As stablecoins threaten to redesign the financial system, banks are getting ready — but will they be outpaced by the vast investments crypto exchanges have made in the technology?

For years banks dabbled in cryptocurrencies but kept them at arm’s length, while regulations around this asset class remained unclear. But now, as legislation like the Genius Act in the US has given a stamp of approval to stablecoins – crypto tokens pegged to real-world assets like currencies – financial institutions are having to get serious about the way cryptocurrencies could shift banking flows.

“For the first time ever, [the banking and crypto] worlds are converging,” says Matt Shroder, co-founder and president of 1Money, a stablecoins payment technology startup. “And the reason that they’re converging is suddenly people are realising that there is an entire money movement flow that’s up for grabs with a whole new set of use cases, of customers.”

Stablecoin enthusiasts believe the technology could be the future of payments, offering inexpensive, speedy and middleman-free transactions, even across borders. The most bullish predict they will be the gateway to a fully tokenised economy, where everything can be bought and sold on the blockchain.

Most banks are working to make sure they will not be left behind the trend. JP Morgan, for example, announced plans in June to launch a token that was designed to perform similar functions to a stablecoin, like speedy cross-border settlements. That same month, Societe Generale became the first major bank to launch a dollar-pegged stablecoin, called USD CoinVertible.

Getting ahead of the curve

One bank that has been investing in cryptocurrencies proactively since 2018 is Standard Chartered.

Gurdeep Singh Kohli, global head of enterprise innovation at Standard Chartered, who runs the bank’s investment and venture building arm, SC Ventures, believes his team’s early bet on digital assets has helped the bank prepare for what is coming. Now that a crypto-friendly US administration is prompting faster adoption, Singh Kohli thinks the unit’s “holistic approach” of investing in, adopting and building various digital asset products means they can lead the new industry that is emerging, rather than be damaged by it.

In a show of confidence in February, Standard Chartered announced a joint venture with Animoca Brands, a crypto company, and Hong Kong Telecoms, to create a Hong Kong dollar-denominated stablecoin. Hong Kong passed a bill in December that established licensing laws for stablecoins.

Banks hold some advantages when it comes to building new digital asset products. They bring strong experience of innovating within the regulatory regimes of the countries they operate in. They also have the scale that’s needed to launch financial products like stablecoins, which require enormous liquidity to have the one-to-one backing required by rules like those in the Genius Act.

Singh Kohli says that because they have made investments across the value chain – in custody services, market solutions, and now issuance – the bank stands to be ready when adoption accelerates. One of these strategic ventures is Zodia Markets, a startup developed by SC Ventures’s venture building unit that orchestrates payments via stablecoins for institutional customers. It raised $18.3m in its series A funding round in July.

“As a regulated institution, our understanding of what it means to build institutional grade capabilities is better than many [startups] because they don’t know what they don’t know,” Singh Kohli says.

