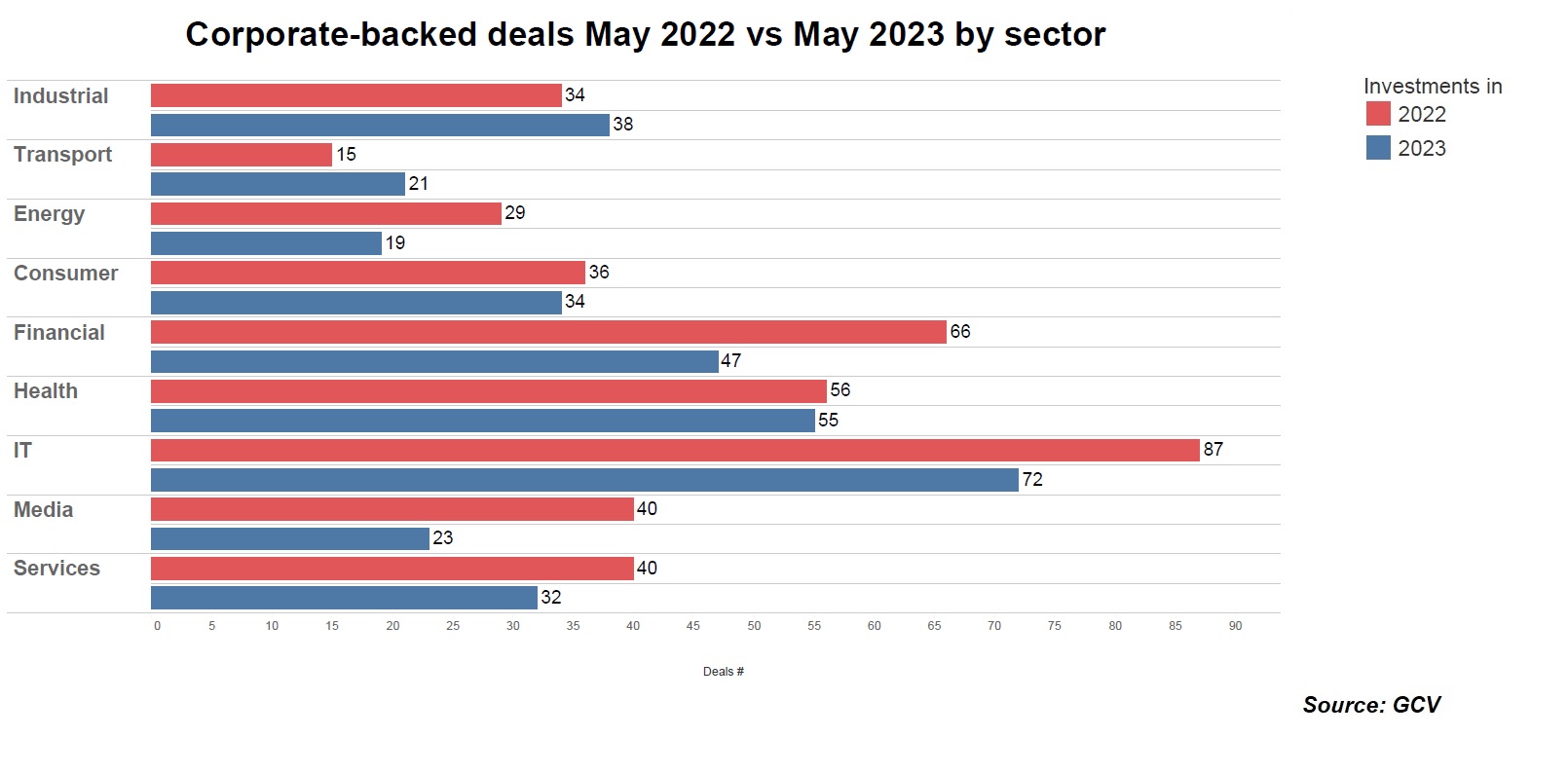

The downward trend of CVC deals showed signs of flattening in May 2023 with industrial and transport sectors and geographies like Japan, China and the UK showing year-on-year increases.

Corporate investment in startups is still down from a year ago but the decline appears to be flattening, with the amount spent in May 2023 slightly higher than in the previous two months. The industrial and transport sectors bolstered the overall numbers, with both areas showing a higher number of startup funding deals than a year ago.

