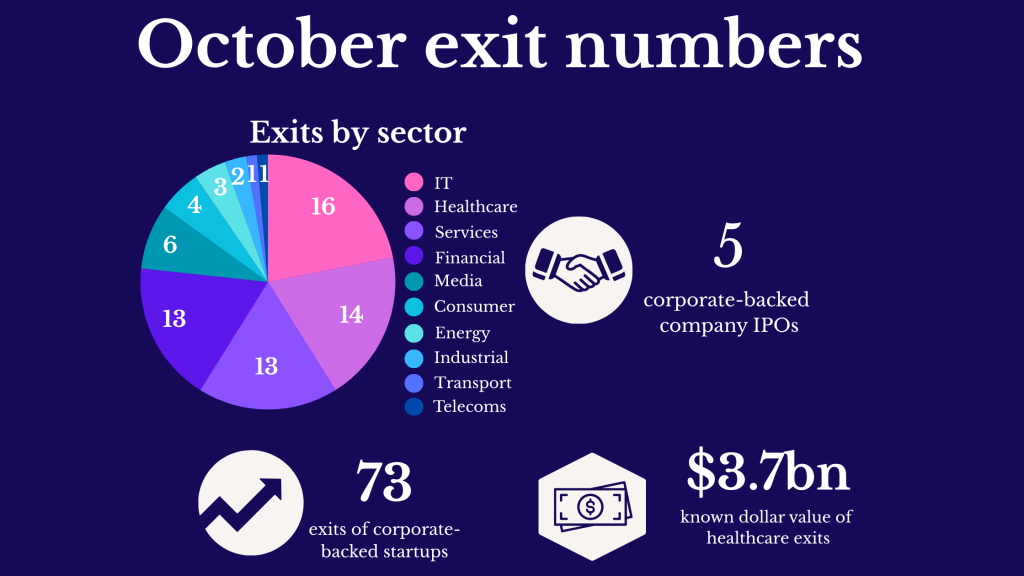

M&As and IPOs continue their upward trend in October, with healthcare having a standout month, characterised by big exits in the private and public markets.

The largest exits in October were in healthcare, with four large acquisitions of corporate-backed startups dominating the top 10 exits by size.

The biggest deal was Bristol Myers-Squibb’s $1.5bn acquisition of RNA medicine developer Orbital Therapeutics. This was followed by the $900m purchase of self-administered medicine technology company Elektrofi by Halozyme Therapeutics. Other deals were non-opioid pain management technology provider Nalu Medical’s $533m acquisition by Boston Scientific, and antibody-based oncology tech developer ImCheckTherapeutic’s $406m takeover by Ipsen.

Overall, the value of the disclosed exits for healthcare companies last month was just over $3.7bn.

