Monex Ventures and Uncovered fund are investing tens of millions into the African tech startup ecosystem.

Monex Ventures, the corporate VC unit of Japanese financial services company Monex Group, has teamed up with Japanese VC Uncovered Fund to back tech startups across Africa.

The new ¥3bn ($20.4m) fund, called Uncovered Fund Monex Africa Investment Partnership, will will invest up to $2m per company in four broad areas, namely finance, mobility, distribution and sustainability.

Within those, it will target startups working on areas like mobile payments technology, microlending, retail digitisation, logistics fulfilment and last-mile delivery, electric vehicles, battery-as-a-service, used car marketplaces, agri-tech, carbon credit-based business models and others.

“The world population is predicted to reach 10 billion by 2050, with Africa accounting for 25% of that, making it a huge market. Meanwhile, while many social issues remain, the rapid spread of mobile internet is giving rise to a succession of startups aiming to build next-generation social infrastructure,” said Monex Group CEO Yuko Kiyoaki.

It’s not the first time Monex Ventures has invested in African startups, having backed Kenyan car finance platform Hakki Africa as part of a ¥220m round in 2022. The following year it also backed Degas, a Japanese agritech company that did much of its work in African markets.

What other corporations are investing in Africa?

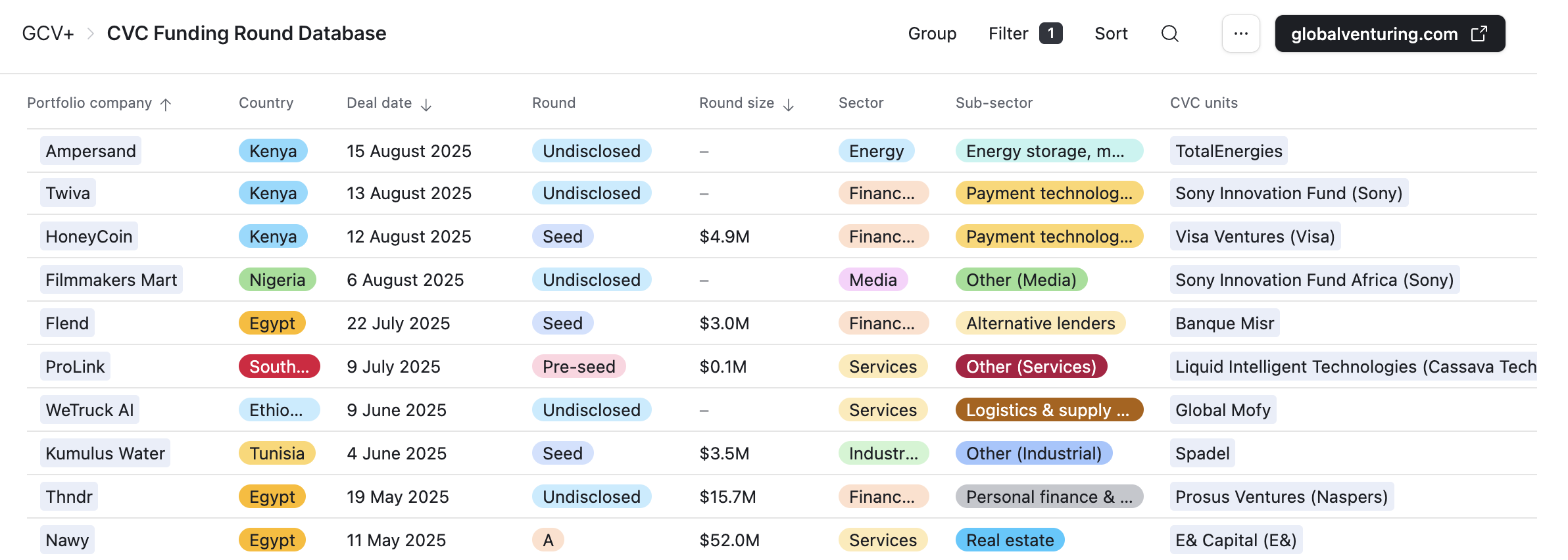

See our CVC Funding Round Database to see all the recent corporate-backed deals in the region.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.