German startups can harness the country's manufacturing expertise to make up ground on their AI rivals, and mid-sized CVC could be the key.

Germany — and Europe in general — is trailing the US and China when it comes to developing AI software, especially generative AI and large learning models (LLMs). But investors are confident the country will make up much of that gap when it comes to embedding AI into the physical world, particularly in industrial equipment.

“Europe is behind the US and China regarding LLM´s, but application-wise the race is still open,” says Ute Mercker, investment director at Berlin VC firm IBB Ventures. New industrial AI applications are being developed as data is consolidated, she says, and the country is in an especially strong position in healthcare areas like radiology or foundational models for use in pathology.

“When it comes to specific AI topics, solutions or requirements for industrial applications, I don’t get the impression we’re far behind, if at all,” agrees Tobias Schwind, managing partner at FTTF, the tech transfer arm of research institute Fraunhofer-Gesellschaft. “I would say all the startups in our deep tech portfolio have AI on the agenda.”

Leaning into hardware and industrial expertise

Even in Europe, Germany has so far seemed a laggard in AI compared with France, which has produced large language model developer Mistral and the UK, home to AI video company Synthesia. That may partly reflect Germany’s more decentralised startup environment, and a more careful approach to the technology.

“I think we were maybe a bit more cautious than Paris or London when it came to the technology,” says Jasper Roll (left), who heads German enterprise software producer Haufe Group’s corporate VC arm. “We love to overregulate anything that’s new.”

Data use has proven key to AI software development, and Germany has always been very careful with data protection,” adds Achim Plum, managing director of corporate-backed VC fund High-Tech Gründerfonds (HTGF).

“Historically, when it comes to personal data in Germany, things have always been a little on the slow side. If someone has an idea on some topic of AI, there may always be this thing: ‘Will I really get funded here with of all these issues?’. If you go into healthcare, [Germany] just introduced an electronic patient record system, literally this year.”

But while it may be slower on innovation, no one (apart from maybe Japan) is better at perfecting the technology, Plum (right) says.

“Take the car industry, we were not necessarily always the ones that came up with [new innovations],” he adds. “With electronic windows, the French were 10 years ahead on that. But then when Mercedes started manufacturing them, they worked to perfection. They won’t release something until it works to perfection – that was pretty much the mindset.”

If Germany’s biggest strengths lie in what Plum calls ‘incremental innovation’, that means that while its startups may not be on the bleeding edge of AI innovation, they can be the companies that develop and produce the hardware and components when the technology begins to be deployed more fully in the physical world.

“We’ve always been good at inventing things, and we’ve always been good at delicate technical topics: sensors, cameras, lasers, you name it, anything highly complex from that point of view. And I believe there is space for startups in that area as well,” Roll says.

“There are a lot of software or deep tech pieces that could evolve around the markets where we’re already strong.”

Jasper Roll, Haufe Group Ventures

“There are a lot of software or deep tech pieces that could evolve around the markets where we’re already strong. Let’s build on that.”

One area Germany is actively building on that is defence, where AI software is meeting hardware development. The country’s hottest startup is Helsing, which has raised nearly $1.2bn over the last 18 months for its autonomous fighter jet technology, while the third largest round closed in the country this year was for drone-based aerial intelligence provider Quantum Systems.

Can mid-sized corporates solve Germany’s funding gap?

One barrier German tech startups will need to overcome is funding, which can be challenging to find beyond series A rounds.

“The money is available at seed and early stage if you have reached a certain level,” says Schwind (left). “If you need a series B or C round, then it becomes really challenging.”

“We do have a scale up problem,” Plum agrees. The problem is pronounced enough that HTGF, Germany’s largest seed investor, launched a $765m Opportunity Fund last year so its portfolio companies would have more access to capital once they reach growth stage.

“But later venture money is a real issue in Europe in general,” Plum adds. “That is where we lose a lot of companies to the US, because that’s where the money is and so they go where the money is. And that has been recognised by politics, both on national level and EU level, and there is a big discussion on how we mobilise starter tickets.”