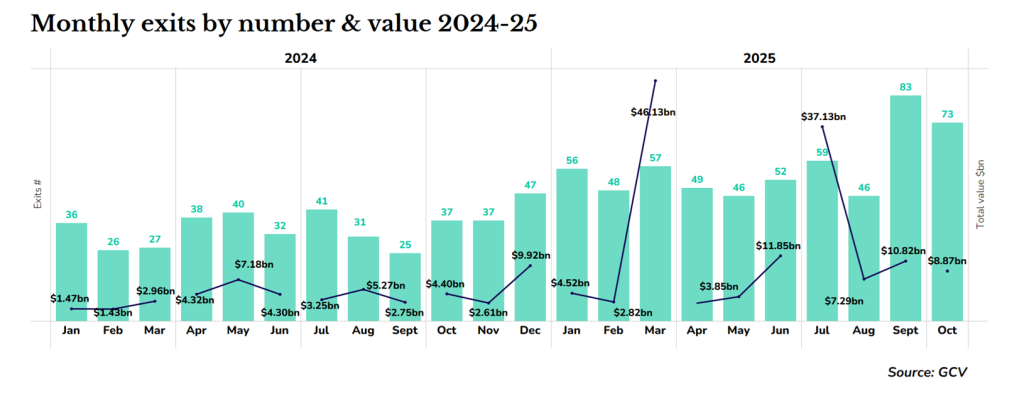

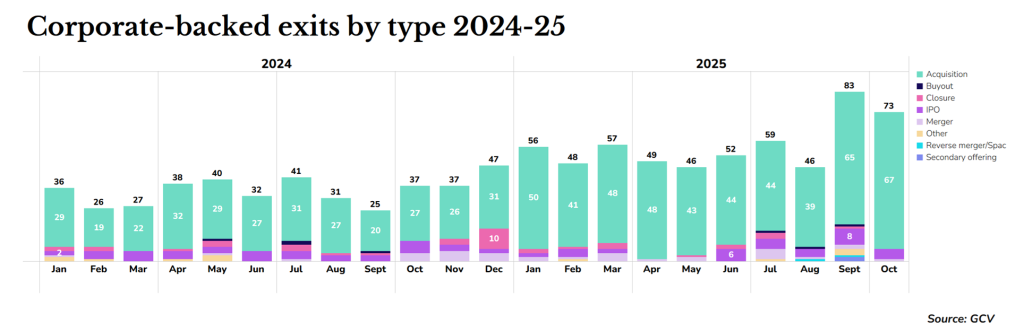

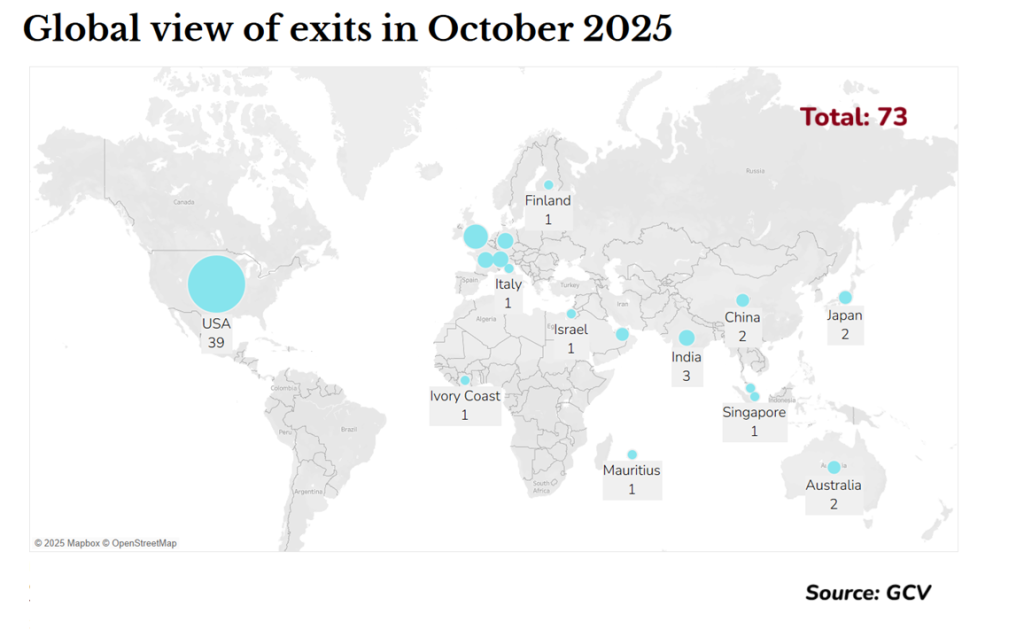

October was characterised by the continued return of exits for venture-backed startups. Last month there were 73 exits, the second highest monthly number in the past couple of years.

