XGS is the third geothermal startup to raise cash this year, as the industry looks to overcome drilling costs and geography.

Baltimore-based energy producer Constellation Energy led a $9.7m funding round for XGS Energy this week, one of three geothermal startups to raise cash so far this year as the industry looks to innovations in technology to fulfil its promise.

Geothermal energy is sourced from heat found beneath the Earth’s surface which is then used to heat water in order to turn turbines. Because it doesn’t rely on weather, it can be used as a more constant power source to complement more intermittent types of renewable energy like wind or solar power.

But geothermal energy is also only currently usable in certain parts of the world, which is why less than 16 GW of capacity had been installed worldwide as of 2021, as opposed to over 740 GW of wind energy and over 1 TW of solar. The hope is that a new wave of technologies could expand the range of use or extract more from existing systems.

Constellation Technology Ventures, the strategic investment arm of Constellation Energy, was joined in the round by BlueScopeX, Thin Line Capital and undisclosed individuals. It followed a $13m round nearly a year ago and the proceeds will be used to build a pilot plant to demonstrate the company’s Thermal Reach Enhancement (TRE) technology.

TRE uses a single drill to get to hot rock, then implants thermally conductive material which can draw more heat to the well that is then collected and used to heat water. The heated water is returned to the surface and converted to electricity.

XGS has been testing its technology in laboratories for two years and aims to build commercial projects in Japan, the Philippines and its home country, the US, once the prototype facility is shown to be successful. It claims its materials are 50 times more conductive than typical underground rock, and that the technology can be used anywhere in the world without needing the millions of gallons of water required for current systems.

The company is the third early-stage geothermal technology startup to raise funding since the start of 2024, following Octavia Carbon, which plans to use Kenya’s geothermal resources to power its carbon capture systems, and Enerdrape, an Après-demain and Romande Energie-backed Swiss company that has created a prefabricated geothermal panel that can take drilling out of the equation altogether.

