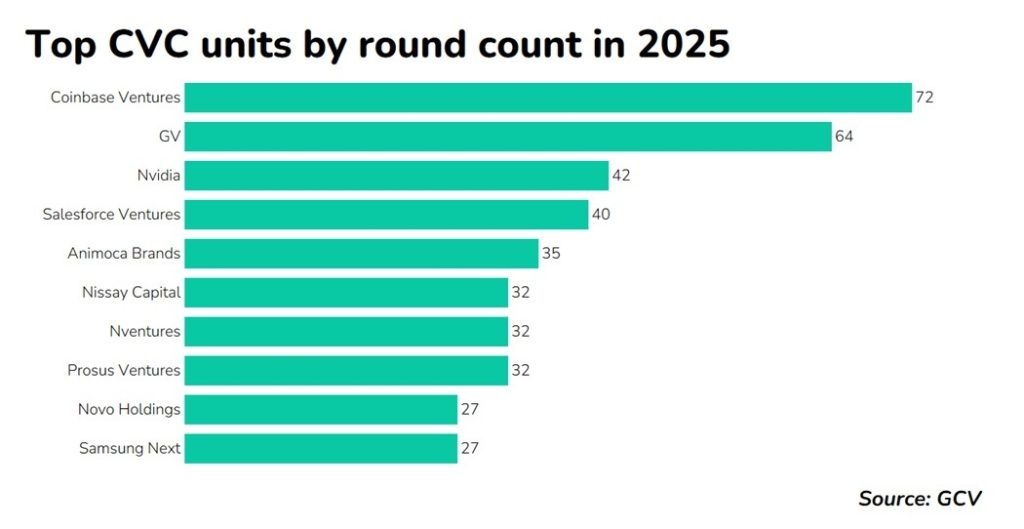

Crypto-native investors such as Coinbase Ventures and Animoca Brands wrote a large number of smaller cheques while AI chipmaker Nvidia emerged as a dominant venture force, especially for large funding rounds.

If this year’s deal flow revealed anything, it was that artificial intelligence continues to absorb the lion’s share of corporate venture capital. Yet a closer look at the most active corporate investors suggests that the story is not simply one of AI exuberance, but of increasingly strategic and diversified capital deployment.

Crypto-native investors such as Coinbase Ventures and Animoca Brands remained prolific, buoyed by a friendlier regulatory climate in the US. Meanwhile, AI chipmaker Nvidia, the world’s most valuable company, emerged as a dominant venture force in its own right, investing both through its NVentures arm and directly from its balance sheet. Elsewhere, stalwarts such as GV and Salesforce Ventures demonstrated that corporate venture capital is becoming less opportunistic and more institutional in its ambitions.

SoftBank and Saudi Aramco also had busy years but did not make this list simply because their investments are made through multiple units, reflecting increased diversification in their strategy of backing early-stage startups.

1. Coinbase Ventures

Coinbase’s investment arm again ranked among the most active, participating in roughly 40 rounds, many of them at pre-series A stage, with more than two dozen priced at $5m or less. Seed round sizes overall have been skyrocketing for corporate investors, but in some areas like crypto it has been possible to keep cheque sizes relatively modest.

Coinbase showed a clear interest in real-world crypto applications, backing payment and infrastructure startups designed to integrate digital assets into everyday commerce. The unit’s most notable investments included a $50m round for restaurant payments platform Blackbird and a $47m raise for RedotPay, which allows users to spend cryptocurrencies in the real economy. Coinbase also joined the $300m series D closed by prediction-market platform Kalshi, a stake that looked prescient when the company’s valuation more than doubled months later.

2. GV

GV, the Alphabet unit formerly known as Google Ventures, continued to display its characteristic breadth. While it participated in some seed stage rounds for startups such as modelling software firm Navier and cybersecurity player MirrorTab, it also backed roughly 20 nine-figure rounds in 2025.

Among the largest were two $600m rounds: one for Isomorphic Labs, the AI drug-discovery company spun out of DeepMind, and another in Wonder, the food hall business set up by Jet.com founder Marc Lore.

The diversity of GV’s 2025 investments – from accounting software (Ramp) to bespoke homebuilding (Homebound), AI legal software (Harvey) and consumer electronics (Nothing) – underscored its unusually flexible mandate.

3. Nvidia

It’s approximately 18 months since Nvidia became the world’s most highly valued company. If 2024 marked the company’s arrival as a big-name corporate investor, 2025 confirmed its dominance. In addition to its NVentures unit, Nvidia made substantial off-balance-sheet investments under corporate development head Vishal Bhagwati, often writing some of the largest cheques in the market.

The corporate participated in more than ten billion-dollar rounds, backing AI software companies such as Cursor, Mistral and Thinking Machines, as well as robotics firm Figure and materials specialist Periodic Labs. The scale of these investments recalled the heyday of SoftBank’s Vision Fund, albeit with a tighter strategic focus on AI infrastructure.

4. Salesforce Ventures

Enterprise software producer Salesforce arguably pioneered the ecosystem-building model of CVC, but as IPO exits for its last crop of portfolio companies have become scarce, its venture arm has pivoted towards artificial intelligence. Its only major investment in a long-standing enterprise software company was a late-stage round for fintech group Airwallex.

