Rare earth metals are critical to the clean energy transition but their extraction comes at massive environmental costs. Here are six startups with solutions, from mining on the moon to microbes that extract minerals without toxins.

A crop of startups have emerged to address the environmental problems that come from mining for rare earth metals, a fast growing sector where the market value is expected to jump 44% by 2030.

Critical to the clean energy transition, rare earth metals go into many forms of renewable energy such as wind turbines, solar cells and electric vehicles. Yet the irony of their rise as an essential part of the green economy is the environmental harm that the mining of these metals causes the environment.

Mining rare earths generates acidic and radioactive waste. It also requires substantial amounts of water and generates carbon emissions in countries that often do not have tight environmental regulations.

China also dominates the supply chain for rare earth metals. As geopolitical tensions between China and US mount, the Asian country recently restricted its export of critical minerals as well as the magnets that are created from rare earths and which go into everyday devices such as consumer electronics, sensors and medical equipment.

Here are six startups that show the kind of technologies that are emerging to reduce the environmental cost of mining critical minerals, as well as the effort to wean the world off China’s grip on the supply chain.

Niron Magnetics

- Located: Minnesota, US

- Founded: 2015

This spinout from the University of Minnesota in the US makes permanent magnets without any of the rare earth elements commonly used in conventional magnets. The raw materials that go into its magnets are globally abundant iron and nitrogen. The magnets are developed and manufactured at a commercial pilot plant in the US city of Minneapolis. The plant reuses and recycles feedstocks to minimise waste.

The company raised $25m in a fundraising round in 2024. Corporate backers include Korean electronics conglomerate Samsung and car companies Magna International, General Motors and Stellantis. The Shakopee Mdewakanton Sioux Community, an Indian tribal group, and the University of Minnesota also invest in the startup.

Cyclic Materials

- Located: Ontario, Canada

- Founded: 2021

This Canadian startup recovers rare earth metals from products at end-of-life such as electric vehicles, consumer electronics, wind turbines and magnetic resonance imaging machines. Its proprietary technology extracts and refines rare earths back to their raw form.

Its recycled materials include aluminium which is used in carmaking, the aerospace sector and industrial machinery, and copper which can be reused in renewable energy generation and electrical wiring.

In June this year, the company raised $25m to build a recycling plant in Ontario. The facility will convert 500 tonnes of feedstock annually into rare earth oxide, a product containing a mix of rare earths used in permanent magnets for the electric vehicle and consumer electronics sectors.

In 2024, it raised $53m in a series B round with corporate backers BMW, Hitachi and Microsoft. Carmaker Jaguar Land Rover participated in an extension to that round in January this year.

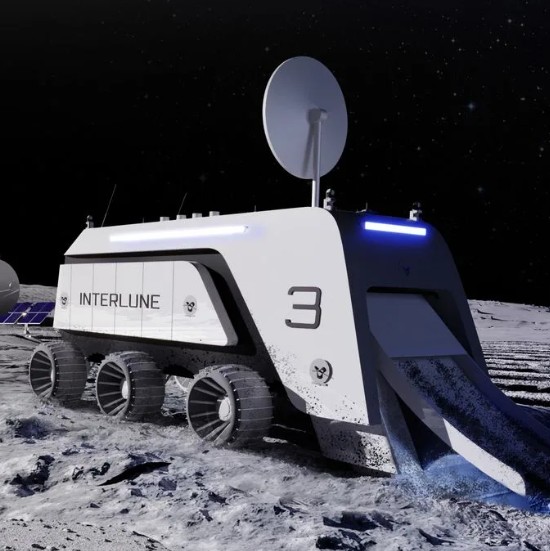

Interlune

- Located: Seattle, US

- Founded: March 2024

Harvesting rare earths from space is the aim of this US company. It has developed novel machinery to detect and harvest natural resources from the moon and bring them back to Earth for use in sectors such as defence and healthcare.

Its first aim is to harvest helium-3, a rare earth element that is plentiful on the moon but rare on Earth. The element has applications in quantum computing where it can be used to reach the extremely low temperatures needed to increase the accuracy of quantum computers.

In May this year, Interlune entered an agreement with Maybell Quantum, a quantum infrastructure company, to provide helium-3 for the company’s dilution refrigerators, which cool quantum devices to near-absolute zero temperatures.

In 2024, it raised $17m in a round with participation from several venture capital firms including Aurelia Foundry, Bachmanity Capital, Liquid 2 Ventures, Mana Ventures, Rosecliff Venture Partners, Shasta Ventures and Spacecadet Ventures.

RarEarth

- Located: Milan, Italy

- Founded: 2023

This Italian company produces permanent magnets from recycled materials. It uses a chemical, non-hazardous solution to recover rare earth metals from end-of-life electric motors. Among the materials it recovers are copper, aluminium and iron, as well as the NdFeB, a permanent magnet alloy made from neodymium, iron and boron.

In July this year, it raised a €2.6m seed round from venture capital firms Corbites Fund, COREangels, MITO Technology, Primo Capital and Vento Ventures.

REEgen

- Located: Ithaca, US

- Founded: 2022

A spinout from Cornell University in the US, the company aims to make the extraction of rare earth elements more sustainable through its engineered microbes, which can extract critical minerals from ores and feedstocks without toxic chemicals or high heat.

Its bioleaching bacteria produce organic, biodegradable acids to extract metals, reducing the environmental harm caused by more conventional methods. It can recover rare earth elements from by-products of recycling industries such as steel slag, electronic waste, spent catalysts and coal ash.

The technology is based on research carried out by Alexa Schmitz (left), CEO and founder, who developed the approach for biomining rare earth elements while working as a postdoctoral research associate at Cornell.

In January this year, the company raised $150,000 from Cornell University and venture capital firm Safar Partners.

Phoenix Tailings

- Located: Massachusetts, US

- Founded: 2019

This US startup focuses on extracting metals and rare earth elements from mining waste, known as tailings, using clean energy sources and without toxic chemicals.

The company has developed a technology that extracts high-grade iron, bauxite and critical minerals such as rare earths, nickel, copper and cobalt. It uses a proprietary technology to produce iron through molten oxide electrolysis.

Phoenix Tailings aims to expand its product portfolio to include the extraction of neodymium and dysprosium used in permanent magnets for electric vehicles, wind turbines and defence applications.

In April, it raised $33m in a series B round from Presidio Ventures, an investment arm of Japanese conglomerate Sumitomo, and Japanese mobility company Yamaha Motor. Other investors include venture capital firms Rhapsody Venture Partners, Foothill Ventures and In-Q-Tel.