Private equity companies have been active in buying VC-backed companies, sometimes at a significant discount. Digital and life sciences startups dominate the list of exits.

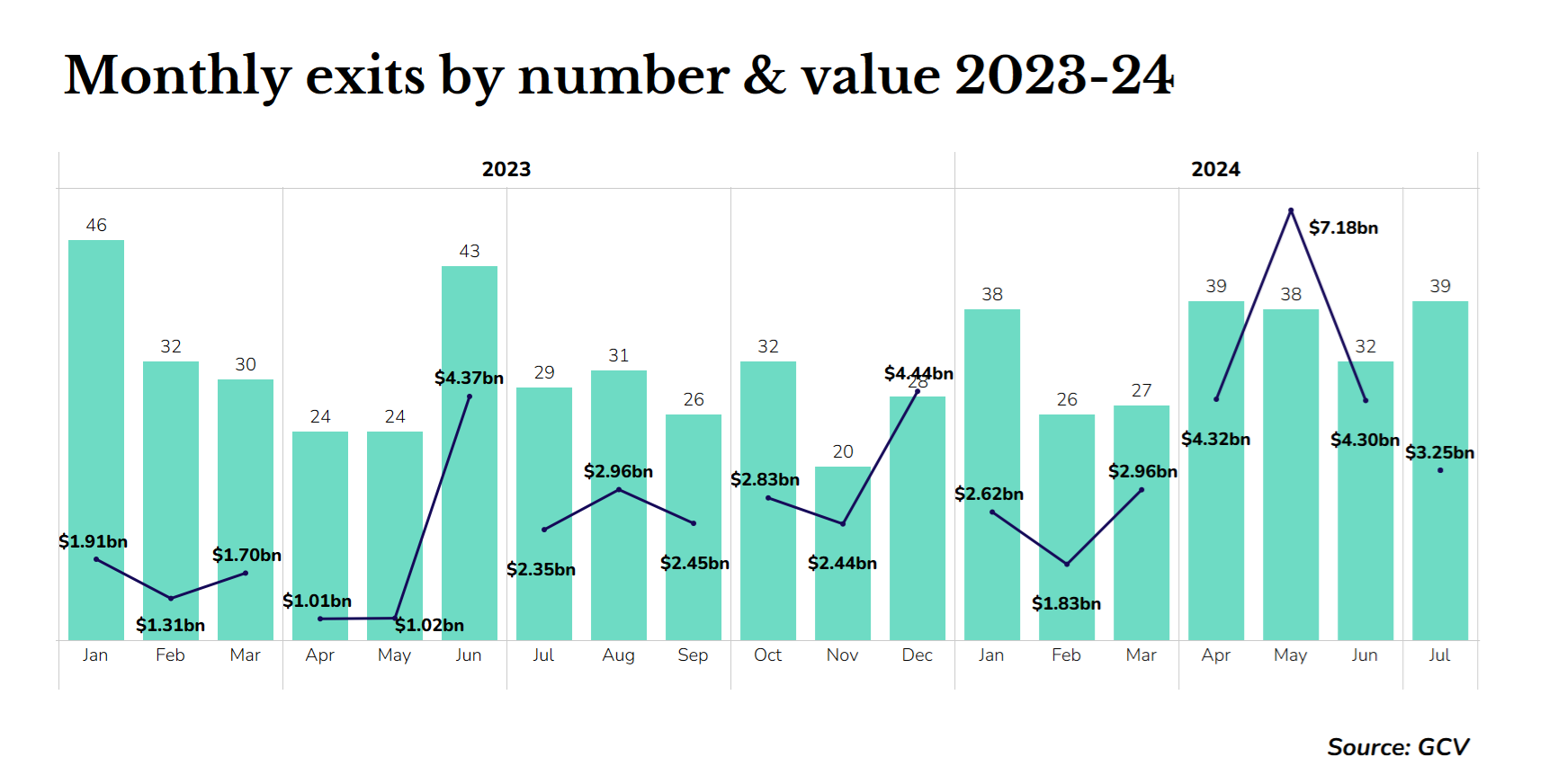

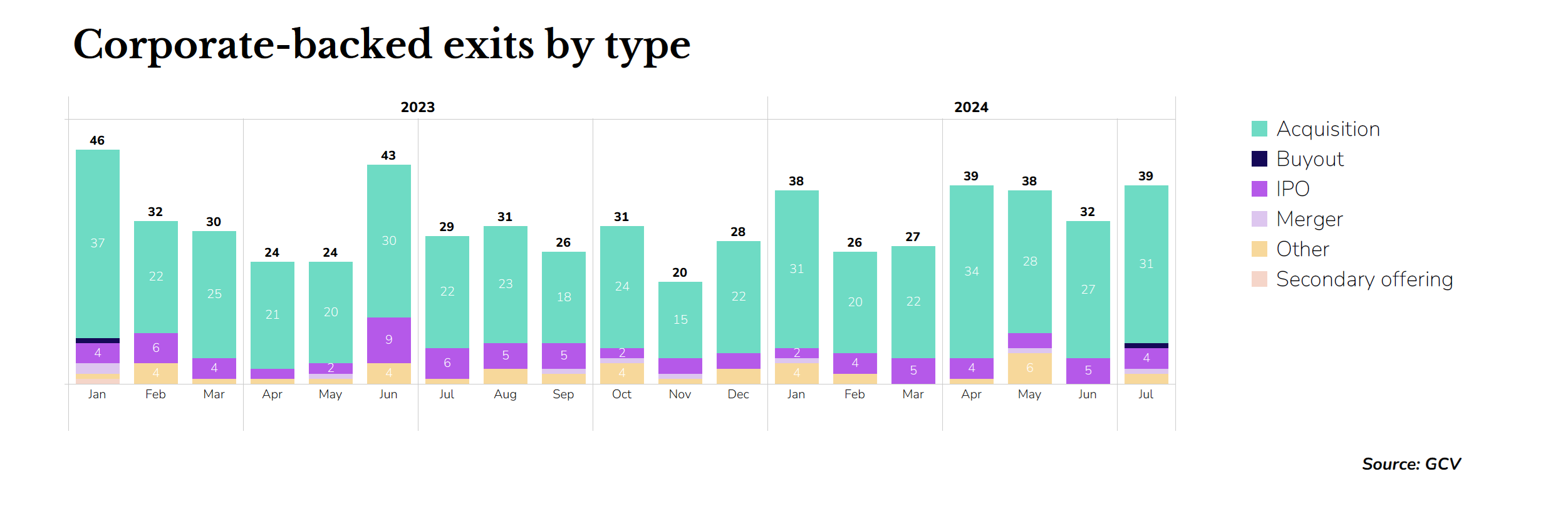

Some 39 corporate-backed startups recorded exits in the summer month of July, a 34% rise from the same period last year. The total estimated dollars raised in those exits was $3.25bn, a 38% increase over the July 2023 figure.

Much of the rise in exits has come from private equity firms, which have been active in buying VC and CVC-backed companies.

The largest corporate-linked exit in July was a private equity transaction – US cloud tech company Nasuni was acquired by PE firms Vista Equity Partners, Kohlberg Kravis Roberts and TCV through a $1.2bn leveraged buyout. The company, which runs an enterprise data platform for modern hybrid cloud environments, had received backing from corporate Dell.

Invetx, a US developer of protein-based therapeutics for animal health, was bought by pharmaceutical firm Dechra Pharmaceuticals for a total consideration of up to $520m. Previous corporate investors in the company include Alphabet’s GV unit, Novo Holdings, WuXi Biologics and Rabobank, via Anterra Capital.

Graphcore, a UK developer of an intelligence processing unit for AI data centres, was acquired by SoftBank for $500m. SoftBank’s large stake in chipmaker Arm has likely influenced this acquisition. Previous backers of Graphcore include tech giants like Microsoft, Dell and Samsung as well as industrial conglomerate Robert Bosch and automaker BMW.

