Intel has spun off its venture capital arm, Intel Capital, after posting multi-billion losses and seeks to cut costs.

Intel is spinning off its investment arm, Intel Capital, as the US chipmaker goes through a restructuring after reporting a $16.6bn net loss in the third quarter of 2024.

The new standalone VC, which will have a new name, will have the flexibility to raise external capital, according to a release. Intel will remain an anchor investor in the spun-out fund.

Intel Capital is one of the oldest corporate venture capital units, having been in operation for more than 30 years.

“While we have enjoyed tremendous success under our existing model, this change brings our corporate structure in line with other leading venture firms and presents exciting opportunities for our future,” said the company in a release.

Former Intel CEO Pat Gelsinger resigned in December after the company posted the multi-billion dollar third quarter loss. It has announced plans for a $10bn cost cutting plan, which includes employee layoffs and cuts in operating expenses and capital expenditures.

Intel has struggled to compete in the market for AI chips as companies such as Nvidia have taken market share for semiconductors that underlie generative AI technology.

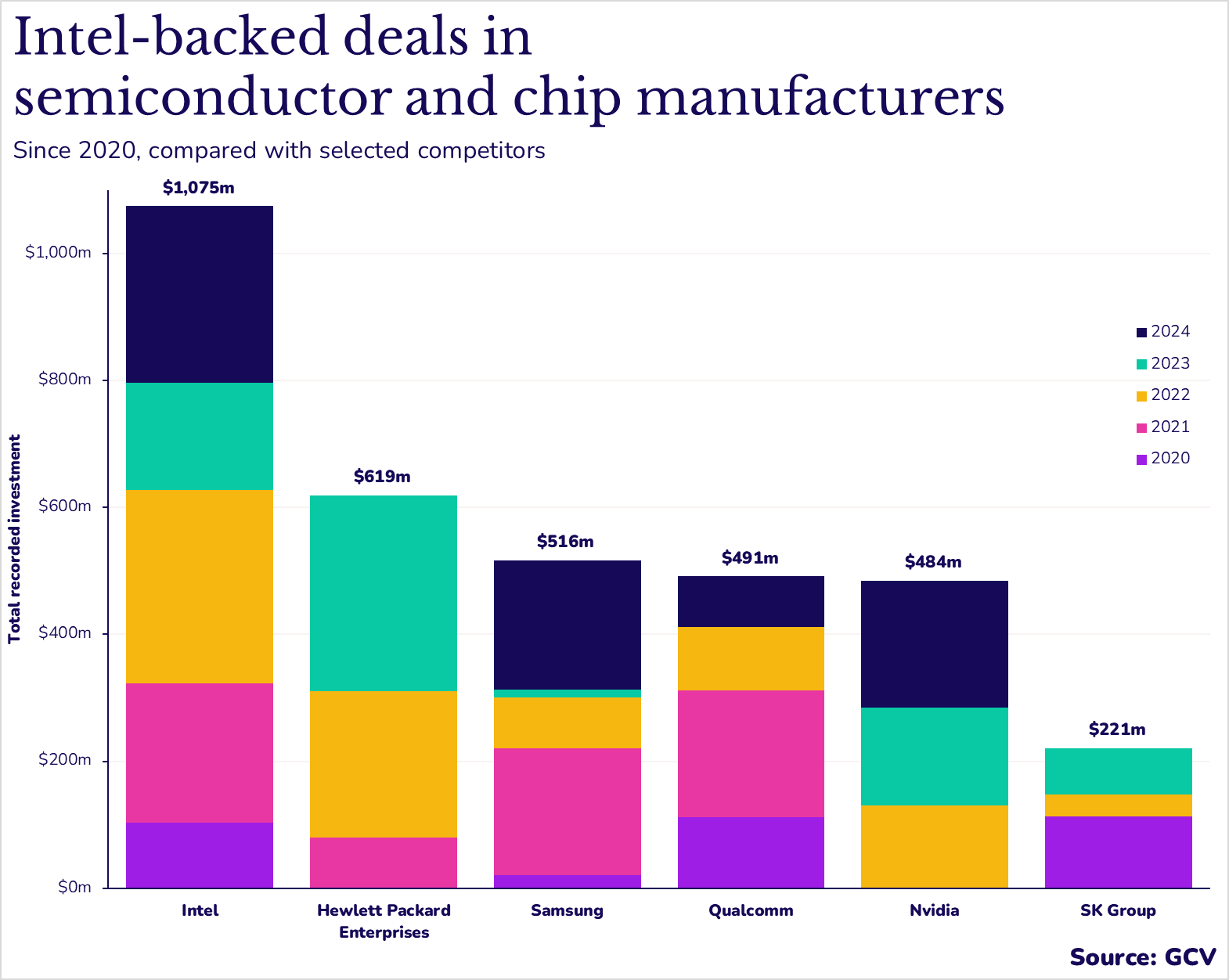

Intel Capital is among the top investors in startup semiconductor technology and chipmakers. It has invested more than $1bn in the sector over the past five years. Competitors such as Samsung and Nvidia have also ramped up investments in the industry over the past year.