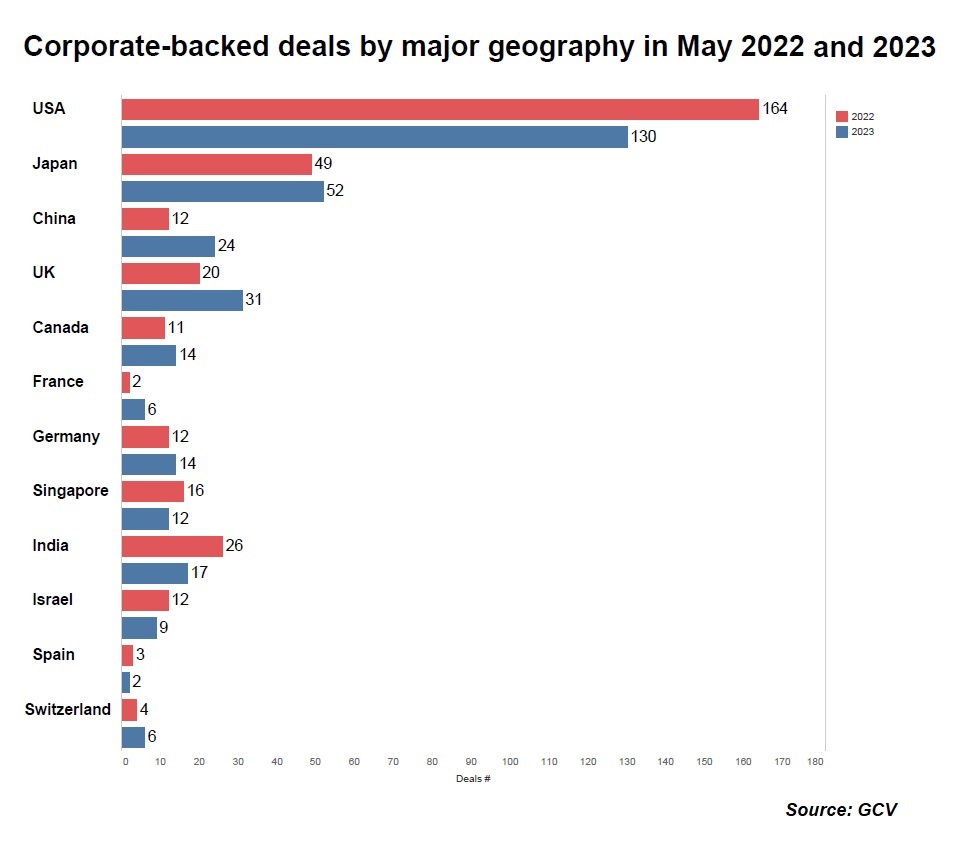

Geographies like Japan, China and the UK are also showing signs of deal numbers trending upwards in May.

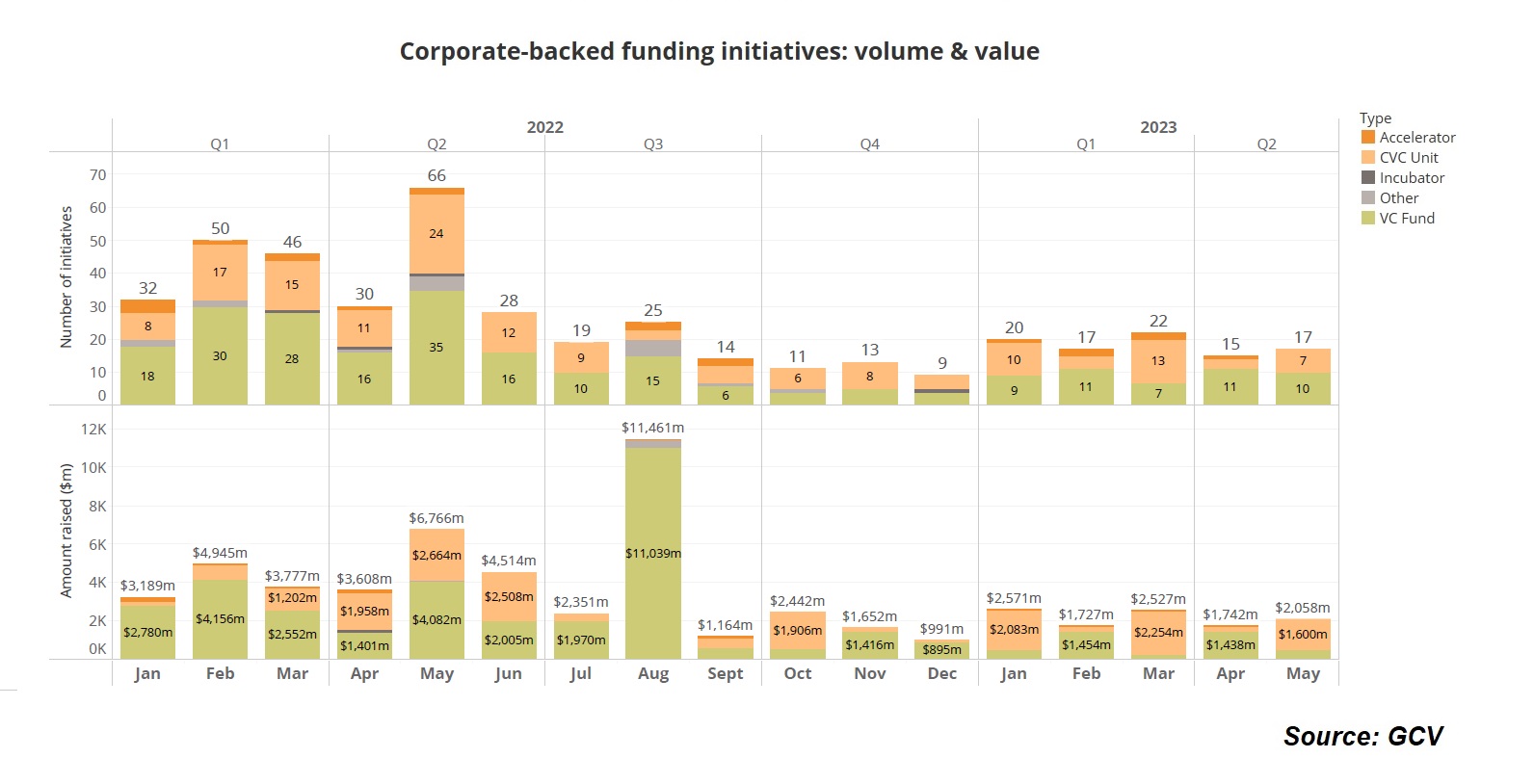

However, corporates appear to be much less willing to start new funds or incubator and accelerator programmes. The number of new initiatives like this announced in May 2023 was just 17, compared with 66 in the same month last year.

Startups working on agricultural technology and those working on advanced materials, particularly in nanotech, attracted backing from corporate investors.

In the US, nano-coating technology developer Forge Nano raised a $50m Series C round led by Hanwha Aerospace Company. Founded in 2011, Forge Nano has developed precision nano-coating technology that provides Atomic Layer Deposition (ALD) techniques to chemically bond coatings with angstrom-level precision.

Also in the US, sustainable advanced material supplier Impact Nano raised $32m in venture funding from Intel Capital and Goldman Sachs Asset Management. The company produces speciality chemicals for the semiconductors industry.

In recent times, we’ve seen a notable uptick in aquaculture deals with corporate backing. In November last year, Indonesian B2B fishery marketplace FishLog raised $3.5 pre-series A round, featuring Bank Rakyat Indonesia’s BRI Ventures and Triputra AgriGroup. Similarly, algae-based jet fuel developer Viridos raised $25m round in March this year, featuring United Airlines and Chervon’s CVC arms as backers.