Some of these exits have been at discounts to previous valuations for the startups — hardly surprising given the sluggish state of the exit markets and the slowdown in new funding rounds over the past two years. EQT, one of the existing investors in Spanish real estate portal Idealista, for example, sold a majority 70% stake to private equity firm Cinven for $3.11bn, reportedly at a lower valuation than previously. Idealista counted Spanish banks Caixa Catalunya and Bilbao Bizkaia Kutxa (BBK) among its backers.

There has been a small but steady number of stock market listings this year and in July South Korean console game developer Shift Up went public, raising $320m – the largest IPO in the country for a gaming firm in almost three years, according to Yahoo Finance. The startup counted corporates Tencent, Smilegate, Kakao and IPX among its backers.

Japanese on-demand gig job application developer Timee went public on the Tokyo Stock Exchange, raising $350m including overallotment with sellers, according to Reuters. The company was backed by several corporates including Kintetsu Group’s Kintetsu Venture Partners unit, Mixi, Nexyz Group and Prologis Ventures, part of Prologis.

Digital and life sciences companies have typically dominated the exit lists, but there have been some in other areas, such as deeptech. SciAps, a US-based producer of handheld material analysis systems, was purchased by Spectris for $260m. The company had previously received backing from Jolimont Global Mining Systems.

It is still not clear whether the rise in exits for corporate-backed startups is a sustained trend for 2024. The number of exits for the year to date is slightly ahead of the same period last year (239 transactions compared with 228), but the difference is small. All eyes will still be on the second half of this year to see if exit markets are really opening.

The table below lists the exits recorded for July, although it is worth noting that a few of these took place in June but were only made public in July.