The pandemic and cost of living crisis have weakened the sector, as the stories of these five startup failures demonstrate.

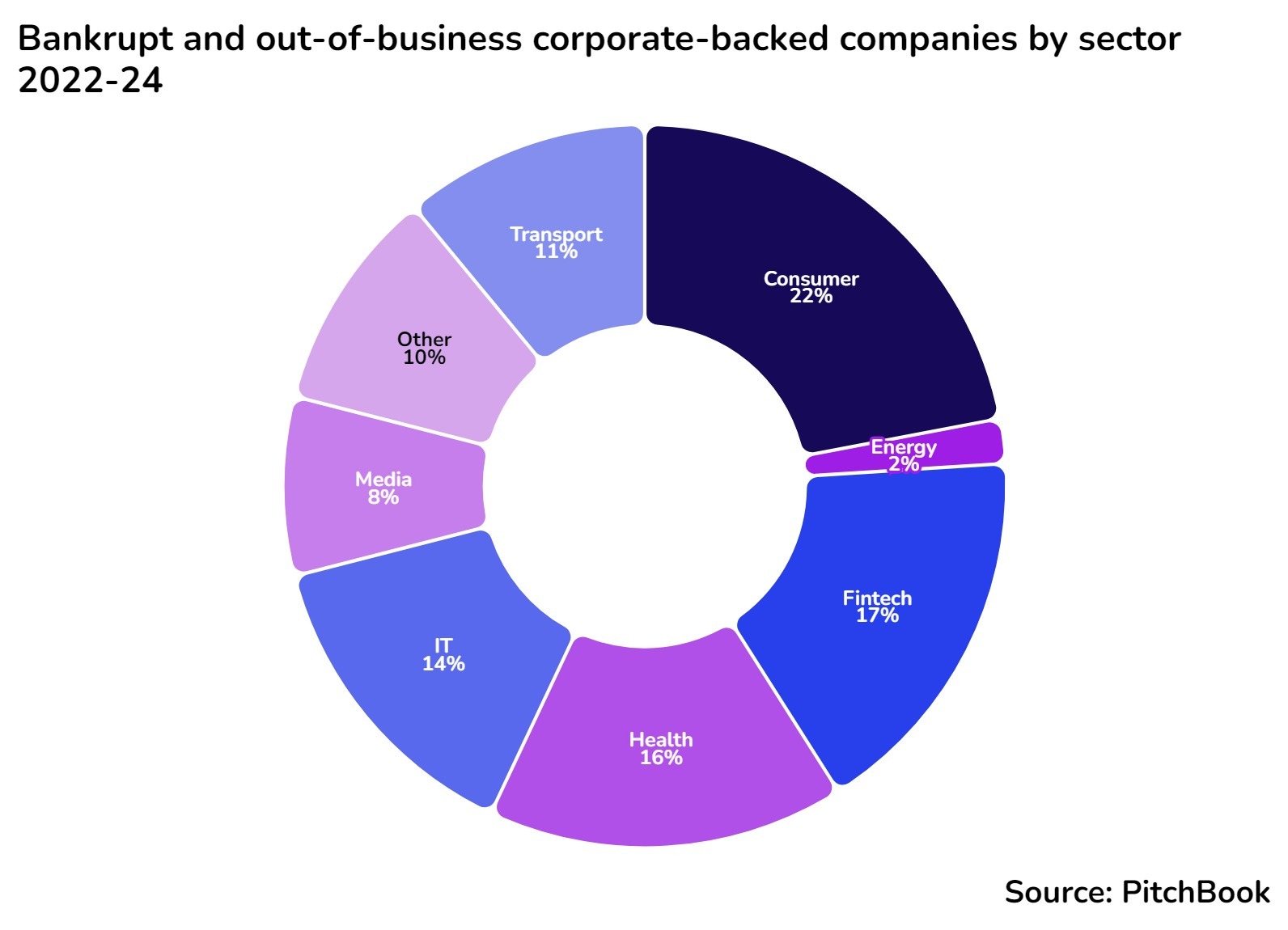

The last two years have been a brutal time for startups with capital more scarce and funding rounds harder to find — even for corporate-backed startups. The largest tranche of bankruptcies for corporate-backed startups — 22% of the total — has been in the consumer sector, according to data from PitchBook.

Earlier we looked at a number of corporate-backed startup failures in life sciences and healthcare, where everything from licensing issues to fraud were the cause of failure. In the consumer sector, however, the causes for failure were much more uniform — a combination of the pandemic followed by the cost of living crisis has made it challenging for companies dealing in luxury and non-essential items.