The most notable agtech deal in May came from aquaculture, too. Indonesian aquatech company eFishery raised $108m in a Series D round led by G42 Global Expansion Fund which invested alongside SoftBank, reportedly at a pre-money valuation at $1.15bn. eFishery runs an IoT-based automatic fish feeder for commercial aquaculture that uses motion sensors to measure fish appetite and feed specific amounts.

Elsewhere in agtech, US-based alternative protein Air Protein raised $75m in a round backed by ADM Ventures, GV, and The Ford Family Foundation. Barclays and other undisclosed investors also participated. Air Protein develops a technology to make edible protein from elements of the air and includes no hormones, pesticides or herbicides, using less water than other alternative meats.

A big part of modern agriculture is about digitisation and automation and that showed up in May’s deals. Swiss agtech machine maker EcoRobotix raised $52m in a round led by Aqton, featuring telecoms firm Swisscom and chemical producer BASF. Founded in 2011. EcoRobotix develops autonomous robots intended for the ecological and economical weeding of row crops, meadows, and inter-cropping cultures, using minimal herbicide.

Transport deals also speed up

Transport is another area which bucked the downward trend. Notable deals included EV manufacturer Faraday Future’s $100m of debt financing provided in large part by holding company FF Global Partners (FFGP), as well as Metaverse Horizon Limited and V W Investment Holding, an affiliate of an undisclosed long-term shareholder of the company.

With the sustainability of air travel still being a massive challenge, one of the biggest transport deals in May was a $100m investment into Lilium Aviation, which is the developer of the world’s first all-electric vertical take-off and landing jet. The investment was made by technology and entertainment conglomerate Tencent. Developing aircraft is an expensive business, and Lilium has said it needs a minimum of $250m to keep the lights on.

UVEye, which is developing a drive-through vehicle inspection technology, seems to be inching closer to bringing its tech to market. It raised $100m with the intention of using it to support “major new sales and manufacturing initiatives in North America.” The investment was led by Hanaco VC and supported by American car maker General Motors, used vehicle retailer CarMax and insurance company W.R. Berkley Corporation, among others.

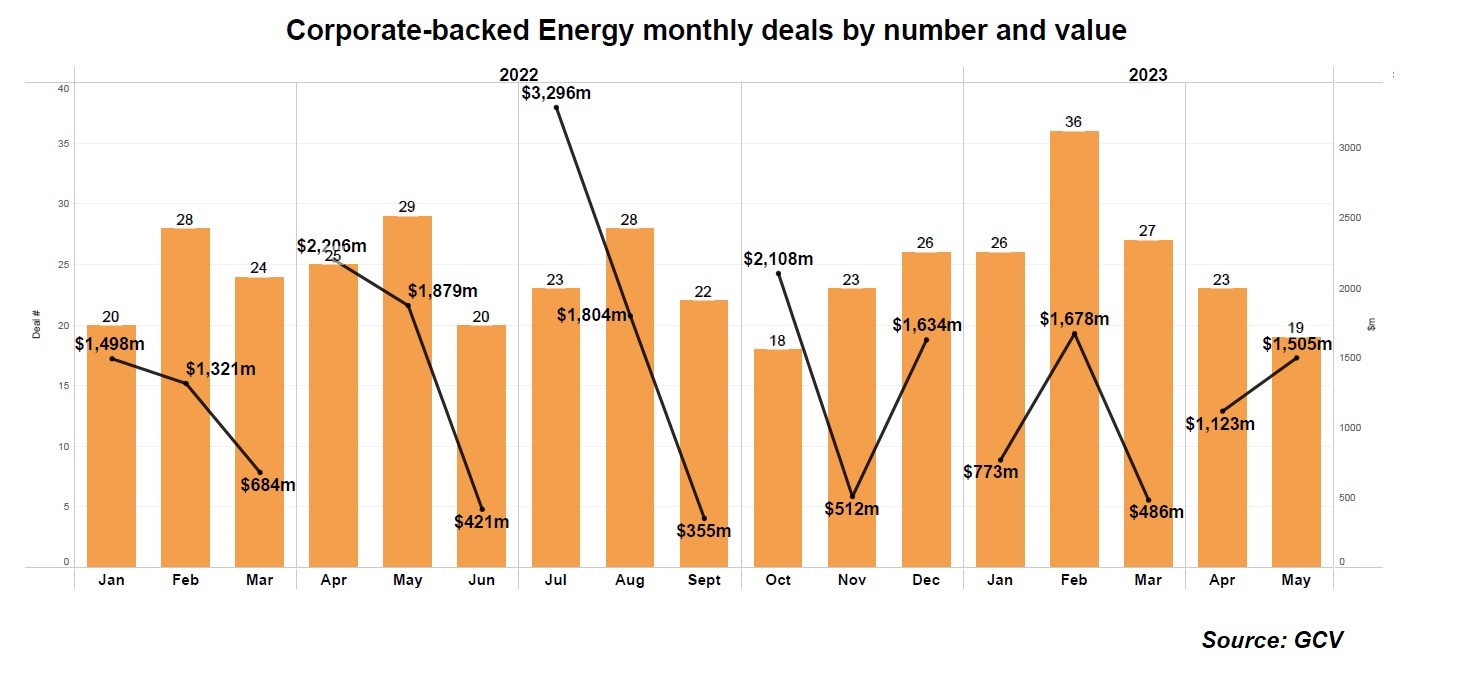

A dip in energy levels

Another trend that sticks out in the May data is the relative and steady decline of corporate-backed deals in the energy sector, which through 2022 remained relatively steady despite the overall downward trend in VC investment. Energy sector deals appear to have declined since February, but it is too early to conclude if that is a consistent trend.

Nuclear fusion, however, is seeing an uptick of interest, with two investments in May in the nuclear fusion space, both from the Asia Pacific region.