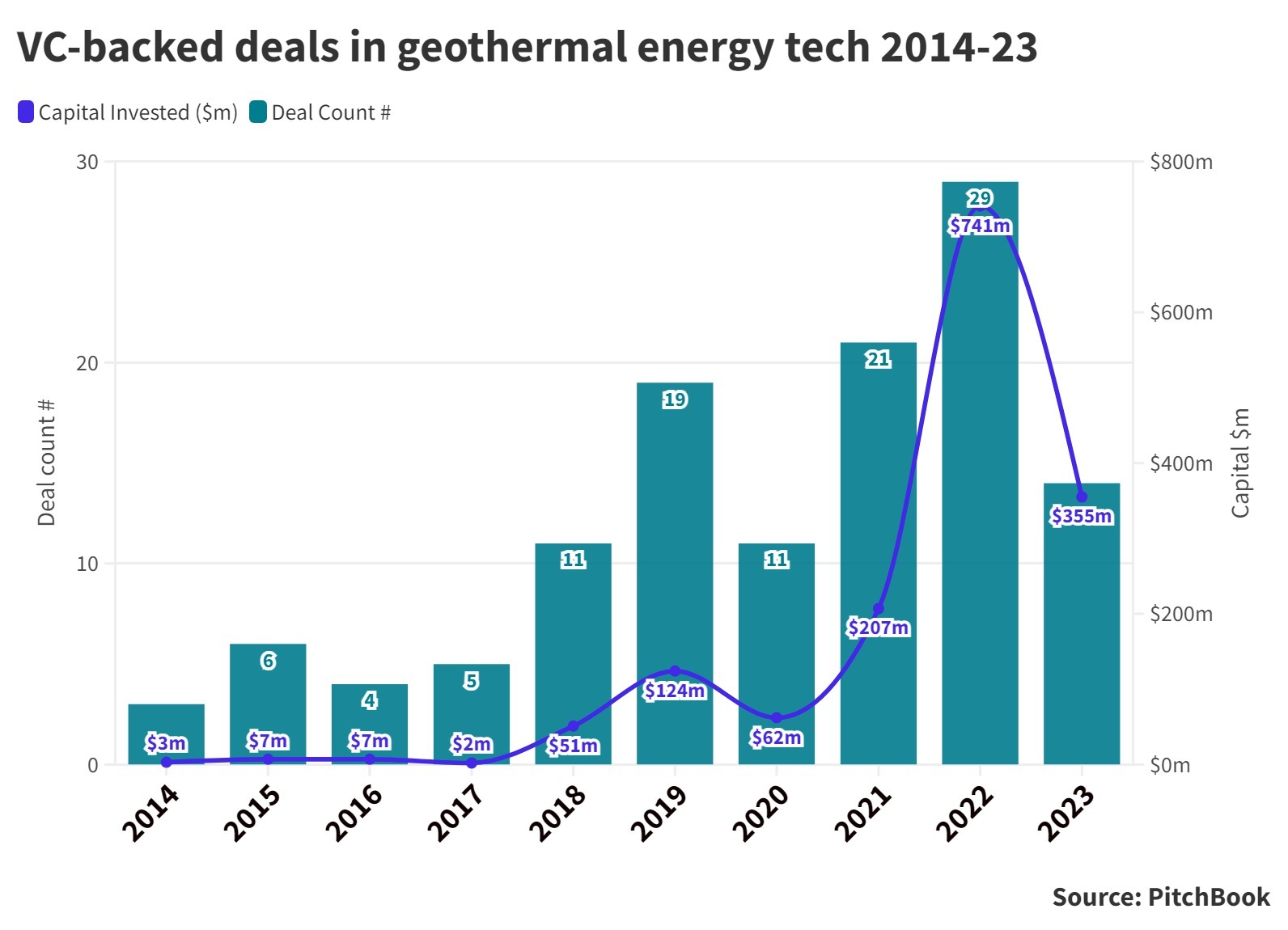

Geothermal energy in general has a lot of room to grow, and it is progressing. While 2023 was not a vintage year for the sector, early-stage funding for geothermal tech is generally on an upward trend and remains significantly above what it was for much of the last decade (see below).

The US Department of Energy released a study a year ago claiming geothermal energy in the US could potentially grow from 3.7 GW to 90 GW by 2050, but only with advances in technology that could reduce the costs by 90%.

That 90% seems like a huge figure, but it’s worth noting that drilling currently makes up half the cost and that wells are currently dug less than 3km deep. Much of the hottest rock is found further down where drilling has so far been impossible or overly expensive. Startups are working towards overcoming that problem.

Fervo broke ground on a 400 MW project in September that will use precision horizontal drilling techniques to deploy several wells at a single location. Quaise, which is backed by Techint unit TechEnergy Ventures, is developing millimetre wave drilling that can drill through hard rock by vaporising it, meaning the company could theoretically reach as deep as 20km. It is currently raising $25m for its next round.

Corporates might have technological expertise to contribute. BP and Chevron are both investors in Eavor, a Canadian company currently building out a global footprint of geothermal power plants based on a closed-loop system that combines two vertical wells with several horizontal wellbores. Fervo’s equipment makes use of developments in oil and gas exploration, the industry that’s home to several of its corporate investors.

Fracking may not have lived up to early hype, but the drilling innovations that allowed shale oil and gas companies to drill faster and deeper could be passed on to geothermal startups.

Ultimately, there are lingering doubts as to whether deep drilling could affect seismic activity and possibly lead to earthquakes, but right now the largest barrier apart from cost is geography. Only three countries – Iceland, Kenya and El Salvador – rely on geothermal for more than 20% of their energy needs, and only the US and Indonesia have installed more than 2 GW.

Geothermal could possibly become the baseload clean energy source that could facilitate solar and wind worldwide, but if it is to do, technologies like XGS’s will be essential.