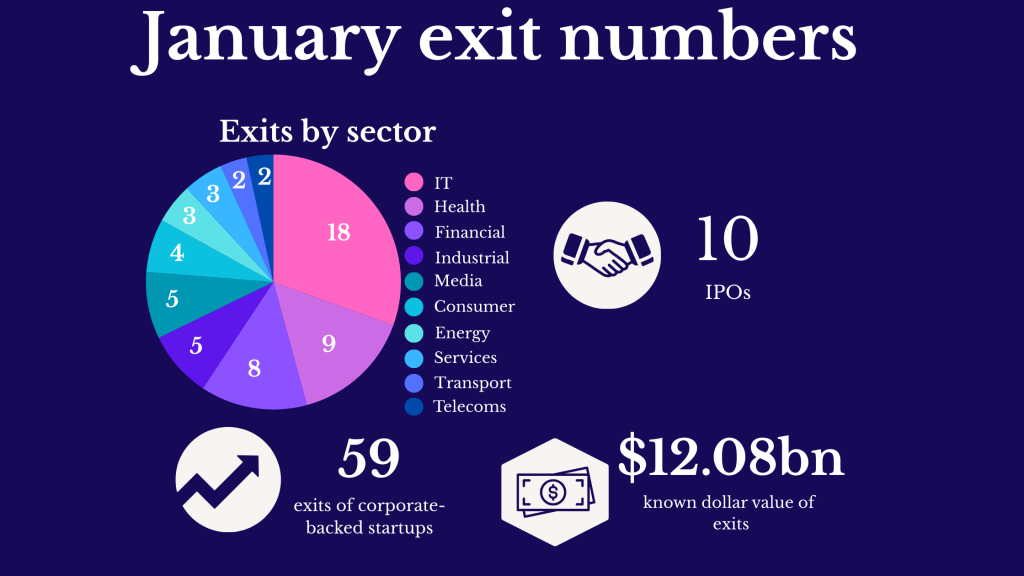

Large exits for AI companies pushed up investor returns in January, but sub-billion-dollar IPOs are on the rise as well.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.