Japanese nuclear fusion developer Kyoto Fusioneering raised ¥10bn ($75m) in a Series C round, led by JIC Venture Growth, which also featured real estate firm Janus Continental, Global Brain and MUFG Bank. The funds will be used to accelerate its research and development of nuclear fusion reactor peripheral equipment and plants as well as help expansion in the US and the UK.

Chinese Energy Singularity raised nearly $58m of venture funding featuring input from video game development and publishing company MiHoYo. Founded in 2021, Energy Singularity is developing controllable nuclear fusion technology, focused on the development of high-magnetic field, high-parameter, standardised high-temperature superconducting tokamak devices with commercial power generation potential.

Month-on-month trends still subdued

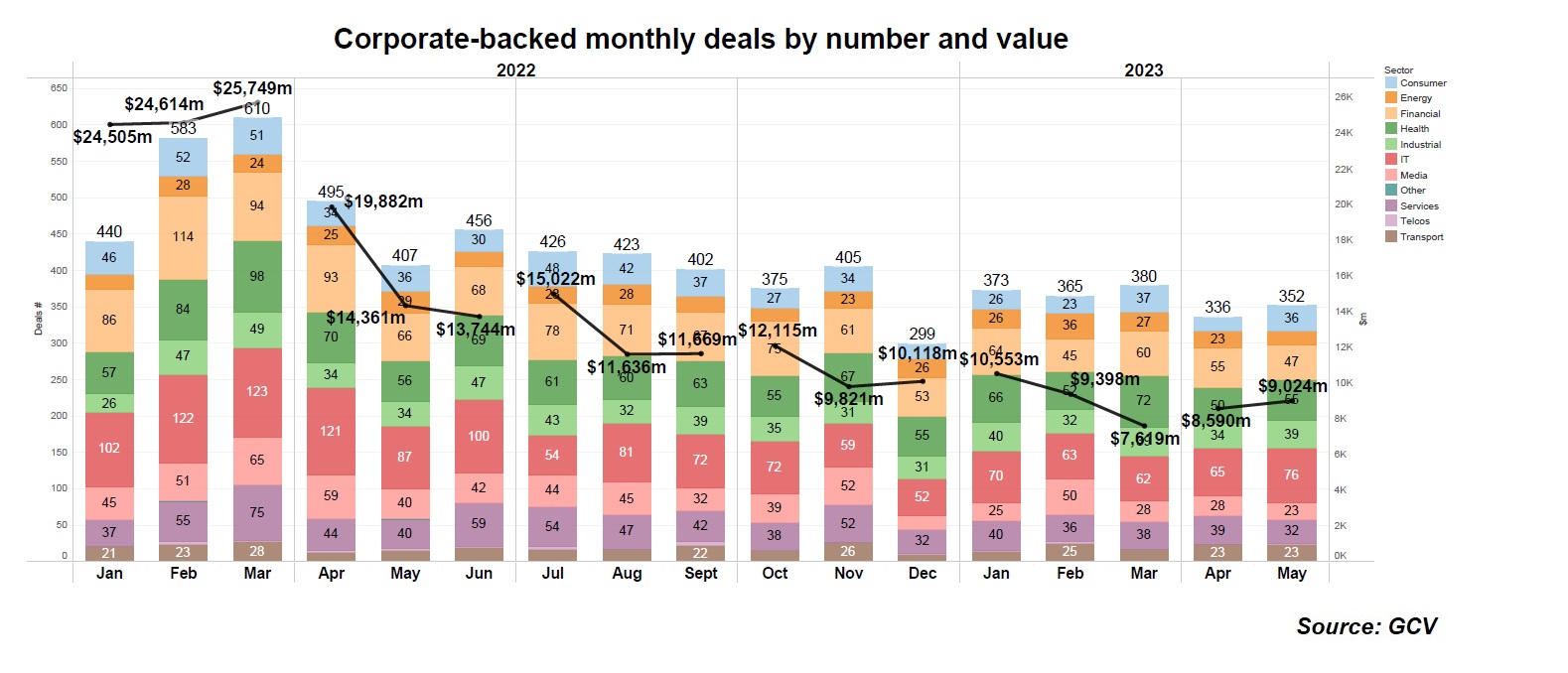

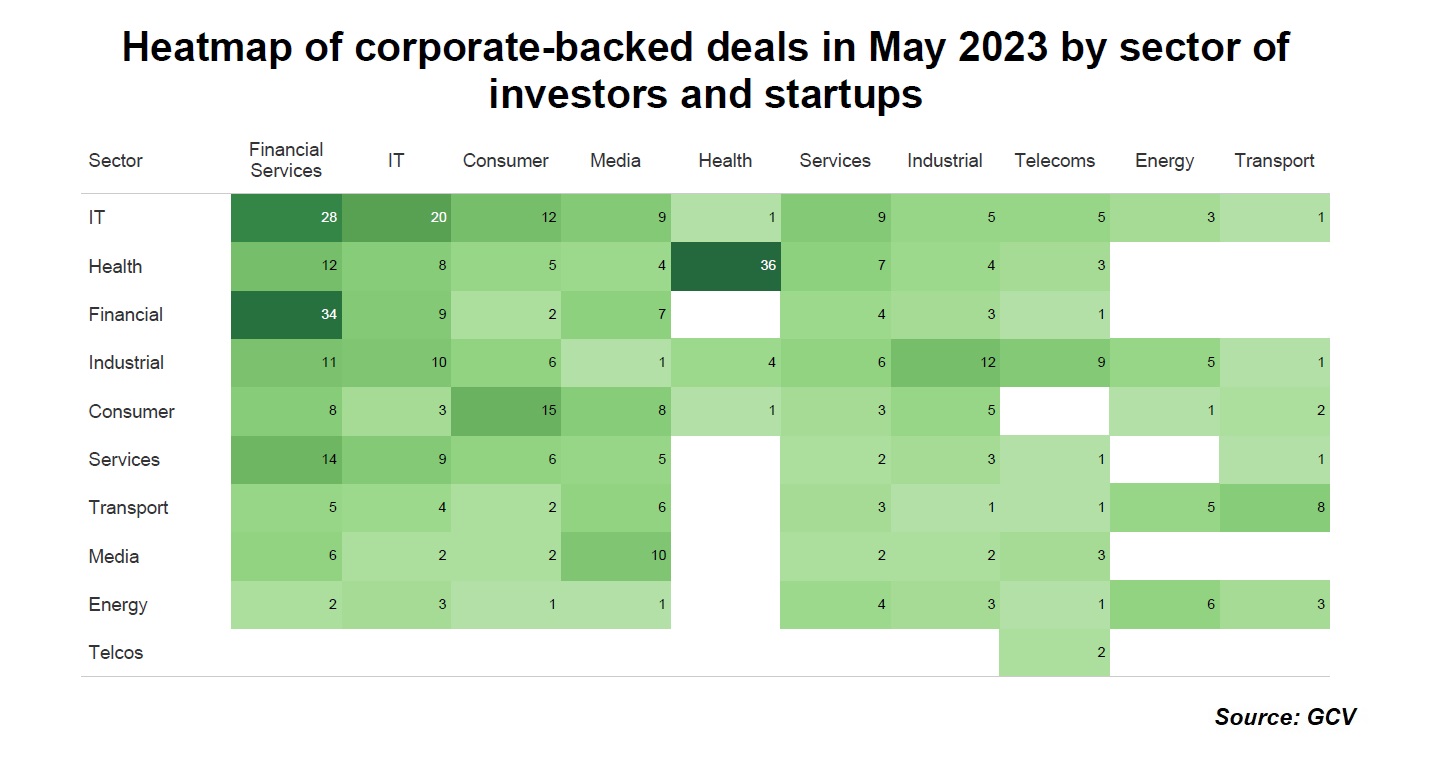

Emerging businesses from nearly every sector but IT and health raised less funding in corporate-backed rounds this May than in previous months of this year.

First signs of the downturn flattening?

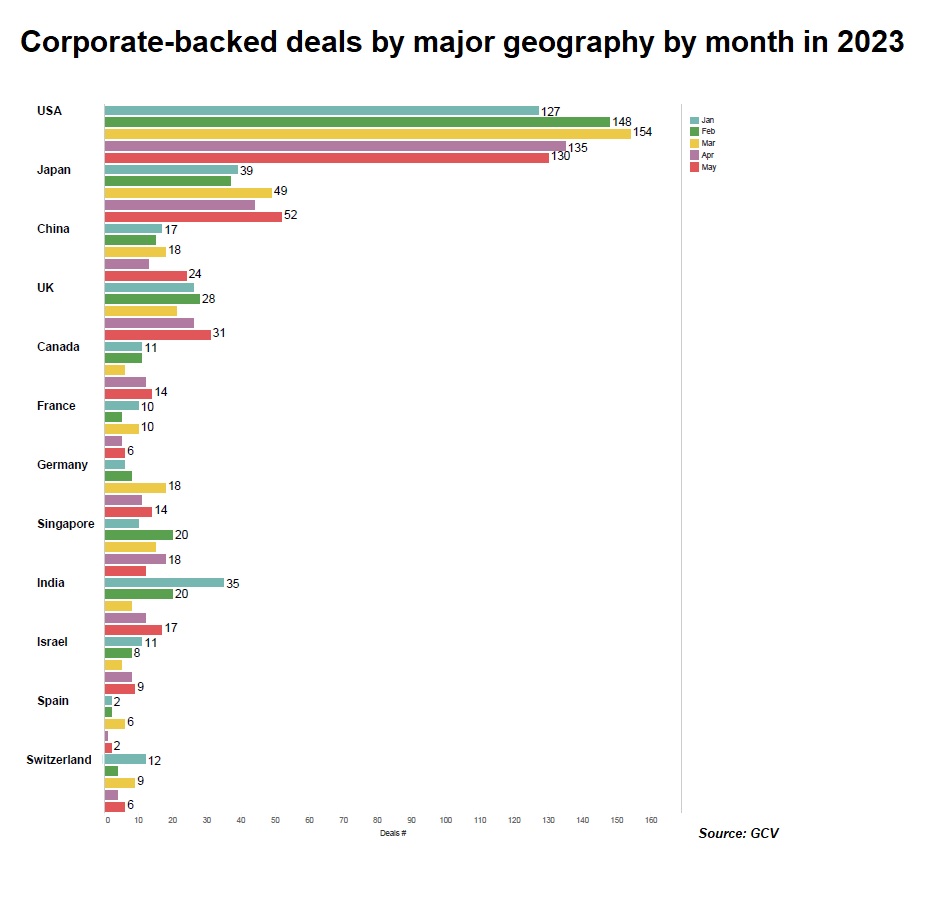

The number of corporate-backed deals from around the globe stood at 352 in May, which is down 14% from the 407 rounds registered in the same month of 2022.

Investment value stood at $9.02bn in total estimated capital, down 37% from the $14.36bn of the same period last year.

