General Electric is hiring for a corporate venture arm that will invest on behalf of GE Healthcare, returning to CVC after a five-year gap.

GE Healthcare, the medical technology arm of US conglomerate General Electric (GE), is forming a corporate venture capital unit under the guidance of CVC veteran Sabir Rassiwalla.

The company is hiring a director and an associate for the unit, which will represent GE’s first dedicated venture fund since it shut down GE Ventures in 2021.

GE Healthcare produces ultrasound systems, medical care equipment, imaging systems for use in drug development, as well as software in areas such as care optimisation and cybersecurity.

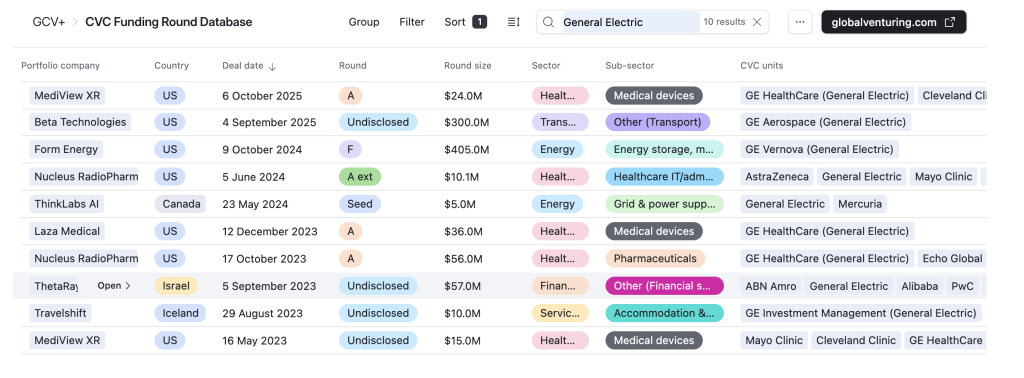

Despite not having a dedicated investment fund, it has made occasional venture investments from the corporate balance sheet, most recently co-leading a $24m series A round for MediView, a developer of augmented reality technology for surgery, last October.

See all the recent corporate-backed rounds on the CVC Funding Round Database

“This is a unique opportunity to build a world-class strategic investing function while advancing the work already underway,” Rassiwalla said in a LinkedIn post.

“I am energised by the chance to help define our investment thesis, build a high-performing team, and collaborate across the healthcare innovation ecosystem to identify transformative technologies and growth opportunities for GE Healthcare.”

Rassiwalla has been managing director of strategy and corporate development for GE Healthcare since 2023, following a two-year spell at investment manager CRG, the Houston-based healthcare investment company. He had previously spent eight years in CVC for medical device maker Abbott, rising to venture investments director in 2019.