As corporate interest in generative AI increases, sector leader Anthropic and VC backer Menlo launch the Anthology fund to drive innovation

San Francisco-based AI company Anthropic has teamed up with Menlo Ventures to create a $100m corporate venture capital fund called Anthology.

The fund will target AI startups from the seed to expansion stage, with a minimum value of $100,000 per investment. It aims to combine Anthropic’s expertise with AI technology and Menlo’s experience of nurturing growing companies.

Anthropic, founded in 2021, is known for developing the large language model Claude, of which the most recent iteration is the Claude 3.5 Sonnet.

Menlo is already an investor in Anthropic, which has raised nearly $8bn in capital from investors including Amazon, Google, Salesforce, SAP and Zoom. Anthropic is following in the footsteps of its rival, OpenAI, creator of the AI chatbot ChatGPT, which set up an investment fund in 2021 and increased the fund’s size to $175m last year.

Anthology will target five areas that complement Anthropic’s work, including AI infrastructure, new applications of the technology, consumer solutions, trust and safety tooling, and AI tech which can benefit society.

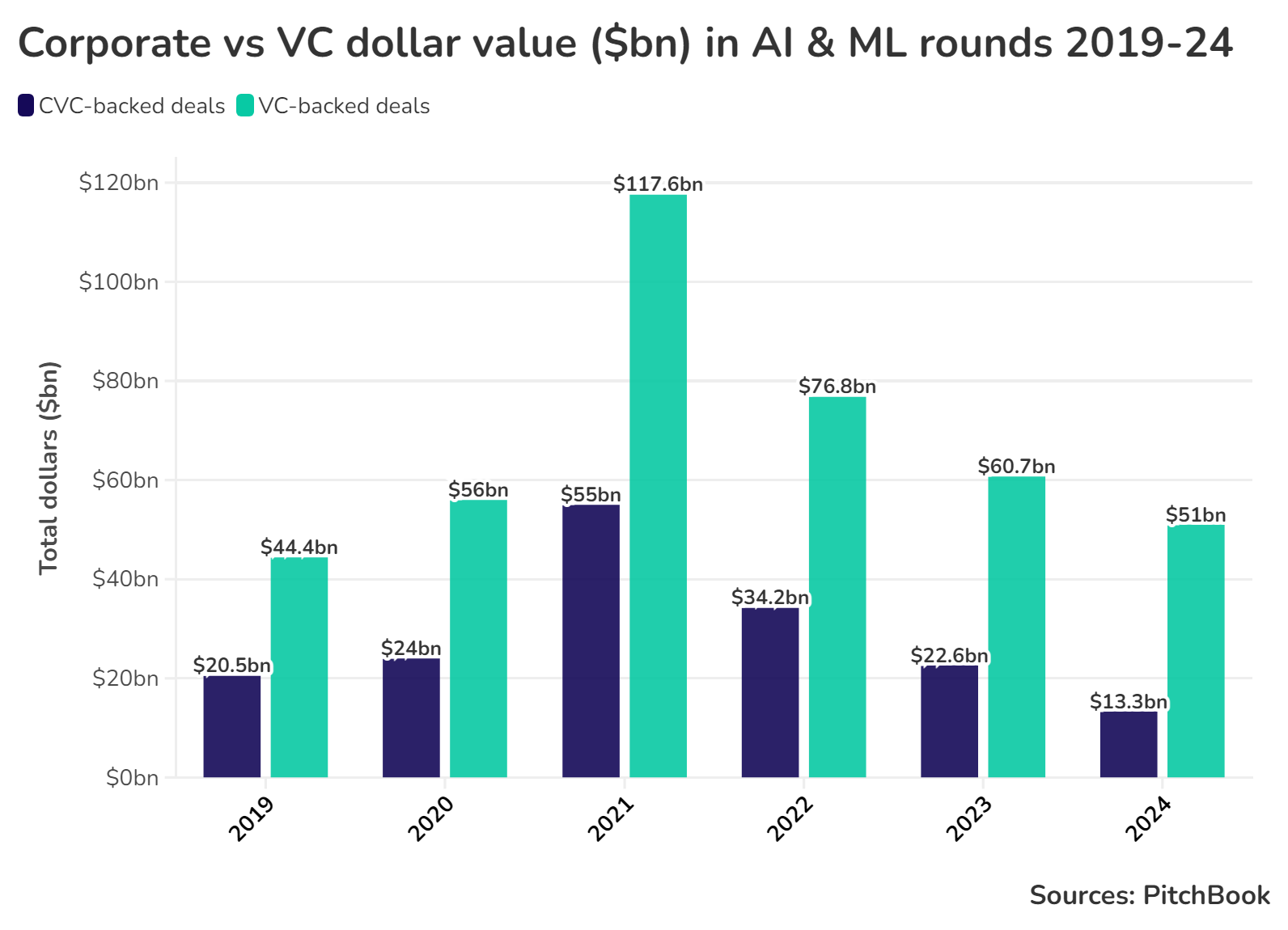

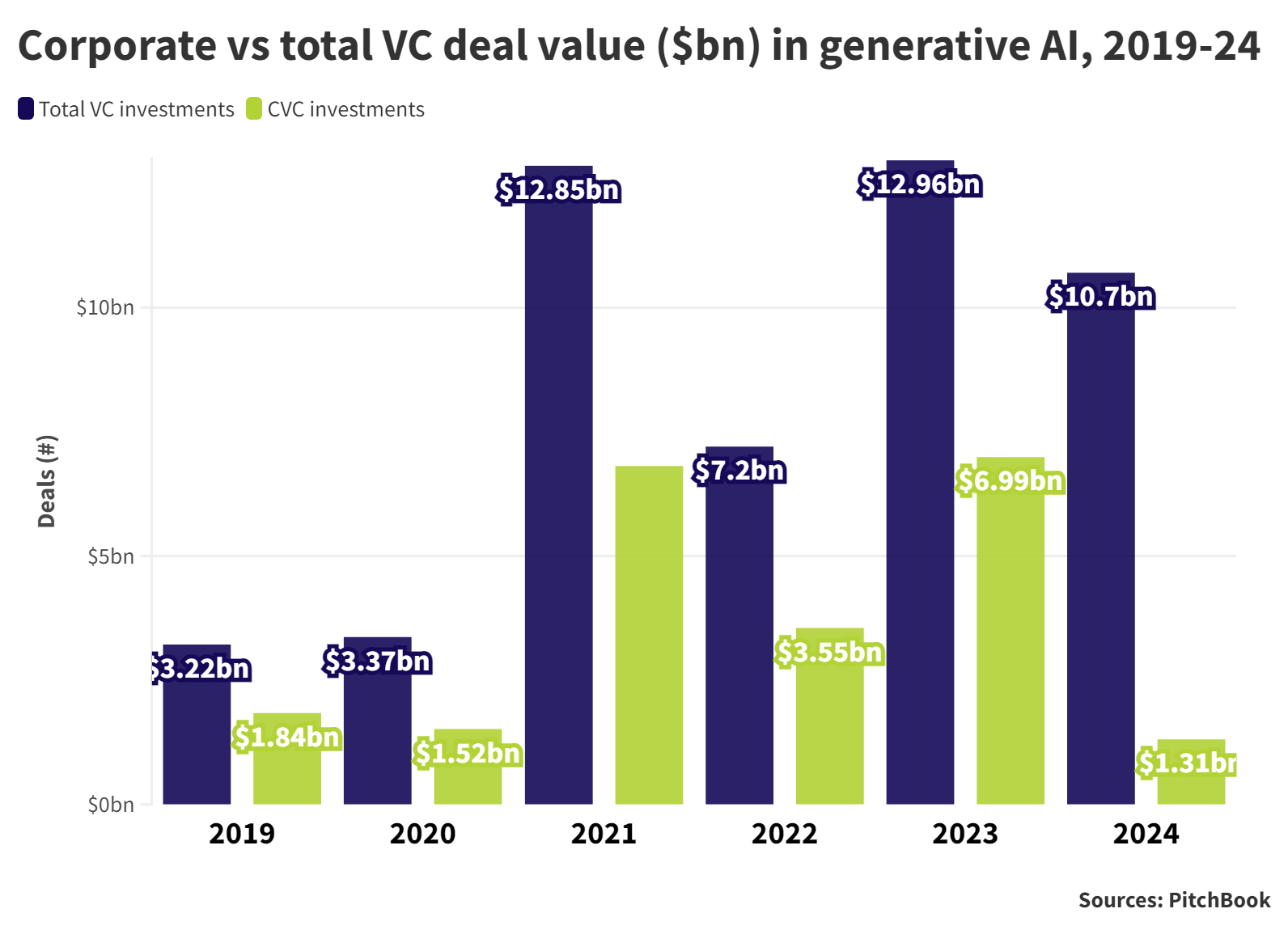

Corporate investors have helped back AI-startups to the tune of more than $100bn since 2021.

Overall spending on AI has declined over the past few years, but the subset of generative AI has shown no decline since the release of ChatGPT in 2022. PitchBook data shows that $7bn, over half of the total 2023 investment, came from funding rounds involving corporate investors.

READ MORE:

A complete guide to every dedicated CVC artificial intelligence fund.