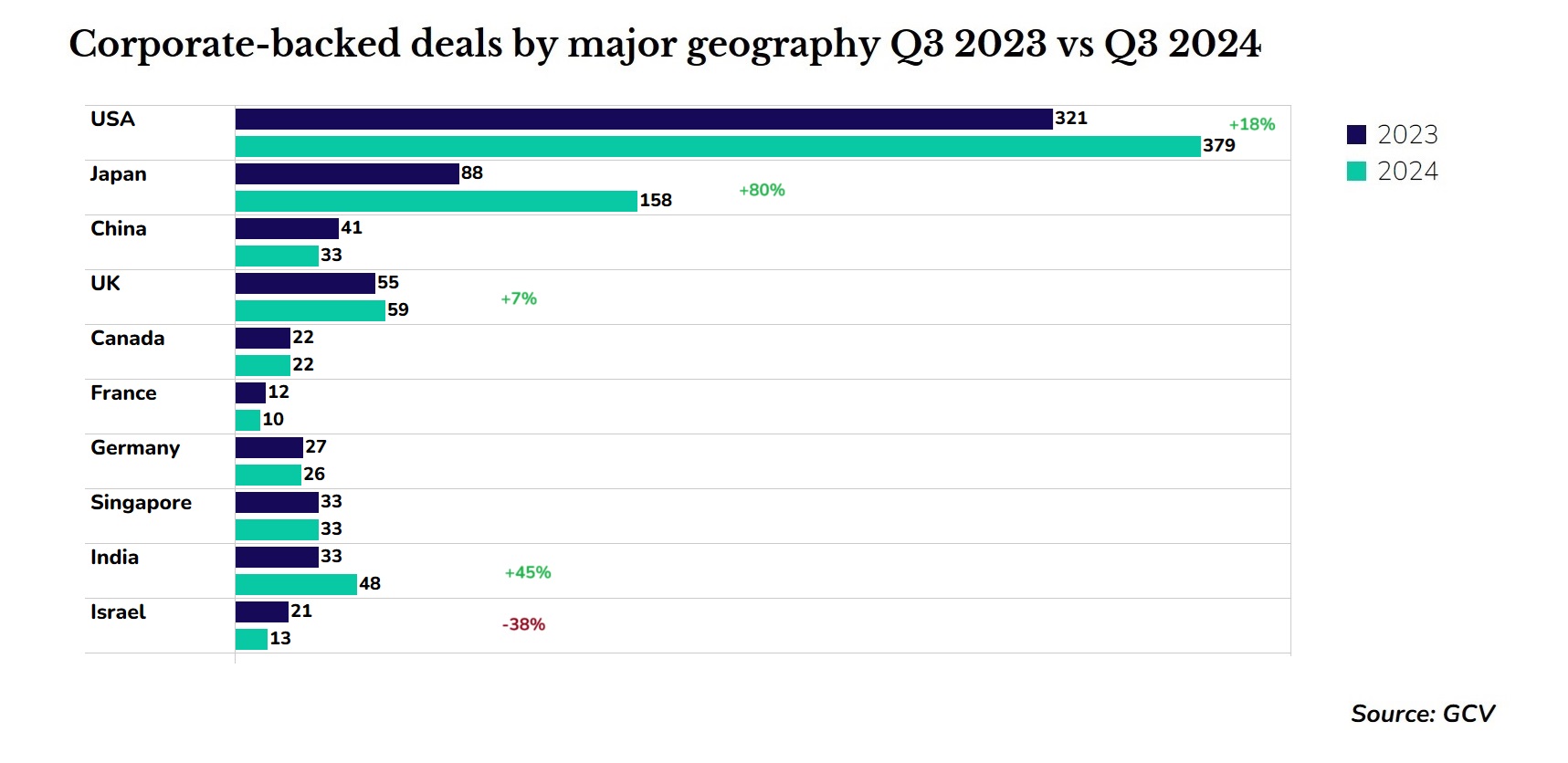

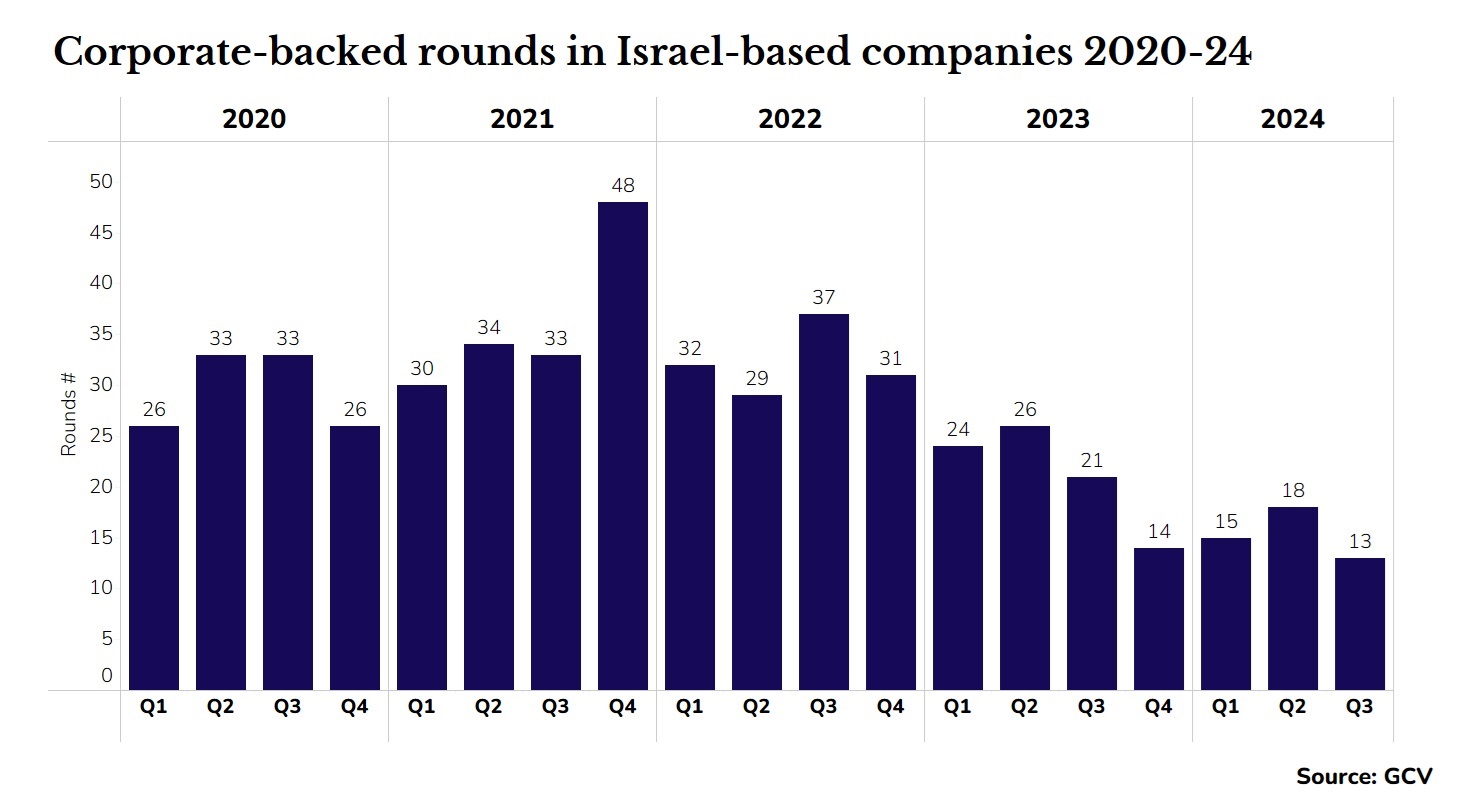

Japan saw an 80% rise in corporate backed funding rounds while India saw a 45% increase and Israel saw a 38% drop.

The third quarter of 2024 has seen an uplift in corporate investment numbers in Japan, India and the USA, while Israel and China saw a reduction, GCV data shows.

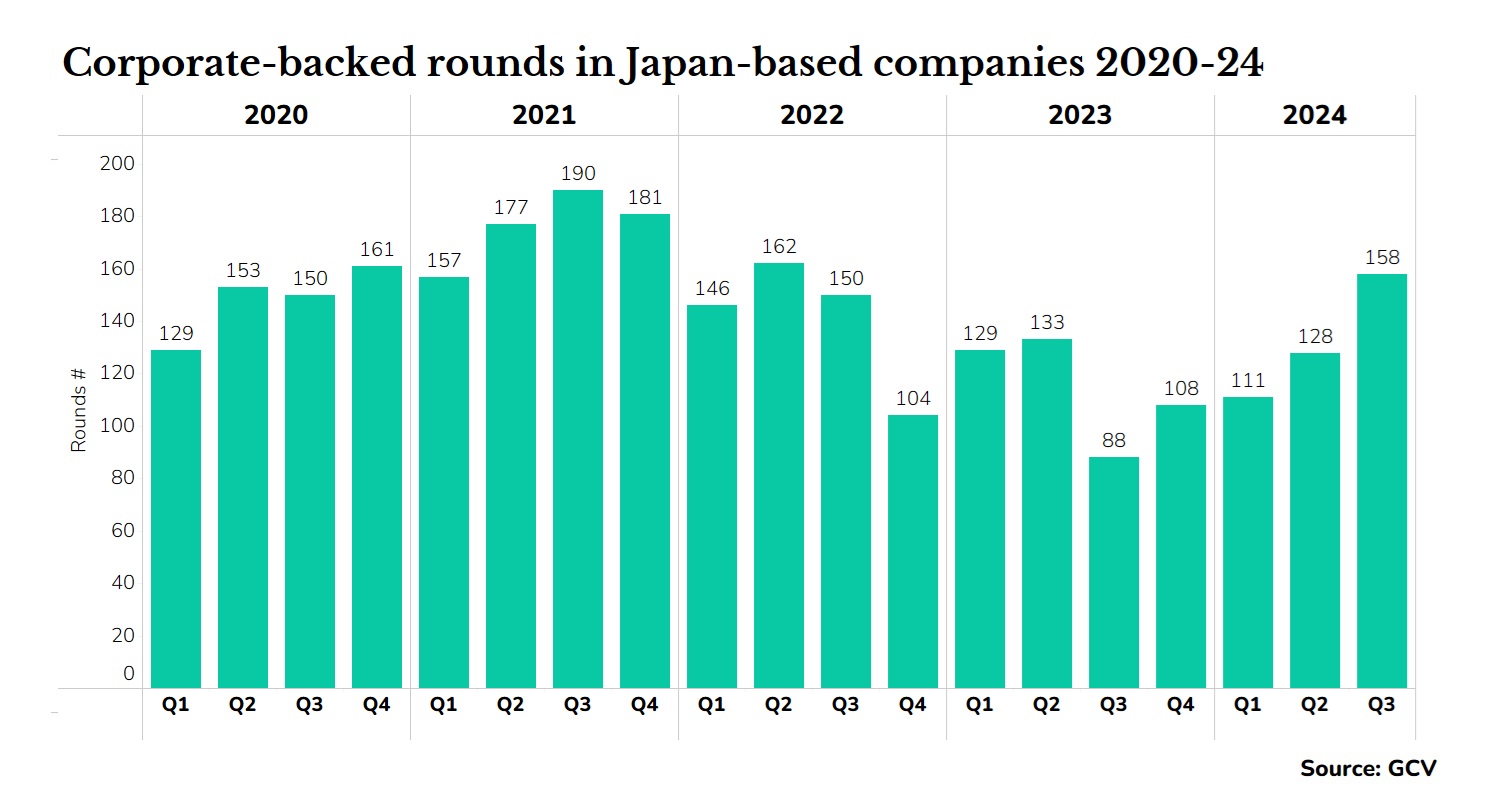

The most significant increase was in Japan, which saw an 80% uplift, from 88 rounds in the third quarter last year to 158 in Q3 2024. The largest Japan-based corporate investment in Q3 was that of Sakana AI, which secured a $200m series A round from backers that included IT companies NEC and Fujitsu, life insurance providers Dai-ichi Life, trading company Itochu, telecoms provider KDDI, financial company Nomura Holdings and Nvidia.