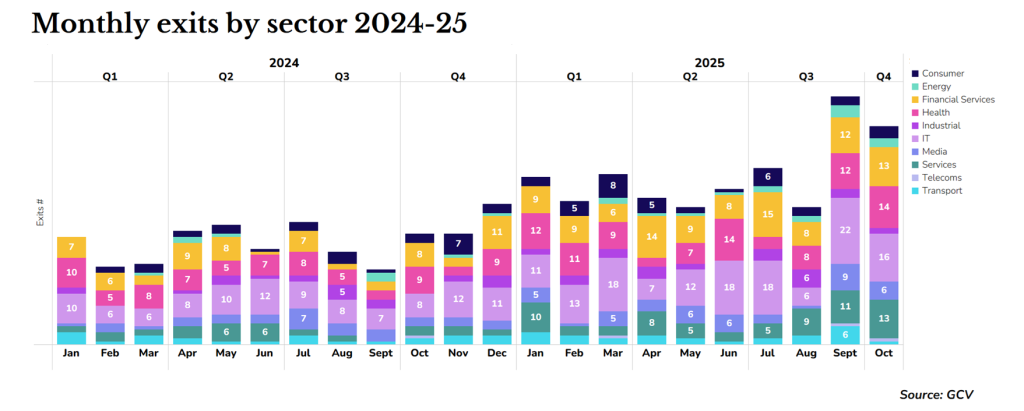

The number of exits in October was evenly distributed across industries, with only three exits separating the top four sectors in financial services, health, IT and services.

IT is still the sector that has had the most exits, as has been the case in all but six months since the start of last year.

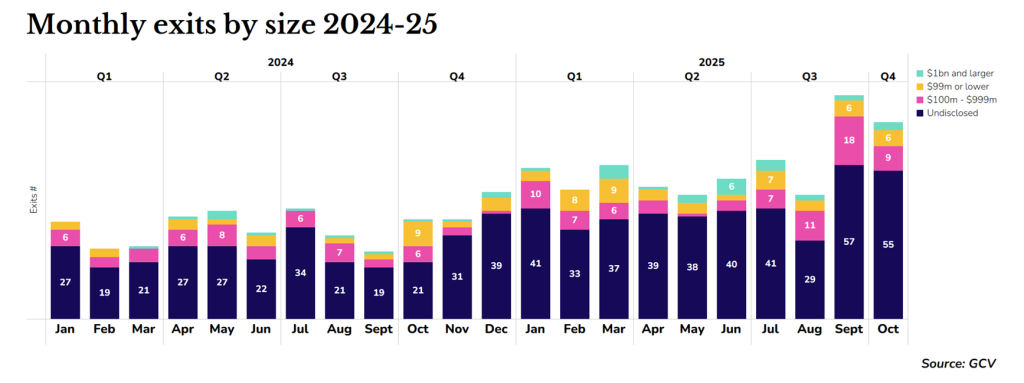

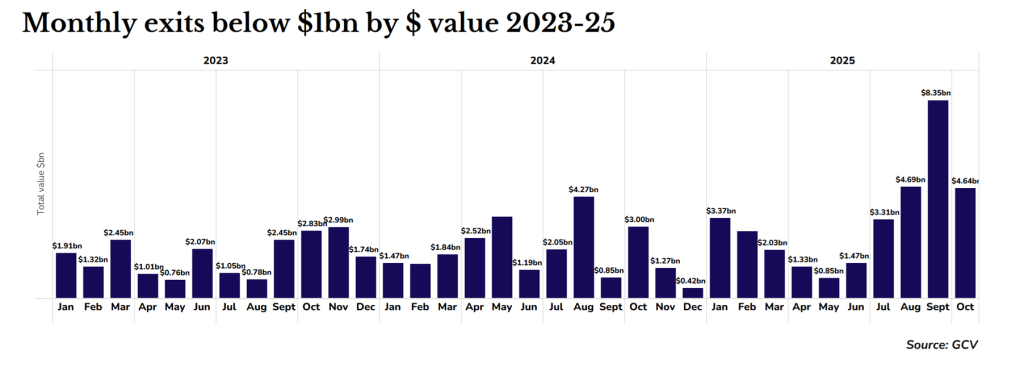

The size of most of October’s exits were undisclosed, but of those that are known, most are nine figures or more.

