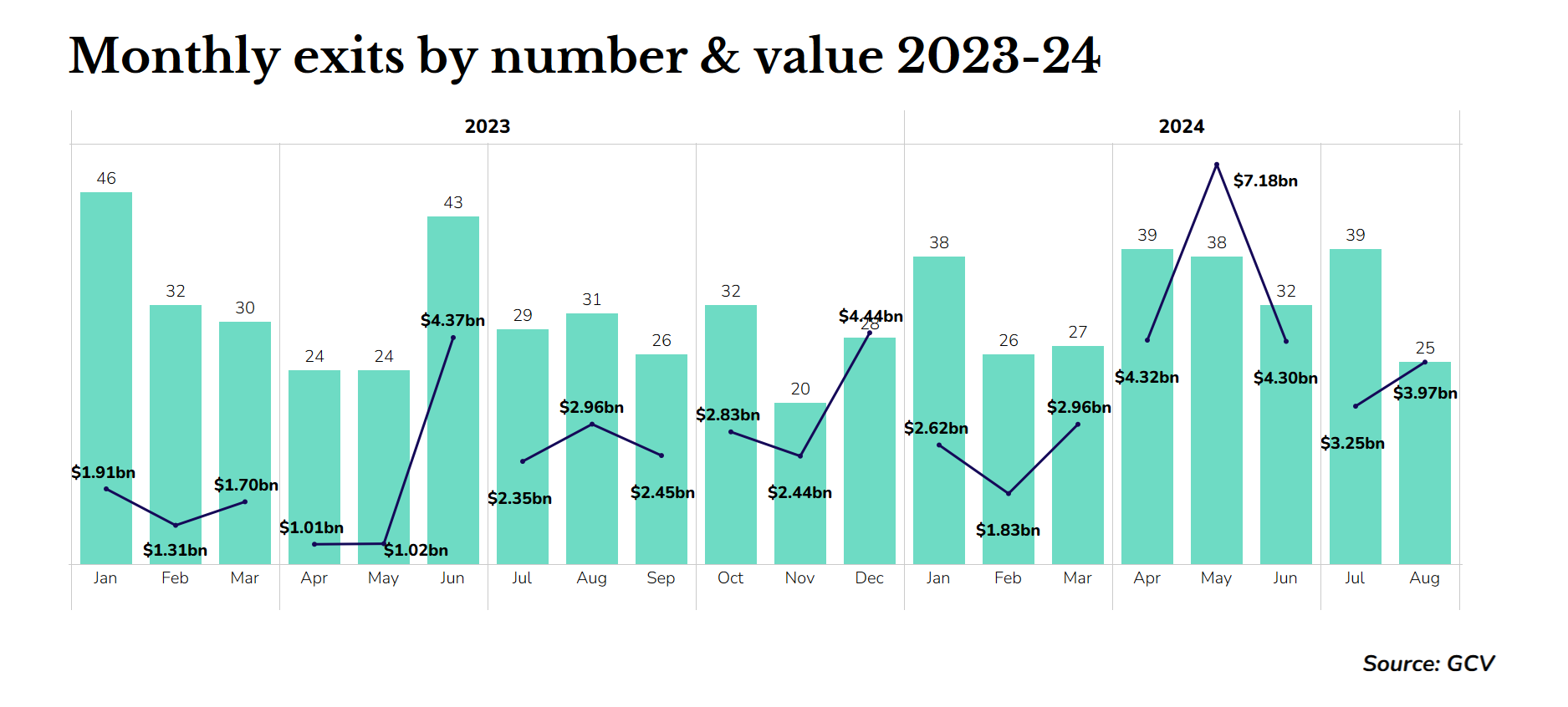

In August, we saw 25 corporate exits, a 19% drop from August last year, though total capital raised hit $3.97bn, up 34% year on year.

Just 25 startups backed by corporate investors made an exit through either a sale or IPO in August, down from 31 in the same month a year ago. But the exits that did happen were bigger, with $3.97bn raised in total, a 34% increase over the August 2023 figure.

The top five exits from August this year were all sized above $500m. Three out of those top five were US-based companies, and three of the top five exits were for companies in the pharmaceutical and life sciences space.

● US-based omnichannel video advertising platform Teads was acquired by web recommendation platform Outbrain for $1bn. The transaction consisted of $725m upfront cash, $25m deferred cash, 35 million shares of Outbrain common stock and $105m of convertible preferred equity. The transaction provided an exit for telecoms and media company Altice. Teads specialises in providing innovative video advertising solutions across various platforms, helping advertisers reach their target audiences more effectively.

● US-based Jnana Therapeutics, a drug developer focused on rare and immune-mediated diseases, was acquired by Japan-based Otsuka Pharmaceutical for $800m and an additional $325m on completion of development and regulatory milestones. Pharmaceuticals AbbVie and Pfizer had previously backed Jnana. Jnana focuses on drug discovery using approaches that complement those of Astex Pharmaceuticals, a subsidiary of Otsuka located in Cambridge, UK.

● India-based Ola Electric, an electric vehicle spinoff of ride-hailing company Ola, went public, raising $734m in its initial public offering. Ola Electric is focused on the development of electric vehicles, particularly electric scooters, aiming to lead the transition to sustainable transport in India and beyond. Hyundai and Kia Motors were among the backers of Ola Electric.

● Israel-based V-Wave, which develops implantable therapeutic devices for heart disease patients, was acquired for $600m by pharmaceutical company Johnson & Johnson, which had previously backed it. Medical instruments Edwards Lifesciences was also among V-Wave’s backers. This acquisition strengthens Johnson & Johnson’s position in the medical device sector, specifically in treating cardiovascular conditions.

● US-based Truepill, a B2B pharmacy fulfilment service provider, was acquired by Ireland-based home lab test kits and healthcare solutions provider LetsGetChecked for $525m. The company counted pharmaceuticals Kaiser Permanente and Optum among its backers. Truepill provides backend pharmacy services, allowing businesses to integrate digital health and pharmacy offerings into their platforms.

The list of all August exits for corporate-backed startups is below. You can also see the exits from July here.