The most significant increase was in Japan, which saw an 80% uplift, from 88 rounds in the third quarter last year to 158 in Q3 2024. The largest Japan-based corporate investment in Q3 was that of Sakana AI, which secured a $200m series A round from backers that included IT companies NEC and Fujitsu, life insurance providers Dai-ichi Life, trading company Itochu, telecoms provider KDDI, financial company Nomura Holdings and Nvidia.

We have also been seeing corporate-backed rounds in Japan-based companies growing steadily over the past four quarters.

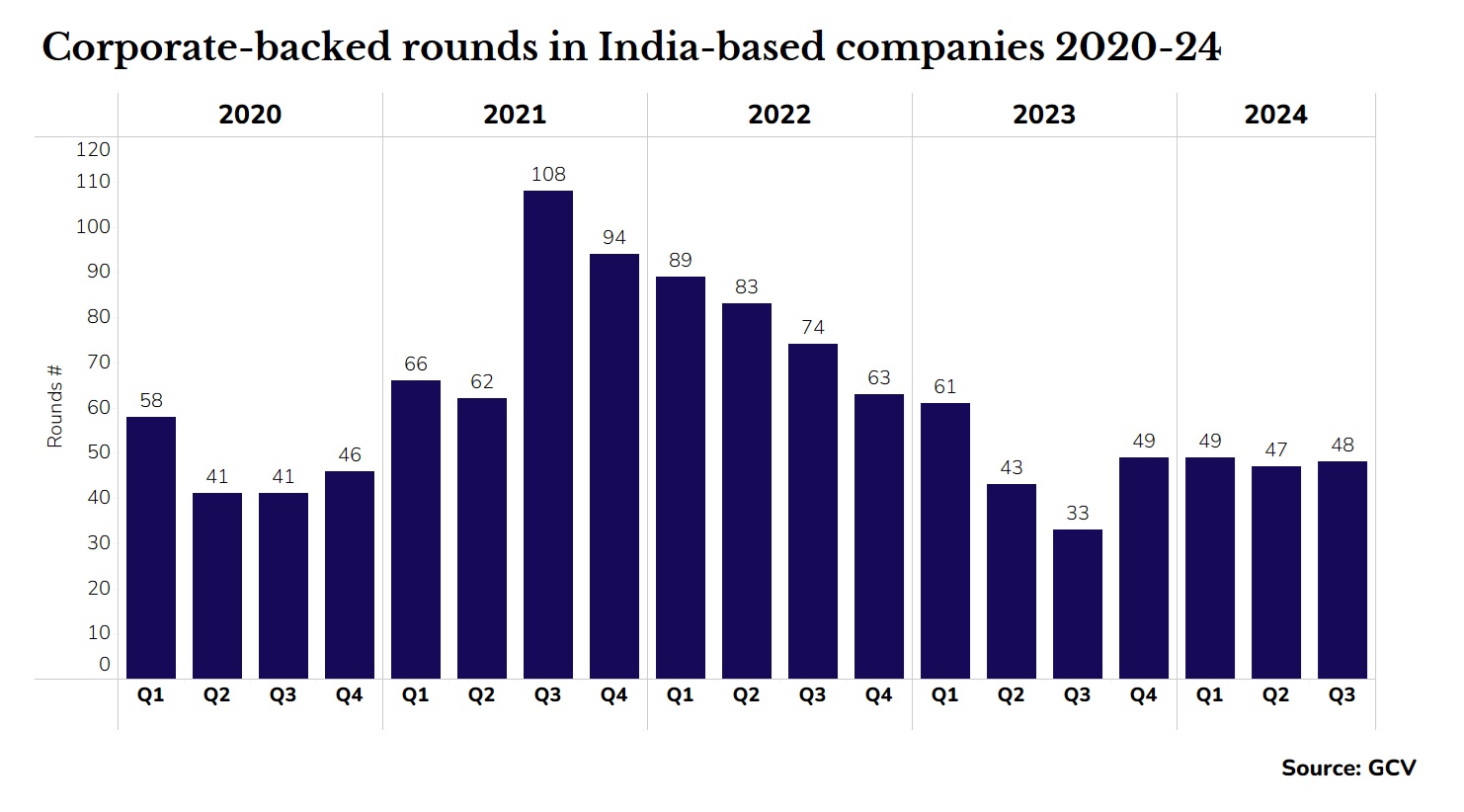

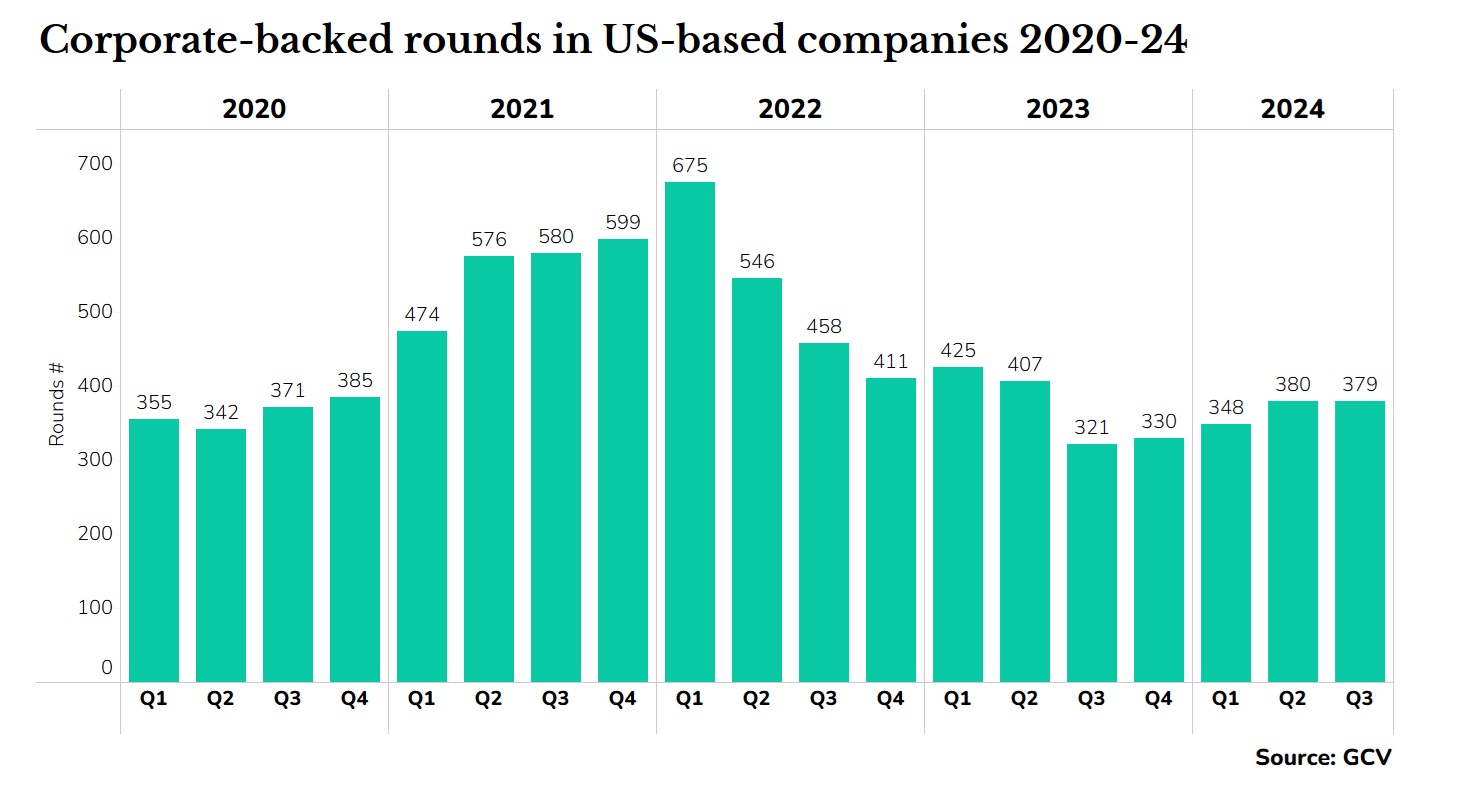

India saw a 45% boost in the number of corporate-backed rounds, while a 17% rise in corporate investment in the USA adds some more weight to anecdotal indications that the post-COVID slump in US corporate investment might be over.

India saw a 45% boost in the number of corporate-backed rounds, while a 17% rise in corporate investment in the USA adds some more weight to anecdotal indications that the post-COVID slump in US corporate investment might be over.

The biggest round from India in Q3 was a $65m series D round for healthcare company Qure.ai. The company, which uses AI to detect disease, had funders that included pharmaceutical company MSD and healthcare company Novo.

The largest corporate funding round in the US in Q3 was a $640m series D raised by machine learning chip maker Groq, which included backing from Cisco, KDDI/Global Brain and Samsung.

In Q3 there was a reduction in corporate investment deals in Israel and China. These developments are not surprising given the growing conflict in the Middle East and the fact that China is in a recession and a real estate crunch that has recently made its central bank intervene and cut interest rates.

