The longed-for recovery in startup exits hasn't yet arrived. But those startups that did get bought or publicly listed in September did so at higher prices.

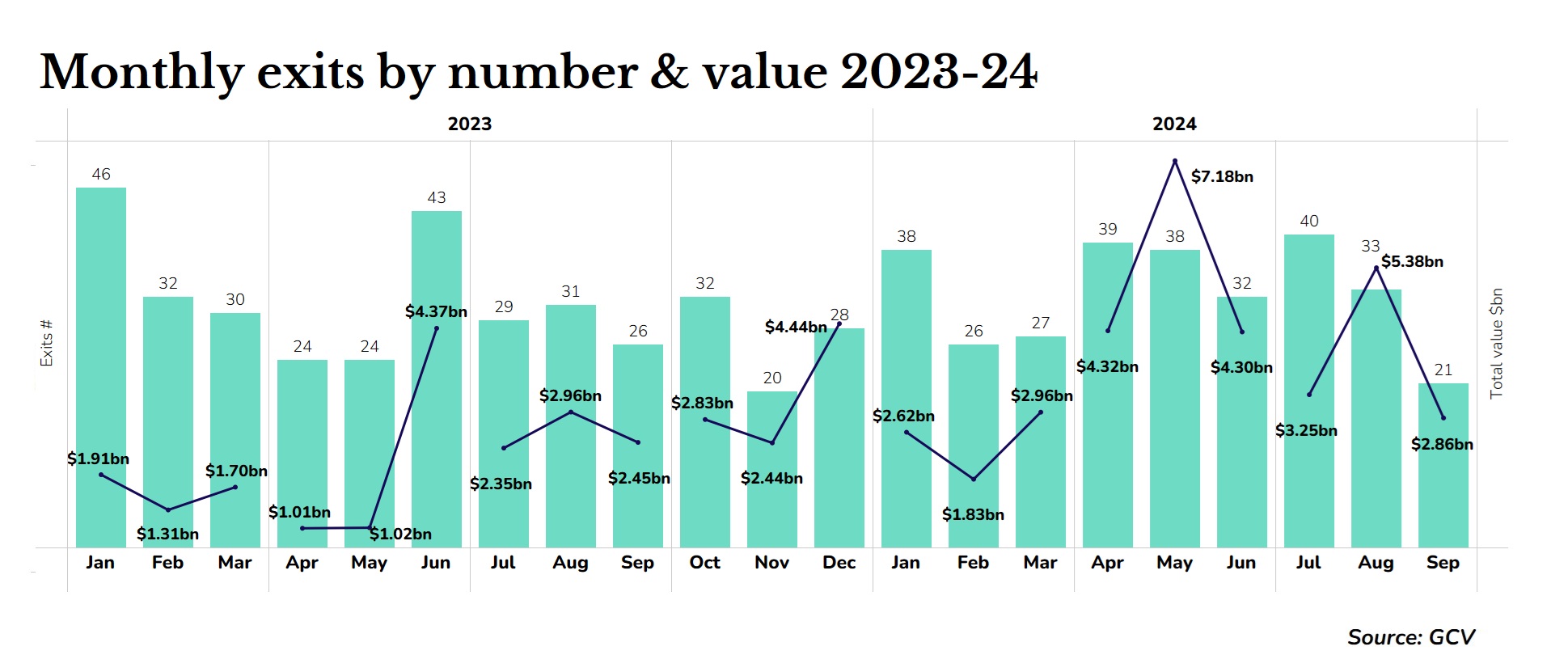

The longed-for recovery in exits has yet to materialise, as only 21 corporate investor-backed startups were bought or listed on public markets in September. This is down from 26 in the same month a year ago. But in total dollar terms, exits in September this year ($2.86bn) registered a 16% increase over the same month in 2023 ($2.45bn).

