The startup's latest fundraising round maintains its $1bn plus valuation.

Qualcomm and Schneider Electric are among the investors backing the late stage $75m round for Augury, an industrial AI startup with offices in the US and Israel.

Augury uses AI technology to help manufacturers and industrial companies monitor machines so that they can avoid production downtime. It claims its customers, which include PepsiCo, Du-Pont and Colgate-Palmolive, achieve up to a 10 times improvement on their return on investment.

The latest round was led by venture capital firm Lightrock, with participation from existing corporate investors Qualcomm, the US semiconductor and software maker, and Schneider Electric, a French digital automation and energy management company. Existing VC investors Insight Partners, Eclipse, Qumra Capital also participated.

The latest funding maintains the startup’s $1bn plus valuation. The company last did a fundraising in 2021, when it raised $180m in a series E round.

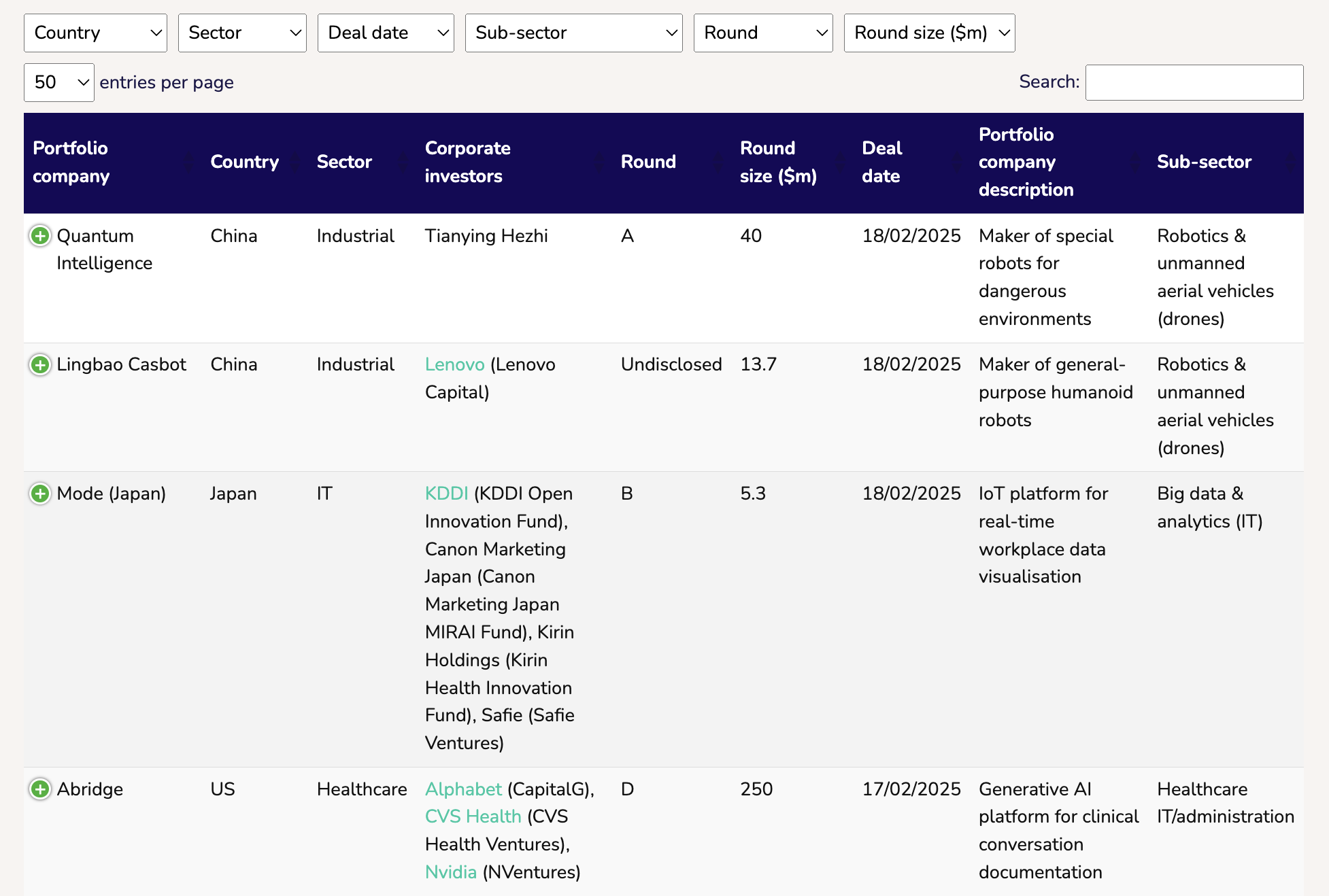

The financing round is relatively small compared with the hundreds of millions raised by AI startups for earlier rounds, such as the $300m series D round for US startup Harvey, an AI technology provider for legal professionals, and the $250m raised by Abridge, a generative AI platform for clinical conversation documentation. Both announced these fundraisings in February 2025.

Since its last fundraising in 2021, Augury has seen a five-fold increase in revenues, tripled its customers base among Fortune 500 manufacturers, and incorporated AI into its process optimisation technology.

The company’s technology also helps manufacturers cut up to 37% process waste and achieve 2% gain in energy efficiency.

Register for free to see all the corporate-backed deals in the past 14 days