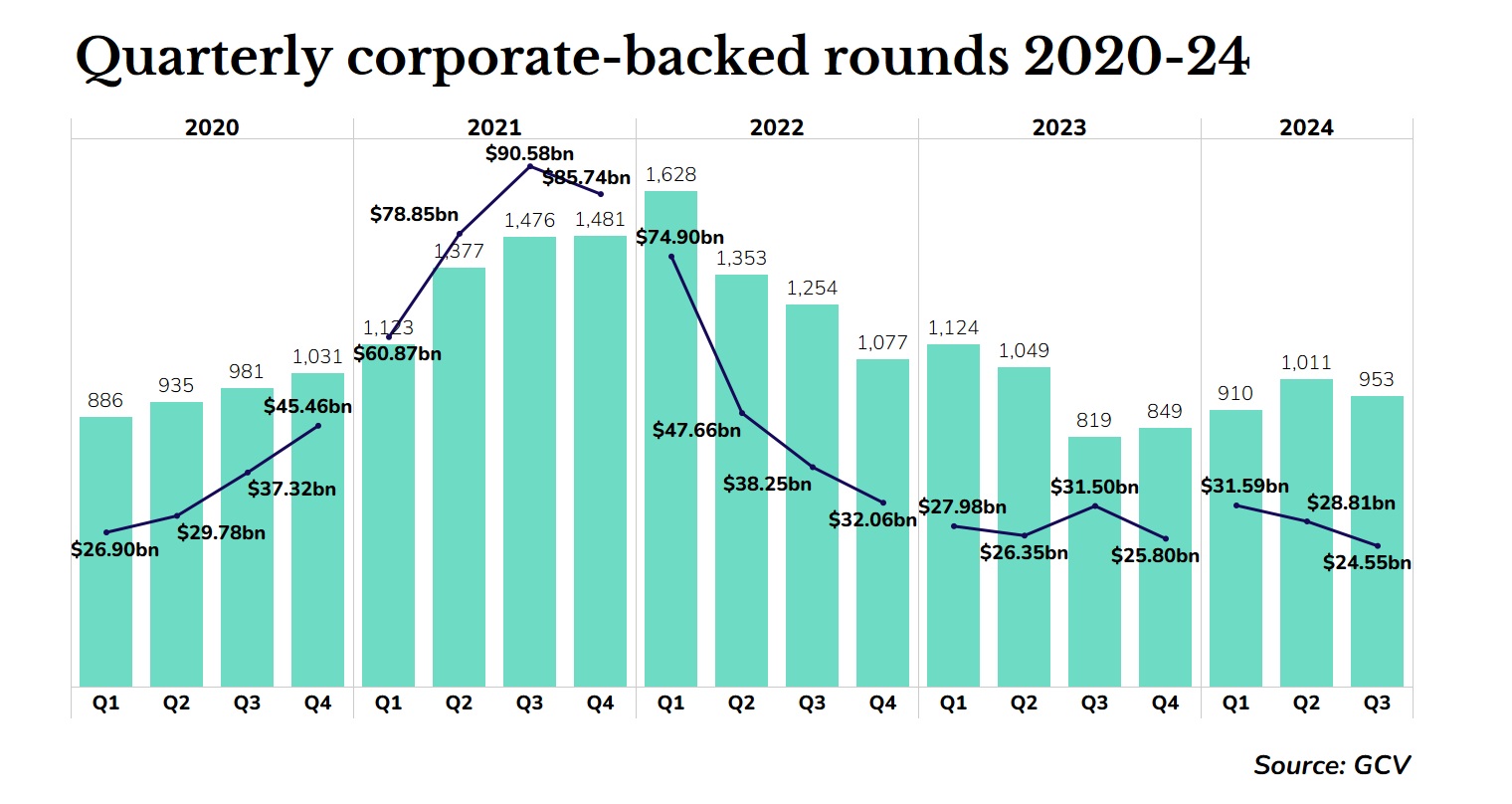

Overall, the number of corporate deals has increased during the most recent quarter, with 953 rounds taking place, versus 819 from Q3 2023. However, the dollar value of these deals went down on year-on-year basis from an estimated $31.5bn in Q3 last year to $24.55bn this year, a 22% drop.

Overall, the number of corporate deals has increased during the most recent quarter, with 953 rounds taking place, versus 819 from Q3 2023. However, the dollar value of these deals went down on year-on-year basis from an estimated $31.5bn in Q3 last year to $24.55bn this year, a 22% drop.