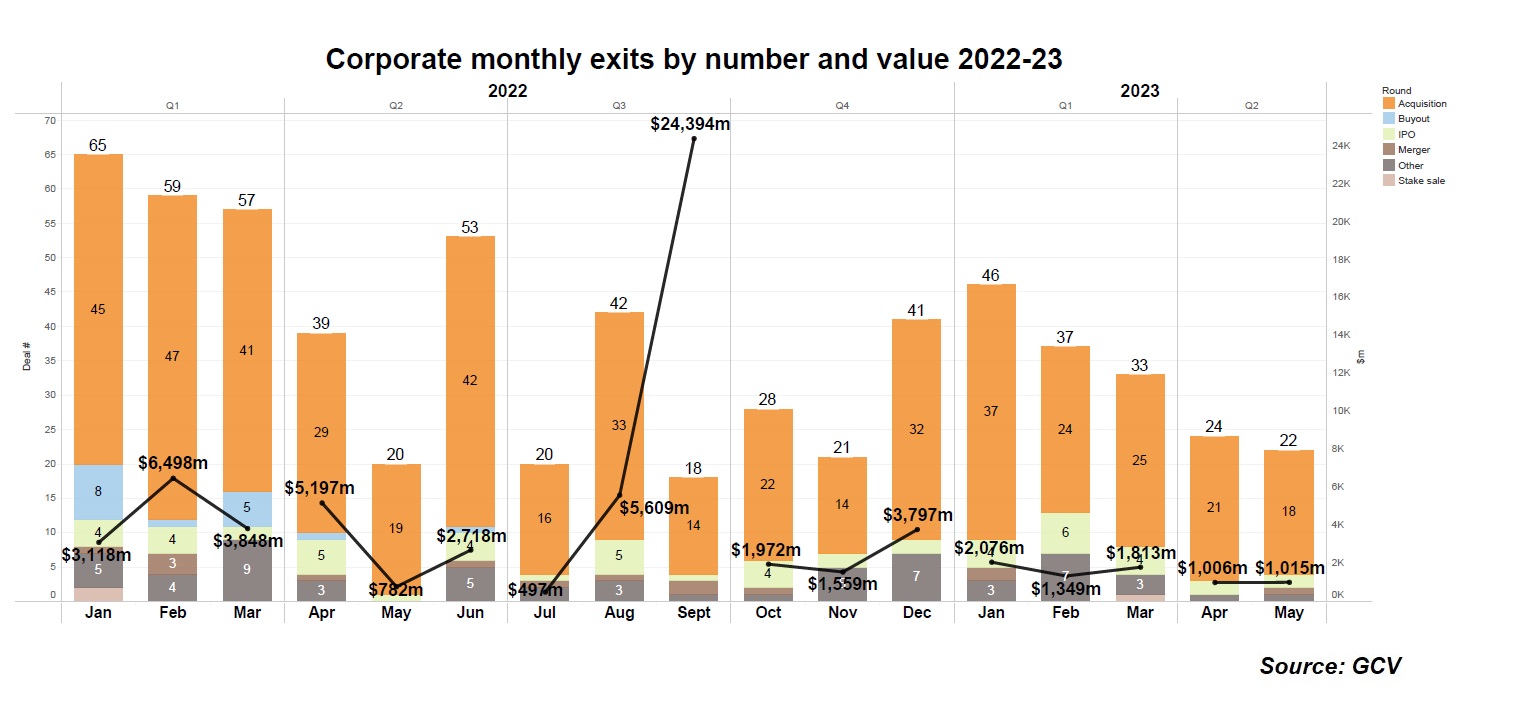

However, as we can see from the chart below, the number and value of deals by month appears to be stabilising. Perhaps the next few months will bring an end to this downward trend.

The US came first in the number of corporate-backed deals, hosting 130 rounds, while Japan was second with 52 and the UK third with 31.

If we look at how major venturing geographies fared in May year-on-year, we see there has been an increase of deals in geographies like China, the UK and Canada and also –though only marginally – in Japan, Switzerland and Germany.

Those year-on-year observations are somewhat confirmed by ongoing trends so far in 2023, too. In most of the major countries, there were fewer or the same number of deals this May than in previous months of 2023, with the exceptions of Japan, China, the UK and Canada.

This could be considered at least some evidence and indication that corporate VCs are looking more opportunistically in specific regions, which may appear particularly attractive at the moment.

New funds focused on East Asia

Corporate willingness to spend on startup funds and accelerators is much lower than last year. GCV reported 17 corporate-backed funding initiatives that were announced in May, including VC funds and new venturing units. This is down from 66 in May last year.

Out of the 17 new funding initiatives, 10 of them are either based in or focused on East Asia, indicating that this is a key location for promising new companies and exciting innovations.

The biggest of these, two investment funds launched by Kweichow Moutai, a leading Chinese liquor distiller, with a combined value of $1.4bn, will aim to invest in a diverse selection of areas including biotechnology, next-generation information technology, new energy, and mass consumption fields.

Notably, three of the other new funds have a specific focus on deeptech and artificial intelligence – Baidu VC Fund, Genesia Ventures Third Fund and Deepcore Tokyo No.2. That, coupled with the biggest deal of the month being Anthropic, an AI company formed by former staffers of Open AI, makes it seem that investment in these areas will likely continue to build.

Leading corporate investors

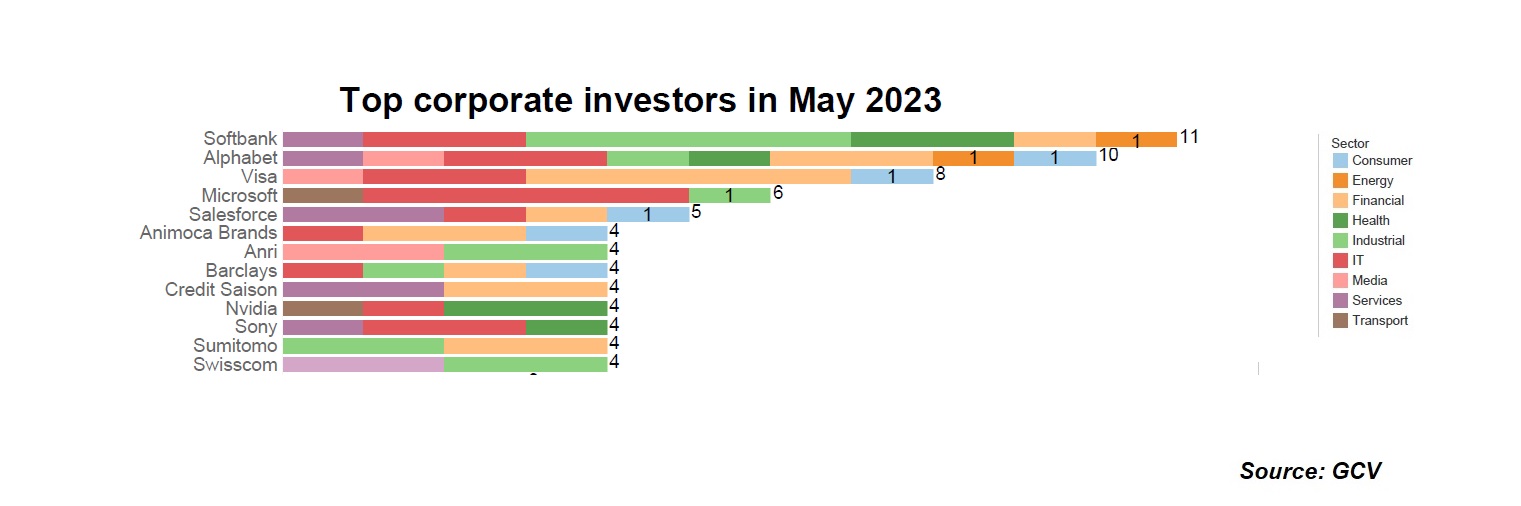

The leading corporate investors by number of deals were telecoms conglomerate SoftBank, internet conglomerate Alphabet and credit card operator Visa.

