Gubra Ventures will be headed by Zoë Johnson, a former founder and biotech researcher.

Gubra, a Danish biotechnology company, has launched an incubator, Gubra Ventures, to create companies based on its scientific research.

Each venture will be established as an independent company with its own governance and leadership, designed for capital efficiency and clarity of decision-making, says Zoë Johnson, head of the new incubation unit.

Gubra, founded in 2008, is a publicly listed biotech company specialising in peptide-based drug discovery and preclinical contract research services.

The company’s focus on building its own ventures rather than on traditional VC investing “reflects a belief that the greatest leverage comes from hands-on company creation rather than minority equity participation,” says Johnson.

“By driving the company at formation, we can shape translational plans and development strategy in an integrated way, drawing on Gubra’s data, platforms and development experience,” she says.

The unit will, however, also look to build ventures based external external biotech or pharma programmes or academic research “where there is a strategic fit, particularly when we can add disproportionate value through our translational expertise, infrastructure, and company-building capability. Ideally programs will be close to or in early clinical development,” says Johnson.

The ventures unit welcomes collaboration with other corporate venture groups, institutional investors and pharmaceutical partners where there is strong strategic alignment and mutual benefit, she adds.

The unit will focus on technologies such as peptide-based therapeutics, advanced biologics and combinations of biologics with novel delivery. It will also seek to build on its research in cardiometabolic disease and obesity-related complications.

Johnson cofounded Melio Bio, a developer of treatment for cardiometabolic disease. She was also chief scientific officer for biotechnology research company Affivant and iOnctura.

Investments in biotech are on the rise, with four funds launched in January 2026 focused on biotech and healthcare technologies.

Corporate venture capital investors took part in $2bn worth of biotech and pharmaceutical startup funding rounds in January 2026, the fifth consecutive month in which CVC investments in the sector have totaled more than $1bn.

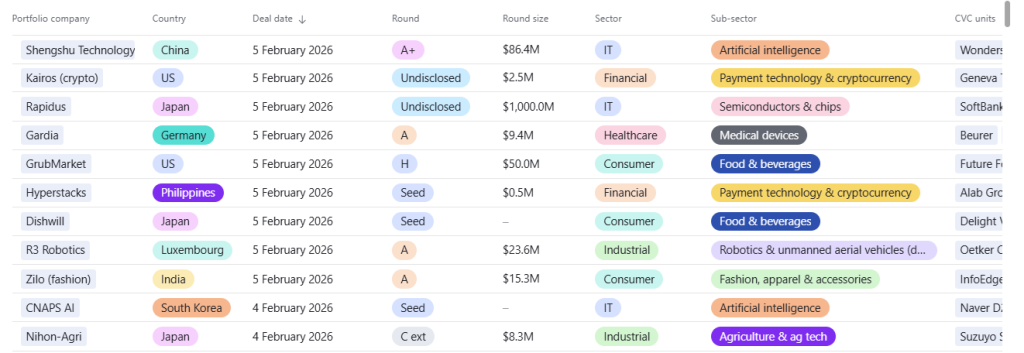

See all the recent corporate-backed deals on the CVC Funding Round Database