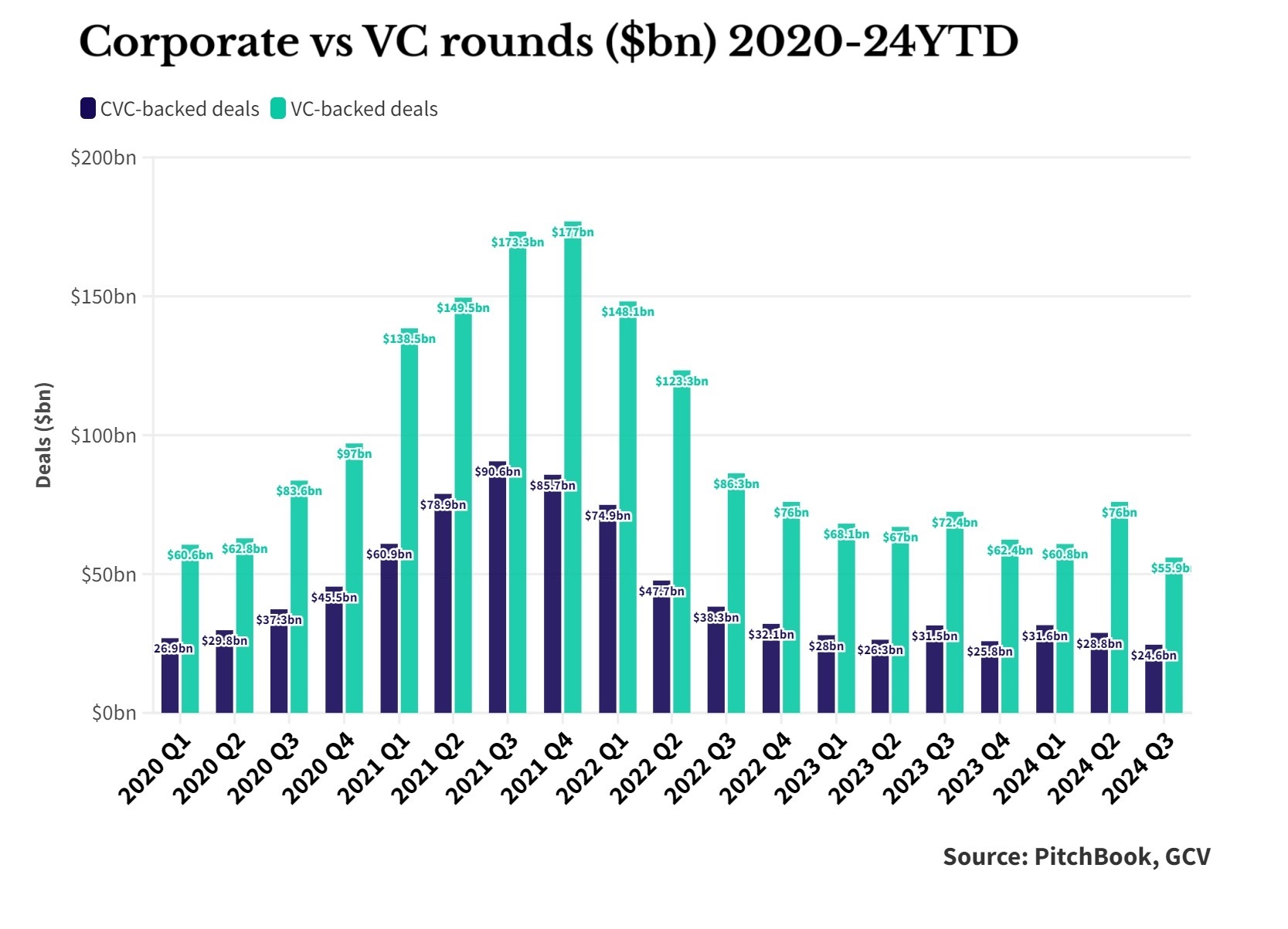

Although corporate-backed funding rounds broadly follow the general trend of VC investment, in this latest quarter there is some divergence, with the dollars spent in purely VC-backed funding rounds in decline, while funding rounds that included a corporate backer have stayed more consistent and stable.

Although corporate-backed funding rounds broadly follow the general trend of VC investment, in this latest quarter there is some divergence, with the dollars spent in purely VC-backed funding rounds in decline, while funding rounds that included a corporate backer have stayed more consistent and stable.

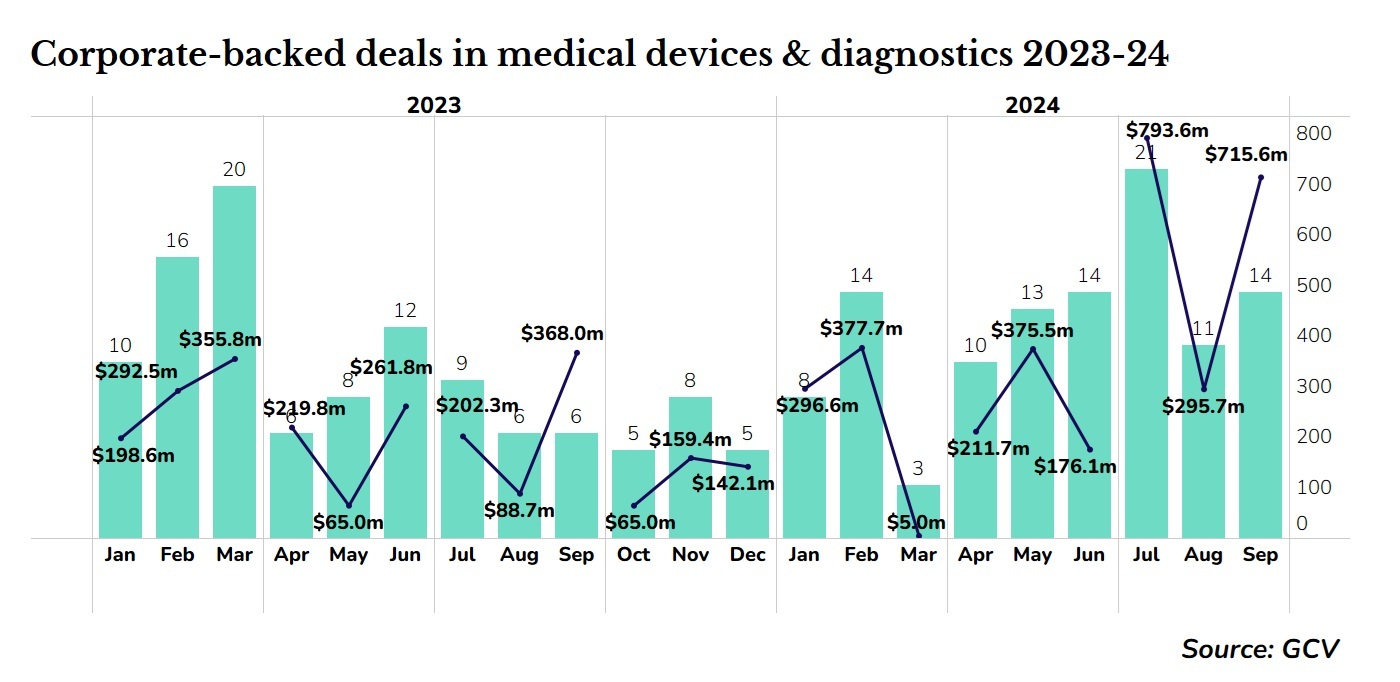

Medical devices see a boost in corporate deals

Medical devices is an area of healthcare where there was noticeable increase in corporate activity in Q3. A total of £1.8bn was invested this area in the three months to the end of September, in deals including corporates.

The most significant deal in this area was a $277m series D round for Element Biosciences, which develops DNA sequencing and multiomics,a biological analysis approach combining multiple data sets such as the genome and epigenome. The round was backed by Samsung.

Elsewhere, we saw Israel’s Magenta Medical raise $105m in funding from backers that included Novo Holdings. The company are the developers of a heart pump for patients undergoing intervention.

There was also Jupiter Endovascular, a US company that develops robotics for gastrointestinal disease. The company raised $97m in series D funding from backers that included UK distribution company Neptune Medical, and Japanese manufacturer Olympus