Cryptocurrency exchanges are investing most in stablecoin startups

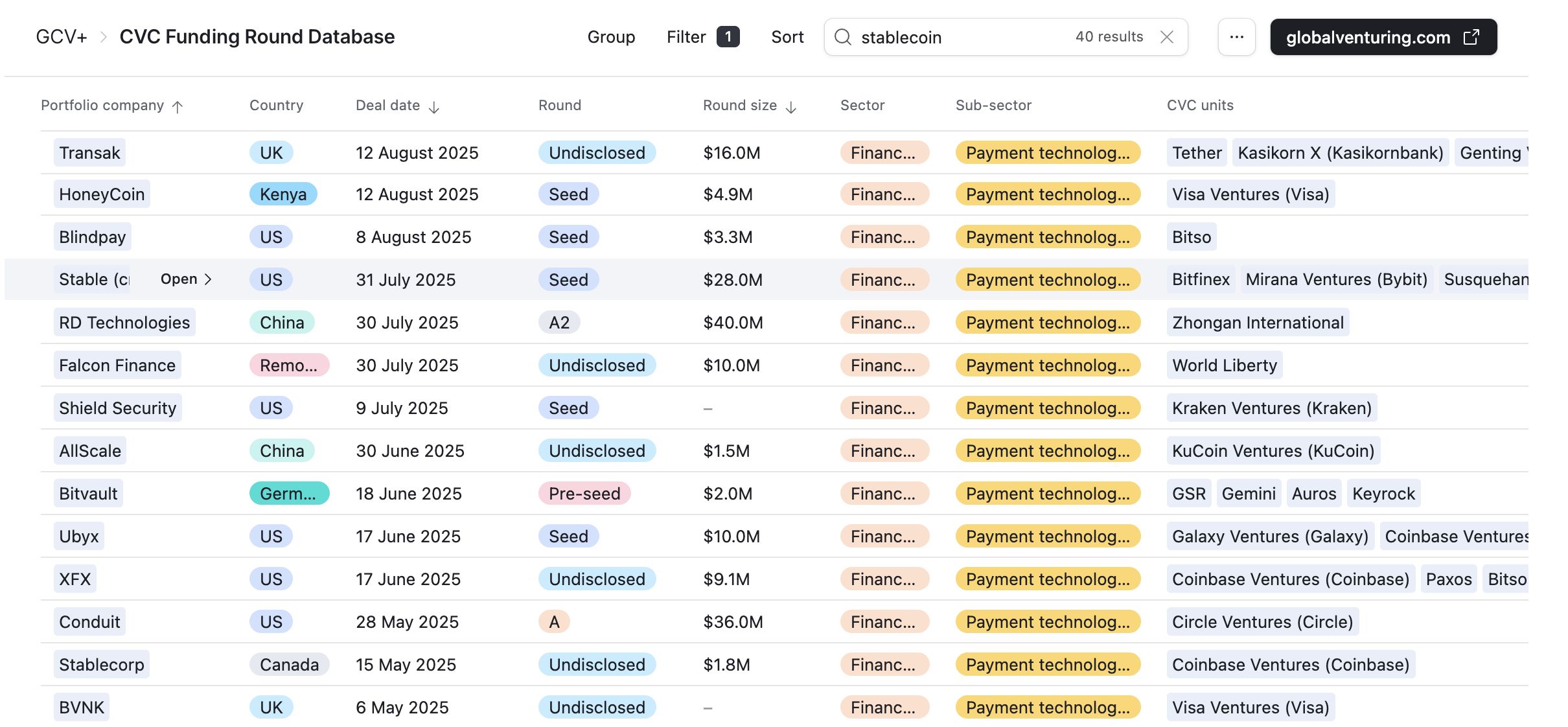

Corporate investments in stablecoin startups have risen dramatically in 2025, although these transactions are typically being made by the big cryptocurrency exchanges like Coinbase and OKX, as well as gaming company Animoca Brands, rather than traditional financial institutions. These organisations are prolific investors and feature frequently at the top of GCV’s lists of most active investors.

Hoolie Tejwani, who runs Coinbase’s VC arm, Coinbase Ventures, says that the venture unit is bullish on stablecoins, and cites figures putting the total market capitalisation of all coins at $250bn and total transfers in 2024 at nearly $30trn.

“Our view is that in the near future, stablecoins are going to be so deeply woven into commerce and payments flows that most people won’t even realise that they’re using them,” he says.

The unit’s focus, according to Tejwani, is broadly to back the founders who are “pushing the on-chain economy forward.”

Stablecoins form a part of this. Coinbase’s recent investments have included BVNK, which provides payment and conversion services for stablecoin users. Ubyx, another portfolio company, makes a clearing system that allows users to deposit stablecoins from any issuer into a bank account to be redeemed at full value, achieving what it calls the singleness of money, where the user can be assured that one USD-denominated stablecoin, for example, can always be swapped for one dollar.

Cryptocurrency companies like Coinbase, Kraken and KuCoin are the most active in backing stablecoin startups, according to data in our CVC Funding Round Database, although Visa has backed a number of startups this year.

But will they catch on?

It is still far from certain that stablecoins will take over the financial world. But if the optimistic projections are right, then there is a big market up for grabs for any startup that can help the transition along.

Shroder’s 1Money is one of these startups. He hopes his service can eliminate some of the major barriers to widespread adoption of stablecoins, such as the speed at which transactions are made. He claims the startup’s patented technology can process transactions in under one second because it uses a version of the broadcasting method, which avoids having to verify transactions on the blockchain sequentially, which can cause congestion.

Also, Shroder says his company removes the need to pay a transaction (or “gas”) fee in a blockchain network’s currency. For example, sending money across Ethereum incurs a gas fee in the cryptocurrency Ether, a volatile speculative asset corporate customers would be hesitant to expose their payments to. 1Money aims to remove that concern by letting users pay the fee in the same type of stablecoin currency that is being transferred. As Shroder puts it, you would no longer need two assets to send a stablecoin.

“We were trying to answer the question of, what would it take for like a Starbucks or an Uber to actually move payments on chain?” says Shroder.

“We’re only going to do one thing exceptionally well, and that’s just payments. I’m not trying to be your NFT minter. I’m not trying to be this ecosystem for meme coins. I want to compete with Visa and MasterCard long term.”

If the technology does crack payments, Tejwani says the next step will be using stablecoins for the “tokenisation of everything.”

“Every financial asset or instrument that can be put on a blockchain will be,” he says. “Every pen and paper financial contract can be re-imagined as a programmable smart contract. This will bring increased liquidity, transparency and access to what were opaque asset classes, opening up a wide range of financial innovation that just isn’t possible in the legacy system.”

Singh Kohli shares this broader vision, seeing tokenisation as a tool for financial inclusion.

“There’s a phrase which I quite like,” Singh Kohli says, “which is that stablecoins are fulfilling the early tenets of digital assets, which is accelerating financial inclusion globally.”

The idea is that if, say, you can convert assets like gold or a house into stablecoins and parcel out portions of it to retail investors, then suddenly far more people can buy stakes in assets that would previously have been unavailable or unaffordable. Singh Kohli uses the example of an investment fund with a minimum buy-in. This stake, if too expensive for a retail investor, could be broken down into smaller amounts if it was tokenised on the blockchain.

“Rather than having a big chunk of, let’s say, $10,000 you can actually make small tokens of investment, which could be [worth] $1,000 or $100,” says Singh Kohli.

Much still remains to be be ironed out in the regulations around stablecoins but nobody in the financial sector is taking these instruments lightly any more.

“I think a lot of traditional [finance] firms will either have to adapt, or there’ll be some Darwinian effect,” Tejwani warns.

“Just like every firm had to adapt to the internet and the mobile phone.”