The AI infrastructure provider's share price jumped as it announced the formation of corporate venture unit CoreWeave Ventures.

Computing software producer CoreWeave unveiled a corporate venture capital arm on Tuesday to invest in early-stage companies developing artificial intelligence and computing technologies.

“Our aim with CoreWeave Ventures is to give other audacious, like-minded founders the support they need to drive technical advancements and bring to market the next class of innovation,” CoreWeave chief development officer Brannin McBee said in a press release announcing the fund’s launch.

The launch of the fund comes six months after CoreWeave’s $1.5bn initial public offering and news of its formation caused the corporate’s share price to leap, closing roughly 20% up on the day yesterday.

CoreWeave, founded in 2018, is the latest tech company to set up an investment arm at a relatively early stage in its existence. OpenAI, for example, still itself a venture-backed company, founded a startup investment fund in 2021. Perplexity AI, the AI-powered search company, launched a startup investment fund earlier this year, less than three years after it was founded.

CoreWeave produces cloud software infrastructure designed to help users accelerate their AI computing activities. In addition to capital, portfolio companies will be able to get direct access to the platform and test their products on its infrastructure, as well as product and market insights from the corporate.

CoreWeave Ventures will invest from pre-seed stage to late-stage rounds but its sweet spot is seed and series A. The company has not disclosed whether its newly formed CVC unit will invest out of a dedicated fund or off balance sheet, but it is open to leading rounds.

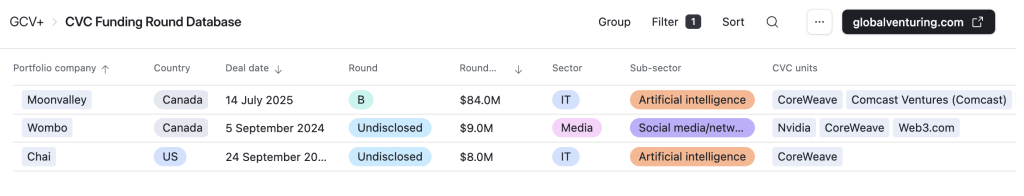

Although CoreWeave has not revealed a full portfolio for the unit, it has previously disclosed investments in three startups: AI chat platform developer Chai, lip sync app developer Wombo and, most recently, generative video tool provider Moonvalley, contributing to its $84m seed round in July this year.

“Working with CoreWeave has given us the freedom to think bigger and move faster,” said Moonvalley co-founder and CEO Naeem Talukdar on Tuesday.

“They understand the challenges of scaling breakthrough technologies and have backed us with the kind of support that lets us focus on innovation. We’re grateful to have a partner that invests in both our company and the future we’re trying to create.”

CoreWeave’s startup investments to date. See more details on corporate investment in emerging companies in the CVC Funding Round Database.