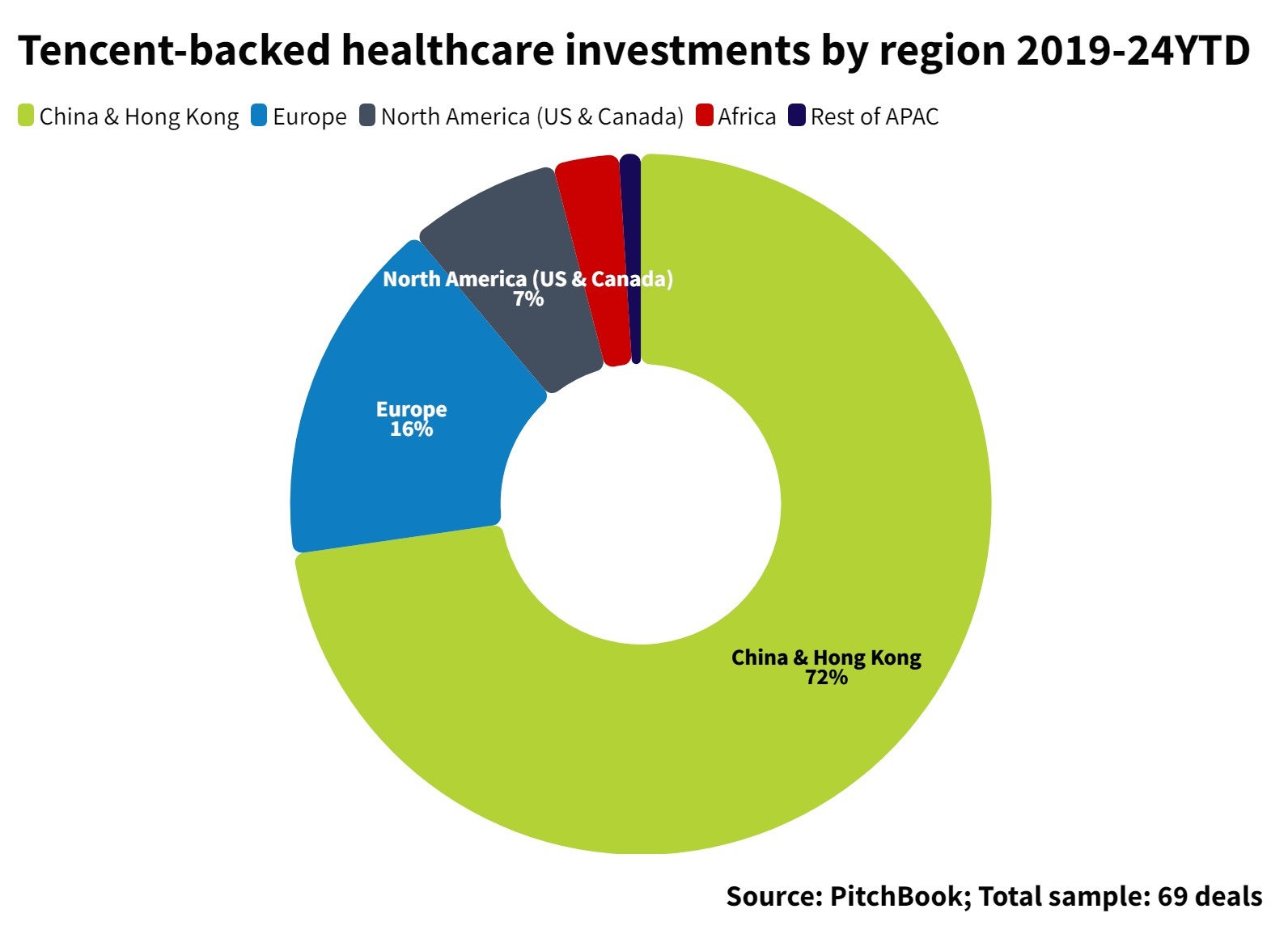

Around 11% of Tencent’s investments in the past five years have been in healthcare-related startups, PitchBook data shows — almost as much as it has invested in gaming and entertainment, and the same percentage that has gone into fintech investments.

Of those healthcare investments, some 72% have been in mainland China and Hong Kong.

Tencent’s overseas healthcare investments share similar strategies to those carried out at home. In mature markets such as Europe and North America, biomedicine and innovative medical technology companies are preferred while in emerging markets like India and Nigeria, it focuses on digital care and medical services.

Tencent’s participation in Nigerian pharmaceutical supply chain platform Remedial Health’s $8m series A round in August 2023 is a good example.

Tencent’s life sciences investment strategy is very similar to that of Alphabet, Google’s parent company, which began investing in healthtech companies in 2009 through GV. The corporate venturing unit, formerly known as Google Ventures, has backed nearly 160 companies in that sector.