We looked at five corporate-backed consumer startups that ceased operations in the past two years to see what lessons could be taken from these. All five were, to some extent, the victim of either geopolitical or macroeconomic factors — although over-expansion and working in crowded markets has not helped.

WayRay

Raised: $104m (Source: PitchBook)

UK-based WayRay was a startup focused on developing augmented reality (AR) technology for vehicles. It was known for its AR head-up displays (HUDs) that projected navigation and other critical driving information directly onto a car’s windshield, creating a more immersive and safer driving experience. WayRay backers included automakers Hyundai Motor and Porsche (via Porsche Ventures), electronics maker JVCKenwood and e-commerce giant Alibaba.

However, Russia’s invasion of Ukraine changed everything for the company. WayRay was originally founded in Moscow, and after the war in Ukraine broke out, WayRay found itself increasingly unable to raise VC funding. As one of its board directors recounts in a LinkedIn post, the company went out of its way to sever ties with Russia, moving key knowledge holders from Moscow to Zurich and Barcelona and its top managers changing citizenship. However, none of this appears to have made fund raising or striking commercial deals with automotive manufacturers any easier. It declared bankruptcy in September 2023.

Eve Sleep

Raised: $63.65m (Source: PitchBook)

Eve Sleep was a direct-to-consumer mattress and sleep wellness company based in the UK. They offered a range of products including mattresses, pillows, and bedding accessories, all designed to enhance sleep quality. Eve Sleep counted Channel 4 Ventures among its backers. The company had had a remarkable trajectory, having gone from a VC-backed consumer product startup to a public company in a matter of merely four years by 2017.

The business was hit hard by the pandemic in 2020 and 2021 but, as its former CEO, Cheryl Calverley, recalls the business was on an upward path to recovery by the beginning of 2022. However, as the cost of living crisis hit, Eve Sleep saw its sales and orders drop drastically, while the cost of doing business increased with rising inflation. By September 2022 the company had to enter into administration. Calverley described it as “a tsunami of market conditions.”

Festicket

Raised: $52.54m (Source: PitchBook)

UK-based Festicket provided a platform for booking festival tickets as well as travel and accommodation packages, covering everything from tickets to lodging and transportation. Previous backers of the company included Channel 4 Ventures and InMotion Ventures – venturing arms of Channel 4 and Jaguar Land Rover Automotive, respectively.

The company grew fast, and in 2019 bought two other ticketing platforms, Event Genius and Ticket Arena. However, the pandemic had a devastating impact on the live events industry, including music festivals, leading to widespread cancellations and refunds. The company went into administration in September 2022 and subsequently US-based ticketing business Lyte took over assets and operations, integrating Festicket’s technology and customer base into its own platform.

The administration process was mired in controversy as the company owed £22.5m to event promoters it worked with. These creditors claimed that their contracts implied that funds from ticket sales, after Festicket’s fee, would be protected and kept in trust. Two years later, in June 2024, an English court ruled that Festicket did not hold money on trust for the agencies and promoters.

Boisson

Raised: $34.63m (Source: PitchBook)

US-based Boisson was a startup offering non-alcoholic beverages, targeting health-conscious consumers and those looking for alcohol-free alternatives. Their product lineup included a variety of non-alcoholic wines, spirits and cocktails. It ran 8 brick-and-mortar stores in New York, San Francisco, Los Angeles and Miami. Its roster of investors included Convivialité Ventures, the venturing arm of Pernod Ricard.

It filed for Chapter 11 bankruptcy protection in April 2024. The bankruptcy filing reportedly cited an “overly aggressive expansion plan” and “inefficient deployment of capital.” The costs of running traditional brick-and-mortar stores were likely challenging in a time of high inflation — and attracting consumers in a relatively niche market may have proved more difficult than anticipated.

Boisson is currently aiming to restructure and continue operating as a wholesaler and direct-to-consumer online retailer, according to RetailTouchpoints.

Cudoni

Raised: $21.83m (Source: PitchBook)

UK-based Cudoni was a luxury resale platform that facilitated the buying and selling of high-end fashion items. The company offered a convenient and premium service for consignors looking to sell luxury goods and buyers seeking authenticated second-hand items. It had received backing from the e-commerce platform eBay.

Cudoni entered into administration in April 2023 due to the current macroeconomic environment and its failure to raise more venture funding.

Aside from the post-pandemic economic downturn and changing consumer spending patterns, the company also likely faced high competitive pressure. While the luxury resale market is growing, it is highly competitive and Cudoni may have struggled differentiating itself and achieving the necessary scale.