There is already a shortage of air traffic controllers and with drones and eVTOLs adding to the mix of air congestion, there's big opportunity for startups with new technologies to help manage the skies.

Millions of Americans are breathing a sigh of relief this week as air traffic controllers return back to work following the end of a 43-day government shutdown. Everyone will, it appears, be able to travel home for the Thanksgiving holiday after all.

But the cancelled flights and disrupted services of the past month and a half have put the importance of air traffic control into sharp focus. There is already a shortage in the industry, due to insufficient hiring, but the skies are only getting busier.

That’s what makes this an area that is ripe for investment, says Mukul Hariharan, managing partner at United Airlines Ventures.

“The nexus between a growing need for the infrastructure to expand [airspace] demand growth and technology that’s providing tools to be able to facilitate it is really exciting to us,” he says.

Commercial air traffic has made a full comeback since the pandemic, and demand is trending up. Added to that, the traffic at lower altitudes is set to grow with the adoption of unmanned drones and eVTOL aircraft — electric aircraft designed for “taxi-style” short hops in cities. These will require their own management infrastructure, and an ability to co-ordinate with existing air traffic.

Hariharan and his team are looking for startups with technologies that can help orchestrate all this. The winners in the next wave of air traffic control, he says, are likely to secure long-term contracts making this an attractive space for investors right now.

Modernising air traffic control

Air traffic control is an industry as old as commercial aviation itself, dating back to the early 1920s. There’s a constant need to update legacy systems, especially as they come under strain from rising demand. Predicting congestion, weather and demand bottlenecks are a challenge for existing systems.

One of the major bottlenecks in commercial aviation today is training. Together with quality control, training is the biggest investment opportunity United Airlines Ventures sees in the air traffic control space today.

“We have a pilot shortage. We have an ATC shortage. So any products that are going to better train aspiring pilots and ATC folks, we think are going to have real value in the market,” says Hariharan.

There is a plethora of data available from avionics, voice recordings, and other data, ripe to be used in AI-assisted training tools, and even for helping people carry out their day-to-day work more reliably.

“ We unequivocally think people are going to be part of the system, and they need to be part of the system. So we’re interested in tools for aviation management, and ATC in particular, that are going to bridge the gap between people, infrastructure, and be the glue that’s going to allow the capacity to grow,” says Hariharan.

Sticky contracts

Contracts for air traffic control tools tend to come from air navigation service providers (ANSPs) – the primarily public-sector organisations responsible for air traffic control and navigation in a given country – and are hard for startups to break into. The procurement cycles are long and they tend to be given to big government contractors like Thales, L3Harris or Honeywell.

“I don’t imagine there being a lot of new entrants to that node of the rung, but I think there’s lots of room for startups and new technologies to be in the supply chain and sell to those companies,” says Hariharan.

Once a startup sells technology to a big government contractor, the relationship lasts a long time. The big primes don’t like removing IP that’s already been integrated into their system architecture, particularly given the multi-year product road maps they put together. Removing a startup’s technology from their offering would, in some cases, require them to revalidate part of their systems to the end-buyer.

There is also some opportunity to sell some tools to private providers alongside governments, says Hariharan.

“There are also private uses, whether it’s in training or specific airport jurisdictions, where they might use private tools and applications that we think will be viable as well. So I think it’s more expansive than just one-buyer winner-takes-all. There’s more opportunity for us in the space,” he says .

The drone layer

Unmanned traffic management (UTM) – which covers drones and other unmanned aircraft whether for delivery, infrastructure inspection, mapping and other activities – is both a massive growth area and a testbed for orchestration software that can then be applied at higher-altitude, higher-stakes contexts.

For many startups, this will be where they will prove themselves before being taken on by the big names in aviation.

“Think of Amazon drones delivering certain things. It’s the first testing ground to perfect those things. Then they can move into higher stakes, more safety-critical applications, whether that’s urban air mobility and managing manned eVTOLs or into more commercial traffic where jets are flying around in bigger airspace,” says Hariharan, pointing out how systems tested in an unmanned context – where routes are typically flown over areas where property damage will be minimal and no airborne lives are at stake, can then present a much bigger investment proposition down the road.

In Europe, initiatives that push the boundaries have emerged like U-space, a new digital air traffic layer for drones, designed for minimal human intervention to allowing the system to handle significantly more traffic at one time than a typical commercial air traffic control system could.

The regulatory framework for U-space has been live in Europe since 2023, and testbeds have been going live in limited areas of certain regions like Berlin, Puglia, Greece and others.

It is in the drone space where there has been some space for startups to move into dealing directly with government air navigation service providers. Unifly, a Belgian drone traffic management platform that raised money from Japanese drone technology company Terra Drone across multiple rounds before being acquired by it in 2023, has been providing services directly to ANSPs like NAV Canada, putting itself in a position to be a strong incumbent when the market matures.

Even unmanned flying systems are likely to have human intervention for the foreseeable future. Even if digitised or partly autonomous, there is simply no equivalent available yet that can replicate the safety redundancies that come with human supervision.

Down the line

Urban air mobility involving human passengers is starting to be on the horizon, too, and although it will take longer for these to pass safety hurdles, systems to manage these aircraft will be heavily influenced by the learnings in managing unmanned airspace.

United Airlines Ventures has invested in eVTOL technology companies like Archer and Eve Air Mobility. Eve Air Mobility, a spinout from Brazilian aerospace company Embraer, earlier this month launched the first deployment of its Vector urban air traffic management system in partnership with heli-taxi operator Revo.

Unlike air traffic management for other urban aircraft like helicopters, eVTOLs will be largely automated or fully autonomous, with procedural, pre-planned routing that doesn’t rely on experienced pilots, and will need to scale far beyond the availability of pilots.

“Urban air mobility increases the workload of human controllers trying to manage that airspace, so if you have data analytics that can provide tools to better enable people to manage that more congested airspace, it’s just going to be a more efficient and safer operation for human controllers to handle,” says Hariharan.

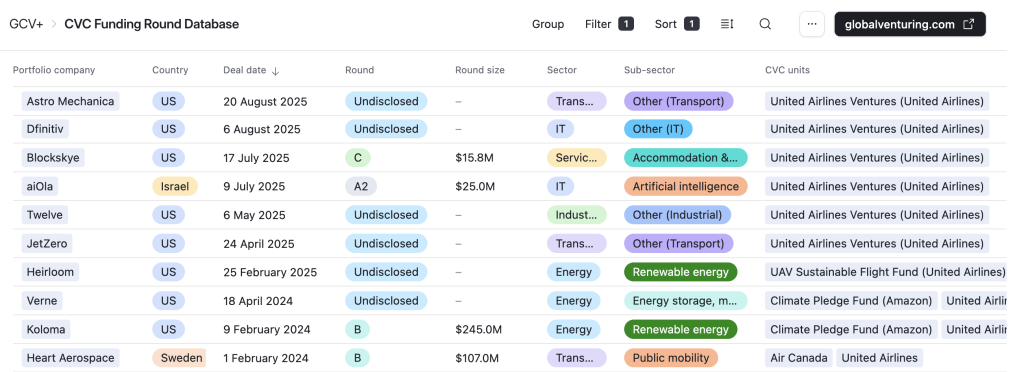

Startups backed by United Airlines since the start of 2024

See our full list of corporate-backed startup funding rounds in the CVC Funding Round Database

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.