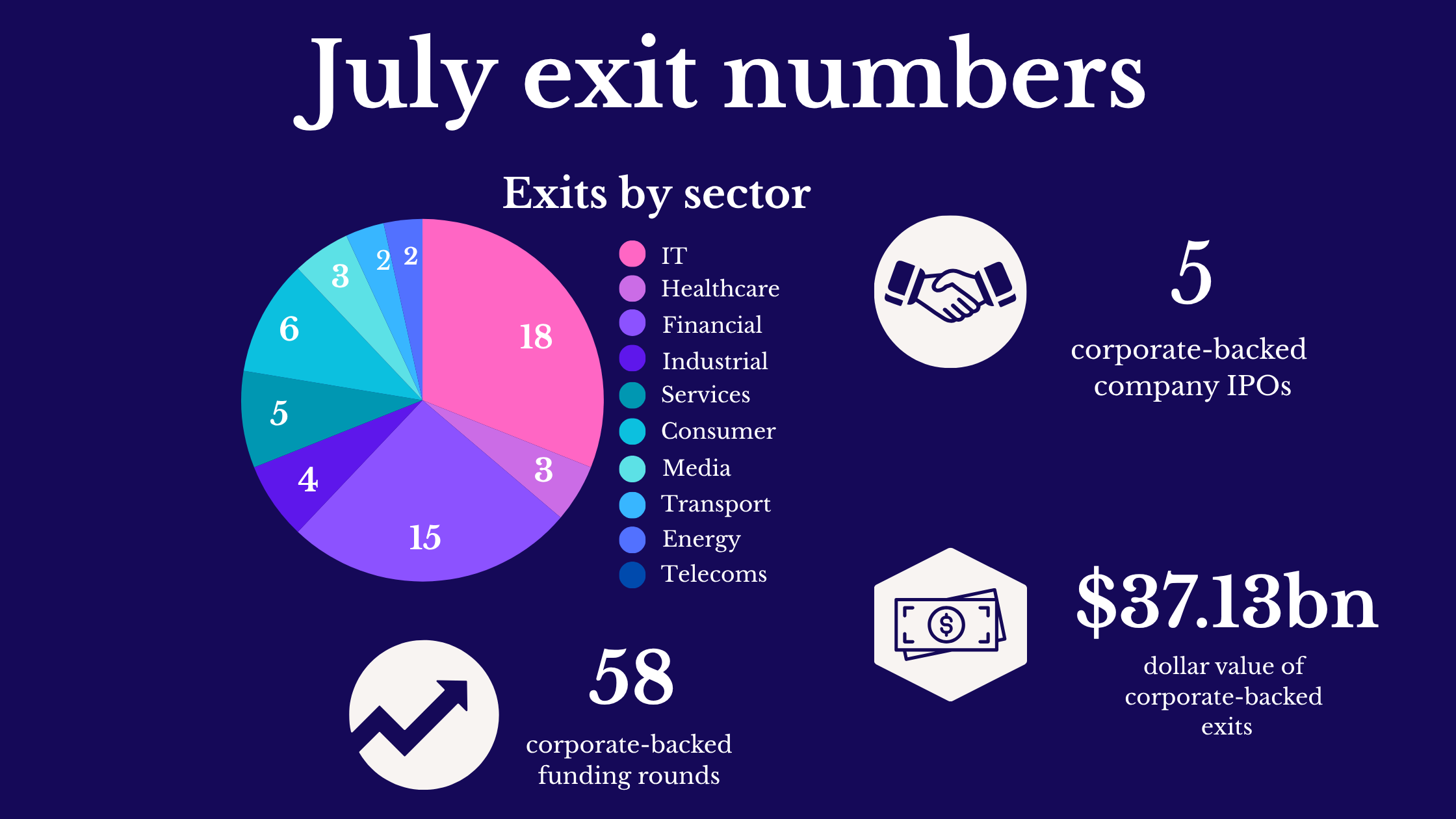

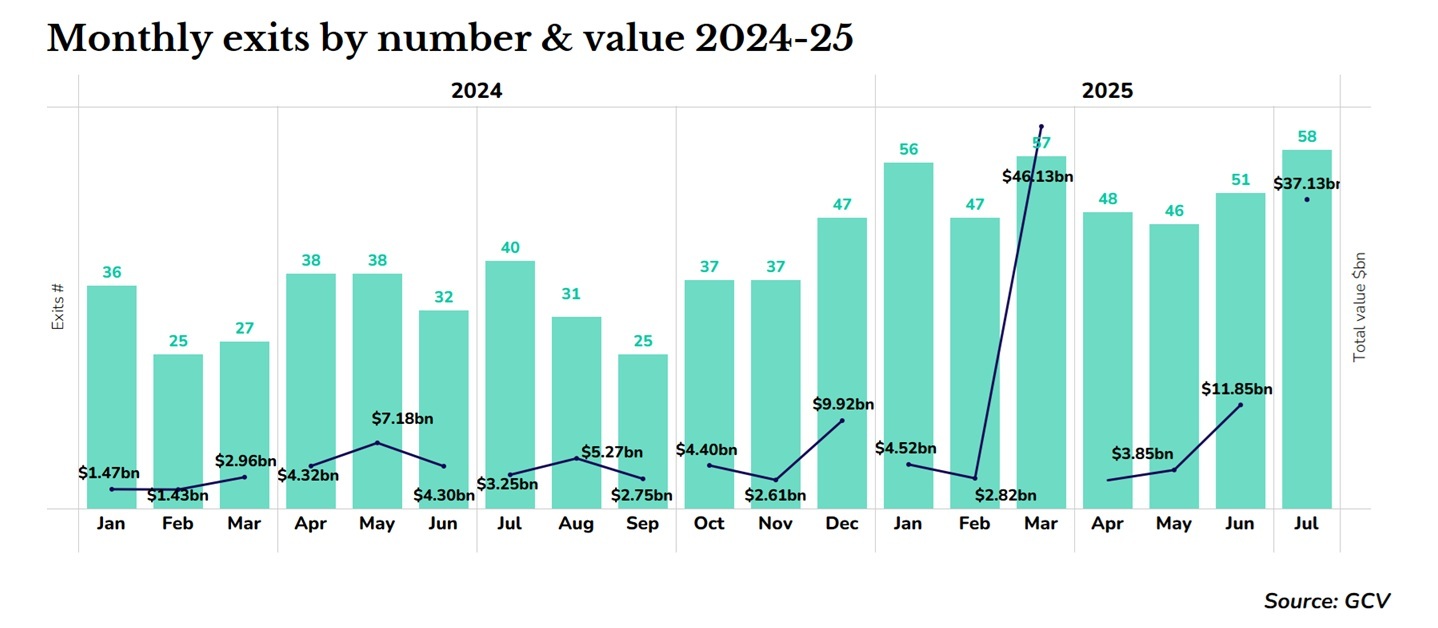

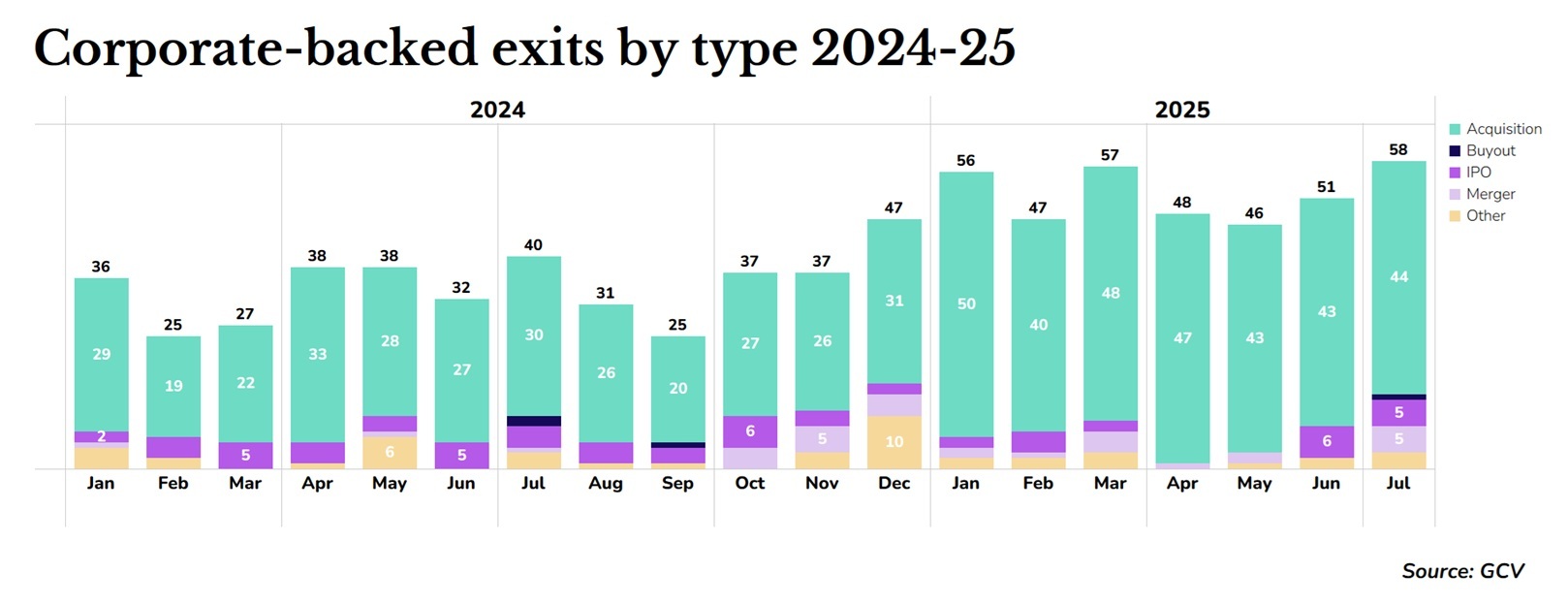

Some 58 corporate-backed startups had an exit in July, amid a return of stock market listings.

July had the highest number of exits for corporate-backed startups since the start of 2024 (58), while the value of exits — where the valuation was disclosed — jumped to $37bn, the second highest monthly value over the same period.

IPOs

Another five stock market listings for corporate-backed startups in July suggests that the return of IPOs seen in June may not be just a blip but more of a consistent pattern.

Three of the IPO listings were in Asia — China, Japan and India — and two took place in the US.

In one of the most notable IPOs of the year, web design tool Figma went public on the New York Stock Exchange in an IPO that was oversubscribed by 40 times.

