Europe has strong life sciences research and lower costs, but still has a funding gap for early-stage companies, says Alexis Vandier, who is heading the French pharma company's new fund.

French pharmaceutical firm Servier pledged €200m ($234m) last month for one of the largest new venture funds by a drug producer in years. Alexis Vandier, who is leading the investment team, says it is betting big on Europe’s biotech startups because the continent is primed for investment.

“There is a lot of good science coming from Europe,” he says. “Obviously, the US VC world is different. There are a lot of innovations there, more money and maybe more leadership teams that are used to the biotech world. That does help. But some US VCs realise that it’s quite expensive to develop a biotech startup in the US, whereas you can have very good science in Europe. And it’s cheaper.”

Servier Ventures does plan to eventually expand to the US, where Servier has research and development operations, as well as to Asia, but is focusing on Europe. In addition to good science and lower development costs, says Vandier, the continent is also benefitting from more deep-pocketed investors, including corporate VCs – he cites Angelini Ventures and Boehringer Ingelheim Venture Fund as examples – that are unafraid to put their money into backing biotech startups through growth stage.

That added support means the best European biotech startups can avoid listing on the public markets too early, which can sometimes result in difficulties managing shareholder demands and retaining their management while trying to bring promising assets through the clinic.

“I remember some years ago, there was nothing at series C or D stage in Europe,” he says. “The gap was huge. Now, you have a lot of funds that have raised $1bn or close to it, and maybe the way they focus their investment is with fewer targets but big tickets, big enough to be sure they will be able to go to the next inflection point. And they will do it with the right level of investment, a big team, and without doing a trial that will last for ages.”

Vandier says recent large acquisitions of European life sciences companies, including UK-based Vicebio, Switzerland’s Araris Biotech and Belgium’s EsoBiotec, show that Europe’s biotech sector has scope for big returns. All three were venture-backed companies snapped up by big pharma players in billion-dollar deals last year.

However, he says, there is still an issue with early-stage funding.

“We are still seeing some gaps at series A and B, a lot of companies are struggling to get to the next round”

“We still have some gaps. It’s difficult at the early, early stage – at seed stage. Some funds are doing well, but companies are struggling because it’s really a difficult business at the start,” Vandier says. “In addition, we are still seeing some gaps at series A and B, a lot of companies are struggling to get to the next round.”

The series A gap, in particular, is where Servier Ventures is planning to come in.

Balancing financial and strategic returns in “high-risk, high reward” disease areas

Vandier (below) is currently putting together a team at Servier Ventures that will balance experience in finance roles like M&A, banking and, naturally, VC, with scientific backgrounds. He is seeking staff at an investment director level rather than juniors or analysts, people who can scout deals, assist with valuations and sign deal terms independently.

The unit plans to invest an average of €5m to €10m per deal with a view to getting board seats where possible. Its series A sweet spot is what Vandier calls the “late-research stage”. Servier is already conducting early-stage research and late-stage activities like business development and in-licensing. The idea behind going into corporate VC is to plug that gap in the middle.

The two areas Servier Ventures is targeting specifically are oncology and neurology. Both are specialist areas for its parent company, and while that gives the venture arm a clear strategic interest, it also means Servier knows what is happening globally in those areas and has already taken a look at what is happening at startup level.

“You have a lot of innovation in both fields, we know some [ventures] are high risk, high reward,” Vandier says. “The advantage of having the Servier background behind this is a lot of thinking has already happened within the research in terms of where we can play, where we could win and where to go in terms of priorities.”

Those priorities involve being able to validate which areas are likeliest to result in substantial breakthroughs, helping Servier decide where to put its resources.

Servier Ventures was launched as an evergreen fund, designed to be self-funding beyond the initial investment made by the company. That means it must keep one eye on getting returns from “very good” exits down the line. Out of its first 15 investments, says Vandier, one, two or three could result in some kind of collaboration with Servier while the rest will aim for successful IPOs or acquisitions by other pharma companies.

“I also think that putting together the power of a pharmaceutical company and the power of a venture arm will be able to accelerate some innovation,” he adds. Neurology, in particular, has not been a popular area for researchers, which means there are some areas where there is simply no cure. One is a highly aggressive form of brain tumour called glioblastoma.

“It’s basically an area where, when you discuss it with other venture investors or pharma companies, they agree it’s a graveyard in terms of development,” Vandier says. “It’s a very difficult, dramatic disease with no solution, and sharing the risk with other venture investors and injecting a little bit of innovation behind this might be a way to bring about a solution in 10 years.

“I would be happy in 10 years’ time if I’ve not only done the job in terms of a financial return and a strategic return for Servier, but also if I’ve been able to bring a breakthrough innovation for patients in these difficult-to-treat areas.”

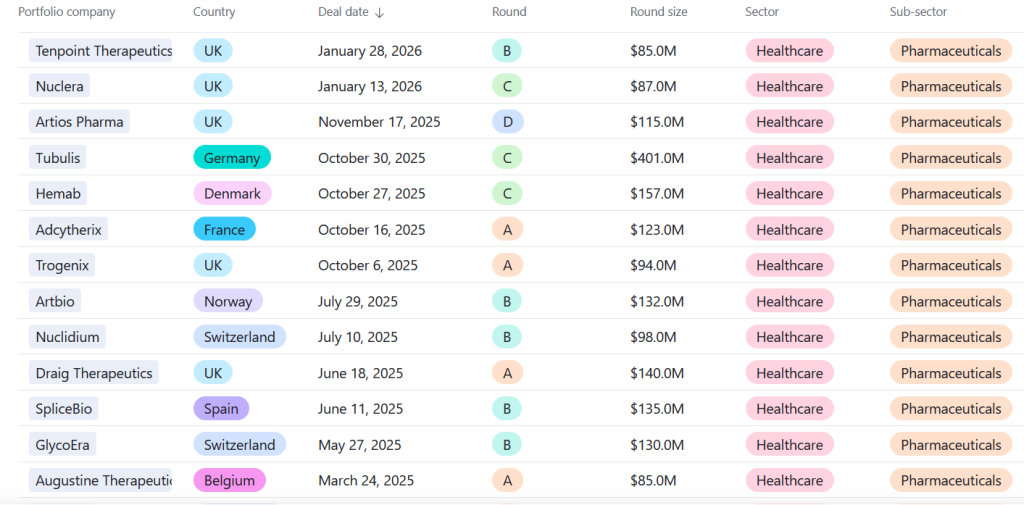

See all the of European biotech’s most recent large deals on the CVC Funding Round Database