More than 3,000 corporations invested in startups last year. One in five startup funding rounds now includes a corporate backer and more than half the dollars raised last year came from this kind of round.

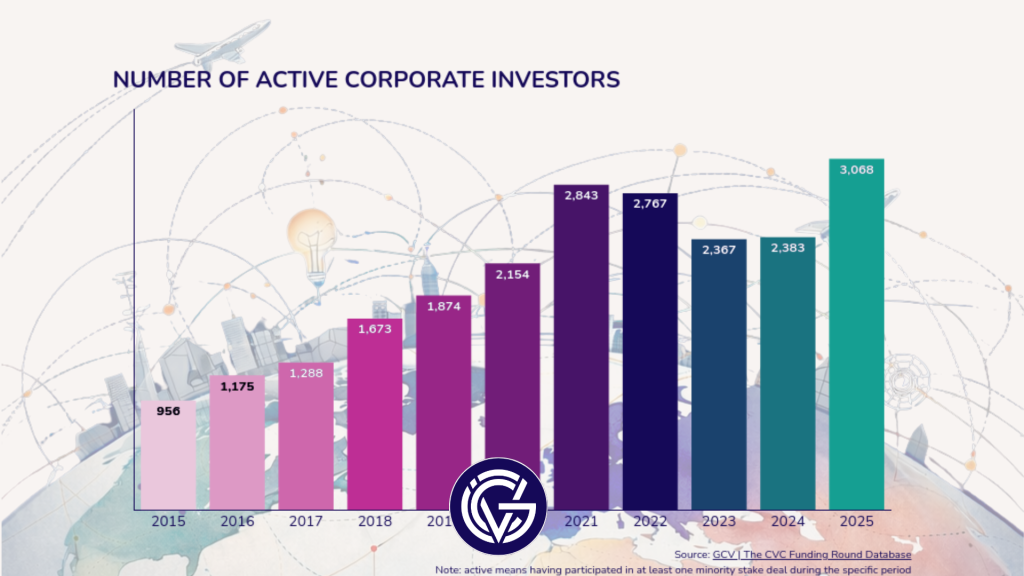

More than 3,000 corporations invested in startups in 2025, exceeding even the peak reached during the 2021 market cycle.

The rise comes at a time when the rest of the venture capital market remains well below its 2021 peak in volume and value. This means that corporate investors now play a materially larger role in the startup funding ecosystem.

One in five funding rounds globally included a corporate participant, and more than half of all capital raised by startups last year came from rounds with at least one corporate backer.

Artificial intelligence accounted for a large share of this corporate investment — especially by value — with big tech companies, including Nvidia, Meta and Microsoft, featuring prominently in some of the largest AI funding rounds of last year.

But even stripping out the large AI mega-rounds there has been a general increase in corporate investment activity across the board. Startup investment, once a sporadic and experimental activity, has become a regular part of corporate strategy. In countries such as Japan and Brazil, corporate investment programmes have multiplied over the past decade, partly as a response to government incentives. These programmes, now maturing, are having a material impact on the local startup ecosystem.

Our research suggests that corporate-backed startups, which often have commercial deals and other support from the corporations that invest in them, have better outcomes than those without corporate backers. They are less likely to go bankrupt and are more likely to have a liquidity-realising exit than their non-corporate-backed peers.

Our annual report on the state of the corporate investment sector, The World of Corporate Venturing, tracks the growth in corporate venture investment and the changing structure and operation of these programmes.

The executive summary of the key findings is free to read here.

GCV subscribers have access to the full report, including our annual survey of nearly 400 corporate venture units globally.

Maija Palmer

Maija Palmer is editor of Global Venturing and puts together the weekly email newsletter (sign up here for free).