The poster child for that shift is probably Anthropic, which raised $3.5bn in a Salesforce Ventures-backed round in March valuing it at over $61bn (Anthropic had grown to a $183bn valuation by September – Salesforce has been an investor since 2023). But it was also part of mega rounds for several leading AI developers outside Europe, notably Cohere (Canada), Black Forest Labs (Germany) and Sweden (Lovable).

Lastly, the unit looked to explore deals for startups looking to solve AI’s thirst for energy, backing a $1bn series C round for energy back-up system provider Base Power in early October and a $1.4bn series E for Crusoe, which is building out a range of data centres with energy infrastructure attached, a fortnight later.

5. Animoca Brands

Animoca remained one of the most prolific investors in Web3, albeit with a portfolio skewed towards smaller cheques. Of its 35 investments, the majority were under $10m, with only a handful exceeding that threshold. The largest round the team backed was the $30m fundraising by Recall, the creator of a decentralised AI agent platform, when it emerged from stealth in March.

The strategy reflects both the experimental nature of the sector and its uneven recovery from the crypto downturn. Portfolio companies like OpenSea and Dapper Labs initially built up extraordinary valuations during the NFT boom, only to see them fall later on.

Deregulation has been good for Web3 businesses this year, but disproportionately for the ones in areas like stablecoins. Animoca Brands’ focus has largely been on early-stage bets on Web3 gaming and digital ownership models still searching for their breakout moment.

6. (joint) NVentures

Nvidia made most of its largest investments off its increasingly huge balance sheet, but early-stage investment arm NVentures has also had a busy year, contributing to a range of seed and series A rounds for emerging AI software developers. Those included sizeable investments in quantum computing, such as a $1bn round for PsiQuantum and a $600m raise for Quantinuum at a $10.6bn valuation.

Energy also featured prominently, an acknowledgement that powering AI at scale will require breakthroughs well beyond semiconductors. NVentures backed nuclear and fusion startups including Commonwealth Fusion Systems and TerraPower, in rounds totalling some $1.5bn between them.

6. (joint) Prosus Ventures

Prosus Ventures and its parent, digital holding company Prosus, dominated consumer internet spending over the last decade during the app boom, backing several of the largest international startups in areas like ride hailing and food delivery.

However, the unit’s recent focus has shifted towards fintech, suggesting that payments and financial infrastructure remain among the few digital markets still offering room for disruption.

Prosus Ventures’ most significant deals this year included investments in Mexico (digital bank Klar), Singapore (wealth management service Endowus), Switzerland (humanoid robotics developer Flexion) and Brazil (digital life insurer Azos). But it also delved into the US, backing the likes of earned wage access platform Rain and finance risk management platform Taktile, as well as India and the UK.

6. (joint) Nissay Capital

Japan’s most active corporate venture arm, Nissay Capital, invests on behalf of insurance firm Nippon Life, mostly at seed and series A stage, focusing largely on domestic opportunities.

Apart from Qlay Technologies, the US-headquartered creator of an AI tool that detects cheating in interview situations, all of Nissay Capital’s 30-plus investments this year were in Japanese startups, spanning pre-seed deals all the way to series C rounds.

While the unit’s investments may lean towards traditional insurance CVC areas like fintech and enterprise software, it has also taken some idiosyncratic bets, backing startups as diverse as fish breeder Sakana Dream, VTuber entertainment studio Blackbox, water propulsion system developer Pale Blue and Zeal Boxing Fitness (above). The portfolio’s diversity underscores the breadth of innovation quietly taking place within Japan’s startup ecosystem.

9. (joint) Novo Holdings

Novo Holdings once again dominated healthcare investing, backing large rounds across biopharma, medical devices and life sciences infrastructure. Its $372m investment in MapLight Therapeutics was followed just by an IPO just three months later.

The unit also made substantial commitments to early-stage biotech, leading nine-figure series A rounds for immunological disease drug developer Windward Bio, gout medicine developer Crystalis Therapeutics and Expedition Therapeutics, which is working on treatments for inflammatory and respiratory diseases.

But it wasn’t just pharmaceutical startups Novo Holdings was interested in: it took part in $120m rounds for medical device startups Supira Medical and Fire1, and backed early-stage rounds for fungi-based food ingredient producer Matr, food colourant developer Chromologics and The Protein Brewery, a startup that derives proteins from animal-free sources, towards the tail end of the year.

9. (joint) Samsung Next

The most active of Samsung’s CVC subsidiaries, Samsung Next beat out South Korea-headquartered Samsung Ventures and the deep tech-focused Samsung Catalyst Fund this year.

Officially, Samsung Next’s areas of interest are AI, healthtech, consumer services and frontier technologies, but that’s a jurisdiction wide enough to include fintech (financial connectivity software producer Method), quantum computing (quantum algorithm developer Classiq) and elderly care technology (fall detection system creator Safely You).

But perhaps Samsung Next’s most interesting quirk is that it has emerged as one of the most active CVC investors in Web3 – from outside of that industry anyway. Its contribution to stablecoin payment startup Fin’s $17m series A this month capped a year when it backed the likes of Rain, Bastion Protocol and Primus.

See full details of 600+ global corporate venture units in the CVC Directory