The most active corporate venturers came from the financial, IT, consumer and media sectors, as shown on the horizontal axis of the heatmap here.

The top deals of May were concentrated in emerging businesses primarily from the energy, IT and health sectors.

Anthropic, an artificial intelligence technology developer, founded by former OpenAI executives, raised $450m from investors including Alphabet’s Google and Spark Capital. This latest round reportedly brings Anthropic’s total funding to nearly $1bn. The round also featured Microsoft, Salesforce Ventures and Zoom Ventures. The company focuses on research into increasing the safety of artificial intelligence systems and increasing the reliability of large-scale models.

ElevateBio raised $401m in a Series D round that featured industrial conglomerate Itochu and pharmaceutical Novo Nordisk. SoftBank Investment Advisers also participated in the round. The funding will go to advancing cell and gene therapies and geographic expansion. ElevateBio has a portfolio of cell and gene therapy companies intended to develop, manufacture and commercialise life-transforming medicines to treat severe diseases.

China´s titanium metal producer Yunnan National Titanium Metal, a subsidiary of Shenzhen-listed chemicals producer LB Group, received CNY 2.27bn (USD 321m)in a funding round, featuring Shenzhen Capital Group and China National Building Material as a backer. Founded in 2019, Yunnan manufactures titanium sponges used in the process of producing refined titanium metal.

France-based EV charging system maker DriveCo received €250m of development capital from APG Group. APG Group provided loans in the form of convertible debt to support the transaction. The funding will be used to develop its network of charging stations in France and Belgium, as well as expand to Germany, Spain, Italy, Switzerland and the Netherlands. Launched in 2010, DriveCo is the developer of complete EV charging systems intended to charge vehicles through solar energy.

US-based energy-generating equipment developer Redaptive raised $250m in a series E round which included industrial conglomerate Honeywell and real estate group CBRE, reportedly putting the company’s pre-money valuation at $750m. Founded in 2014, Redaptive is the provider of energy system upgrade services intended to serve heating, ventilation and air conditioning (HVAC), lighting and data analytics industries.