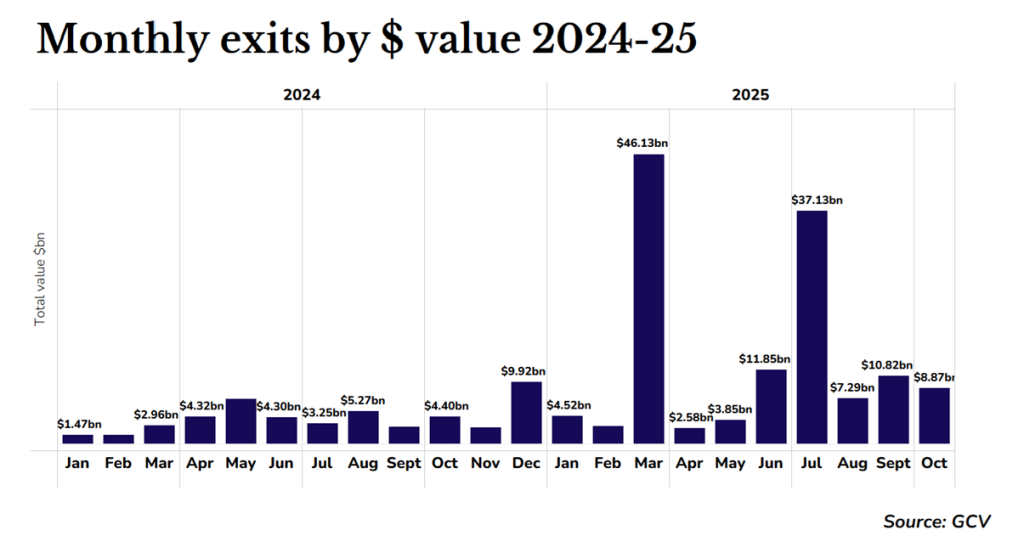

The $8.9bn in known exit value in October is the highest in all but one month of 2024, and more than twice the size of what it was in October 2024.

Roughly half of October’s exit value came from three acquisitions valued at over $1bn: Veeam Software’s $1.73bn purchase of privacy management software developer Securiti AI; the Orbital Therapeutics deal; and Workday’s $1bn deal to buy recruitment technology developer Paradox.

Cisco, Citi, Capital One, Alexandria Real Estate Equities, DLA Piper and Indeed.com were among the corporates that exited in the billion-plus M&As.

Virtually all exits came by way of acquisitions, but the five IPOs – fewer than the eight in September – were still among the most this year as startups continue to see the public markets as a viable exit route once more.

Corporate travel management platform provider Navan had the largest IPO, going public with a $923m listing which provided an exit for German airline Lufthansa, while Chinese enterprise software platform Deepexi had a $612.5m IPO, and brain disorder therapy developer Maplight Therapeutics listed for $251m.

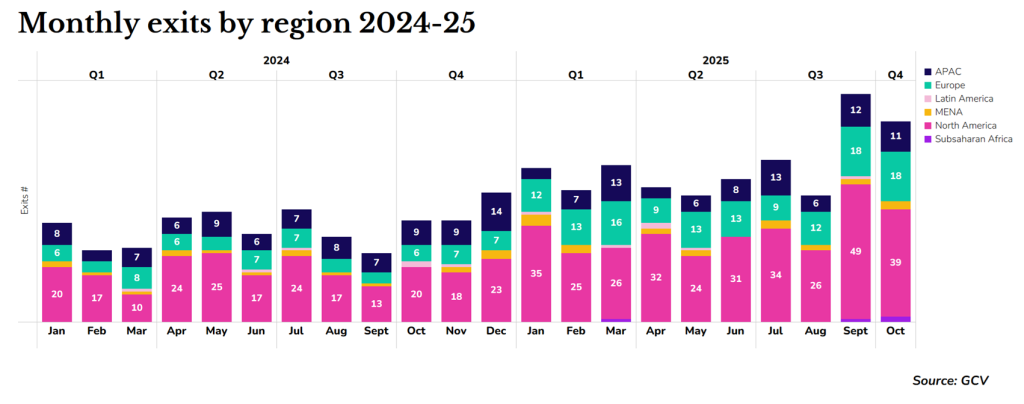

North America, reliably the largest region for exits, saw 10 fewer exits than it did last month, while Europe and Asia-Pacific have virtually identical numbers to September. Compared with October 2024, there were roughly double the exits in North America , triple the exit numbers in Europe, and a couple more in Asia-Pacific.

The UK had a strong month for exits, boasting more than the next two European countries – France and Germany – combined.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.