Pharmaceutical firm Sanofi's corporate venture unit has added $625m to its evergreen fund following a succession of big exits.

French pharmaceutical firm Sanofi pledged a further $625m to its corporate venture capital arm Sanofi Ventures today, boosting its assets under management to more than $1.4bn.

“This new, significant capital commitment reflects our strong belief that some of the most important medical breakthroughs begin in early-stage companies,” said Sanofi CEO Paul Hudson in a release.

“By strengthening our investment capabilities, we are accelerating our ability to bring next-generation therapies that improve people’s lives while building valuable partnerships across the healthcare ecosystem.”

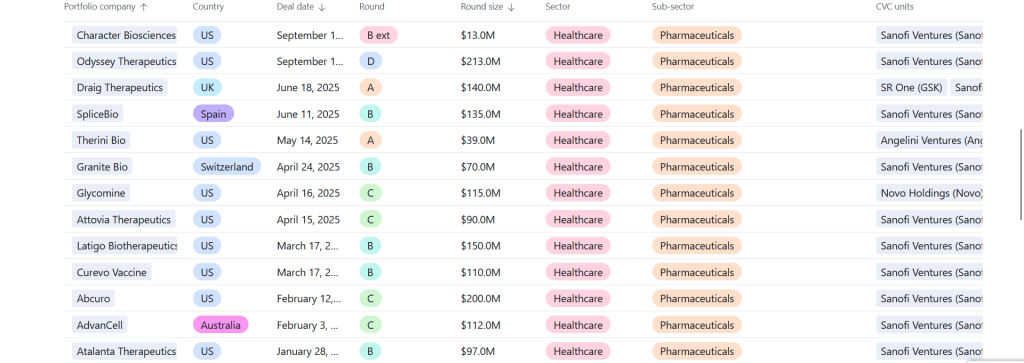

Check out where Sanofi Ventures has been investing in GCV’s CVC Funding Round Database

Sanofi Ventures, based in Silicon Valley, invests in biotech and digital health startups from seed to IPO stage. The expansion of its evergreen fund comes in the wake of several exits for the unit, most recently when virtual care provider Omada Health floated in a $150m IPO in June.

“The strong performance of our fund, including three realised exits in 2024 from companies with a combined acquisition value of $3.25bn, validates our evergreen structure and approach to identifying and supporting companies that are at the forefront of medical innovation,” said Sanofi Ventures’ managing director, Jason P. Hafler, in the release.

CVC investors we need your help!

The corporate venture industry has never been more influential — but it is also changing rapidly. Help us track these shifts by adding in the details of your unit to our annual survey.

All responses are anonymised and we share the benchmarking data back with all respondents.