Total exit value still low

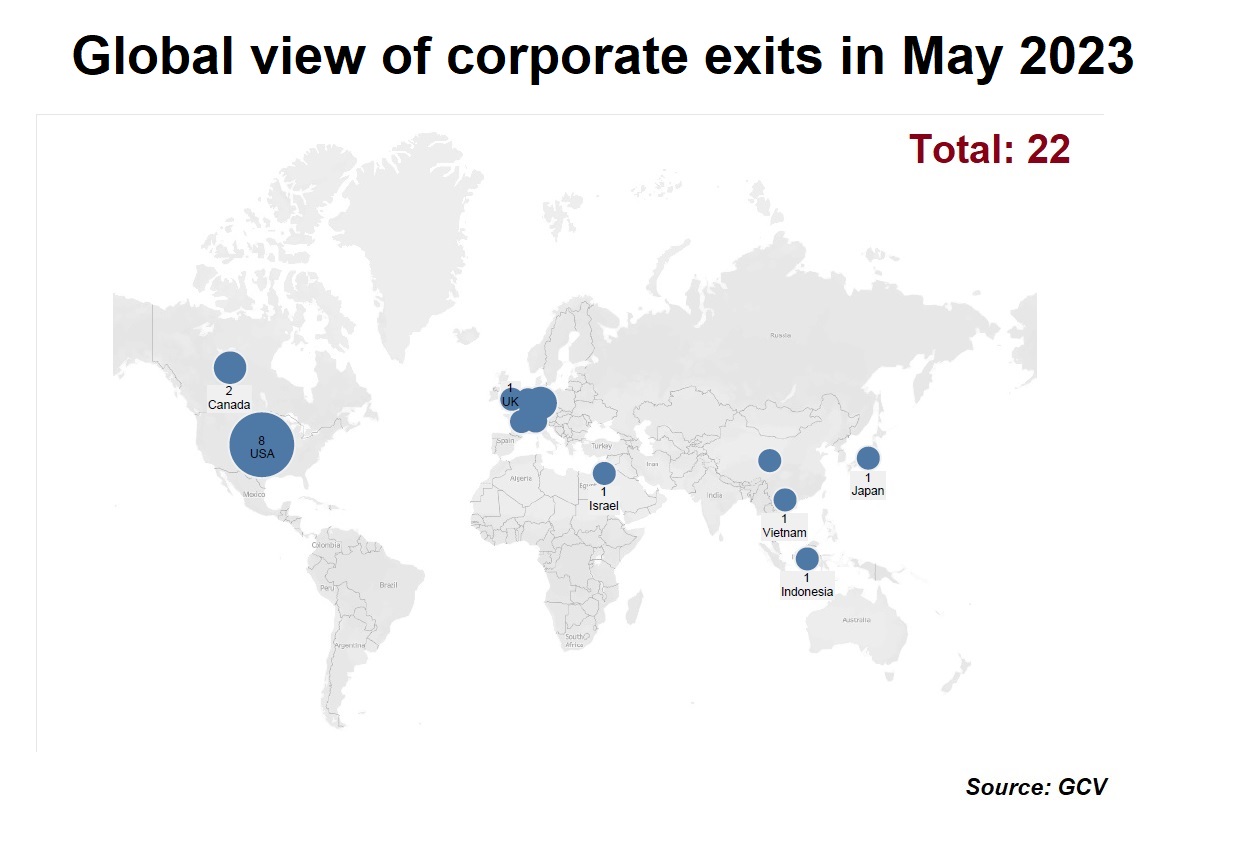

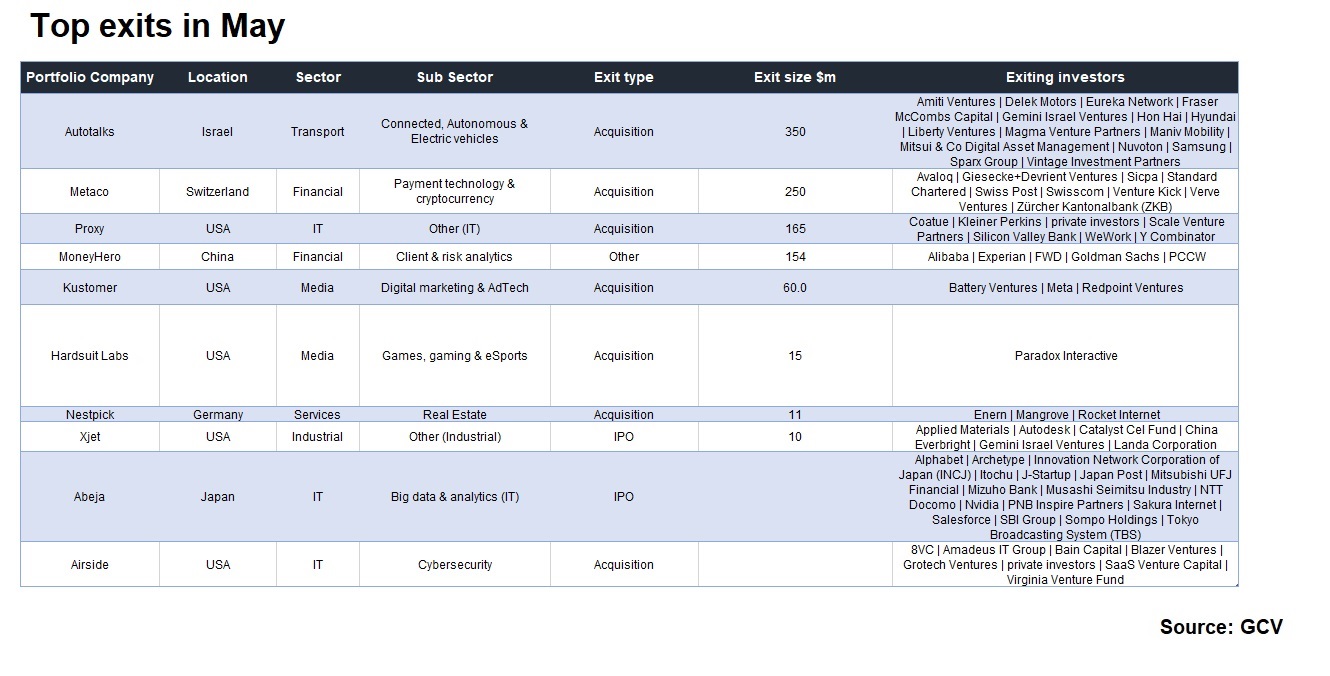

GCV Analytics tracked 22 exits involving corporate venturers as either acquirers or exiting investors in the fifth month of this year. The transactions included 17 acquisitions, two announced initial public offerings (IPO), one merger of equals and two other transactions.

The exit count was slightly up from the May 2022 figure this year (20), though significantly lower than the January this year (46). The total estimated exited capital stood at $1.02bn. While this was up vis-à-vis the same month last year, it is still considerably down from the $2.08bn in January this year.

These figures continue to suggest that public and M&A markets are still far from buoyant but there is glimpse of hope for improvement. Moreover, the top ten exits from May were not necessarily concentrated in one or two defensive sectors.

Israel-based fabless semiconductor company Autotalk reached a definitive agreement to be acquired by Qualcomm for an amount reported to be at least $350m. The company counts corporates Samsung, Delek Motors, Hon Hai and Hyundai among its backers. Founded in 2009, Autotalks offers automotive-qualified dual-mode global vehicle-to-everything (V2X) solutions compatible with multiple V2X standards designed to reduce collisions and improve mobility.

Swiss digital asset management platform Metaco was acquired by Ripple for $250m. The acquisition is expected help Ripple allow customers the technology to take custody of, issue and settle any type of tokenised asset. The startup counted corporates Swisscom, Swiss Post as well as Zürcher Kantonalbank and Standard Chartered among its backers. Founded in 2014, Metaco has developed an orchestration platform to issue, secure, manage and trade cryptocurrencies, tokens as well as smart contracts.

US-based digital identity tech developer Proxy was acquired by Finnish wearable technology maker Oura Tech, reportedly for $165m. Proxy Technologies counted among its backers the now defunct Silicon Valley Bank and office renter WeWork. Founded in 2016, Proxy has developed a technology that uses smart devices and digital platforms to power universal identity signals that provide mobile access throughout commercial buildings including workplaces.

Chinese fintech startup MoneyHero, which counts among its backers corporates Alibaba and Experian as well as billionaire Richard Li, agreed to go public on the Nasdaq stock exchange via a merger with publicly traded SPAC Bridgetown Holdings. Proceeds from the transactions are expected to amount to $142m. Founded in 2014, MoneyHero runs a financial comparison platform designed to offer information on personal finance.

We also saw what we may loosely call reversed exit. US-based CRM platform Kustomer, which was previously acquired for $1bn in 2020 by Meta, the parent of social network Facebook, was spun out again as an independent startup and raised its first round of $60m, reportedly at a valuation $250m, a fraction of its previous unicorn level. The round was supported by previous backers Battery, Redpoint and boldstart, while Meta will remain a minority owner. Founded in 2015, Kustomer has developed a CRM platform designed to offer proactive customer service and support.