The UK investment bank was an early adopter and investor in cryptocurrency technologies.

SC Ventures, the corporate venture capital arm of UK-headquartered investment bank Standard Chartered, plans to start raising capital for a $250m fund to invest in digital asset technologies for the financial services sector.

The VC arm aims to launch the fund, first reported by Bloomberg, with backing from investors from the Middle East.

SC Ventures is also planning a $100m fund to invest in African startups, a company spokesperson confirmed.

“We are continually evaluating opportunities in the digital asset space, whether it is through investments made directly or through joint ventures,” said the spokesperson. “In addition to our commitment to digital assets, we are also evaluating opportunities in dynamic regions, like the Middle East and Africa.”

CVC investors – we need your help!

The industry has never been more significant in the global economy — but the way companies operate and run these funds is changing. Help us track the changes by taking part in the industry’s largest survey.

Answers are anonymous and all respondents get a free copy of the resulting benchmarking report.

Standard Chartered was an early investor in digital assets. Through its venture capital arm it has been investing in cryptocurrencies since 2018. It also builds digital assets products internally.

Its startup investments include Zodia Custody, a digital assets platform; Zodia Markets, a trading service for crypocurrencies; and Libeara, a tokenisation platform.

In February, the bank announced a joint venture with Animoca Brands, a gaming a blockchain company, and Hong Kong Telecoms, to create a Hong Kong dollar-denominated stablecoin. Hong Kong passed a bill in December that established licensing laws for stablecoins.

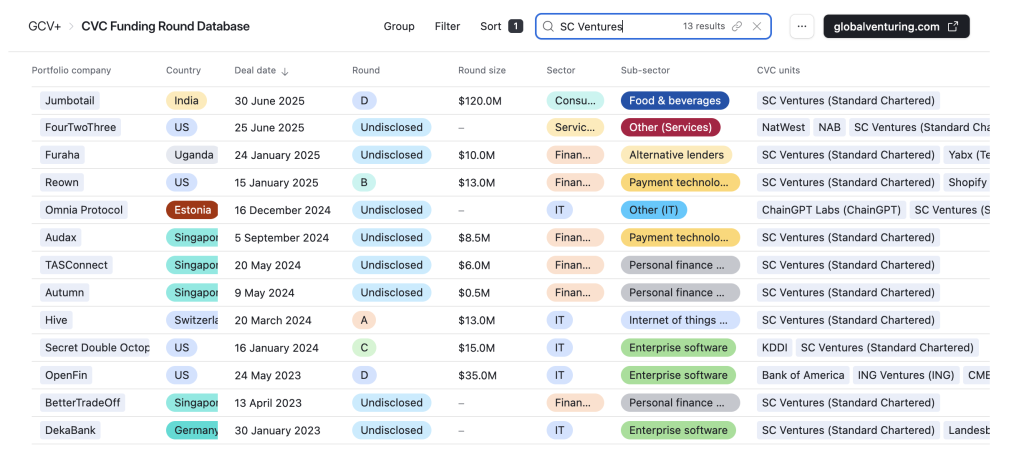

See all the recent startup funding rounds backed by SC Ventures in the CVC Funding Round Database.