The new fund – Bertelsmann Healthcare Investments – will provide capital and expertise to help startups develop and scale their business models.

Bertelsmann Investments, the investment arm of the German media, services and education company, has established a new fund called Bertelsmann Healthcare Investments to consolidate its investments in the healthcare sector. The new fund is BI’s third investment vehicle – along with BAI Capital and Bertelsmann India Investments – and the first with a clear sector focus.

“The healthcare market is facing profound changes – technologically, structurally, and socially. Bertelsmann Healthcare Investments gives us a clearly positioned, long-term-oriented vehicle to support founders from an early stage and actively drive innovation in the healthcare market,” said Carsten Coesfeld, CEO of Bertelsmann Investments, in a release.

The new fund, which is $200m, according to Axios, will invest in high-growth health tech companies. It has a transatlantic focus, with offices in Europe and the US. The fund is led by Thorsten Wirkes, managing director, and Tim Schneider, partner.

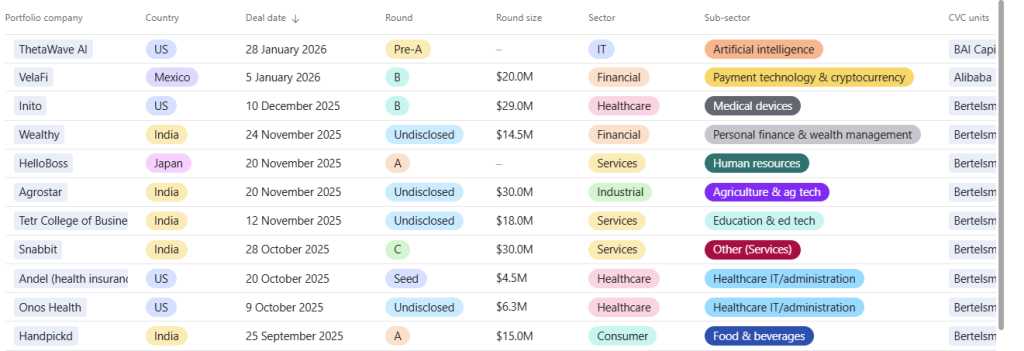

Its launch follows several years of investments by the CVC in healthcare startups. The portfolio has 14 companies and one exit.

“We believe that we are at the beginning of a new era – enabled by technological advancement via AI as well as a regulatory recognition that the frameworks need to be adopted, for example around interoperability, incentives, and how we pay for care,” said Wirkes in a release.

“We are entering a massive transformation on how people will consume preventive and reactive care, how care is personalized, delivered and paid for, and how the underlying admin processes will operate,”

See all the recent deals by Bertelsmann in the CVC Funding Round Database