The Future Energy Ventures fund is looking to supercharge Europe's energy tech sector.

A number of energy and industrial conglomerates are backing a €235m ($272m) fund raised by Future Energy Ventures (FEV), the venture capital firm anchored by German energy utility E.ON, in order to invest in technologies related to grid resilience and energy transition.

This is the first fund Future Energy Ventures has raised with multiple investors since it spun out from E.ON three years ago.

E.ON is still an anchor investor in the new fund, together with the European Investment Fund, with additional funding coming from a number of energy providers including Hong Kong-headquartered power company CLP, Latin American energy group ISA Energia and Austrian energy provider Kelag. A number of other corporations also invested in the fund, including Hong Kong-based public transport operator MTR and Turkish industrial conglomerates Borusan, Zorlu Holding and Sabanci, through its Sabanci Climate Ventures investment fund.

Formed in 2020 after the merger of E.ON and Innogy, FEV combined both companies’ CVC portfolios together and invests in Europe and Israel-based developers of digital technologies that can enhance energy infrastructure. It moved towards an independently managed structure in 2022.

The close of Future Energy Ventures Fund II comes roughly a year after FEV managing director Jan Lozek told GCV the firm was actively recruiting limited partners and targeting a €250m final close for the fund. Its capital includes €30m from Italian development bank Cassa Depositi e Prestiti which will be reserved for investment in Italian startups.

“Closing our first multi-LP fund at a time when the energy transition is accelerating, when energy security, resilience and geopolitical tensions are higher than ever, reinforces my belief: software-first, asset-light solutions are the enablers of a highly localised and decentralised energy system,” said FEV partner Moritz Jungmann in a LinkedIn post announcing the close.

“With Future Energy Ventures Fund II, we’re doubling down on supporting early-stage founders as they navigate this complex market and scale into commercial growth.”

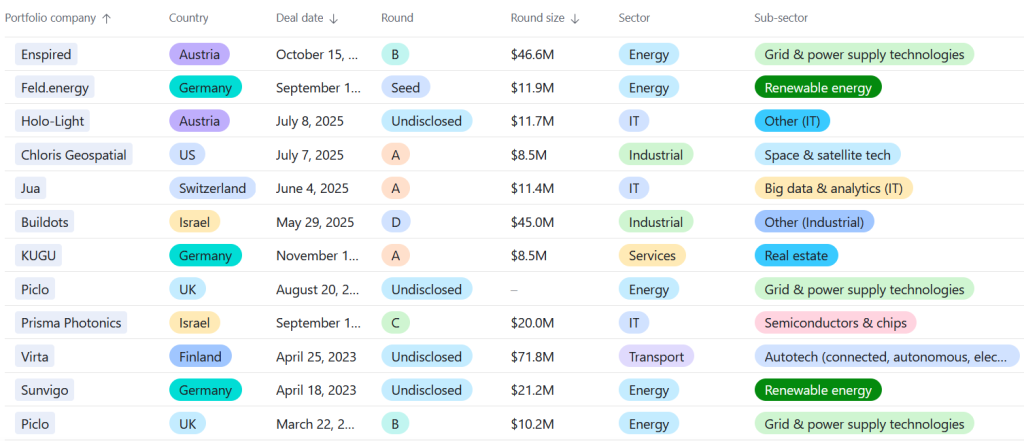

Want to find out more? Check out every Future Energy Ventures investment in the GCV Funding Database!