The startup, which was backed by Atlassian Software, specialises in cloud-based design for creating user interfaces and user experiences for websites and apps. Figma raised $1.2bn from the IPO.

Another big IPO was Chinese company Geek+, a developer of robotics technology designed to improve automation for logistics and warehouses. A decade after being founded, Geek+ listed on the Hong Kong Stock Exchange at the end of July, securing $281m. Vertex Ventures and Intel previously backed Geek+.

Indian co-working space provider Smartworks also went public on the Bombay Stock Exchange and the National Stock Exchange in India, raising $51.7m. The company, which was backed by Australian property developer Lend Lease, serves 728 clients including Indian corporates and startups.

The largest exits

Two of the biggest acquisitions of the month, where monetary value was disclosed, were in cybersecurity and AI consumer electronics. Recent GCV data show that July saw the highest absolute increase in IT deal volume.

US cybersecurity operator Cyber-Ark, which provides technology for the financial services, energy, retail, healthcare and government markets, was acquired by cybersecurity company Palo Alto Networks for $25bn. Previous backers included SoftBank and Vertex Ventures.

While CyberArk is already establishing itself as an identity security platform, Palo Alto Networks plans to help accelerate its platform to drive better security outcomes for customers.

US AI consumer hardware developer io, founded by former Apple designer Jony Ive, was also acquired by OpenAI for $6.5bn, with the AI research and deployment corporate previously backing the startup.