Back to “normal” on big deals

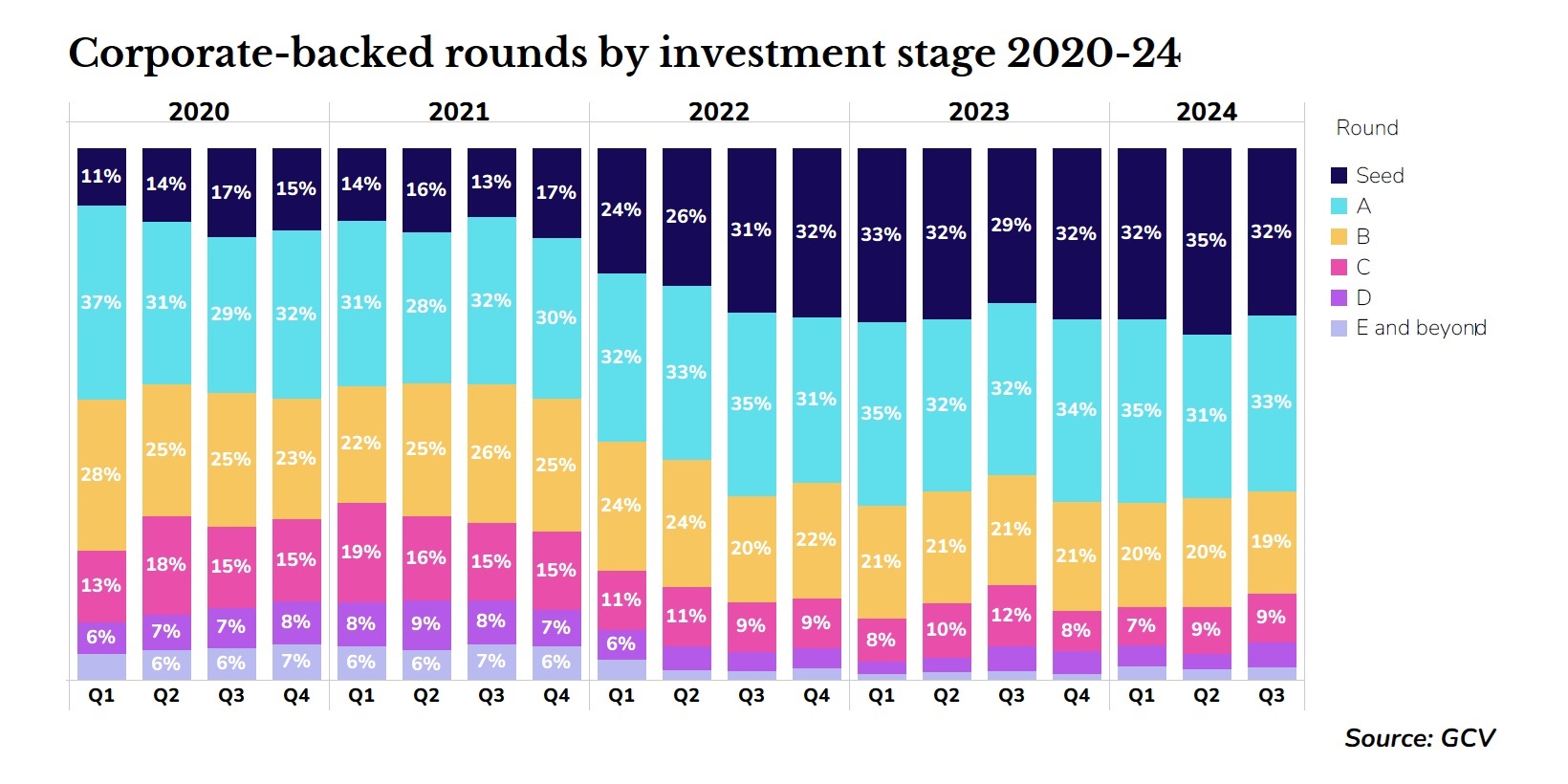

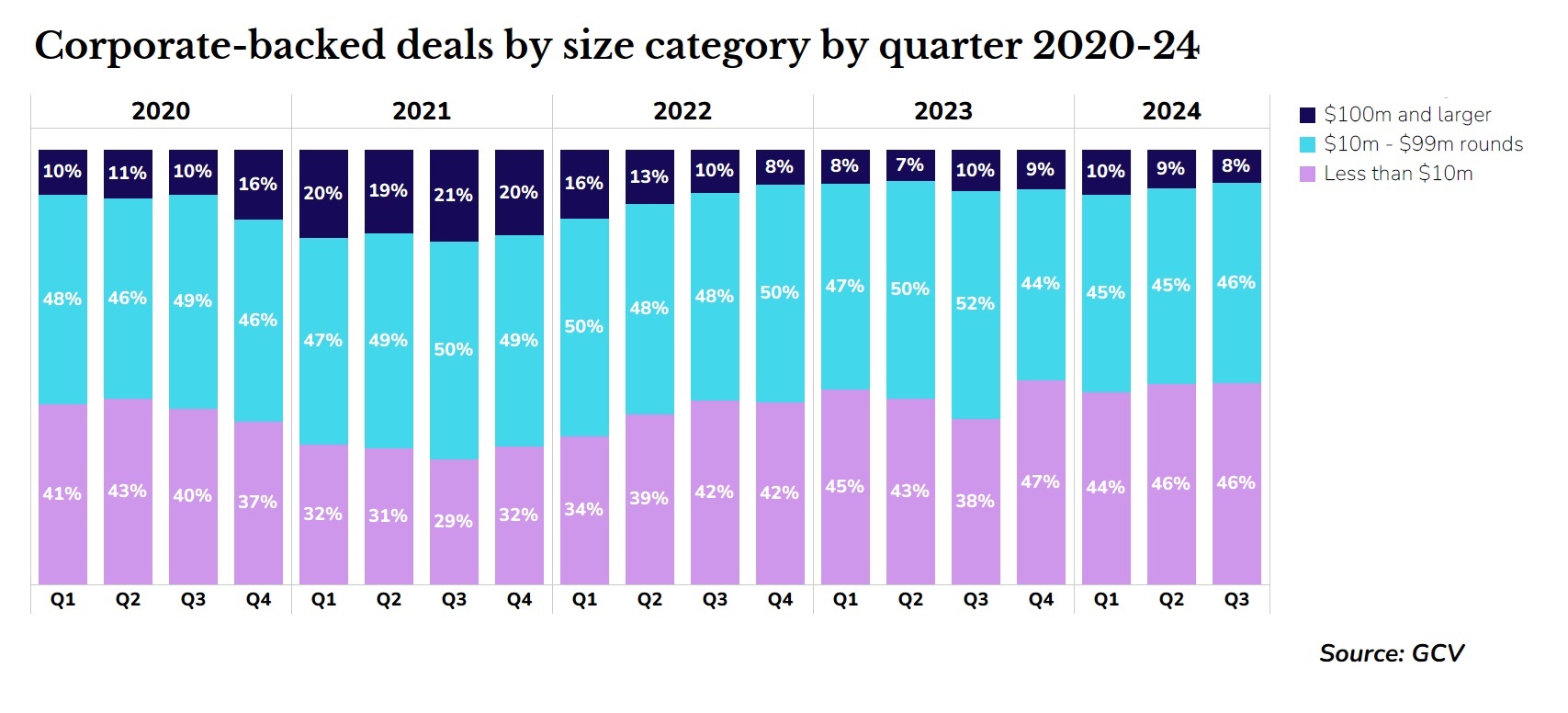

The share of relatively small funding rounds has been growing since the end of 2021. Large rounds above $100m, which made up around 20% of deals at the height of the pandemic boom, have now stabilised at roughly 10% of transactions, similar to pre-boom norms.

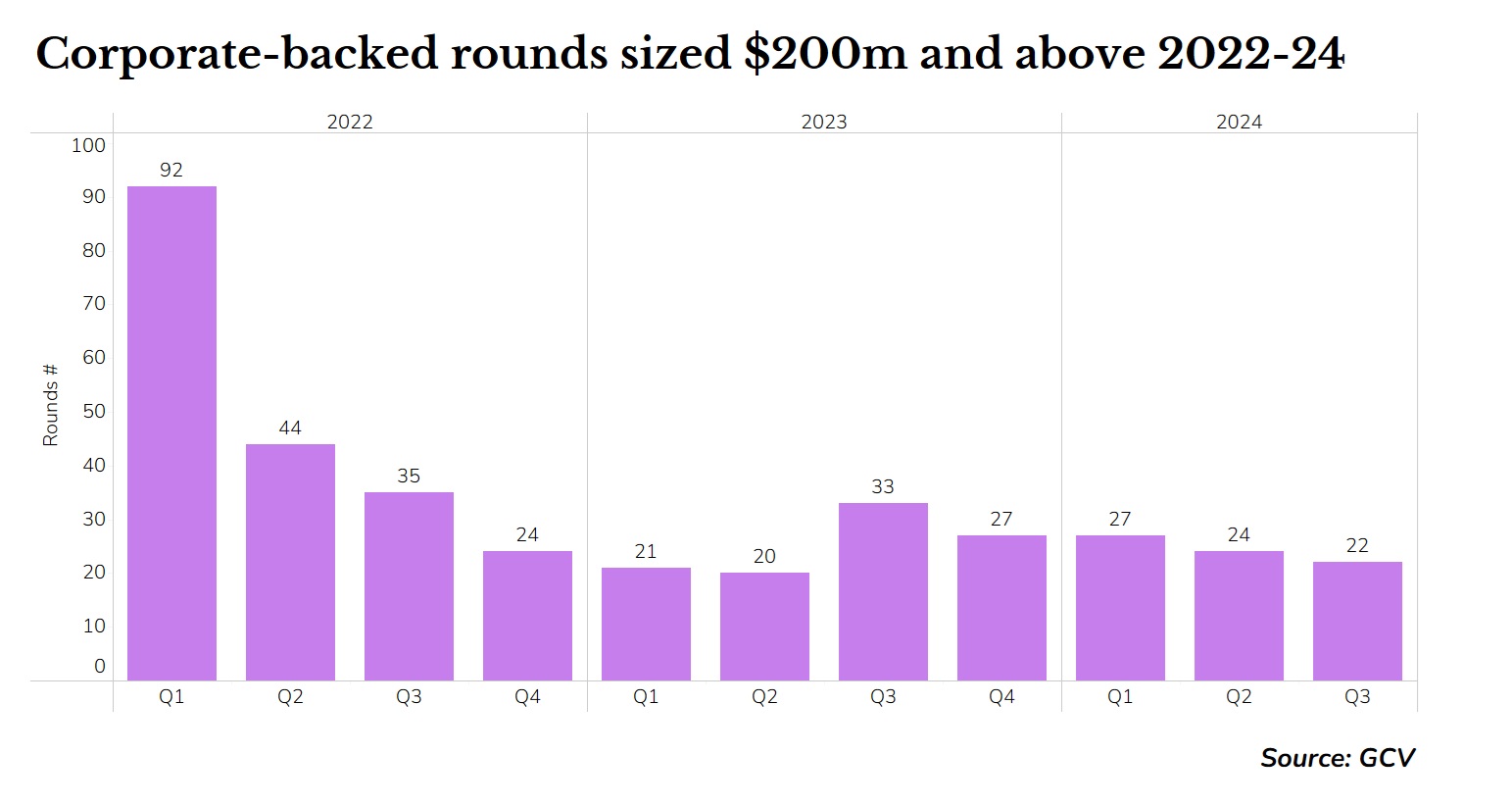

The number of large rounds above $200m, in particular, have flattened in the past three years.

However, really rounds are still happening and, in fact, all ten of the largest rounds of Q3 2024 stood above the $300m mark.

The largest deal of the quarter was for Canadian company Clio, a legaltech which develops cloud solutions for the legal industry, raised $900m in a series F. The round was backed by one of Alphabet’s CVC arm Capital G.

In another mega round, generative AI company Cohere raised $500m from backers that included Cisco, Fujitso, Salesforce and Nvidia. German defence company Helsing also received $493m in series C funding from backers including car manufacturer Saab.