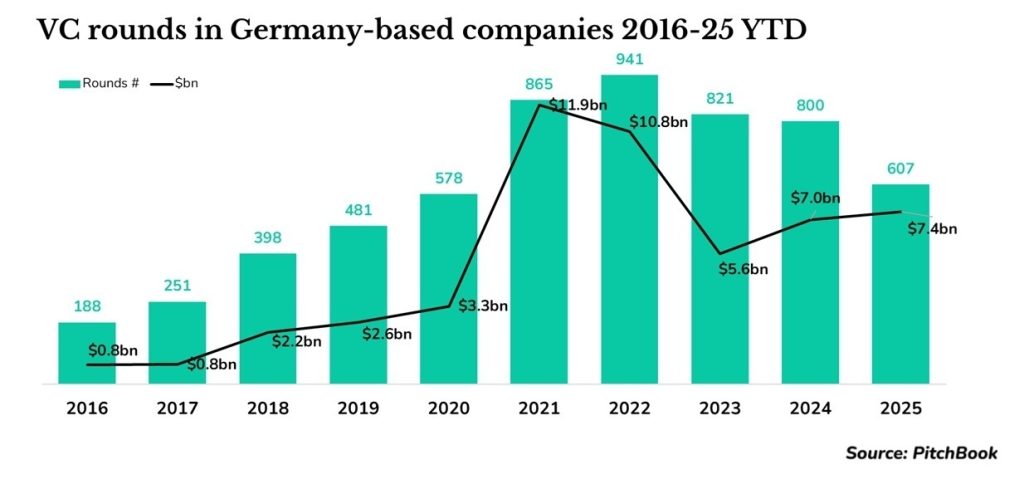

There is at least some evidence that funding rounds are becoming bigger in Germany. While the number of startups receiving backing is still trending downwards following the post-2022 hangover, the amount of money being spent on rounds is growing. But issues still remain, especially for deep tech startups.

One solution to create more scale-up capital would be to organise it on a Europe-wide basis, such as the proposed multibillion-euro Scale Up Fund being set up by the EU, or a pan-European tech market that could rival Nasdaq. Another idea would involve securing more capital from longer-term investors like insurance firms and pension funds, but Plum says there are complex regulatory hurdles around those asset classes that need to be overcome.

Roll believes the answer could lie at least partially with corporate VC, more specifically with greater involvement from Germany’s mid-sized, family-owned companies – known as the Mittelstand. Haufe is part of that cohort, which already makes up a good proportion of HTGF’s limited partners.

Plum says family-run businesses are often better than large multinationals in reacting to threats and adopting change. Because the leadership doesn’t change in three-to-five year cycles, they can be better at making a long-term view on investments in innovation.

”These days there is no more ‘just hardware’, it’s always an integration of hardware and software.”

Achim Plum, High-Tech Gründerfonds

“Germany comes from this idea of manufacturing physical products,” Plum says. “But that ship has sailed, these days there is no more ‘just hardware’, it’s always an integration of hardware and software. And I think that’s one of the reasons German Mittelstand work with us, because they understand that the innovation cycles got much faster and more disruptive.

“At this stage of geopolitical scale, but also in terms of how fast innovation cycles are these days, you won’t survive with incremental innovation anymore,” he adds. “And I think that is being realised by German industry, particularly German Mittelstand, because in the end, those family-owned, mid-size businesses are sometimes much better at adopting change and reacting to threats.”

“A lot of those companies still have liquidity,” Roll says. “They might not have a business model for the next five or 10 years, depending on how the world is changing – I don’t know about those industries – but they have liquidity. And, in my opinion, they should use it.”

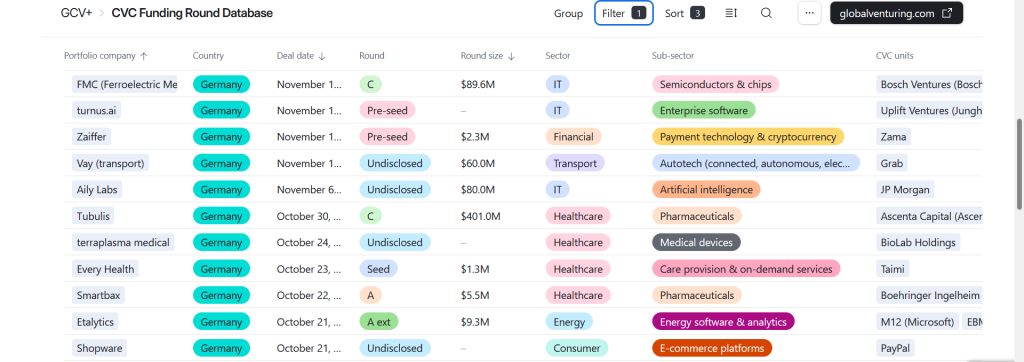

Want to track all the corporate-backed funding rounds in Germany or elsewhere? Find them all in the CVC Funding Round Database.