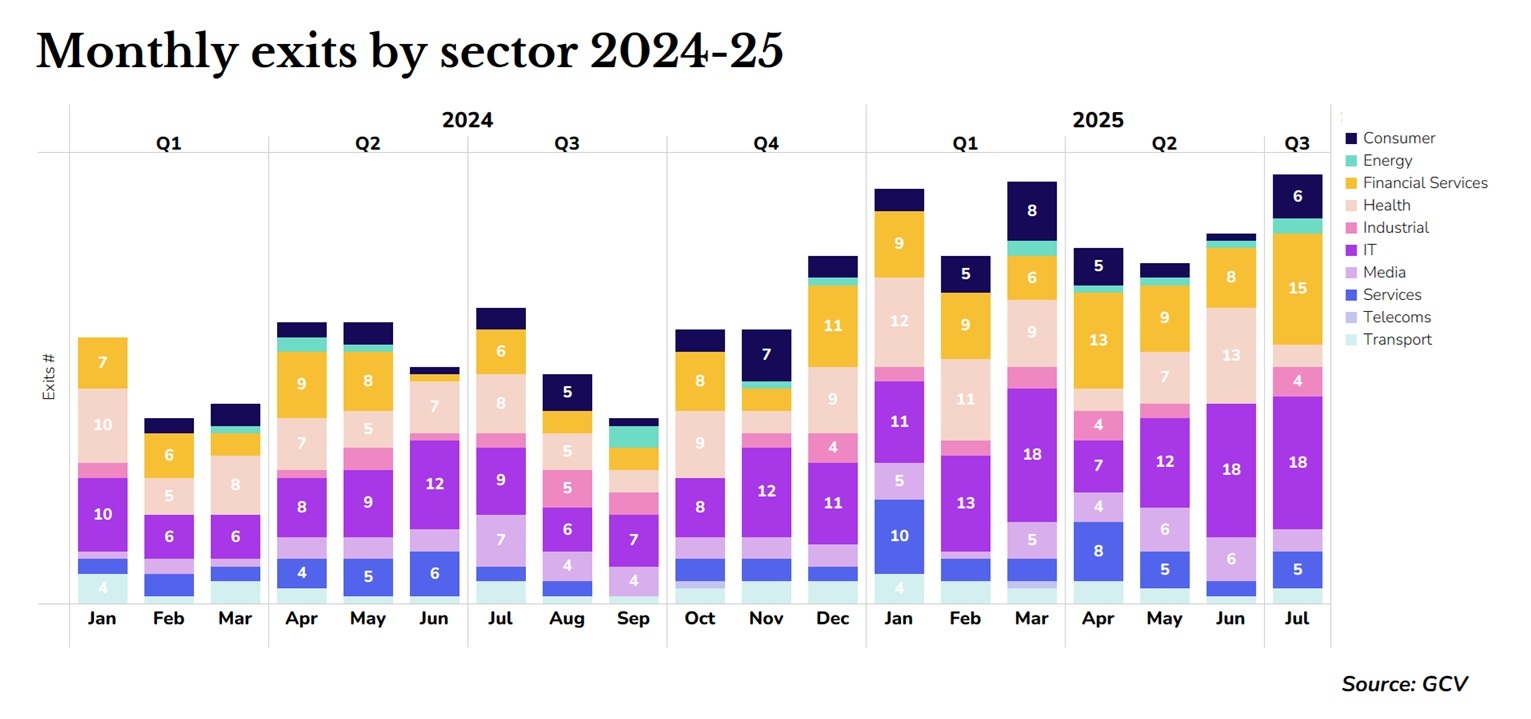

Exits by sector

The increase in July’s exits total is largely attributable to more deals in the financial (15) and consumer sectors (6).

Financial

Japanese corporate credit card provider Upsider was acquired by Mizuho Bank for $309.8m. The company had previously been backed by Mizuho Financial, along with a long list of corporate investors including Aiful Corporation, Credit Saison, Global Brain Corporation, Japan Airlines, Japan Airlines, Sumitomo Mitsui, Tencent and World Innovation Lab.

US blockchain analytics provider CoinMetrics, which organises crypto data by making it transparent and accessible, was also acquired by digital asset trading company Talos for $100m. The startup was previously backed by Avon Ventures, Cboe Global Markets, Coinbase, Digital Currency Group and Fidelity.

Consumer

In a notable deal from the consumer space, fresh beverage and food condiments firm Generous Brands acquired US beverage producer Health-Ade for $500m. The firm was previously supported by Coca-Cola Europacific Partners and IHeartMedia.

Closures

There were three publicly disclosed business shutterings in July for corporate-backed startups.

Indian all-electric ride-hailing service and charging infrastructure company BluSmart, which was founded in 2019, entered insolvency amid corporate governance challenges. BP Ventures had been a prominent backer of BluSmart.

Both US-based gas fermentation startup Novonutrients and alternative meat company Planetarians also called it quits while seeking buyers for their assets. Novonutrients converts industrial carbon dioxide emissions into protein for food and feed using a gas fermentation platform. The startup’s backers included Woodside Energy, the Australian energy group. Planetarians in turn upcycles food industry byproducts and food waste into high-protein, high-fibre ingredients. It had been backed by AB Inbev’s ZX Ventures and Italian food conglomerate Barilla Group.