Illumina Ventures started with a target of $300m for its latest fund but has cut that to $200m amid a tough climate for biotech investors.

Illumina Ventures, the corporate VC arm of biotechnology company Illumina, has lowered the amount it is looking to raise for its third fund from $300m to $200m, in the latest sign of how difficult the fundraising climate is in the biotech market.

Biotech investment had already been in a prolonged downturn following the Covid boom, and this year tariff uncertainty, changes to the US Federal Drug Administration and cuts to National Institutes of Health budgets have added to the challenges.

Illumina Ventures began raising funding for its third fund a year ago but according to a filing with the US Securities and Exchange Commission, the unit has so far raised just $60m for the new vehicle. It has now knocked a third off the target for final close.

This is in contrast to the unit’s second fund which closed at $325m in 2021 at the height of the market.

Illumina’s new fund will invest in startups in areas like life sciences, genomics, diagnostics, digital health solutions and others.

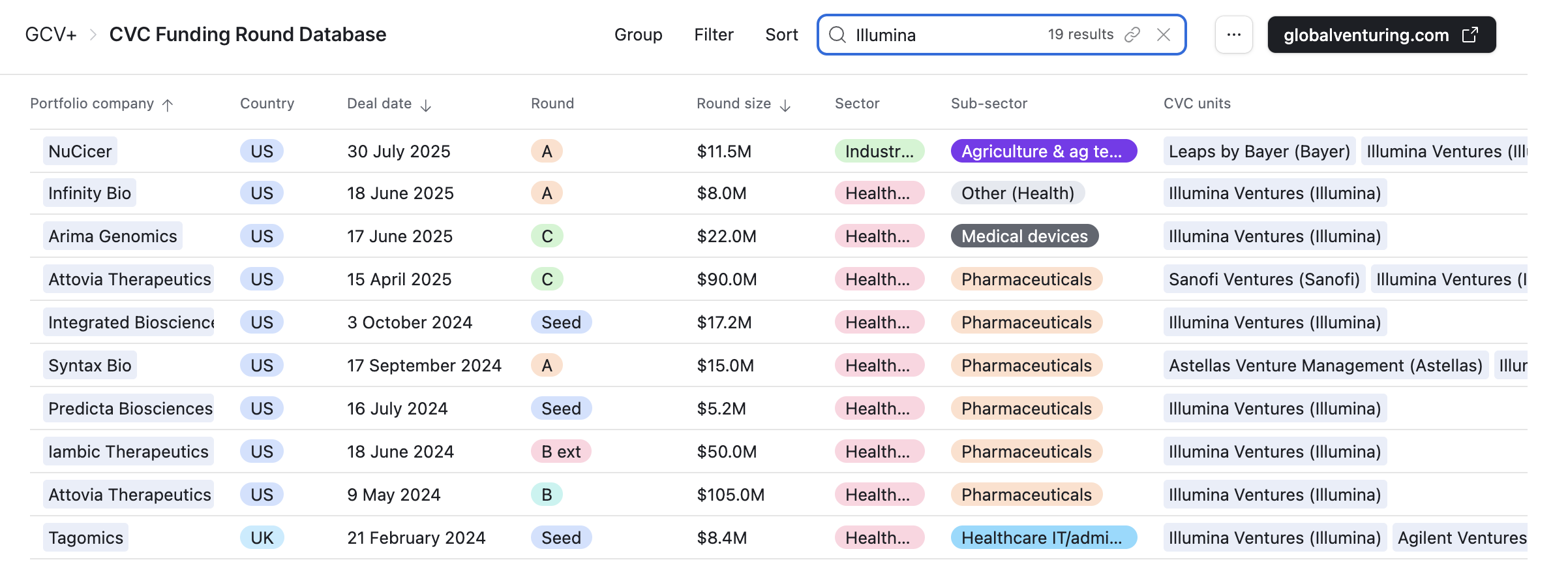

The unit has made at least four investments so far this year, including antibody-based treatments companies Attovia Therapeutics and Infinity Bio, as well as genomics medicine startup Arima Genomics and chickpea-based ingredients producer NuCicer.

See all the recent startup deals Illumina Ventures has backed in the CVC Funding Round Database.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.