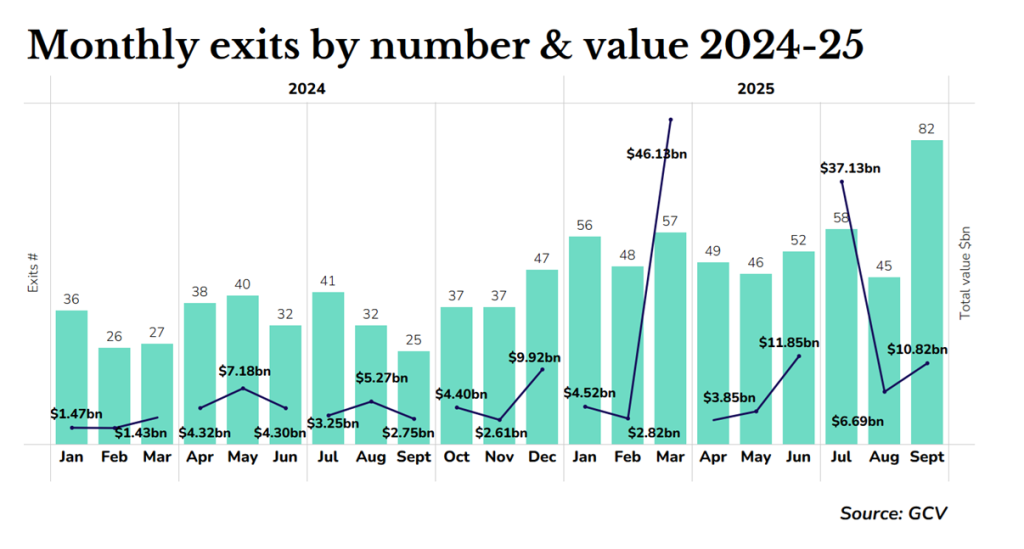

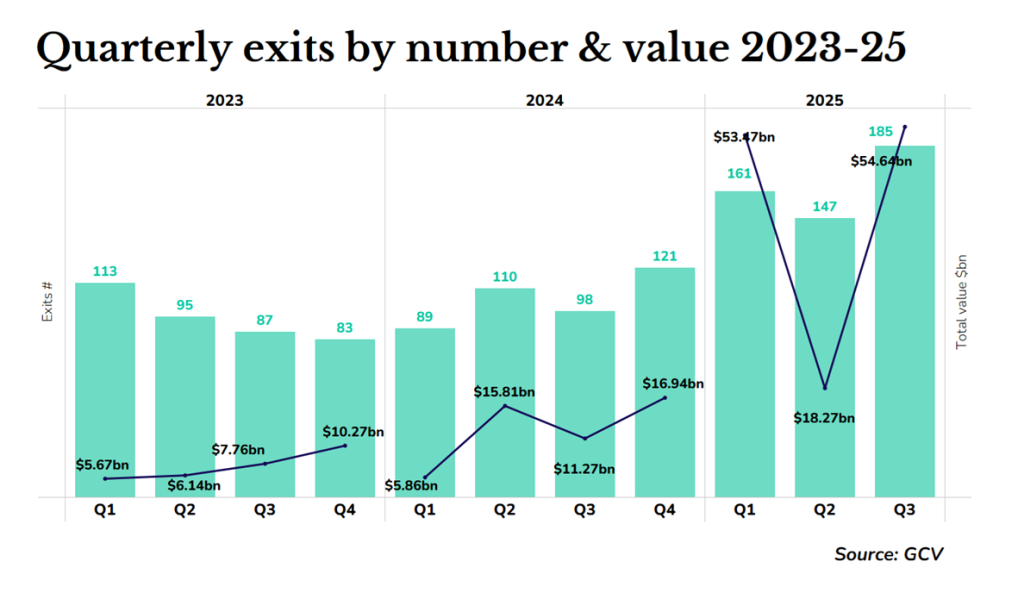

All signs are looking positive for investors who have been hungering for exit opportunities for over two years.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.