As cryptocurrencies become mainstream, Jeff Ren, head of OKX's investment arm, expects more partnerships with traditional financial institutions and getting more real-world assets onto crypto exchanges.

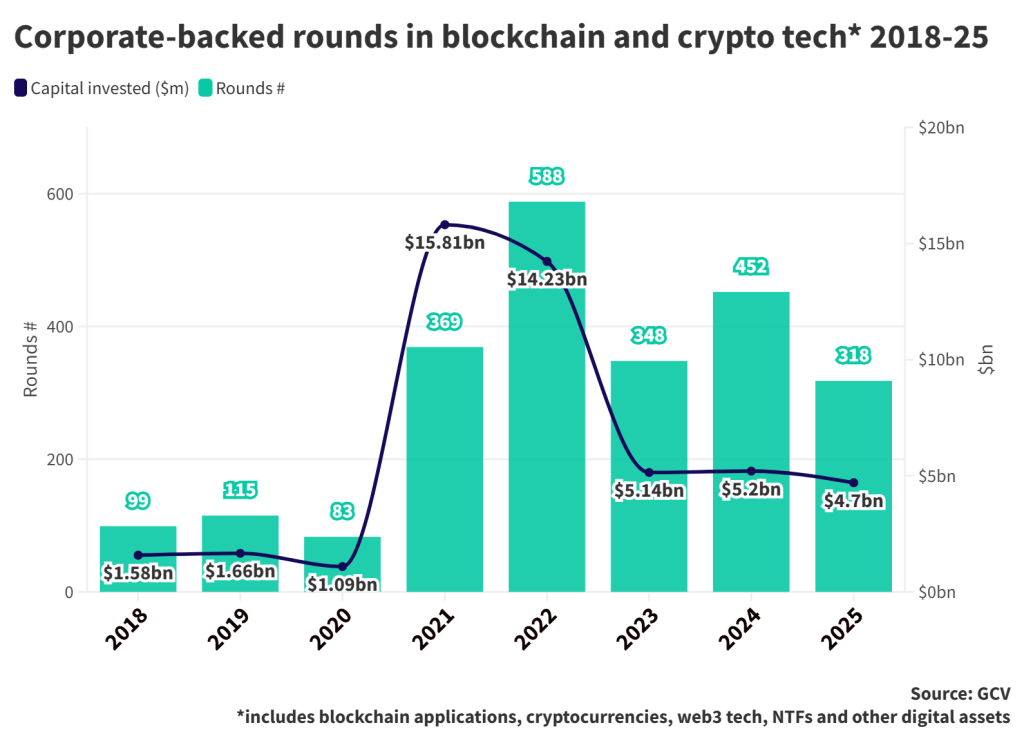

When Jeff Ren founded OKX Ventures in 2021, most big financial institutions were not making visible investments in cryptocurrency startups. It was investors like Ren, investing on behalf of cryptocurrency exchange OKX — as well as a handful of peers at crypto companies such as Coinbase and KuCoin — that were building the ecosystem in this area by providing capital for young startups.

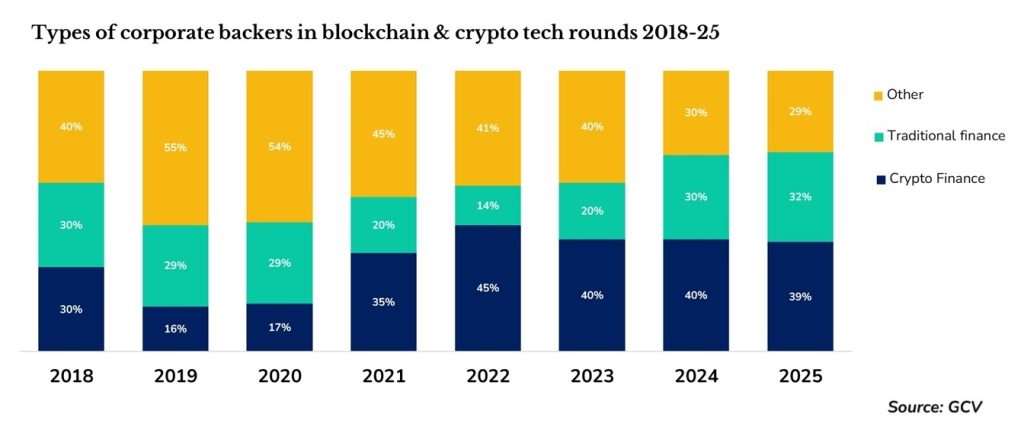

That all changed this year. With a crypto-friendly US president in the White House and the passing of legislation such as the US Genius Act and the EU’s Markets in Crypto-Assets Regulation (MiCA), cryptocurrencies are suddenly mainstream. Big banks and brokerages have poured investment into the sector at unprecedented rates since the start of the year.

“Last year, you wouldn’t imagine BlackRock investing in this area,” says Ren, referencing the investment management company’s launch of a Bitcoin exchange traded fund. “Now you see Wall Street firms are sponsoring all these crypto company IPOs. The Genius Act is bringing more institutions into the space.”