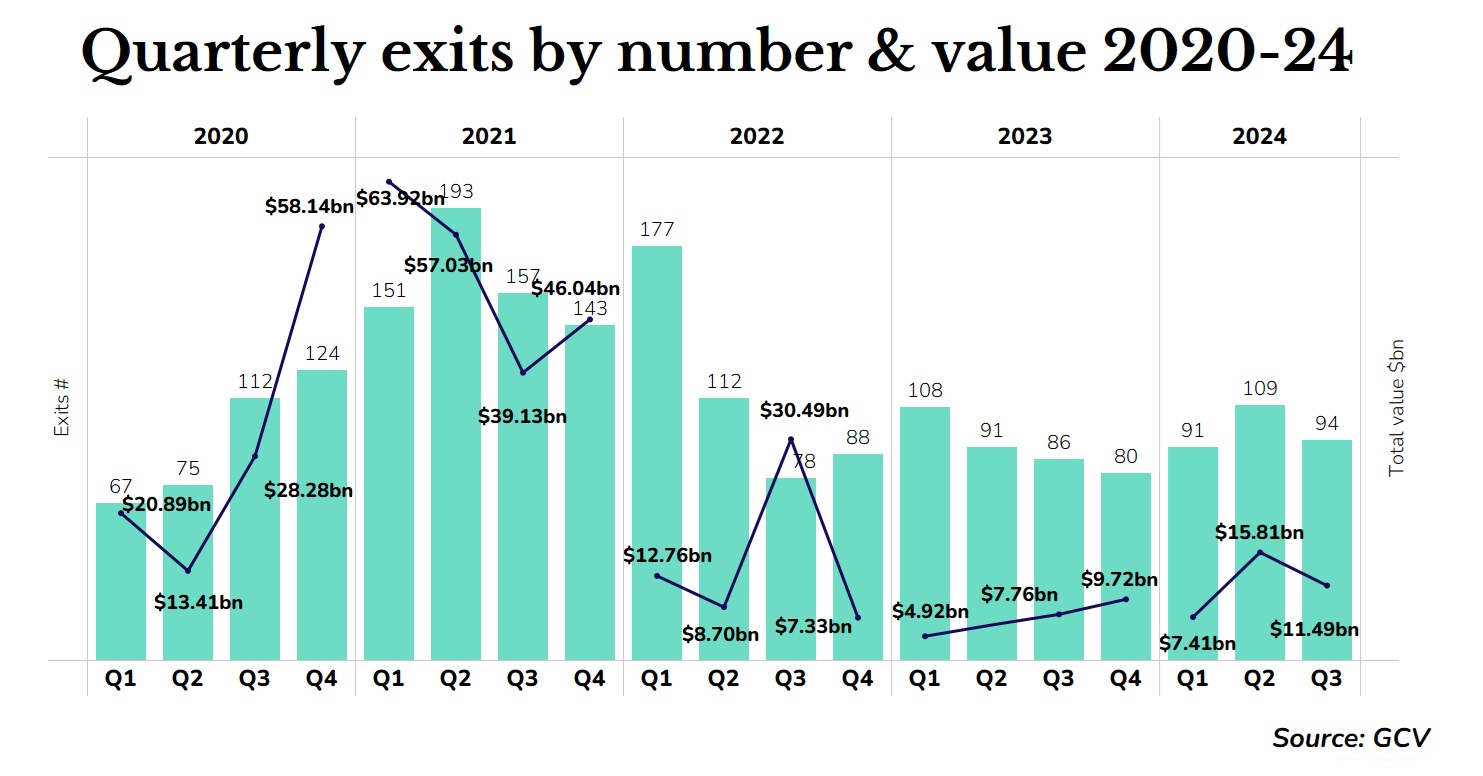

On a quarterly basis the situation looks less bleak. We tracked 94 exits, worth an estimated $11.5bn in Q3 this year. That is a 9% increase in the the number of exits and a 48% in uplift dollar terms with $11.5bn. However, the tally for Q3 2024 was down compared to the preceding quarter Q2, when we tracked 109 exits, worth an estimated $15.8bn.

Two large acquisitions by Salesforce of its own portfolio companies and two large biotech initial public offerings (IPOs) boosted the dollars raised in September’s exits.

● Cloud computing giant Salesforce agreed to acquire for $19bn the Own Company, a provider of data protection and data management solutions with Israeli founders, previously backed by Salesforce Ventures. As a part of the Salesforce AppExchange, Own has expanded beyond its original backup and recovery solutions and is now trusted by nearly 7,000 customers to protect mission-critical data.

● Salesforce made another large acquisition of a portfolio company with Israeli founders in September. It agreed to buy data management provider Zoomin for $450m. Zoomin transforms unstructured data—such as user manuals, product documentation and customer support queries— into a structured format AI models can effectively use.

● Immunology biopharmaceutical company Zenas BioPharma went public in a $225m IPO on the Nasdaq stock exchange under the ticker symbol of ZBIO. Over 15.2 million shares were sold at $17 per share. Its clinical-stage product candidate, obexelimab, is a bifunctional monoclonal antibody designed to inhibit the activity of cells that are implicated in many autoimmune diseases without depleting them. The company was previously backed by pharmaceutical firms WuXi AppTe and GSK.

● BioAge Labs, a biotech company specialising in therapeutic product candidates for metabolic diseases, such as obesity, went public in an upsized $198m IPO on the Nasdaq under the ticker BIOA. The company counts corporates like Amgen, Kaiser Permanent, Eli Lilly and Nang Fung among its backers. BioAge BioAge is targeting metabolic diseases like obesity by leveraging the biology of human aging.

● India-based gaming and esports platform Loco sold a majority stake to UAE-based Redwood, a newly floated investment firm, for $65m. The substantial stake sale is meant to expand the company’s expansion into overseas markets. The company had previously received backing from game publisher Krafton.