Please help us track trends in corporate venturing by taking part in our annual benchmarking survey.

- All answers are anonymised

- All respondents receive a free, advance copy of the report results

“Crypto is not the wild west anymore,” was the message in a high production-value short film that OKX produced earlier this year in partnership with the Tribeca Film Festival. And indeed OKX itself has obtained several regulatory licences, relaunched in the US and set up its headquarters in San Jose, California, all part of establishing trust and reputation.

As more investors move into the cryptocurrency sector, Ren says he anticipates more partnerships for OKX with traditional banks — but he still sees a pioneering role for the investment unit he heads, seeking the new assets that could be traded on the OKX exchange, such as oil and gold, as well as IP rights and even games.

Partnerships with financial institutions to become the norm

In addition to BlackRock, US financial institutions such as Morgan Stanley, Charles Schwab and PNC Financial Services Group have moved to allow the trading of cryptocurrencies on their platforms this year. State Steet, meanwhile, plans to launch a stablecoin. JPMorgan, which has launched multiple crypto initiatives, plans to test stablecoin services.

In tandem, banks are investing in crypto-related startups. A number of banks including Citigroup, ING, Banco Santander, Barclays, UBS and BNP Paribas piled into the $136m funding round last week for Fnality, a blockchain-based wholesale payments provider, while HSBC invested in blockchain analytics company Elliptic. Standard Chartered, meanwhile, is raising capital for a $250m fund to invest in cryptocurrency and Web3 assets.

Ren isn’t daunted by the arrival of so many traditional finance firms into his territory.

“OKX has been anticipating this and is well-positioned to welcome the regulatory tailwinds,” he says.

In fact, OKX is partnering with a number financial sector companies to push through projects such as $USDG, a stablecoin that has a value pegged to the US dollar. OKX has collaborated with more than 30 partners, including financial companies Worldpay, Kraken, Anchorage Digital and Robinhood in backing the $USDG project.

“We don’t really see much rivalry. It takes a village to actually build startups,” says Ren.

He expects the cryptocurrency sector to move to an era of more collaboration on investments and projects. “We have been operating in a tribal environment. There a lot of silos, for different historical reasons. But, moving forward, what we see is a technology-driven, compliance-first environment for the entire industry. As we go down that path, we welcome partners to come along and walk with us together.”

After stablecoins: gold, oil, IP, games

While Ren is enthused to see stablecoins like $USDG emerge into the mainstream, he is also looking ahead to many other real-world assets being represented by crypto tokens.

“Tokenised currency and securities are happening. But what about tokenising other commodities, like gold, oil and gas? How about intellectual property? How about carbon?” he says. Last year, in an interview with GCV, Ren spoke about putting property rights and even compute power on the blockchain.

This is one of the reasons that Ren, already one of the most prolific investors in the crypto sector, expects to continue his search for new startups.

“We’re an exchange, a wallet and we continuously try to identify good assets that could potentially be either listed on the exchange or become a critical means of storing value,” he says.

One new area of assets that Ren and his team are exploring is putting intellectual property rights onto the blockchain. OKX Ventures recently partnered with Story to launch a $10m fund supporting early-stage startups focused on the intersection of intellectual property and artificial intelligence.

“We have seen only the beginning of bringing IP rights onto the blockchain, but that is a direction we want to go,” says Ren, adding that partnering with Story is a way of learning about this new area. “This is a little bit of branching out without diluting our focus. We don’t have the expertise in that particular asset class, but we can do investments and reach out to the excellent, hard-working founders in these spaces.”

Another area of interest is mini-games that could be added to the OKX wallet to bring new dimensions to the user experience. OKX Ventures invested in UAE-based gametech startup PlaysOut. It backed the company’s $7m seed funding round in March and later made a separate strategic investment in July.

Pipeline of startups

OKX Ventures, which has a team of 20 investors, has backed more than 229 startups in just over four years of operation, a frenetic pace characteristic of the cryptocurrency sector. The aim has been to seed a wide ecosystem, so investments tend to be small but numerous. Ren is keen to stress, however, that these are not shots in the dark.

“We don’t want people to feel that we’re making hasty decisions,” he says.

The OKX Ventures team has close relationships to several blockchain platforms such as Solana and Aptos which incubate young Web3 startups. Ren and his team will watch emerging founders develop and pass milestones, building up an understanding of the business before they invest.

“They aren’t strangers,” says Ren. “We follow them, we support them.” By the time these companies are ready to take on their first investment, OKX Ventures will already have a good knowledge of their roadmap and abilities.

After the investment, OKX Ventures works with these companies in a very hands-on way.

“Investing isn’t just money. It is a commitment to work with them, market them. We help put them on the map, help them understand where they are in the grand scheme of things,” says Ren. The team will help young startups get access to key parts of the crypto community, as well as assisting them in areas such as compliance and legal. “It’s really a partnership, signing them onto our platform,” he says.

Startups backed by OKX Ventures since 2023

Track all the corporate-backed startup funding rounds in the CVC Funding Round Database

Maija Palmer

Maija Palmer is editor of Global Venturing and puts together the weekly email newsletter (sign up here for free).